North America Tea Extract Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-845 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The market for tea extract includes concentrated products derived from different tea leaves, including green tea, black tea, oolong tea, and white tea. These extracts are made by separating the healthy compounds from the tea leaves by using solvents such as water or ethanol and then undergoing processes such as filtration, concentration, and drying to obtain a powder or liquid product. Tea extracts are bioactive, containing polyphenols (e.g., catechins and theaflavins), caffeine, amino acids (e.g., L-theanine), and antioxidants that are thought to provide a variety of health benefits.

These tea concentrates are versatile and convenient, with applications in a range of industries. In the food and beverage industry, tea extracts are utilised for flavouring and strengthening products such as ready-to-drink tea, energy drinks, confectionery, and baked foods. The nutraceutical and dietary supplement markets apply tea extracts due to their antioxidant, weight management, and cognitive benefits, formulating them into capsules, tablets, and powders.

Tea Extract Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

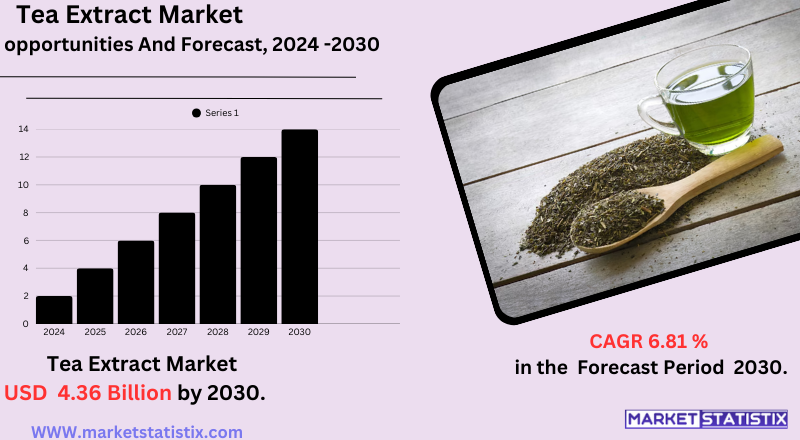

| Growth Rate | CAGR of 6.81% |

| Forecast Value (2030) | USD 4.36 Billion |

| By Product Type | Green Tea Extract, Black Tea Extract, White Tea Extract, Oolong Tea Extract |

| Key Market Players |

|

| By Region |

|

Tea Extract Market Trends

The market for tea extract is expanding hugely on account of growing consumer interest in the health benefits that are linked with tea, which include antioxidants and function in enhancing metabolism. This has resulted in a growing demand for tea extracts as natural and clean-label additives across industries. The food and beverages industry are one of the key application sectors, where tea extracts are incorporated into ready-to-drink teas, functional drinks, and natural flavourings.

Another trend is the growing use of tea extracts in the cosmetics and personal care sector. Their anti-inflammatory and antioxidant characteristics are prized in skincare and haircare products, responding to the increasing need for natural and plant-based beauty products. In addition, improvements in extraction technologies are improving the quality and strength of tea extracts, making them increasingly attractive for various uses. The market is also seeing an increasing demand for organic tea extracts, led by the clean label trend and consumer demand for pesticide-free ingredients.

Tea Extract Market Leading Players

The key players profiled in the report are Bombay Burmah Trading Corporation Limited (India, Associated British Foods plc (United Kingdom), Shangri-la Tea (United States), Tata Consumer Product Limited (India), Unilever (United Kingdom), Celestial Seasonings (United States), Numi, Inc. P.B.C (United States), Stash Tea (United States), Mighty Leaf Tea (Canada), Vahdam (India), Bigelow Tea (United States, Yogi (United States)Growth Accelerators

The market for tea extracts is driven by a synergy of forces based on health and wellness trends. One of the major drivers is growing consumer sensitivity to the various health benefits linked to tea extracts, including their high antioxidant content, weight management potential, and cardiovascular and cognitive benefits. The expanding health awareness is driving demand for natural and plant-based ingredients across different applications.

In addition, growth in demand for functional beverages and dietary supplements is another driving factor. Tea extracts are becoming more prominent in ready-to-drink teas, energy drinks, and nutraceutical products to meet consumers' demands for easy-to-consume and health-promoting products. The clean-label trend, where consumers choose products that contain natural and recognisable ingredients, further drives demand for tea extracts as a natural substitute for artificial additives in the food, beverage, and cosmetic industries.

Tea Extract Market Segmentation analysis

The North America Tea Extract is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Green Tea Extract, Black Tea Extract, White Tea Extract, Oolong Tea Extract . The Application segment categorizes the market based on its usage such as Food and Beverages, Cosmetics, Pharmaceuticals, Dietary Supplements. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market competition for tea extracts is moderately concentrated, with a combination of large, established ingredient companies and small, specialised manufacturers. Some of the major players in the world are Archer Daniels Midland (ADM), International Flavours & Fragrances (IFF), Givaudan, Kerry Group, and Tate & Lyle, who have large portfolios and extensive distribution channels. These firms tend to supply different application industries such as food & beverage, dietary supplements, and cosmetics.

But the market is also dominated by the presence of tea-specialist companies such as Finlays, Martin Bauer Group, and Synthite Industries, with in-depth knowledge in tea extraction and processing. Competition is motivated by the number of tea extracts that are being made available (green, black, oolong, etc.), the quality and purity of the extracts themselves, advancements in extraction technologies (such as supercritical CO₂ extraction), and competitiveness in meeting increased demand for organic and clean-label ingredients. Strategic alliances, launches of new products (such as instant tea extract powders with improved bioavailability), and entries into growing markets are typical tactics followed by participants to become competitive.

Challenges In Tea Extract Market

The market for tea extract is subject to various major challenges that may slow its growth pattern. Among the major challenges is the limited and unstable supply of high-quality raw tea leaves, which is greatly affected by climate change, unstable weather patterns, and farm volatility. They are likely to lower the production level, raise the cost, and interfere with supply chains, especially in large tea-growing countries like China, India, Sri Lanka, and Kenya. Moreover, labour shortages and sustainability issues also complicate the steady supply of raw materials, and geopolitical tensions and logistics bottlenecks may slow down product delivery and affect global market stability.

Another significant challenge is the growing competition from cheaper synthetic substitutes and other natural extracts offering comparable health benefits, which challenges tea extract manufacturers to differentiate. The market is also under threat from the spreading of counterfeit or low-quality extracts, which dissolve consumer trust and brand equity. Finally, changing consumer needs and economic downturns can affect demand, so manufacturers need to keep innovating and adjusting to changing market patterns.

Risks & Prospects in Tea Extract Market

Major drivers for growth are increasing consciousness of the antioxidant and bioactive properties of tea, rising functional and clean-label product activity, and expanding demand for speciality and herbal tea. Technological progress in extraction technology and broadening e-commerce and direct-to-consumer sales channels also drive market potential higher. Furthermore, demand for tea extracts in dietary supplements and nutraceuticals, particularly for weight management and prevention of disease, is likely to fuel market growth.

Geographically, Asia-Pacific leads the market for tea extract through its long-established tea culture, strong production base, and rising global exports, especially from China and India. North America is presently the largest market, as it exemplifies high demand for functional foods and supplements, whereas Europe is also seeing growth driven by consumer choice for natural and organic products. Latin American and Middle Eastern emerging markets are also promising as health benefits awareness and disposable incomes increase.

Key Target Audience

The market is especially high for green tea extracts due to their popularity among consumers seeking weight management and natural energy solutions. The rising demand for clean-label and organic products has also resulted in higher tea extract intake in ready-to-drink, dietary supplement, and food applications. The trend can be seen across all generations, ranging from busy professionals to fitness enthusiasts, who are seeking convenience while still opting for healthier solutions.

,,The tea extract industry appeals to a broad spectrum of consumers, who are mainly health-aware individuals looking for natural and functional ingredients. Such consumers are attracted to tea extracts due to their high antioxidant profile, such as catechins and polyphenols, that are linked with a number of health benefits, such as enhanced metabolism, cardiovascular care, and immunity.

,,

Merger and acquisition

The tea extract industry has witnessed significant mergers and acquisitions in recent times, a testament to companies pursuing strategic alliances to consolidate and expand capabilities. In July 2023, Finlays, a beverage solutions provider in the UK, acquired tea and yerba mate extraction assets in Natural Instant Foods. This acquisition is intended to boost Finlays' production capacity by moving the assets to its Saosa plant in Kericho, Kenya, setting up a small-scale production line and pilot plant. Such actions suggest a trend among companies to strengthen their supply chains and production capacities in major tea-producing areas.

Moreover, the market has experienced substantial investments targeting increased production and responding to increasing demand. For example, in February 2024, Tata Consumer Products made a $50 million investment in a new manufacturing facility for tea extracts in Assam, India, to boost production capacity by 40%. This investment reflects the company's drive to expand operations in anticipation of increased global demand for tea extracts.

These developments highlight a dynamic period in the tea extract market, characterized by strategic acquisitions and substantial investments aimed at enhancing production capabilities and meeting increasing consumer demand for tea-based products.

>

Analyst Comment

The tea extract market is experiencing strong growth, driven by rising health consciousness, demand for natural ingredients, and the popularity of functional beverages. The market is projected to grow from $4.44 billion in 2024 to $6.21 billion by 2029. Tea extracts, valued for their antioxidant properties and bioactive compounds, are increasingly used in food and beverages, dietary supplements, pharmaceuticals, and cosmetics. The surge in ready-to-drink teas, clean-label trends, and the expansion of e-commerce are further fuelling market expansion, with Asia-Pacific leading due to its rich tea culture and export demand.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Tea Extract- Snapshot

- 2.2 Tea Extract- Segment Snapshot

- 2.3 Tea Extract- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Tea Extract Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Green Tea Extract

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Black Tea Extract

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 White Tea Extract

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Oolong Tea Extract

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Tea Extract Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food and Beverages

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pharmaceuticals

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Cosmetics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Dietary Supplements

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Tea Extract Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Associated British Foods plc (United Kingdom)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Bigelow Tea (United States

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Bombay Burmah Trading Corporation Limited (India

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Celestial Seasonings (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Mighty Leaf Tea (Canada)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Numi

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Inc. P.B.C (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Shangri-la Tea (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Stash Tea (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Tata Consumer Product Limited (India)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Unilever (United Kingdom)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Vahdam (India)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Yogi (United States)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Tea Extract in 2030?

+

-

How big is the North America Tea Extract market?

+

-

How do regulatory policies impact the Tea Extract Market?

+

-

What major players in Tea Extract Market?

+

-

What applications are categorized in the Tea Extract market study?

+

-

Which product types are examined in the Tea Extract Market Study?

+

-

Which regions are expected to show the fastest growth in the Tea Extract market?

+

-

Which application holds the second-highest market share in the Tea Extract market?

+

-

What are the major growth drivers in the Tea Extract market?

+

-

The market for tea extracts is driven by a synergy of forces based on health and wellness trends. One of the major drivers is growing consumer sensitivity to the various health benefits linked to tea extracts, including their high antioxidant content, weight management potential, and cardiovascular and cognitive benefits. The expanding health awareness is driving demand for natural and plant-based ingredients across different applications.

In addition, growth in demand for functional beverages and dietary supplements is another driving factor. Tea extracts are becoming more prominent in ready-to-drink teas, energy drinks, and nutraceutical products to meet consumers' demands for easy-to-consume and health-promoting products. The clean-label trend, where consumers choose products that contain natural and recognisable ingredients, further drives demand for tea extracts as a natural substitute for artificial additives in the food, beverage, and cosmetic industries.

Is the study period of the Tea Extract flexible or fixed?

+

-