United States Pet Food Palatants Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-796 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Pet Food Palatants Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

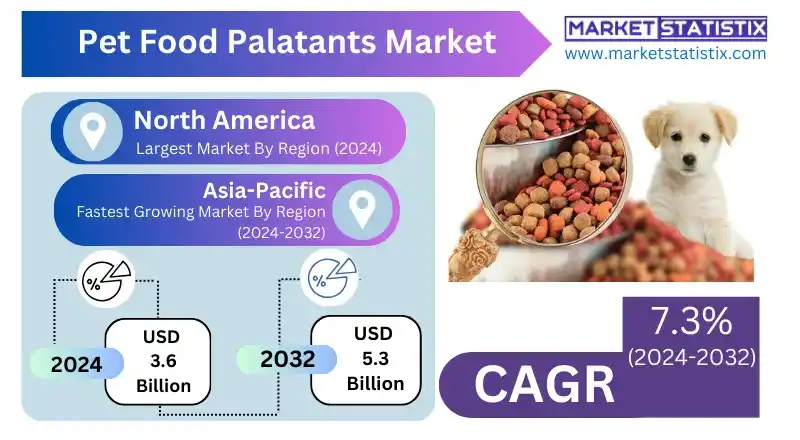

| Growth Rate | CAGR of 7.3% |

| Forecast Value (2032) | USD 5.3 Billion |

| By Product Type | Cats, Dogs, Other Pets |

| Key Market Players |

|

| By Region |

|

Pet Food Palatants Market Trends

A major trend emerging in this segment is the growing demand for natural and sustainable palatants. Pet owners are increasingly reaching for clean-label options, giving rise to manufacturers interested in providing plant-based options, upcycled ingredients, and environmentally friendly ones. Organic palatants and those devoid of artificial additives are now increasingly tangential interests—these trends are expected to parallel trends in human food. Another conspicuous trend is the increasing sophistication in the development and application of palatants. Novel developments are designing species-specific and even breed-specific palatants that apply a better understanding of felines' and canines' sensory preferences. Encapsulation techniques are being used to provide stability to palatants during processing and allow for the incorporation of functional ingredients such as probiotics.Pet Food Palatants Market Leading Players

The key players profiled in the report are BRF Ingredients, Pet Flavors, Trilogy Flavors, ADM, Lyka, Kemin Industries Inc., Profypet, Kerry Group plc., Ohly, Symrise, DSM, AFB International, Susheela GroupGrowth Accelerators

The pet food palatants market is pervaded by several key drivers that show the gradual changes in pet ownership and care. The first is increased humanisation of pets, one of the biggest aspects. As pet owners begin to see their pets as family members, they are willing to spend for premium food products that are not only nutritious but also tasty so that their dear friend can truly enjoy the meal. This trend thus increases the demand for palatants that appeal to the senses of taste and smell of pet food. Secondly, another crucial driver is the increase in the awareness of pet health and nutrition among pet owners. As pet parents become more aware of the importance of a balanced diet in their pets' well-being, they are also actively searching for high-quality food alternatives. Palatants play an important role in ensuring that pets receive the nutrients they need by making the food more palatable, especially for tough or select eaters with special diets. Additionally, with the rise in pet populations worldwide and the increase in disposable incomes in some regions, the market gains traction as more households can afford and are willing to invest in enhanced pet-food products.Pet Food Palatants Market Segmentation analysis

The United States Pet Food Palatants is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cats, Dogs, Other Pets . The Application segment categorizes the market based on its usage such as Meat Based, Vegetable Based. Geographically, the market is assessed across key Regions like United States (The West, Southwest, The Middle Atlantic, New England, The South, The Midwest) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape for the pet food palatants market is moderately consolidated, with AFB International, Diana Pet Food (Symrise), and Kemin dominating the industry as key global players. These companies have strong research and development capabilities, provide various products, and also have distribution networks that reach a broad range of pet food manufacturers. Hence, competition is based on product innovation, the development of natural and sustainable palatants, and the provision of customized solutions that address specific preferences and dietary needs of all pets. However, some market participants also compete against multiple regional and specialised companies focusing on niche segments such as organic or plant-based palatants. Collaboration strategies, acquisition, and a growing concern for natural and functional palatants are other ways that firms are seeking to gain a competitive advantage.Challenges In Pet Food Palatants Market

The pet food palatants market, despite being a rather new one, faces multiple challenges, a lot of them being serious obstacles in achieving smooth operations. Regulatory compliance is a complex web through which manufacturers are required to navigate different and, at times, very stringent food safety standards regarding ingredients in a given country before selling their products. Cost sensitivity is another factor since palatants drive the overall production of pet food, with cost playing an important role in maintaining the quality at reasonable pricing in the price-sensitive regions. Supply chain complexity: This is another perennial challenge since the industry depends on a wide variety of raw materials. Shortages, price fluctuations, and production delays could ensue as a result of disruption. The increasing demand for natural, organic, and sustainable palatants also puts pressure on manufacturers to source green ingredients and adopt better environmental practices, which are expected to add to operational costs and call for serious investment in research and development. Competition from product substitutes and the continuous innovation required to meet the changing favours of the customer markets.Risks & Prospects in Pet Food Palatants Market

Manufacturers are looking at the market for natural, clean-label, and functional food flavours and enhancers that improve taste while lending health benefits for digestion and immunity. The diversion is also toward novel, bespoke palatant formulations with a specific focus on target breeds, dietary needs, and health conditions. The growth of e-commerce and online retail platforms provides different prospects that allow a wider, tech-savvy consumer base to reach brands marketing distinct, premium products with palatant infusion. Geographically, North America holds the highest share of the pet food palatants market, fuelled by a high rate of pet ownership and consumer spending on premium pet food, as well as a well-established retail infrastructure. Europe is expected to follow closely, propelled by trends in pet humanisation and awareness about pet nutrition. Asia-Pacific, on the other hand, is the fastest-growing market due to rapid growth in the adoption of pets, increasing disposable income among customers, and a shift toward premium pet nutrition in countries like China and India.Key Target Audience

, The pet food palatants market focuses on companies manufacturing palatants for their finished products. Such companies discover ways of flavouring or adding aroma to make their pet food palatable to pets and increase acceptance of that product. These improvements in palatability will make the pets happy with the product use and would probably build brand loyalty towards that brand. Picky eaters or pets with claims are examples of market targets for this palatant improvement. Premium and functional pet food lines depend on innovation in taste and texture, and thus palatants were major ingredients for differentiation in competition., On the other hand, the pet owners indirectly influence the market where most keep pets as family members. Such owners demand quality, appetising, and nutritious food products for their pets. This includes pet parents whose pets are getting on in age, those with health conditions, and those on special diets where palatability will play a crucial role in determining intake of nutrients. Other contributors to the demand channel include veterinary clinics and speciality pet retailers that recommend palatable therapeutic diets to pets consuming medical nutrition.Merger and acquisition

Significant activities surrounding mergers and acquisitions (M&A) are underway in the realm of pet food palatants, as companies are strategically working towards improving flavour solutions and extending market entry. The top headline for this market is the acquisition of Whitebridge Pet Brands, valued at $1.45 billion, by General Mills in November 2024. The acquisition enriched General Mills' pet food segment with premium brands such as Tiki Pets and Cloud Star and was a subsequent acquisition following General Mills' acquisition of Blue Buffalo in 2018 as a means to strengthen its position in pet nutrition. Furthermore, the establishment of Ethos Pet Brands in March 2024 from the merger of Canidae and Natural Balance represents a strategic consolidation in the super-premium pet food sector. Backed by L Catterton and Nexus Capital Management, the merger aimed to combine resources for improved product development and market penetration. The above-discussed M&As thus represent a trend toward the consolidation of complementary companies to service the changing demands of consumers for high-quality, palatable options in pet food. >Analyst Comment

The global pet food palatant market is evolving at a high growth rate, with a value expected to increase from approximately USD 2.35 billion in 2024 to nearly USD 3.9 billion by 2034. A multitude of factors increasing globalisation of pet animals, higher trends for humanisation of pets, and then increasing demand for more premium, nutritious, and tasteful pet foods are working together for the expansion of this market. Owners are now demanding ingredients that are more natural, organic, and grain-free, and this has prompted the manufacturers to themselves innovate palatants that would enhance taste, aroma, and overall appeal, often mimicking those human food flavours like salmon, chicken, and sweet potato.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Pet Food Palatants- Snapshot

- 2.2 Pet Food Palatants- Segment Snapshot

- 2.3 Pet Food Palatants- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Pet Food Palatants Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cats

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Dogs

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Other Pets

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Pet Food Palatants Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Meat Based

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Vegetable Based

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Pet Food Palatants Market by Origin

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Naturally Derived

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Synthetic

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Pet Food Palatants Market by Functionality

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Flavor Enhancement

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Nutritional Supplementation

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Food Preservation

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Pet Food Palatants Market by Formulation Type

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Dry Formulations

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Wet Formulations

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Liquid Formulations

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Powdered Formulations

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

9: Pet Food Palatants Market by Distribution Channel

- 9.1 Overview

- 9.1.1 Market size and forecast

- 9.2 Online Retail

- 9.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.2 Market size and forecast, by region

- 9.2.3 Market share analysis by country

- 9.3 Pet Specialty Stores

- 9.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.2 Market size and forecast, by region

- 9.3.3 Market share analysis by country

- 9.4 Supermarkets and Hypermarkets

- 9.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.2 Market size and forecast, by region

- 9.4.3 Market share analysis by country

- 9.5 Veterinary Clinics

- 9.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.2 Market size and forecast, by region

- 9.5.3 Market share analysis by country

10: Pet Food Palatants Market by Region

- 10.1 Overview

- 10.1.1 Market size and forecast By Region

- 10.2 The West

- 10.2.1 Key trends and opportunities

- 10.2.2 Market size and forecast, by Type

- 10.2.3 Market size and forecast, by Application

- 10.2.4 Market size and forecast, by country

- 10.3 Southwest

- 10.3.1 Key trends and opportunities

- 10.3.2 Market size and forecast, by Type

- 10.3.3 Market size and forecast, by Application

- 10.3.4 Market size and forecast, by country

- 10.4 The Middle Atlantic

- 10.4.1 Key trends and opportunities

- 10.4.2 Market size and forecast, by Type

- 10.4.3 Market size and forecast, by Application

- 10.4.4 Market size and forecast, by country

- 10.5 New England

- 10.5.1 Key trends and opportunities

- 10.5.2 Market size and forecast, by Type

- 10.5.3 Market size and forecast, by Application

- 10.5.4 Market size and forecast, by country

- 10.6 The South

- 10.6.1 Key trends and opportunities

- 10.6.2 Market size and forecast, by Type

- 10.6.3 Market size and forecast, by Application

- 10.6.4 Market size and forecast, by country

- 10.7 The Midwest

- 10.7.1 Key trends and opportunities

- 10.7.2 Market size and forecast, by Type

- 10.7.3 Market size and forecast, by Application

- 10.7.4 Market size and forecast, by country

- 11.1 Overview

- 11.2 Key Winning Strategies

- 11.3 Top 10 Players: Product Mapping

- 11.4 Competitive Analysis Dashboard

- 11.5 Market Competition Heatmap

- 11.6 Leading Player Positions, 2022

12: Company Profiles

- 12.1 Kerry Group plc.

- 12.1.1 Company Overview

- 12.1.2 Key Executives

- 12.1.3 Company snapshot

- 12.1.4 Active Business Divisions

- 12.1.5 Product portfolio

- 12.1.6 Business performance

- 12.1.7 Major Strategic Initiatives and Developments

- 12.2 ADM

- 12.2.1 Company Overview

- 12.2.2 Key Executives

- 12.2.3 Company snapshot

- 12.2.4 Active Business Divisions

- 12.2.5 Product portfolio

- 12.2.6 Business performance

- 12.2.7 Major Strategic Initiatives and Developments

- 12.3 Ohly

- 12.3.1 Company Overview

- 12.3.2 Key Executives

- 12.3.3 Company snapshot

- 12.3.4 Active Business Divisions

- 12.3.5 Product portfolio

- 12.3.6 Business performance

- 12.3.7 Major Strategic Initiatives and Developments

- 12.4 AFB International

- 12.4.1 Company Overview

- 12.4.2 Key Executives

- 12.4.3 Company snapshot

- 12.4.4 Active Business Divisions

- 12.4.5 Product portfolio

- 12.4.6 Business performance

- 12.4.7 Major Strategic Initiatives and Developments

- 12.5 Trilogy Flavors

- 12.5.1 Company Overview

- 12.5.2 Key Executives

- 12.5.3 Company snapshot

- 12.5.4 Active Business Divisions

- 12.5.5 Product portfolio

- 12.5.6 Business performance

- 12.5.7 Major Strategic Initiatives and Developments

- 12.6 Symrise

- 12.6.1 Company Overview

- 12.6.2 Key Executives

- 12.6.3 Company snapshot

- 12.6.4 Active Business Divisions

- 12.6.5 Product portfolio

- 12.6.6 Business performance

- 12.6.7 Major Strategic Initiatives and Developments

- 12.7 BRF Ingredients

- 12.7.1 Company Overview

- 12.7.2 Key Executives

- 12.7.3 Company snapshot

- 12.7.4 Active Business Divisions

- 12.7.5 Product portfolio

- 12.7.6 Business performance

- 12.7.7 Major Strategic Initiatives and Developments

- 12.8 Kemin Industries Inc.

- 12.8.1 Company Overview

- 12.8.2 Key Executives

- 12.8.3 Company snapshot

- 12.8.4 Active Business Divisions

- 12.8.5 Product portfolio

- 12.8.6 Business performance

- 12.8.7 Major Strategic Initiatives and Developments

- 12.9 DSM

- 12.9.1 Company Overview

- 12.9.2 Key Executives

- 12.9.3 Company snapshot

- 12.9.4 Active Business Divisions

- 12.9.5 Product portfolio

- 12.9.6 Business performance

- 12.9.7 Major Strategic Initiatives and Developments

- 12.10 Pet Flavors

- 12.10.1 Company Overview

- 12.10.2 Key Executives

- 12.10.3 Company snapshot

- 12.10.4 Active Business Divisions

- 12.10.5 Product portfolio

- 12.10.6 Business performance

- 12.10.7 Major Strategic Initiatives and Developments

- 12.11 Lyka

- 12.11.1 Company Overview

- 12.11.2 Key Executives

- 12.11.3 Company snapshot

- 12.11.4 Active Business Divisions

- 12.11.5 Product portfolio

- 12.11.6 Business performance

- 12.11.7 Major Strategic Initiatives and Developments

- 12.12 Profypet

- 12.12.1 Company Overview

- 12.12.2 Key Executives

- 12.12.3 Company snapshot

- 12.12.4 Active Business Divisions

- 12.12.5 Product portfolio

- 12.12.6 Business performance

- 12.12.7 Major Strategic Initiatives and Developments

- 12.13 Susheela Group

- 12.13.1 Company Overview

- 12.13.2 Key Executives

- 12.13.3 Company snapshot

- 12.13.4 Active Business Divisions

- 12.13.5 Product portfolio

- 12.13.6 Business performance

- 12.13.7 Major Strategic Initiatives and Developments

13: Analyst Perspective and Conclusion

- 13.1 Concluding Recommendations and Analysis

- 13.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Origin |

|

By Functionality |

|

By Formulation Type |

|

By Distribution Channel |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Pet Food Palatants in 2032?

+

-

What is the growth rate of Pet Food Palatants Market?

+

-

What are the latest trends influencing the Pet Food Palatants Market?

+

-

Who are the key players in the Pet Food Palatants Market?

+

-

How is the Pet Food Palatants } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Pet Food Palatants Market Study?

+

-

What geographic breakdown is available in United States Pet Food Palatants Market Study?

+

-

Which region holds the second position by market share in the Pet Food Palatants market?

+

-

Which region holds the highest growth rate in the Pet Food Palatants market?

+

-

How are the key players in the Pet Food Palatants market targeting growth in the future?

+

-