Short-Term Rental Platforms Market Trends and Forecast to 2031

Report ID: MS-402 | Consumer Goods | Last updated: Feb, 2025 | Formats*:

Short-Term Rental Platforms Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2024 |

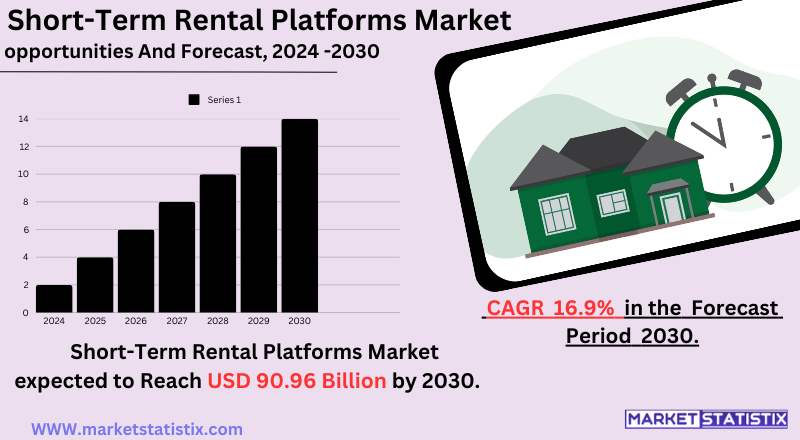

| Growth Rate | CAGR of 16.9% |

| Forecast Value (2031) | USD 90.96 Billion |

| By Product Type | Cloud Based, Web Based, On Premises |

| Key Market Players |

|

| By Region |

Short-Term Rental Platforms Market Trends

Short-term rental platforms have become featherweights, fast gaining momentum on account of travel patterns that keep adapting with technology. Travelers increasingly seek uncluttered and personalised accommodation alternatives to hotels, routing themselves toward the diversified offerings of these rental platforms. Market trends are further urged toward the same for the reasons of experiencing local culture firsthand, getting unblemished flexibility, and being picky about competitive prices. Key segments of the market consist of software (cloud/license application-based and on-premise) and services (namely professional and managed services). Applications range from consumer to industrial, government, health care, and legal, each with distinct demands and challenges. While AI definitely is propelling investments in the North American market, growth is expected in the Asia-Pacific region.Short-Term Rental Platforms Market Leading Players

The key players profiled in the report are Only-apartments (Spain),, HouseTrip (Switzerland),, 9flats (Germany),, HomeAway (United States),, Wimdu (Germany),, Housetrip (United Kingdom),, Vrbo (United States),, ZenRooms (Singapore),, Windu (France),, Rakuten Stay (Japan)Growth Accelerators

There are quite a few primary factors driving the short-term rental platforms market that add to its attractiveness for consumers and property owners alike. One key factor is the increase in consumer demand for exceptional travel experiences, which short-term rentals usually offer as opposed to hotel stays. The rise of digital platforms such as Airbnb and Vrbo goes hand in hand with this shift in traditional travel consumers' attitudes. Another major driving force in this particular market is the growth in people working remotely and taking advantage of the flexible travel option. Both factors drive even more people to check out short-term rentals—in fact, these are for self-rewarding "vacations" or work on the business side. The progress of the tourist business also has a significant impact on this, with the increase in worldwide travel rates pushing demand further for vacation rentals. In addition, government investments in improving infrastructure and promoting tourism in various regions have improved access and, therefore, the attractiveness of short-term rentals.Short-Term Rental Platforms Market Segmentation analysis

The Global Short-Term Rental Platforms is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cloud Based, Web Based, On Premises . The Application segment categorizes the market based on its usage such as Individual, Business, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for short-term rental platforms is intensely competitive, with a few main players monopolising the field. Airbnb and Vrbo are the two biggest retail networks across the globe, associated with long listings as well as a strong trademark name. Other prominent competitors, besides these, are Booking.com, Expedia, and some local players like MakeMyTrip in India. Factors of competition include the range of types of properties, pricing, customer experience, and services offered. The market also consists of many such niche platforms that cater to specific types of travel groups or types of properties, such as high-end rentals, environmentally friendly sites, or rentals centred on specific pursuits like skiing or hiking. Such a market is fragmented enough to allow specialisation as well as broad appeal to many different tastes of travellers. It is a very lively, evolving space.Challenges In Short-Term Rental Platforms Market

The short-term rental platform market has a tangled web of challenges. One major difficulty is the intense scrutiny and restrictions imposed by local governments. Cities are trying to tackle the impact of short-term rentals on housing affordability, neighbourhood character, and taxation; to this end, many have formulated regulations that may virtually halt the function of these platforms while increasing costs for hosts. Another great challenge is maintaining trust and safety on the platforms. Guest behaviour, property damage, and disturbances to the neighbourhood deter hosts and guests alike. An investment by the platforms in strong verification procedures, secure payment systems, and a good dispute resolution mechanism is very much needed to mitigate the risks and build a positive experience for all users.Risks & Prospects in Short-Term Rental Platforms Market

The short-term rental industry, unlike others within the hospitality sector, is light on glamour but gaining momentum with the ever-changing evolving travel patterns with technology. Travelers are choosing aversion to hotels toward uncluttered, personalised lodging possibilities, thus routing themselves toward the varied sources offered by short-term rental platforms. Market trends are further pushed in this direction to directly experience the local culture with a decent flexibility of choice and to pick and choose competitive pricing. The key segments of the market are software (cloud-based and on-premise) as well as services (professional services and managed services). Applications could involve any from consumer to industrial, governmental, healthcare, and legal, each with specific needs and challenges. AI has played a pivotal role in attracting investments in the North American market, with growth prospects anticipated in the Asia-Pacific region.Key Target Audience

, One of the primary target markets of the short-term rental platforms is travellers searching for flexible and affordable accommodation facilities. These include tourists, business travellers, and digital nomads who prefer home-like stays to traditional hotels. Families and groups tend to hold different motives in selecting short-term rentals, including space, amenities, and affordability, which makes such vacation homes and apartments a frequent option. Increasingly, even corporate clients and remote workers are turning to the platforms for longer stays made imperative by the new work-from-anywhere changing trend., Another important audience for whom the short-term rental platforms are intended is landlords and hosts who would otherwise generally immure their spaces. These owners include single households, real estate investors seeking a model for generating short-term rental income, and property management companies. Dynamic pricing, guest screening, and automated management features are just some of the aforementioned intended functionalities by most hosts for revenue optimisation.Merger and acquisition

Short-term rental platforms are very busy acquiring companies to consolidate services and to spread their reach into various parts of the world. In December 2024, Casago, a vacation rental property management franchise, announced plans to acquire all outstanding shares of Vacasa for $128.6 million. This is anticipated to greatly strengthen the company's portfolio and, as an effect, strengthen its position in an industry segment where it is not yet mature, that of vacation rentals. Earlier, in 2024, Guesty—a property management system provider for the vacation rental sector—acquired Rentals United, a channel management service based in Barcelona. This acquisition is expected to further consolidate the industry into a much more fragmented environment whereby Rentals United will still operate under its own name with an improved Guesty distribution network and more scalable operations for its business. >Analyst Comment

Soon, short-term rentals are taking the world by storm, attracting most travellers who prefer more personalised and quite unique accommodation experiences. The global market had, in 2024, a value of USD 134.51 billion and will cross nearly USD 344.06 billion by 2034. The growth comes about through increasing online booking agencies like Airbnb and VRBO, where a range of types of properties—from apartments to unique stays—are easily accessible to travellers enjoying local neighbourhoods and cultures. The rise of remote work has also built on this; people can now choose where they live according to personal needs, increasing the demand for rental properties across many sites.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Short-Term Rental Platforms- Snapshot

- 2.2 Short-Term Rental Platforms- Segment Snapshot

- 2.3 Short-Term Rental Platforms- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Short-Term Rental Platforms Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cloud Based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Web Based

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 On Premises

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Short-Term Rental Platforms Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Individual

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Business

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Others

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 HomeAway (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Vrbo (United States)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Wimdu (Germany)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 9flats (Germany)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 HouseTrip (Switzerland)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Only-apartments (Spain)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Housetrip (United Kingdom)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Windu (France)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 ZenRooms (Singapore)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Rakuten Stay (Japan)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Short-Term Rental Platforms in 2031?

+

-

Which type of Short-Term Rental Platforms is widely popular?

+

-

What is the growth rate of Short-Term Rental Platforms Market?

+

-

What are the latest trends influencing the Short-Term Rental Platforms Market?

+

-

Who are the key players in the Short-Term Rental Platforms Market?

+

-

How is the Short-Term Rental Platforms } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Short-Term Rental Platforms Market Study?

+

-

What geographic breakdown is available in Global Short-Term Rental Platforms Market Study?

+

-

Which region holds the second position by market share in the Short-Term Rental Platforms market?

+

-

How are the key players in the Short-Term Rental Platforms market targeting growth in the future?

+

-