North America Refrigerant Oil Market – Industry Trends and Forecast to 2030

Report ID: MS-839 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

Air Conditioners, Coolers, Chillers, Refrigerators/Freezers, Condensers, Others

) And Regions (North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa)) : Industry Forecast and Opportunity Analysis for 2024 - 2030The Refrigerant Oil Market revolves around the specialised lubricants crucial for the efficient operation and longevity of refrigeration and air conditioning systems. These oils are designed to work in conjunction with refrigerants to circulate in the system and lubricate between moving parts of the compressor to minimise friction, wear, and tear. Apart from lubrication, refrigerant oils help in heat transfer processes within the system, taking heat away from the compressor to provide top-notch cooling. Also, they act as sealants against leakage in the refrigeration circuit and must have specific properties, including in terms of chemical stability, resistance to thermal shock from extreme temperature variations, and compatibility with a wide array of refrigerants applied in various applications.

The upward movement of this market is highly related to all the factors responsible for giving rise to a global demand for cooling solutions, concerning the stricter regulations for environmental protection that stimulate the application of new refrigerants, along with the ceaseless development in refrigeration technology for the creation of high-performance lubricants.

Refrigerant Oil Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

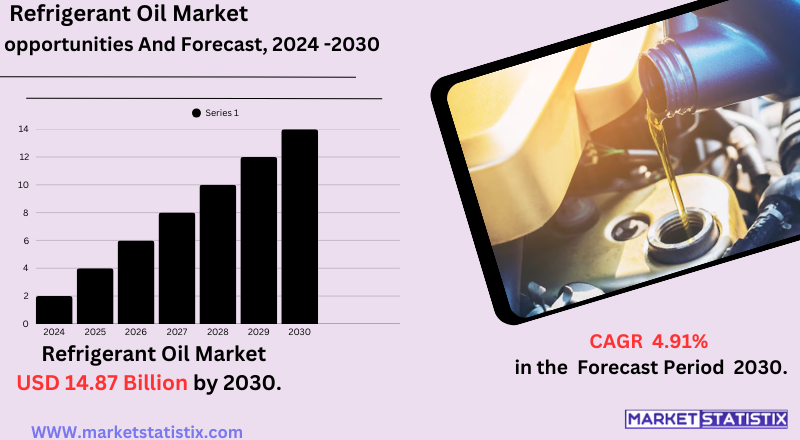

| Growth Rate | CAGR of 4.91% |

| Forecast Value (2030) | USD 14.87 Billion |

| By Product Type | Synthetic Oils, Mineral Oils, Semi-Synthetic Oils |

| Key Market Players |

|

| By Region |

|

Refrigerant Oil Market Trends

The refrigerant oil market is currently experiencing trend movements under the influence of environmental issues and technology. Strict environmental regulations throughout the globe and at regional levels, such as the Montreal Protocol and the Kigali Amendment, regulate the phase-out of refrigerants with high Global Warming Potential (GWP), such as HFCs. This, therefore, increases demand for corresponding refrigerant oils with greener refrigerant alternatives, which are natural refrigerants (CO₂ and ammonia) and low-GWP synthetic refrigerants such as HFOs.

Another trend that is evident is that increasing preference is being given to synthetic refrigerant oils rather than mineral oils. Synthetic oils do have superior properties like higher thermal stability, better lubrication efficiency, lower volatility, and extended equipment life, all of which are demanded by these newer, more demanding refrigeration systems and refrigerants. Moreover, industries' increasing emphasis on energy efficiency is building a demand for high-performance refrigerant oils that amortise energy consumption by aiding system optimisation.

Refrigerant Oil Market Leading Players

The key players profiled in the report are Lubriplate Lubricants Company (United States), ENEOS Holdings, CITGO (United States), Klüber (United States), Calumet Specialty Products Partners (United States), Inc (Japan), FUCHS (United States), Idemitsu Kosan Co.,Ltd (Japan), Eni (Italy), ISELGLOBAL (United States), CAMCO Lubricants (United States), Exxon Mobil Corporation. (United States), Johnson Controls (United States), Chevron Corporation (United States), Indian Oil Corporation Ltd. (India), Cosmo Oil Lubricants Co., Ltd. (Japan), China Petrochemical Corporation (China), The Lubrizol Corporation (United States)Growth Accelerators

The refrigerant oil market is majorly propelled by the escalating demand for refrigeration and air conditioning systems in industries. With rapid urbanisation and industrialisation in developing countries like India and China, there is a swell in the demand for HVACR (Heating, Ventilation, Air Conditioning and Refrigeration) systems for various residential, commercial, and industrial applications.

The second major keyword driving the market is the demand for energy efficiency and environmental sustainability. It is the restrictions orientated toward the phase-out of high Global Warming Potential (GWP) refrigerants that are in effect pushing the use of environment-friendly greener alternatives. Such conversions have necessitated the use of newer synthetic oils like POE and PAG for better performance and compatibility with the latest refrigerants, thereby boosting the growth and innovation in the refrigerant oil market.

Refrigerant Oil Market Segmentation analysis

The North America Refrigerant Oil is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Synthetic Oils, Mineral Oils, Semi-Synthetic Oils . The Application segment categorizes the market based on its usage such asAir Conditioners, Coolers, Chillers, Refrigerators/Freezers, Condensers, Others

. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

A mixture of global giants and regional players is engaged in competition in this refrigerant oil market arena. Major oil and gas companies, along with specialised lubricant companies, broadly delineate the sector. These major competitors have perhaps the largest distribution network, research and development capabilities, and product portfolio for various applications and types of refrigerants. Hence, a very intense competition is going on in the area of product innovation, development of high-performing oils compatible with newer environmentally friendly refrigerants, and, hence, product commercialisation through alliances or acquisitions to broaden their market footprint and technological knowledge.

Some of the factors that make the environment competitive include strident environmental regulations pushing the formulation of next-generation refrigerants with low global warming potentials; hence, compatible lubricants are needed. Technological strides in refrigeration systems also necessitate oils with greater ability in thermal stability, lubricity, and chemical resistance. This dynamic landscape animates continual innovation and adaptation from players so as to keep and expand their market position.

Challenges In Refrigerant Oil Market

Several parameters challenge the refrigeration oil market, mainly brought about by environmental strengthening regulations and the green refrigerant changes. The manufacturers are being asked by strict international and regional policies to design oils that can work with lower GWP refrigerants such as hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs) and with natural refrigerants like ammonia and carbon dioxide. This means heavy spending on R&D to ensure compatibility, stability, and performance of said oils, especially since the use of synthetic and polyolester-based oils is dominant.

Another significant threatening factor is the fluctuating price of raw materials, which affects production costs and profit margins of market players. A fragmented market with a plethora of regional and international players intensifies price competition and forces companies to invest in innovations. Alongside this, the increasing demand for advanced refrigeration systems in food processing, pharmaceutical, and residential applications obliges manufacturers to adjust their production in accordance with varied technical exigencies and regulatory standards in different countries, thereby compromising continuous promotion of quality and standard compliance on a global scale.

Risks & Prospects in Refrigerant Oil Market

The increasing demand for frozen and packaged foods, food and pharmaceutical sectors, and regulatory changes toward low-GWP (Global Warming Potential) refrigerants further stimulate the growth of new-generation environmentally friendly oils. Nanotechnology lubricant developments with AI integration in refrigeration monitoring systems are posited to grow another avenue for market players as the aftermarket and automotive AC system sectors continue to grow.

The refrigerant oil market is dominated by the Asia Pacific region, accounting for over 32% of the global market share. This is due to rapid industrialisation along with rising middle-income group conversions and increasing demands for refrigerators, freezers, air conditioners, and automobiles across countries such as China and India. North America and Europe rank second and third, respectively, with the former benefiting from strong industrial infrastructure and the latter as the leader in sustainability initiatives and regulatory compliance. The Middle East & Africa is rising as an area for growth, particularly in the application of climate-controlled storage and advanced HVAC, where countries are investing in smart cooling technologies and large-scale cold chain infrastructure. This regional variation further highlights the dynamic growth path of the market and the need for local strategies by manufacturers and suppliers.

Key Target Audience

The refrigerant oil market is basically geared towards industries characterised by intense usage of refrigeration and air conditioning systems. Key consumers include the food and beverage industry, as refrigeration is a must to preserve perishable goods, and the pharmaceutical sector, which demands tight temperature control in the storage and transportation of medicines and vaccines. Besides that, the automotive industry is one of the largest segments, wherein air conditioning systems are heavily used in vehicles and need refrigerant oils for smooth functioning. Likewise, another major contributor to refrigerant oil demand is the commercial sector, which includes supermarkets, restaurants, and cold storage facilities.

,,

, In general, increased usage of refrigeration systems within different industries and continuous innovations in refrigerant oil formulations to satisfy the ever-changing requirements of customers and regulatory authorities drive the growth of this market.

Merger and acquisition

The refrigerant oil market, of late, has seen a flurry of M&A manoeuvres, stemming from the industry's gradual pivot toward eco-friendly and energy-efficient solutions. In a trade valued for obvious strategic reasons, in June 2023, Johnson Controls acquired M&M Carnot, which is involved in natural refrigeration systems with ultra-low GWP. This move has enhanced Johnson Controls' portfolio of options toward sustainable refrigeration. Along similar lines, in July 2023, FUCHS launched RENISO UltraCool 68, a synthetic oil compatible with ammonia-based systems, thereby echoing the industry's preference for environmentally friendly refrigerants.

ExxonMobil, Shell, and Chevron are other major oil players who have been active in M&A in order to fortify their positions in the refrigerant oil sector. Large oil companies are investing in R&D, in expanding their capacities, and in developing strategic partnerships in response to the changing marketplace. For example, ExxonMobil and Qatar Energy agreed, in June 2022, on first developing Qatar's North Field East project so as to increase LNG capacity, which would have implications for refrigerant applications. These activities suggest a trend of industry leaders attempting proactively to respond to environmental regulations and market shifts by upgrading their product and technical capabilities.

>

Analyst Comment

The global refrigerant oil market is witnessing considerable growth owing to high demand for energy-efficient cooling systems, cold chain logistics services expansion, and refrigeration technology improvements. The market is expected to reach a size of roughly USD 1.7 billion by 2025 and further expand to around USD 2.9 billion by 2035. This projection is supported by the rather increasing use of synthetic and low-GWP refrigerants, regulatory pressure on the phase-out of high-GWP refrigerants, and the further installation of HVACR systems in residential, commercial, and industrial establishments.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Refrigerant Oil- Snapshot

- 2.2 Refrigerant Oil- Segment Snapshot

- 2.3 Refrigerant Oil- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Refrigerant Oil Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Mineral Oils

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Synthetic Oils

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Semi-Synthetic Oils

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Refrigerant Oil Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2

Air Conditioners

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Coolers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Chillers

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Refrigerators/Freezers

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Condensers

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Others

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Refrigerant Oil Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Calumet Specialty Products Partners (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 CAMCO Lubricants (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Chevron Corporation (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 China Petrochemical Corporation (China)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 CITGO (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Cosmo Oil Lubricants Co.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Ltd. (Japan)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 ENEOS Holdings

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Inc (Japan)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Eni (Italy)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Exxon Mobil Corporation. (United States)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 FUCHS (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Idemitsu Kosan Co.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Ltd (Japan)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Indian Oil Corporation Ltd. (India)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 ISELGLOBAL (United States)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Johnson Controls (United States)

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Klüber (United States)

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Lubriplate Lubricants Company (United States)

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 The Lubrizol Corporation (United States)

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Refrigerant Oil in 2030?

+

-

Which application type is expected to remain the largest segment in the North America Refrigerant Oil market?

+

-

How big is the North America Refrigerant Oil market?

+

-

How do regulatory policies impact the Refrigerant Oil Market?

+

-

What major players in Refrigerant Oil Market?

+

-

What applications are categorized in the Refrigerant Oil market study?

+

-

Air Conditioners, Coolers, Chillers, Refrigerators/Freezers, Condensers, Others

Which product types are examined in the Refrigerant Oil Market Study?

+

-

Which regions are expected to show the fastest growth in the Refrigerant Oil market?

+

-

Which application holds the second-highest market share in the Refrigerant Oil market?

+

-

What are the major growth drivers in the Refrigerant Oil market?

+

-

The refrigerant oil market is majorly propelled by the escalating demand for refrigeration and air conditioning systems in industries. With rapid urbanisation and industrialisation in developing countries like India and China, there is a swell in the demand for HVACR (Heating, Ventilation, Air Conditioning and Refrigeration) systems for various residential, commercial, and industrial applications.

The second major keyword driving the market is the demand for energy efficiency and environmental sustainability. It is the restrictions orientated toward the phase-out of high Global Warming Potential (GWP) refrigerants that are in effect pushing the use of environment-friendly greener alternatives. Such conversions have necessitated the use of newer synthetic oils like POE and PAG for better performance and compatibility with the latest refrigerants, thereby boosting the growth and innovation in the refrigerant oil market.