United States Document Analysis Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2032

Report ID: MS-541 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Document Analysis Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

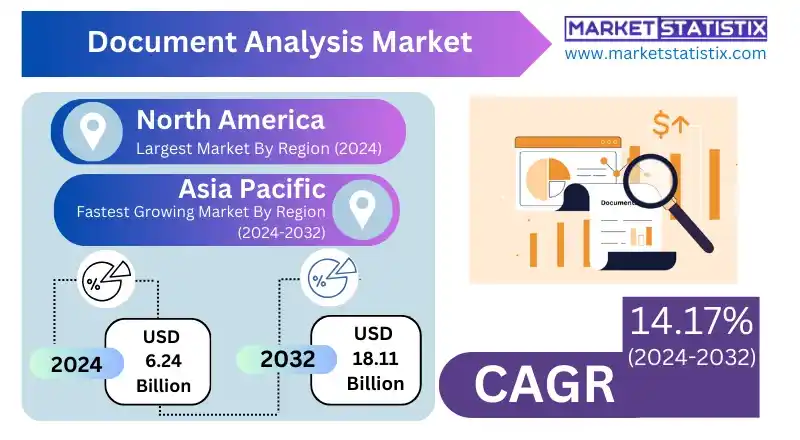

| Growth Rate | CAGR of 14.17% |

| Forecast Value (2032) | USD 18.11 Billion |

| By Product Type | On-Premises, Cloud-Based |

| Key Market Players |

|

| By Region |

|

Document Analysis Market Trends

The document analysis market is currently swinging sharply toward AI-orientated automation, including pervasive applications of machine learning and natural language processing. The key trend is the emergence of intelligent document processing (IDP) solutions that go beyond ordinary OCR to understand documents' context and meaning and thereby enable extraction of data more accurately and efficiently. Another key area that continues to expand is cloud-based deployment, considering its scale and easy access integration in document analysis tools with enterprise systems. Further attention on hyper automation provides integration by which document analysis is synchronised into larger workflows for end-to-end business process improvement. There is also an increasing demand for specialised solutions tailored to specific industries and document types; for example, the financial documents, legal contracts, and healthcare records focus on much more than just general document analysis. However, of much consideration in this market today are the practices that guarantee strong encryption and access control, fuelled by the need for data privacy and security. Low-code/no-code platforms are increasingly in vogue so that non-technical end users can configure and customise their document analysis workflows. The synergistic onset of document analysis with robotic process automation (RPA) is gathering pace to allow the automation of repetitive document-centric tasks.Document Analysis Market Leading Players

The key players profiled in the report are Extract Systems (US), AntWorks (Singapore), Infrrd (US), Parascript (US), Automation Anywhere (US), WorkFusion (US), InData Labs (Belarus), Ephesoft (US), Kodak Alaris (UK), IBM (US), Datamatics (India), ABBYY (US), Rossum (Czech Republic), HCL Technologies (India), Hyland (US), OpenText (Canada), HyperScience (US), Kofax (US), Celaton (UK), and IRIS (Belgium)Growth Accelerators

Unstructured data has witnessed explosive growth across various domains, and this constitutes one of the core drivers for the document analysis market. Organizations feel the pressing need to fairly fast process and gather insights from this data, which are mainly entombed in documents such as invoices, contracts, and reports. Automation and digital transformation efforts are also chief factors for organizations trying to limit human data entry, increase operational efficiency, and reduce errors. Moreover, an organisation seeking to oblige strict regulatory requirements, like data privacy and security regulations, will need capable document analysis solutions to ensure record-keeping and auditing. Another major driver is the shift toward cloud-based solutions, allowing for scalability, accessibility, and cost-effectiveness. Finally, real-time data processing and analytics have increased the demand from businesses for quick document analysis tools for extracting critical information needed for timely decision-making.Document Analysis Market Segmentation analysis

The United States Document Analysis is segmented by Type, Application, and Region. By Type, the market is divided into Distributed On-Premises, Cloud-Based . The Application segment categorizes the market based on its usage such as Banking and Financial Services, Healthcare, Legal, Education. Geographically, the market is assessed across key Regions like United States (The West, Southwest, The Middle Atlantic, New England, The South, The Midwest) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The document analysis market has been further defined by the competitive presence of IBM, Microsoft, Adobe, and Google, as well as new entrants that developed AI-focused startups. They now enhance document processing, data extraction, and automation by leveraging artificial intelligence (AI), machine learning (ML), and optical character recognition (OCR). Also, large enterprises implement document analysis thoughts and tools with full business automation tools across selected industries like finance, healthcare, and legal services. Also, the adoption of cloud-based document processing continues to rise and hence will increase competition among these market players in providing opportunities for real-time collaboration and efficiency.Challenges In Document Analysis Market

The document analysis market is posed with various challenges that might affect the growth landscape. The primary challenge is the high costs involved in the implementation and maintenance of advanced document analysis solutions, particularly for small and medium-sized enterprises (SMEs). The tools normally call for huge investments in infrastructure, skilled personnel, and integration with existing systems, which truly become a hurdle for resource-constrained organizations. Furthermore, with the increasing adoption of cloud-based solutions, data security and privacy concerns have also come to the fore. As enterprises work with sensitive information in highly regulated industries such as healthcare and BFSI, they are often cautious about employing the new technologies due to the inherent risk of data breaches or regulatory non-compliance.Risks & Prospects in Document Analysis Market

The growing demand for these solutions in predictive analytics, workflow automation, and advanced natural language processing (NLP) solutions across industries such as BFSI, healthcare, and government has created key opportunities for growth. The increased demand for intelligent document processing solutions is supplemented by the shift to digital transformation and towards regulatory compliance. The deployment of such solutions increases operational efficiency and enhances customer experience. Regionally, North America leads the market, owing to the early adoption of advanced technologies along with the strong presence of key players. Europe comes second, impacted by strict regulatory requirements and growing digitisation across industries. The Asia-Pacific region is forecasted to witness the highest growth during the anticipated period, driven by swift digital transformation initiatives across China and India. Emerging markets in Latin America and the Middle East, where companies are increasingly turning to AI-driven solutions for operational efficiency and data management improvement, present potential opportunities.Key Target Audience

The document analysis market primarily targets enterprises, government agencies, and financial institutions for advanced data extraction and automation solutions. These include large corporations and industries such as healthcare, banking, and legal services, which have employed document analysis systems in their processes to effect workflow optimisation, improve accuracy, and adhere to regulatory requirements. However, the main use of this solution by financial institutions depends on fraud detection, risk assessment, and document verification, which lessen the intensity of manual operations and reduce operational costs.,, Public sector organizations and government agencies are also major consumers of this technology, implementing document analysis for record management, identity verification, and secure data processing. Technology companies and research institutions also apply such an analysis for big data processing, artificial intelligence (AI) model training, and knowledge management. As digital transformation absorbs small- and medium-sized enterprises (SMEs) with greater speed, cloud-based document analysis becomes a tool for efficiency enhancement and securing competitive advantages, all of which broaden the market reach.Merger and acquisition

There have been notable mergers and acquisitions in the document analysis market as companies enhance their capabilities and forge a broader market presence. Kofax Inc., headquartered in the U.S. and predominantly an intelligent automation software company, acquired Ephesoft Inc. in August 2022. Ephesoft Inc. is recognised for AI-powered document analysis solutions. This acquisition aimed at strengthening Kofax's intelligent document processing and cloud capabilities by infusing advanced data extraction technologies and providing comprehensive solutions. Such acquisitions are examples of a more general trend toward companies seeking to improve their technology and market scope, which specialised solutions in document analysis can help accomplish. While this could allow firms to close a gap quickly in their offerings, it would help expand their reach without the extensive periods of proprietary development time associated with building it in-house. >Analyst Comment

The rapid expansion of the document analysis market is fuelled by the growing pile of unstructured data and the ongoing need for digital transformation in various industries. Increasing operational efficiency, reducing manual data entry, and enhancing compliance are the fundamental drivers behind adopting these technologies. AI and ML change the way we process documents with a lot of complex tasks, including automated data extraction and validation and classification, etc. Cloud-based systems are swiftly gaining much popularity because of scalability and accessibility while also exacerbating the demand for customised solutions pertinent to specific industries and types of documents. With increased emphasis on data security and privacy, vendor strategies and product innovations are currently being tuned accordingly.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Document Analysis- Snapshot

- 2.2 Document Analysis- Segment Snapshot

- 2.3 Document Analysis- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Document Analysis Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 On-Premises

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Cloud-Based

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Document Analysis Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Banking and Financial Services

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Healthcare

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Legal

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Education

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Document Analysis Market by Functionality

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Text Analysis

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Data Visualization

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Document Classification

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Document Analysis Market by Solution

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Product

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Services

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Document Analysis Market by Service

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Professional Services

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Managed Services

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

9: Document Analysis Market by Organization Size

- 9.1 Overview

- 9.1.1 Market size and forecast

- 9.2 SMEs

- 9.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.2 Market size and forecast, by region

- 9.2.3 Market share analysis by country

- 9.3 Large Enterprises

- 9.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.2 Market size and forecast, by region

- 9.3.3 Market share analysis by country

10: Document Analysis Market by Vertical

- 10.1 Overview

- 10.1.1 Market size and forecast

- 10.2 BFSI

- 10.2.1 Key market trends, factors driving growth, and opportunities

- 10.2.2 Market size and forecast, by region

- 10.2.3 Market share analysis by country

- 10.3 Government

- 10.3.1 Key market trends, factors driving growth, and opportunities

- 10.3.2 Market size and forecast, by region

- 10.3.3 Market share analysis by country

- 10.4 Healthcare and Life Sciences

- 10.4.1 Key market trends, factors driving growth, and opportunities

- 10.4.2 Market size and forecast, by region

- 10.4.3 Market share analysis by country

- 10.5 Retail and eCommerce

- 10.5.1 Key market trends, factors driving growth, and opportunities

- 10.5.2 Market size and forecast, by region

- 10.5.3 Market share analysis by country

- 10.6 Manufacturing

- 10.6.1 Key market trends, factors driving growth, and opportunities

- 10.6.2 Market size and forecast, by region

- 10.6.3 Market share analysis by country

- 10.7 Transportation and Logistics

- 10.7.1 Key market trends, factors driving growth, and opportunities

- 10.7.2 Market size and forecast, by region

- 10.7.3 Market share analysis by country

11: Document Analysis Market by Region

- 11.1 Overview

- 11.1.1 Market size and forecast By Region

- 11.2 The West

- 11.2.1 Key trends and opportunities

- 11.2.2 Market size and forecast, by Type

- 11.2.3 Market size and forecast, by Application

- 11.2.4 Market size and forecast, by country

- 11.3 Southwest

- 11.3.1 Key trends and opportunities

- 11.3.2 Market size and forecast, by Type

- 11.3.3 Market size and forecast, by Application

- 11.3.4 Market size and forecast, by country

- 11.4 The Middle Atlantic

- 11.4.1 Key trends and opportunities

- 11.4.2 Market size and forecast, by Type

- 11.4.3 Market size and forecast, by Application

- 11.4.4 Market size and forecast, by country

- 11.5 New England

- 11.5.1 Key trends and opportunities

- 11.5.2 Market size and forecast, by Type

- 11.5.3 Market size and forecast, by Application

- 11.5.4 Market size and forecast, by country

- 11.6 The South

- 11.6.1 Key trends and opportunities

- 11.6.2 Market size and forecast, by Type

- 11.6.3 Market size and forecast, by Application

- 11.6.4 Market size and forecast, by country

- 11.7 The Midwest

- 11.7.1 Key trends and opportunities

- 11.7.2 Market size and forecast, by Type

- 11.7.3 Market size and forecast, by Application

- 11.7.4 Market size and forecast, by country

- 12.1 Overview

- 12.2 Key Winning Strategies

- 12.3 Top 10 Players: Product Mapping

- 12.4 Competitive Analysis Dashboard

- 12.5 Market Competition Heatmap

- 12.6 Leading Player Positions, 2022

13: Company Profiles

- 13.1 ABBYY (US)

- 13.1.1 Company Overview

- 13.1.2 Key Executives

- 13.1.3 Company snapshot

- 13.1.4 Active Business Divisions

- 13.1.5 Product portfolio

- 13.1.6 Business performance

- 13.1.7 Major Strategic Initiatives and Developments

- 13.2 WorkFusion (US)

- 13.2.1 Company Overview

- 13.2.2 Key Executives

- 13.2.3 Company snapshot

- 13.2.4 Active Business Divisions

- 13.2.5 Product portfolio

- 13.2.6 Business performance

- 13.2.7 Major Strategic Initiatives and Developments

- 13.3 Kofax (US)

- 13.3.1 Company Overview

- 13.3.2 Key Executives

- 13.3.3 Company snapshot

- 13.3.4 Active Business Divisions

- 13.3.5 Product portfolio

- 13.3.6 Business performance

- 13.3.7 Major Strategic Initiatives and Developments

- 13.4 IBM (US)

- 13.4.1 Company Overview

- 13.4.2 Key Executives

- 13.4.3 Company snapshot

- 13.4.4 Active Business Divisions

- 13.4.5 Product portfolio

- 13.4.6 Business performance

- 13.4.7 Major Strategic Initiatives and Developments

- 13.5 AntWorks (Singapore)

- 13.5.1 Company Overview

- 13.5.2 Key Executives

- 13.5.3 Company snapshot

- 13.5.4 Active Business Divisions

- 13.5.5 Product portfolio

- 13.5.6 Business performance

- 13.5.7 Major Strategic Initiatives and Developments

- 13.6 Parascript (US)

- 13.6.1 Company Overview

- 13.6.2 Key Executives

- 13.6.3 Company snapshot

- 13.6.4 Active Business Divisions

- 13.6.5 Product portfolio

- 13.6.6 Business performance

- 13.6.7 Major Strategic Initiatives and Developments

- 13.7 Automation Anywhere (US)

- 13.7.1 Company Overview

- 13.7.2 Key Executives

- 13.7.3 Company snapshot

- 13.7.4 Active Business Divisions

- 13.7.5 Product portfolio

- 13.7.6 Business performance

- 13.7.7 Major Strategic Initiatives and Developments

- 13.8 Datamatics (India)

- 13.8.1 Company Overview

- 13.8.2 Key Executives

- 13.8.3 Company snapshot

- 13.8.4 Active Business Divisions

- 13.8.5 Product portfolio

- 13.8.6 Business performance

- 13.8.7 Major Strategic Initiatives and Developments

- 13.9 Hyland (US)

- 13.9.1 Company Overview

- 13.9.2 Key Executives

- 13.9.3 Company snapshot

- 13.9.4 Active Business Divisions

- 13.9.5 Product portfolio

- 13.9.6 Business performance

- 13.9.7 Major Strategic Initiatives and Developments

- 13.10 Extract Systems (US)

- 13.10.1 Company Overview

- 13.10.2 Key Executives

- 13.10.3 Company snapshot

- 13.10.4 Active Business Divisions

- 13.10.5 Product portfolio

- 13.10.6 Business performance

- 13.10.7 Major Strategic Initiatives and Developments

- 13.11 HyperScience (US)

- 13.11.1 Company Overview

- 13.11.2 Key Executives

- 13.11.3 Company snapshot

- 13.11.4 Active Business Divisions

- 13.11.5 Product portfolio

- 13.11.6 Business performance

- 13.11.7 Major Strategic Initiatives and Developments

- 13.12 OpenText (Canada)

- 13.12.1 Company Overview

- 13.12.2 Key Executives

- 13.12.3 Company snapshot

- 13.12.4 Active Business Divisions

- 13.12.5 Product portfolio

- 13.12.6 Business performance

- 13.12.7 Major Strategic Initiatives and Developments

- 13.13 Infrrd (US)

- 13.13.1 Company Overview

- 13.13.2 Key Executives

- 13.13.3 Company snapshot

- 13.13.4 Active Business Divisions

- 13.13.5 Product portfolio

- 13.13.6 Business performance

- 13.13.7 Major Strategic Initiatives and Developments

- 13.14 Celaton (UK)

- 13.14.1 Company Overview

- 13.14.2 Key Executives

- 13.14.3 Company snapshot

- 13.14.4 Active Business Divisions

- 13.14.5 Product portfolio

- 13.14.6 Business performance

- 13.14.7 Major Strategic Initiatives and Developments

- 13.15 HCL Technologies (India)

- 13.15.1 Company Overview

- 13.15.2 Key Executives

- 13.15.3 Company snapshot

- 13.15.4 Active Business Divisions

- 13.15.5 Product portfolio

- 13.15.6 Business performance

- 13.15.7 Major Strategic Initiatives and Developments

- 13.16 Kodak Alaris (UK)

- 13.16.1 Company Overview

- 13.16.2 Key Executives

- 13.16.3 Company snapshot

- 13.16.4 Active Business Divisions

- 13.16.5 Product portfolio

- 13.16.6 Business performance

- 13.16.7 Major Strategic Initiatives and Developments

- 13.17 Rossum (Czech Republic)

- 13.17.1 Company Overview

- 13.17.2 Key Executives

- 13.17.3 Company snapshot

- 13.17.4 Active Business Divisions

- 13.17.5 Product portfolio

- 13.17.6 Business performance

- 13.17.7 Major Strategic Initiatives and Developments

- 13.18 InData Labs (Belarus)

- 13.18.1 Company Overview

- 13.18.2 Key Executives

- 13.18.3 Company snapshot

- 13.18.4 Active Business Divisions

- 13.18.5 Product portfolio

- 13.18.6 Business performance

- 13.18.7 Major Strategic Initiatives and Developments

- 13.19 Ephesoft (US)

- 13.19.1 Company Overview

- 13.19.2 Key Executives

- 13.19.3 Company snapshot

- 13.19.4 Active Business Divisions

- 13.19.5 Product portfolio

- 13.19.6 Business performance

- 13.19.7 Major Strategic Initiatives and Developments

- 13.20 and IRIS (Belgium)

- 13.20.1 Company Overview

- 13.20.2 Key Executives

- 13.20.3 Company snapshot

- 13.20.4 Active Business Divisions

- 13.20.5 Product portfolio

- 13.20.6 Business performance

- 13.20.7 Major Strategic Initiatives and Developments

14: Analyst Perspective and Conclusion

- 14.1 Concluding Recommendations and Analysis

- 14.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Functionality |

|

By Solution |

|

By Service |

|

By Organization Size |

|

By Vertical |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Document Analysis in 2032?

+

-

Which application type is expected to remain the largest segment in the United States Document Analysis market?

+

-

How big is the United States Document Analysis market?

+

-

How do regulatory policies impact the Document Analysis Market?

+

-

What major players in Document Analysis Market?

+

-

What applications are categorized in the Document Analysis market study?

+

-

Which product types are examined in the Document Analysis Market Study?

+

-

Which regions are expected to show the fastest growth in the Document Analysis market?

+

-

Which application holds the second-highest market share in the Document Analysis market?

+

-

Which region is the fastest growing in the Document Analysis market?

+

-