North America Optometry Software Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-882 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

Optometry software market refers to a variety of software solutions geared specifically toward simplifying and optimising the management of optometry practices and eye care professionals. The software systems are designed to address the specific requirements of optometrists, ophthalmologists, and optical dispensaries, going beyond generic healthcare IT applications. The primary purpose of optometry software is to digitalise and consolidate all aspects of practice management and patient treatment. These range from managing the patient records electronically (Electronic Health Records – EHR) to scheduling visits, billing and insurance claims, communicating with patients, and even integrating into diagnostic devices utilised during eye exams.

In addition, the optometry software market is transforming to embrace sophisticated features that enhance clinical success as well as administrative effectiveness. These include features for tele-optometry, such as remote monitoring and consultation capabilities, and artificial intelligence (AI) integration for activities like retinal image analysis for early diagnosis of eye disorders. Cloud deployment is a notable trend, and this provides advantages such as improved accessibility, scalability, and lower IT overhead for practices of varying sizes.

Optometry Software Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2024 |

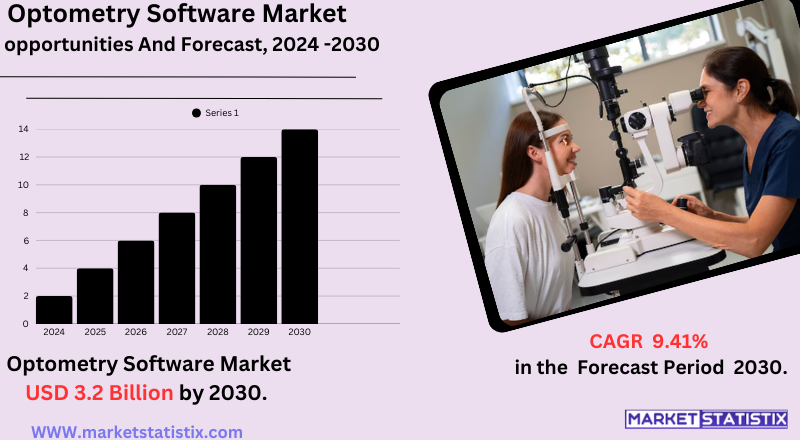

| Growth Rate | CAGR of 9.41% |

| Forecast Value (2031) | USD 3.2 Billion |

| By Product Type | Cloud-Based, On-Premise |

| Key Market Players |

|

| By Region |

|

Optometry Software Market Trends

The optometry software market is now seeing tremendous growth and an impressive swing to cloud-based solutions. This is fuelled by the growing need for effective practice management, greater accessibility, and scalability. Cloud-based software advantages include access to real-time data, smooth workflows, and cost savings through subscription schemes, which especially appeal to small and medium-sized practices. Also, the market is experiencing increasing use of tele-optometry services that provide remote consultations and increase the reach of eye care experts, particularly in rural or underdeveloped regions.

The second major trend is increasing the use of artificial intelligence (AI) in optometry software. AI-based applications are being created for numerous uses, such as automated scheduling of appointments, patient data analysis, and even to help detect eye problems at an early stage using retinal image analysis. This integration will help increase diagnostic efficiency, reduce administrative burden, and ultimately lead to better patient care.

Optometry Software Market Leading Players

The key players profiled in the report are VisualEyes (United Kingdom), Crystal Practice Management (United Kingdom, Officemate (United States), RevolutionEHR (United States), Ocuco (Ireland), Eyefinity (United States), Eyecare Advantage (United States), My Vision Express (United States), MDoffice (United States), Compulink Healthcare Solutions (United States), Nextech (United States), MaximEyes (United States), AdvancedMD (United States), Pinnacle (United States), VisionPro (Canada)Growth Accelerators

The optometry software market is also growing at a great rate, fuelled by a number of factors. To begin with, the growing demand for effective practice management software is compelling optometrists and ophthalmologists to opt for digital software for managing their business operations in an efficient manner. This involves automating business processes such as scheduling appointments, patient record management (EHR), and billing transactions, enabling doctors to give more attention to patients and less to administrative tasks. The shift from paper records to EHR systems is also the key driver, with practices looking to enhance efficiency and precision and adhere to changing healthcare regulations.

Second, advancing software technology as well as optical technology is driving market growth. Optometry software is adding sophisticated features such as AI for diagnostic support (e.g., interpreting retinal photographs to detect early disease) and automation of clinical processes. Tele-optometry, inspired by the need for remote eye care services, is another important trend, with software now capable of virtual consultations and remote diagnosis.

Optometry Software Market Segmentation analysis

The North America Optometry Software is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cloud-Based, On-Premise . The Application segment categorizes the market based on its usage such as Clinics, Hospitals, Optical Centers, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive market dynamics of the optometry software industry are defined by the presence of established firms and new entrants, which results in a concentrated market structure. Major players provide integrated suites that include EHR, practice management, billing, and scheduling capabilities. Competition is based on the depth and extent of functionalities, ease of use, integration with diagnostic devices, customer care, and pricing strategies. Cloud-based offerings are picking up steam, and this has created more competition in this space, providing scalability and accessibility benefits.

Additionally, the market experiences ongoing innovation through the inclusion of newer technologies such as AI-based diagnostic assistance and tele-optometry capabilities to upgrade remote patient management. This technological progression fuels competition as vendors work toward providing innovative solutions. Mergers and acquisitions are also witnessed with firms seeking to widen their product portfolio and reach in the marketplace.

Challenges In Optometry Software Market

The market for optometry software experiences significant challenges, with the issue of data privacy posing a top concern. As optometry software systems manage sensitive patient data, the risk of data breaches and unauthorised use has increased, which has brought the issue of compliance with the regulations and secure handling of data into question. Further, complexity in combining the new software solutions with existing clinical and diagnostic equipment and legacy systems may make it difficult to adopt the new solutions seamlessly and achieve efficient workflows within optometry practices.

Another major challenge is the speed of technological progression, necessitating ongoing investment in software maintenance and employee training to maintain pace with advancing diagnostic technologies, telemedicine functionality, and artificial intelligence functionalities. Small practices can be challenged by the expense and technical skill required to install and manage such advanced systems. Additionally, the market is growing more competitive, with numerous vendors providing similar functionalities, complicating practitioners' choices of the most appropriate and future-proof solutions for their requirements.

Risks & Prospects in Optometry Software Market

Market opportunities are vast in cloud-based deployment, AI-driven diagnostic applications, and mobile applications for enhanced patient engagement and clinical workflow improvement. The movement toward value-based care and individualised healthcare experiences is compelling optometrists to integrate end-to-end software platforms that enhance accuracy, efficiency, and patient outcomes, while emerging markets offer untapped opportunity as healthcare digitisation gathers steam worldwide.

Regionally, North America dominates the market because of its well-developed healthcare infrastructure, high rate of digital adoption, and substantial investments in health IT, with an estimated value of $0.75 billion in 2024. Europe is next, influenced by the strict regulatory environments and increasing need for cost-effective management solutions. The Asia-Pacific market is set to experience fast growth, stimulated by healthcare modernisation and an increasing patient base, projected to be $0.5 billion by 2032. South America and the Middle East & Africa, while having smaller market sizes, also provide significant growth potential as digitalisation and access to healthcare increase in these markets.

Key Target Audience

The primary target market for the optometry software market consists of optometrists, ophthalmologists, and eye care centers looking to automate patient management, electronic health records (EHR), scheduling of appointments, billing, and inventory management. Optometrists and other institutions value software solutions that are user-friendly, healthcare regulation-compliant (such as HIPAA), and integrated with diagnostic equipment and other health IT systems to optimise workflow and improve patient care.

,

, Another key segment consists of hospital eye clinics, schools, and retail optical groups, who need scalable and configurable solutions to handle large patient volumes and complicated operations. Vendors also address healthcare IT consultants, administrators, and purchasing decision-makers who have an impact on the adoption of such technology. Increasing demand for teleoptometry, cloud platforms, and AI-based diagnostics also influences the needs and preferences of this group.

Merger and acquisition

Recent optometry software mergers and acquisitions clearly indicate the strategic shift to more integrated, AI-driven solutions and broadened service offerings. EverCommerce acquired MyVisionExpress in 2024, adding new strength with advanced practice management features like centralised optical lab interfaces and patented "Smart Rx" technology designed to streamline prescription workflows across multiple clinics. The move underscores the emphasis on interoperability and efficiency within the industry in managing complex optometric operations. In like manner, VSP Vision's purchase of Eyemart Express, an optical retailer with almost 250 stores in Texas, seeks to expand its network and improve service delivery, reflective of a trend towards consolidating to enhance patient access and continuity of care.

The larger ophthalmic industry has also been experiencing high activity, with large firms purchasing companies to enhance their technology capabilities.

For example, Alcon's deal to buy Lensar for as much as $430 million features the Ally femtosecond laser cataract system and Streamline-branded proprietary software, strengthening Alcon's presence in laser-assisted cataract surgery. Carl Zeiss Meditec's purchases of Dutch Ophthalmic Research Centre (D.O.R.C.) for around $1.09 billion is designed to increase its surgical business, especially in retinal and cataract surgeries. These purchases signal a trend for incorporating cutting-edge surgical technology and software solutions to offer full-range eye care services.

>

Analyst Comment

The optometry software market is witnessing strong growth as a result of the increasing incidence of eye-related diseases and the changing face of the healthcare industry toward digitalisation. The sector is expected to grow up to 2033, with North America alone adding more than USD 640 million in value from 2025 to 2029. Drivers include the integration of electronic health records (EHR), cloud, and AI-enabled tools improving patient management, diagnosis, and operational efficacy for optometry clinics. Telemedicine and mobile apps are also increasing, allowing remote consultations and improved patient engagement.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Optometry Software- Snapshot

- 2.2 Optometry Software- Segment Snapshot

- 2.3 Optometry Software- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Optometry Software Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cloud-Based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 On-Premise

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Optometry Software Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hospitals

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Clinics

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Optical Centers

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Optometry Software Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 AdvancedMD (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Compulink Healthcare Solutions (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Crystal Practice Management (United Kingdom

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Eyecare Advantage (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Eyefinity (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 MaximEyes (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 MDoffice (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 My Vision Express (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Nextech (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Officemate (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Ocuco (Ireland)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Pinnacle (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 RevolutionEHR (United States)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 VisualEyes (United Kingdom)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 VisionPro (Canada)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Optometry Software in 2031?

+

-

Which type of Optometry Software is widely popular?

+

-

What is the growth rate of Optometry Software Market?

+

-

What are the latest trends influencing the Optometry Software Market?

+

-

Who are the key players in the Optometry Software Market?

+

-

How is the Optometry Software } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Optometry Software Market Study?

+

-

What geographic breakdown is available in North America Optometry Software Market Study?

+

-

How are the key players in the Optometry Software market targeting growth in the future?

+

-

The optometry software market is also growing at a great rate, fuelled by a number of factors. To begin with, the growing demand for effective practice management software is compelling optometrists and ophthalmologists to opt for digital software for managing their business operations in an efficient manner. This involves automating business processes such as scheduling appointments, patient record management (EHR), and billing transactions, enabling doctors to give more attention to patients and less to administrative tasks. The shift from paper records to EHR systems is also the key driver, with practices looking to enhance efficiency and precision and adhere to changing healthcare regulations.

,

,,

What are the opportunities for new entrants in the Optometry Software market?

+

-