Global Monocrystalline Silicon Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-710 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Monocrystalline Silicon Report Highlights

| Report Metrics | Details |

|---|---|

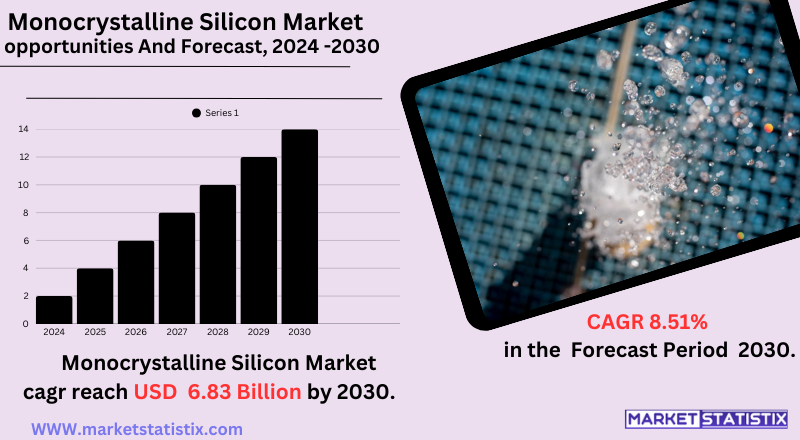

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.51% |

| Forecast Value (2030) | USD 6.83 Billion |

| Key Market Players |

|

| By Region |

|

Monocrystalline Silicon Market Trends

One major trend is the trend towards bigger wafer sizes, like the 182 mm and 210 mm formats, in order to bring down the cost of manufacturing per watt for solar cells and increase throughput. Another strong focus is on improving the quality of wafers and eliminating defects to achieve higher efficiency and reliability of solar cells and semiconductor devices. Technologies that drive ingot growth, such as continuous Czochralski (CCz) methods, are finding acceptance for their potential to enhance production yield and cut down costs. Another strong trend is the increasing acceptance of n-type monocrystalline silicon wafers, mainly in high-efficiency solar cell technologies such as TOPCon and HJT. N-type wafers are more efficient and much less prone to light-induced degradation than regular p-type wafers, making them the definite preferred substrates in advanced solar applications.Monocrystalline Silicon Market Leading Players

The key players profiled in the report are First Solar (United States), Suniva Inc (United States), SunPower Corporation (United States), Solaris Technology Industry, Inc. (India), Canadian Solar (Canada), SHARP CORPORATION (Japan), ALPS Technology Inc. (United States), GREEN BRILLIANCE RENEWABLE ENERGY LLP(India), Jinko Solar (China), Tata Power Solar Systems Ltd. (India)Growth Accelerators

Ongoing demand for the monocrystalline silicon market in India has been boosted mostly by the encouraging government efforts toward renewables, notably solar power. It has put up ambitious targets for solar energy, while the efficiency of monocrystalline silicon favours its usage in solar cells and modules required for achieving those targets. Government initiatives such as subsidies, tax benefits, and domestic content requirements in solar projects further motivate the use and local manufacturing of monocrystalline silicon, thus making it a robust driver for demand in India. Well, apart from that, the rising electronics manufacturing industry in India, smaller than the solar market but rising, is also gradually increasing high-purity levels demand for monocrystalline silicon for semiconductor applications. Indeed, with a goal set by India to be a global hub for electronics manufacturing, there will always remain an increasing need for advanced silicon wafers to produce microprocessors, memory chips, and other electronic components. Therefore, it will bear growth into the monocrystalline silicon market during a long period.Monocrystalline Silicon Market Segmentation analysis

The Global Monocrystalline Silicon is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Residential,, Commercial, Industrial. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The monocrystalline silicon market's competitive landscape is made up of a combination of large, established international players and a growing number of domestic manufacturers, especially in India. Some of the key global companies, like LONGi Solar, Jinko Solar, JA Solar, Shin-Etsu Chemical, and SUMCO, hold a major share of the market owing to their huge production capacities, advanced technologies, and a strong global presence in both the solar and semiconductor industries. In India, the competitive landscape is changing very rapidly under the government's supporting push to develop domestic manufacturing. Although historically the market has remained dominated by imports from the mentioned major players, Indian companies like Waaree Energies, Tata Power Solar, Adani Solar (now more into module manufacturing but planning backward integration), and others are scaling up their competencies along the solar PV value chain, including possibly forays into silicon wafer production. The combination of this increasing domestic rivalry, favourable government policies, and a surge in demand for solar energy and electronics could, in the next few years, radically alter the competitive dynamics of the Monocrystalline Silicon Market in India, promoting self-reliance and thus more competitive pricing.Challenges In Monocrystalline Silicon Market

Based on these demands for advanced high-efficiency solar cells and semiconductor applications, the monocrystalline silicon market faces challenging issues that may influence the current growth of this market. One such issue is that the manufacturing costs incurred in manufacturing monocrystalline silicon wafers are high, using technologies like the Czochralski process. Fluctuations in the prices of raw materials, in particular, the price of polysilicon, increase the costs of productions and affect market stability. Another challenge is the viability of competing materials and technologies such as polycrystalline silicon and the new thin-film solar cells, which might provide cheaper solutions yet have competing efficiency in some applications. Also, market contingencies mount on supply chain disruptions due to the incursion of geopolitics or uncertain economic situations, hindering the delivery of raw materials and continuity in manufacturing.Risks & Prospects in Monocrystalline Silicon Market

While solar panel applications are preferred in that material, innovations like passivated emitter and rear cell (PERC) technology make solar cell performance even greater. Investment in sustainable energy infrastructure and the growing adoption of electric vehicles add another dimension to the demand for high-performance monocrystalline silicon wafers. Asia-Pacific remains the biggest region in the market due to the manufacturing base, investments in solar energy projects, and favourable government policy for renewable energy promotion. North America and Europe are major markets that benefit from tight environmental regulations and increased uptake of clean energy technologies. The potential for growth is still largely untapped in emerging economies such as Latin America and Africa, which are currently expanding their renewable energy capacity to meet rising electricity demand. These regional dynamics will reflect the varied growth opportunities in global markets and, at the same time, point out the requirement for strategic investments towards infrastructure and technology development.Key Target Audience

, The primary target audience for the monocrystalline silicon market encompasses manufacturers and developers of the renewable energy electricity market-cellular technology in terms of specific applications of solar photovoltaic (PV) systems. High-efficiency solar panels use monocrystalline silicon as an important element around which energy projects based on residential, commercial, and industrial usage of solar energy can be formed. Also, it is critical to state that governments and organizations that are promoting renewable energy-targeted and sustainable development initiatives are important stakeholders, as they bring demand for advanced solar technologies that reduce carbon emissions., Another important category involves the semiconductor manufacturers and electronics companies, for monocrystalline silicon serves as a basic material for integrated circuits, microchips, and other advanced electronic devices. Such high dielectric strength makes it very important in high-performance computing, consumer electronics, and electric vehicles (EVs), with increasing demand worldwide making these audiences prime activators for innovation and market growth.Merger and acquisition

The scene for mergers and acquisitions in the monocrystalline silicon market is livid, indicating various strategies put in place by the companies to maintain supremacy in the semiconductor and solar industries. In May 2023, SUMCO Corporation acquired Mitsubishi Polycrystalline Silicon America Corp. and the semiconductor polysilicon business of Mitsubishi Materials Corporation for their supply chain and production capabilities. In the same way, to keep its competitiveness in the semiconductor materials, Sumco from Japan injected $2.05 billion in October 2021 to advance the production of advanced 300mm silicon wafers. Heavy consolidation has taken place in the solar arena to allow for expansion in manufacturing. In June 2021, 1366 Technologies + Hunt Perovskite Technologies, in a merger, created CubicPV, which intends to invest $300-350 million in a 2GW wafer and cell fabrication facility in India. Furthermore, in October 2021, Reliance New Solar Energy Limited acquired REC Group from China National Bluestar Group for $771 million in an effort to bolster its standing in the worldwide solar marketplace. These strategic movements demonstrate the turn of the industry towards scaling production and integrating supply chains to satisfy rising demand for monocrystalline silicon in various applications. >Analyst Comment

As of now, the monocrystalline silicon market in India is gaining strong traction, majorly due to the fact that the government aims at ambitious renewable energy targets for the nation. Apart from this, encouraging policies to promote solar power generation from such initiatives as the National Solar Mission have therefore created a high demand for monocrystalline silicon wafers and cells highly efficient in producing solar PV modules. The "Make in India" campaign would then enhance the development of a local solar manufacturing value chain and diminish dependence on imports, thereby achieving energy independence from a longer perspective.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Monocrystalline Silicon- Snapshot

- 2.2 Monocrystalline Silicon- Segment Snapshot

- 2.3 Monocrystalline Silicon- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Monocrystalline Silicon Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Residential

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Commercial

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Industrial

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Monocrystalline Silicon Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 ALPS Technology Inc. (United States)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Canadian Solar (Canada)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 First Solar (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 GREEN BRILLIANCE RENEWABLE ENERGY LLP(India)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 SHARP CORPORATION (Japan)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Jinko Solar (China)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Solaris Technology Industry

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Inc. (India)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Suniva Inc (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 SunPower Corporation (United States)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Tata Power Solar Systems Ltd. (India)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Monocrystalline Silicon in 2030?

+

-

What is the growth rate of Monocrystalline Silicon Market?

+

-

What are the latest trends influencing the Monocrystalline Silicon Market?

+

-

Who are the key players in the Monocrystalline Silicon Market?

+

-

How is the Monocrystalline Silicon } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Monocrystalline Silicon Market Study?

+

-

What geographic breakdown is available in Global Monocrystalline Silicon Market Study?

+

-

How are the key players in the Monocrystalline Silicon market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Monocrystalline Silicon market?

+

-

What are the major challenges faced by the Monocrystalline Silicon Market?

+

-