North America Sake Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-804 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Sake Report Highlights

| Report Metrics | Details |

|---|---|

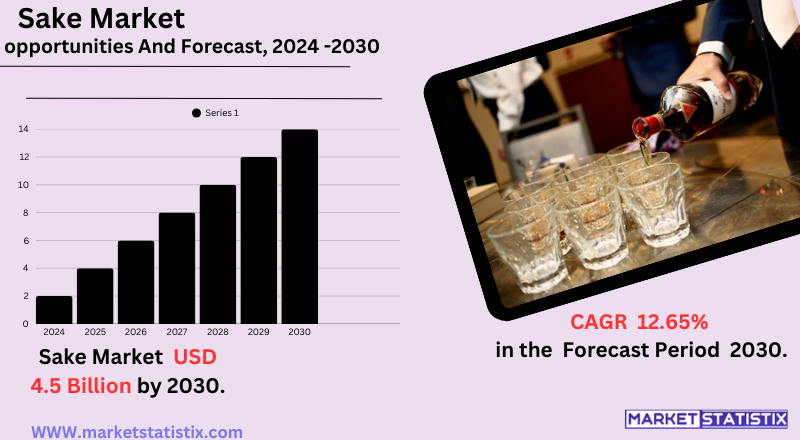

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 4.5% |

| Forecast Value (2030) | USD 12.65 Billion |

| By Product Type | Junmai Ginjo, Ordinary Sake, Honjozo, Junmai, Ginjo |

| Key Market Players |

|

| By Region |

Sake Market Trends

At present, the sake market recognises an important trend, which is premiumisation. Not only have consumers begun keenly pursuing high-quality craft and artisan’s sake around the world, but they also are ready to spend more for it. This reflects in the growing volume of the premium category, such as Junmai Daiginjo, and the awareness that sake can have a variety of certain flavour profiles, specific brewing methods, and local styles. The very widening distribution of sake in the fine-dining spectrum continues to witness increasingly broadened cuisine – from typical Japanese to Western inclusion – and indicates a potential customer who appreciates quality and experience. A significant global emerging manifesto, wherein sake increasingly spread its wings, is that North America is establishing its own market, whose development continues in Europe and Asia (excluding Japan). With these countries, increased demand for exports will include a lot of market expansion, mainly because Japanese cuisine is becoming popular all over the world while consumers are also becoming more concerned about other forms of alcohol in addition to sake.Sake Market Leading Players

The key players profiled in the report are KANPAI London Craft Sake, Gekkeikan Sake Co., Ltd, Hakutsuru Sake Brewing Co., Ltd., Sun Masamune Pty Limited, Asahishuzo CO., Ltd., Tatsuuma-Honke Brewing Co. Ltd., Blue Current Brewery, Aramasa Shuzo Co.Growth Accelerators

Several principal factors propel the increase in growth of the sake market. For once, this rising international appreciation for Japanese culture and cuisine significantly boosts the demand for sake as an authentic accompaniment. Foreign influence on Japanese restaurants enhances sake curiosity and consumption. Following is a more pronounced demand for premium and craft sake. The consumer trend toward higher-quality beverages, often artisanal ones with unique flavour profiles and methods of production, is in line with the overall beverage market. This very premiumisation is thus leaving producers free to optimise revenue by concentrating on the value proposition. Moreover, the export opportunities improve significantly. Japanese breweries, facing the challenge of declining domestic consumption due to demographic trends, are increasingly looking to international markets such as North America and Europe, where interest in sake is very high. Innovative product development, such as flavoured and sparkling sake, and the growing application of sake in cocktails and food pairings, are drawing in new consumer segments and enhancing the spirit's attractiveness outside the traditional Japanese setting.Sake Market Segmentation analysis

The North America Sake is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Junmai Ginjo, Ordinary Sake, Honjozo, Junmai, Ginjo . The Application segment categorizes the market based on its usage such as Restaurants], Commercial Use [Hotel, Home Use. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

As for the competition in terms of the sake market, it's actually pretty fragmented. There exist vast numbers of breweries, mostly small and medium-sized, but some of them are associated with international market pursuance. In contrast, there are many fewer players in this game; just a few major players, such as Takara Holdings and Gekkeikan, dominate the industry. The ten best among them would probably have only a few percentages at best of the whole market. It indicates that the market is diverse and heavily localised with many different regional brands and traditional brewing methods, quite often, holding sway. With increasing interest in global markets about sake, particularly in North America and Europe, and growing interest in premium alcoholic beverages, which are offered as a complement for Japanese food, the competition in the sake market has become tighter. There has been growth in export activities and new breweries outside Japan as a result of this international demand for sake. Major competitive factors remain the quality and uniqueness of sake itself, in addition to appropriate branding and marketing techniques to reach these new consumer segments, as well as the capability to deal with various international regulations and distribution networks.Challenges In Sake Market

The export market for sake has many challenges that hinder the global slant that it is taking toward growth. Supply chain disruptions last, vague economic and political uncertainties remain, and tariffs may even change, particularly with the coming new U.S. administration policies. All these spurred a highly volatile business environment for sake manufacturers. This is further compounded by the very thin profit margins and fluctuation in raw material prices. These scenarios press producers to streamline the workings of their operations besides adapting to the rapidly changing market situations. Aside from operational challenges, the sake market has a drawback of limited consumer awareness beyond Asia, regulatory restrictions – fenced with an import restriction and labelling requirements – and intense competition with alcoholic beverages – wine, beer, and spirits. Storage and shelf-life woes pose other challenges. This makes it tough to use sake in distribution because it requires specific conditions to maintain quality. Meeting those challenges requires the efficacy of value chain collaboration built between a robust regulatory framework and continuous innovation to educate consumers about differentiated sake in a congested global beverage landscape.Risks & Prospects in Sake Market

Key market opportunities include the rising demand for craft and premium sake, the launch of low-alcohol varieties, and innovation in packaging and flavour-related appeal to young, health-conscious adults. The market view is further lit by sake going to new retail channels like online and speciality outlets, coupled with the growing number of Japanese restaurants around the world. Geographically, Asia Pacific is the largest market because of the deep cultural roots and vast consumption of sake in Japan. However, new horizons for growth tend to be appearing in North America and Europe. In North America, the popularity of Japanese cuisine and the rapid proliferation of Japanese restaurants have been the main catalysts for increased sake consumption on the continent. The U.S. market shows a healthy growth rate in both the retail and hospitality sectors. Hence, Europe is witnessing increasing demand, particularly in countries like France and the UK, as it longs for new drink experiences that seem truly authentic. Meanwhile, craft sake breweries are blossoming outside Japan, especially in North America and Europe, where they are adding to the global market while bringing new styles and flavours to many international consumers.Key Target Audience

The main target group for the global sake market consists of middle-aged consumers aged 40 to 60, who tend to gravitate toward premium and traditional drinks. This group appreciates much of the cultural heritage and artisanal excellence associated with sake, especially types such as Junmai, which are noted for their rich umami flavour with a variety of complementary cuisines. The higher prices of sake in comparison to other alcoholic beverages comfortably match the disposable income and hence the preference of the age group for quality.,, Younger adults aged 20 to 40 are an emerging segment, particularly in the countries where Japanese culture is growing in popularity. This group, adventurous by nature, seeks new experiences and welcomes the innovative types of sake, including sparkling and flavoured sake. Programs such as "Sake Viva!" in Japan try to attract this segment by presenting sake in more contemporary contexts, from popular culture to mixology and home consumption. Coupled with the increasing global interest in Japanese food and culture, these factors are further enticing younger generations toward trying sake.Merger and acquisition

The last few years have seen important merger and acquisition activities in the sake market, highlighting a trend of strategic consolidation and expansion. An example is Shaw Ross International Importers purchasing TYKU Sake Co. Ltd., thus enhancing its portfolio and distribution capability in the U.S. market. Other partnerships, such as the collaboration between Heavensake and Monarq Group, suggest that attention must also be paid to sales in new geographic areas. These developments form part of a wider strategy on the part of sake producers and distributors to penetrate various emerging markets and keep in tune with the varying tastes of consumers. The burgeoning interest in premium and craft alcoholic beverage products has driven companies to invest in innovative products and strategic partnerships that give them a competitive standing on the global stage. >Analyst Comment

The global sake market will witness steady growth owing to international demand with rising consumer appreciation for Japanese cuisine and culture. Sake exports increased approximately 6% year-on-year in 2024, reaching US$283 million in value; North America and Europe experienced significant increases in import volume, with 27% and 18%, respectively. Premiumisation is one of the key trends, where consumers are willing to pay more for artisanal high-end sake, which led to a 26% increase in average pricing over the last five years. Craft sake gains ground along with innovative brewing approaches and the wider availability of fine dining and cocktail bars and through e-commerce.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Sake- Snapshot

- 2.2 Sake- Segment Snapshot

- 2.3 Sake- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Sake Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Ordinary Sake

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Junmai

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Honjozo

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Junmai Ginjo

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Ginjo

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Sake Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Commercial Use [Hotel

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Restaurants]

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Home Use

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Asahishuzo CO.

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Ltd.

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Tatsuuma-Honke Brewing Co. Ltd.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Gekkeikan Sake Co.

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Ltd

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Hakutsuru Sake Brewing Co.

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Ltd.

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Sun Masamune Pty Limited

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 KANPAI London Craft Sake

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Blue Current Brewery

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Aramasa Shuzo Co.

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Sake in 2030?

+

-

Which type of Sake is widely popular?

+

-

What is the growth rate of Sake Market?

+

-

What are the latest trends influencing the Sake Market?

+

-

Who are the key players in the Sake Market?

+

-

How is the Sake } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Sake Market Study?

+

-

What geographic breakdown is available in North America Sake Market Study?

+

-

Which region holds the second position by market share in the Sake market?

+

-

How are the key players in the Sake market targeting growth in the future?

+

-