North America IoT Telecom Services Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-956 | IT and Telecom | Last updated: May, 2025 | Formats*:

The IoT (Internet of Things) Telecom Services Market refers to the specialized range of services offered by telecommunication companies to enable and manage the connectivity of IoT devices and applications. This market is crucial because while IoT devices generate data, they require a robust and reliable network infrastructure to transmit that data effectively. Telecom providers offer various connectivity options, including cellular (4G, 5G), Low-Power Wide-Area Networks (LPWAN) like NB-IoT, and satellite, tailored to the diverse needs of IoT applications, from high-bandwidth demands of connected cars to low-power requirements of smart sensors. Beyond mere connectivity, these services extend to device and application management, data management, billing and subscription services, and security solutions.

Essentially, telecom companies are transforming from pure connectivity providers to enablers of the broader IoT ecosystem. They provide the backbone for devices to communicate, offering platforms for seamless integration, secure data transmission, and efficient operation of vast networks of connected "things." The growth of this market is inextricably linked to the proliferation of IoT across various sectors, including smart cities, industrial automation, healthcare, and transportation.

IoT Telecom Services Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

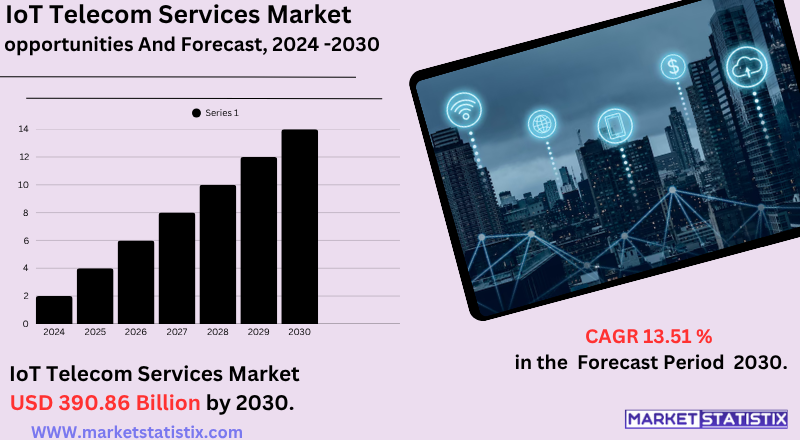

| Growth Rate | CAGR of 13.51% |

| Forecast Value (2030) | USD 390.86 Billion |

| By Product Type | Installation and Integration Services, Device and Application Management Services, Business Consulting Services, IoT Billing and Subscription Management, M2M Billing Management |

| Key Market Players |

|

| By Region |

|

IoT Telecom Services Market Trends

The IOT Telecom Services Market is currently experiencing strong growth, which is mainly powered by a quick global rollout of the 5G network. 5G capabilities, such as ultra-fast speed, extremely low delay, and large-scale machine-type communication (MMTC), are proving to be transformational for IoT applications, which are capable of more complex and data-intensive solutions such as autonomous vehicles, industrial automation and smart city initiatives. This increased connectivity is important to support the rapidly growing number of IoT devices in various fields, pushing telecom operators to expand wide IoT Prasad beyond traditional voice and data services.

Another important tendency is the increasing adoption of edge computing, which allows data processing to be transported closer to the source of the generation, reducing delay and bandwidth use. This is particularly important for real-time IoT applications. In addition, IoT is a strong focus on integrating Artificial Intelligence (AI) and Machine Learning (ML) within the IoT telecom services to adapt to network performance, increase security and enable advanced data analytics for businesses. The demand for cost-effective and efficient IoT solutions, in association with the growing requirement of safe and reliable connectivity, continues to shape the market.

IoT Telecom Services Market Leading Players

The key players profiled in the report are AT&T Inc, Deutsche Telekom AG, Ericsson, Verizon Communications Inc., Swisscom AG, China Mobile Ltd., Huawei Technologies Co., Ltd., T-Mobile USA, Inc., Vodafone Group PLC.Growth Accelerators

The IoT telecommunications service market is experiencing significant development, mainly powered by the explosive proliferation of IoT equipment in diverse industries. From smart home gadgets and wearable technology to industrial sensors and connected vehicles, the number of "things" requiring connectivity and data transmission is increasing rapidly. Widely adopting IoT solutions is fuelled by businesses to increase operational efficiency, automate processes, achieve real-time insights and reduce costs, all of which rely more on strong and scalable telecom connectivity.

A major catalyst for the expansion of this market is the ongoing global rollout of 5G networks. Major features of 5G, such as ultra-high speed, extremely low delay, and unlocked cases of large-scale capacity to connect billions of devices together, are unlocked cases of new and high-demand IoT. This includes applications in areas such as autonomous vehicles, distance surgery, real-time industrial automation (industry 4.0), and advanced smart city initiatives, which were earlier limited by the capabilities of the old network generations.

IoT Telecom Services Market Segmentation analysis

The North America IoT Telecom Services is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Installation and Integration Services, Device and Application Management Services, Business Consulting Services, IoT Billing and Subscription Management, M2M Billing Management . The Application segment categorizes the market based on its usage such as Smart Building and Home Automation, Energy and Utilities, Capillary Networks Management, Industrial Manufacturing and Automation, Vehicle Telematics, Transportation, Smart Healthcare. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The IoT Telecom Services Market has experienced significant merger and acquisition (M&A) activity in recent years, which reflects a tendency towards consolidation and expansion in the industry. Notable deals include Verizon's Frontier Communications acquisition of $20 billion, which aims to increase its fibre internet offerings and expand its market access. In Europe, Swiscom's Vodafone Italia purchase of € 8 billion indicates a strategic move to strengthen its position in the Italian market. This acquisition underlines the industry's attention on serving services and infrastructure to meet the increasing demand for IoT connectivity.

Private equity firms have also been active, with KKR and T-Mobile US entering a joint venture of $4.9 billion to get a 50% stake in the fibre provider Metronate. The purpose of this partnership is to expand fibre network capabilities; it is important to support IoT applications. Additionally, companies like Trasna Solutions have made strategic acquisitions such as the cellular IoT module business of IOTEROP and U-Blox to increase their IoT service offerings. These M&A activities highlight the efforts of the industry to create a broad IoT ecosystem through strategic consolidation.

Challenges In IoT Telecom Services Market

The IoT telecom services market faces many important challenges that may obstruct its development process. One of the primary obstacles is a lack of clear and consistent spectrum allocation rules, which complicates the deployment and management of the IoT network and can create interoperability issues between various service providers and platform vendors. Additionally, telecom companies struggle with a rapidly growing demand for bandwidth-intensive applications and high-quality network experiences, which stress the existing infrastructure and increase operating costs.

Another major challenge is the fragmented nature of the market, with different relations and standards between telecom service providers, IoT platform vendors, and network-e-service providers in various fields. This fragmentation can obstruct cooperation and slow innovation. In addition, the need to develop data privacy rules such as GDPR and CCPA adds complexity in service distribution and increases compliance for telecom operators. As IoT adoption increases, telecom companies should invest heavily in scalable data management, advanced analytics and strong safety protocols to ensure reliable and safe connectivity to their commercial customers.

Risks & Prospects in IoT Telecom Services Market

Major development sectors include smart cities, industrial automation, connected vehicles and smart healthcare, all of which require reliable, low-oppression connectivity and advanced device management solutions. The integration of AI, machine learning and blockchain with IoT telecom services is also opening new routes for innovation, while increasing the enhanced and virtual reality applications leads to an expansion of market capacity.

Regionally, North America and Europe are leading due to high investment in 5G adoption, strong digital infrastructure and smart technologies. However, the fastest development in the Asia Pacific region is expected to be surrounded by ambitious government initiatives such as India's Digital India campaign, rapid urbanisation and growing internet penetration. Emerging markets in Latin America and the Middle East and Africa are also expected to contribute to development as they modernise telecom infrastructure and adopt IoT solutions for various applications.

Key Target Audience

,,,

The major target audiences for the IOT Telecom Services Market include telecom providers, mobile network operators (MNOs), and IOT platform developers, which provide connectivity solutions for a wide range of IOT applications. These stakeholders focus on enabling safe, scalable and reliable communication in equipment in areas such as smart cities, industrial automation, healthcare and logistics. Network architects, IT managers, and professional strategists within these organizations seek services such as NB-IoT, LTE-M, and 5G to support large-scale IoT deployment with low delay and high data throughput.

,

,

Merger and acquisition

The IoT telecom services market faces many important challenges that may obstruct its development process. One of the primary obstacles is a lack of clear and consistent spectrum allocation rules, which complicates the deployment and management of the IoT network and can create interoperability issues between various service providers and platform vendors. Additionally, telecom companies struggle with a rapidly growing demand for bandwidth-intensive applications and high-quality network experiences, which stress the existing infrastructure and increase operating costs.

Another major challenge is the fragmented nature of the market, with different relations and standards between telecom service providers, IoT platform vendors, and network-e-service providers in various fields. This fragmentation can obstruct cooperation and slow innovation. In addition, the need to develop data privacy rules such as GDPR and CCPA adds complexity in service distribution and increases compliance for telecom operators. As IoT adoption increases, telecom companies should invest heavily in scalable data management, advanced analytics and strong safety protocols to ensure reliable and safe connectivity to their commercial customers.

>

Analyst Comment

The IOT Telecom Services Market is experiencing significant growth, which is inspired by increasing the IOT devices and expanding mobile networks. In 2023, the market price was around 28.73 billion USD, and by 2032, it is expected to reach USD 278.16 billion. This growth has increased by increasing demand for smart solutions in various fields, including smart buildings, automation, vehicle telematics, energy and utilities and smart healthcare in various fields.

The expansion of the market is also supported by technological progress and increasing needs of efficient network management solutions. Telecom operators are taking advantage of IoT to offer increased services, improve operational efficiency and create new revenue currents. Integration of IoT in telecom services enables real-time data collection and analysis, making better decisions and customer experiences. As industries continue to embrace digital changes, the IOT Telecom Services Market is ready for continuous development, providing several opportunities for stakeholders in the price chain.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 IoT Telecom Services- Snapshot

- 2.2 IoT Telecom Services- Segment Snapshot

- 2.3 IoT Telecom Services- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: IoT Telecom Services Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Business Consulting Services

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Device and Application Management Services

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Installation and Integration Services

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 IoT Billing and Subscription Management

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 M2M Billing Management

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: IoT Telecom Services Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Smart Building and Home Automation

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Capillary Networks Management

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial Manufacturing and Automation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Vehicle Telematics

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Transportation

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Energy and Utilities

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Smart Healthcare

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: IoT Telecom Services Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 AT&T Inc

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 China Mobile Ltd.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Deutsche Telekom AG

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Ericsson

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Huawei Technologies Co.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Ltd.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Swisscom AG

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 T-Mobile USA

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Inc.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Verizon Communications Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Vodafone Group PLC.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of IoT Telecom Services in 2030?

+

-

Which type of IoT Telecom Services is widely popular?

+

-

What is the growth rate of IoT Telecom Services Market?

+

-

What are the latest trends influencing the IoT Telecom Services Market?

+

-

Who are the key players in the IoT Telecom Services Market?

+

-

How is the IoT Telecom Services } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the IoT Telecom Services Market Study?

+

-

What geographic breakdown is available in North America IoT Telecom Services Market Study?

+

-

Which region holds the second position by market share in the IoT Telecom Services market?

+

-

How are the key players in the IoT Telecom Services market targeting growth in the future?

+

-

,,

The IoT telecommunications service market is experiencing significant development, mainly powered by the explosive proliferation of IoT equipment in diverse industries. From smart home gadgets and wearable technology to industrial sensors and connected vehicles, the number of "things" requiring connectivity and data transmission is increasing rapidly. Widely adopting IoT solutions is fuelled by businesses to increase operational efficiency, automate processes, achieve real-time insights and reduce costs, all of which rely more on strong and scalable telecom connectivity.

, A major catalyst for the expansion of this market is the ongoing global rollout of 5G networks. Major features of 5G, such as ultra-high speed, extremely low delay, and unlocked cases of large-scale capacity to connect billions of devices together, are unlocked cases of new and high-demand IoT. This includes applications in areas such as autonomous vehicles, distance surgery, real-time industrial automation (industry 4.0), and advanced smart city initiatives, which were earlier limited by the capabilities of the old network generations.