North America Predictive Analytics Market – Industry Trends and Forecast to 2032

Report ID: MS-543 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Predictive Analytics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

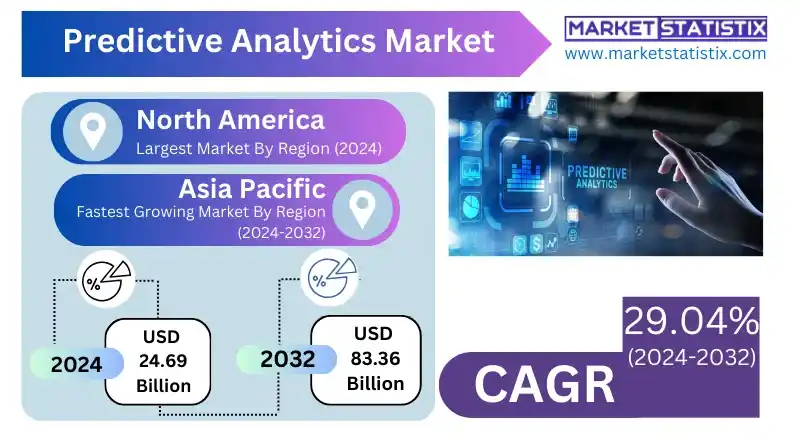

| Growth Rate | CAGR of 29.04% |

| Forecast Value (2032) | USD 83.36 Billion |

| By Product Type | Web & Social Media Analytics, Financial Analytics, Sales Analytics, Risk Analytics, Marketing Analytics, Network Analytics |

| Key Market Players |

|

| By Region |

|

Predictive Analytics Market Trends

The major contributing factors to the expanded marketplace of prediction analytics are the availability of enormous data and improvement in machine learning technologies. Enterprises are increasingly adopting cloud-based predictive analysis solutions. These solutions provide scalability and can make predictive analytics accessible to all forms of enterprises, regardless of size, and help them incorporate predictive capabilities into several operations—from customer relationship management to supply chain optimisation. Another major tale surrounding the concepts is the growing demand for application-specific predictive analytics that differ from sector to sector. For example, healthcare, finance, and retail deploy predictive models for their specific problems, such as fraud detectability, personalised marketing, and preventive maintenance, respectively. The other emerging trend is the faster adoption of artificial intelligence with predictive analytics—that is, making the quality and automated fulfilment of prediction services even better. Businesses will thus be able to expect future trends with very high accuracy, increasing operational efficiency and the much-needed competitive advantage.Predictive Analytics Market Leading Players

The key players profiled in the report are SAS Institute Inc., QlikTech International AB, Altair Engineering Inc., IBM Corporation, Oracle, SAP SE, Alteryx, Cloud Software Group Inc., Salesforce Inc., MicrosoftGrowth Accelerators

This is stimulated by incredible networking technologies, utilising sophisticated analytic tools that are emerging all over the world from various organizations. The entire world is studying big data now; be it through customer transactions, online activities, reading a sensor, or interacting over social media, the world's organizations are generating enormous amounts of data. The result is that they are using machine learning and artificial intelligence to analyse such data and arrive at more or less correct conclusions and probable future financial trends. The market is also driven by their need for proactive risk management and personalised customer experiences. In addition, organizations are becoming more and more dependent on predictive analytics as companies anticipate the various possible risks associated with fraudulence, machinery failures, and supply-chain disruptions; this in-depth analysis assists them in taking the necessary preventive actions. This will also help arrive at differences in customers in areas of churn prediction, customer segmentation, and targeted marketing campaigns by delivering personalised products and services to customers.Predictive Analytics Market Segmentation analysis

The North America Predictive Analytics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Web & Social Media Analytics, Financial Analytics, Sales Analytics, Risk Analytics, Marketing Analytics, Network Analytics . The Application segment categorizes the market based on its usage such as IT & Telecommunication, Healthcare, Automotive & Transportation, Aerospace & Defense, BFSI, Media & Entertainment, Retail and E-commerce. Geographically, the market is assessed across key Regions like United States (The West, Southwest, The Middle Atlantic, New England, The South, The Midwest) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

There's a fierce competition in the predictive analytics market, with the top players: IBM, SAS, SAP, Microsoft, Google, and Amazon Web Services. They remain the strongest in the market because they possess the best technology in AI and machine learning. These companies are constantly innovating and improving their predictive models by adding automation, cloud computing, and big data analytics. On their part, startups and niche players, in their effort to enter the market, are focusing on specialised solutions concentrated on sectors ranging from healthcare to finance to retail, thus increasing cutthroat competition in the market. These competitions are even more fuelled through strategic alliances, mergers, and acquisitions to grow product portfolios for better data-driven decision-making.Challenges In Predictive Analytics Market

The predictive analytics market is hindered in its widespread adoption and effective application of many challenges. One common challenge is the need for specialisation since predictive analytics requires heavy algorithms, machine learning, and statistical modelling. Many organizations are blocked in their ability to implement predictive analytics because of the inability to find and attract professionals capable of effectively managing these technologies. Moreover, ensuring data quality and availability is an everlasting challenge since inaccurate or incomplete data leads to unreliable predictions. Privacy and security issues arise from the sensitive nature of data that is being used in predictive analytics for instance, data from the healthcare and finance industries. Compliance with regulatory standards further complicates the matter since the company should effectively establish a governance framework.Risks & Prospects in Predictive Analytics Market

From fraud detection to decision-making or customer behaviour analysis, predictive analytics are being embraced by industries such as finance, healthcare, retail, and manufacturing. There are opportunities at the integration of the Internet of Things with AI for real-time insights, the growing demand for personalised customer experiences, and the adoption of cloud-based predictive solutions that allow greater scalability and efficiency in cost. North America is the leading region in the market, largely due to the advanced technological infrastructure and investments in analytics tools. The U.S., in this situation, is being a leader with AI and data-driven strategies being adopted widely across industries. The region of Asia-Pacific is likely to witness the highest growth at a CAGR due to the digital transformation initiatives being adopted in China and India. The two nations are heavily investing in AI and big data technologies to become efficient in their operations. Europe also put on a steady growth pace owing to rising demand for data-driven decision-making supported by government initiatives for digital transformation.Key Target Audience

The primary target audience for the predictive analytics market encompasses the business verticals comprising banking, financial services, and insurance (BFSI); healthcare; retail; manufacturing; and IT & telecom. These industries use predictive analytics for risk assessment, fraud detection, customer behaviour analysis, and operational efficiency. Large enterprises and SMBs represent significant users, and the growing trend is fuelled by the need for data-driven decision-making, a competitive edge, and cost reductions.,, The other main part of this market is technology providers such as software vendors, cloud service providers, and AI developers. They offer solutions for predictive analytics based on machine learning, big data analytics, and artificial intelligence for companies with varying levels of data maturity. With the increased demand for improved customer experience, enhanced fraud protection, and personalised marketing, industries now pivot towards predictive analytics solutions.Merger and acquisition

The past several months has shown some fairly conspicuous mergers and acquisitions in the predictive analytics space, underscoring its rising prominence in many industries. In December 2024, Interpublic Group (IPG), a global advertising holding company, acquired retail analytics Intelligence Node from Mumbai for nearly $100 million. Founded in 2012, Intelligence Node provides brands and retailers with data-informed insights to enhance product development, marketing, and sales strategy. Hence, the acquisition primarily targets strengthening the commerce capabilities of IPG amid the strengthening e-commerce and retail media. On the same lines, in November 2024, Canadian Transoft Solutions acquired AMAG from Brisbane-known artificial intelligence software start-up working towards road safety and traffic management through predictive analytical applications. Founded in 2020, AMAG deploys real-time data interpreted through AI to avert road incidents and monitor assets. Such an acquisition suits Transoft's strategy to grow its presence and expertise in the traffic management solution. All these strategic moves indeed indicate the role predictive analytics plays in creating data-informed decision-making and operational efficiencies across sectors. >Analyst Comment

The ever-increasing growth of predictive analytics is mainly due to increasing amounts of data and their resultant complexity combined with advancements in AI and ML. Businesses in almost all sectors recognise the strategic importance of forecasting future trends to fine-tune decision-making, optimise operations, and create a competitive advantage. The demand for sophisticated predictive analytics solutions that can extract nuggets of actionable insight from huge datasets has thus soared. On the other hand, market drivers include a rise in the adoption of cloud-based analytics platforms, an increase in the number of IoT devices that generate real-time data, and the demand for customer personalisation.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Predictive Analytics- Snapshot

- 2.2 Predictive Analytics- Segment Snapshot

- 2.3 Predictive Analytics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Predictive Analytics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Financial Analytics

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Risk Analytics

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Marketing Analytics

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Sales Analytics

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Web & Social Media Analytics

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Network Analytics

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Predictive Analytics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Aerospace & Defense

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive & Transportation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 BFSI

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Healthcare

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 IT & Telecommunication

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Media & Entertainment

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Retail and E-commerce

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Predictive Analytics Market by Component

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Solutions

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Services

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Predictive Analytics Market by Deployment

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Cloud

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 On-Premise

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Predictive Analytics Market by Enterprise Size

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Small and Medium Enterprises

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Large Enterprises

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

9: Predictive Analytics Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 The West

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.3 Southwest

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.4 The Middle Atlantic

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.5 New England

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.6 The South

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.7 The Midwest

- 9.7.1 Key trends and opportunities

- 9.7.2 Market size and forecast, by Type

- 9.7.3 Market size and forecast, by Application

- 9.7.4 Market size and forecast, by country

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 Alteryx

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 SAS Institute Inc.

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 Altair Engineering Inc.

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 QlikTech International AB

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 IBM Corporation

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 SAP SE

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Salesforce Inc.

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Oracle

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 Cloud Software Group Inc.

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 Microsoft

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Component |

|

By Deployment |

|

By Enterprise Size |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Predictive Analytics in 2032?

+

-

How big is the North America Predictive Analytics market?

+

-

How do regulatory policies impact the Predictive Analytics Market?

+

-

What major players in Predictive Analytics Market?

+

-

What applications are categorized in the Predictive Analytics market study?

+

-

Which product types are examined in the Predictive Analytics Market Study?

+

-

Which regions are expected to show the fastest growth in the Predictive Analytics market?

+

-

Which region is the fastest growing in the Predictive Analytics market?

+

-

What are the major growth drivers in the Predictive Analytics market?

+

-

Is the study period of the Predictive Analytics flexible or fixed?

+

-