Global Freeze-Dried Pet Food Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-772 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Freeze-Dried Pet Food Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

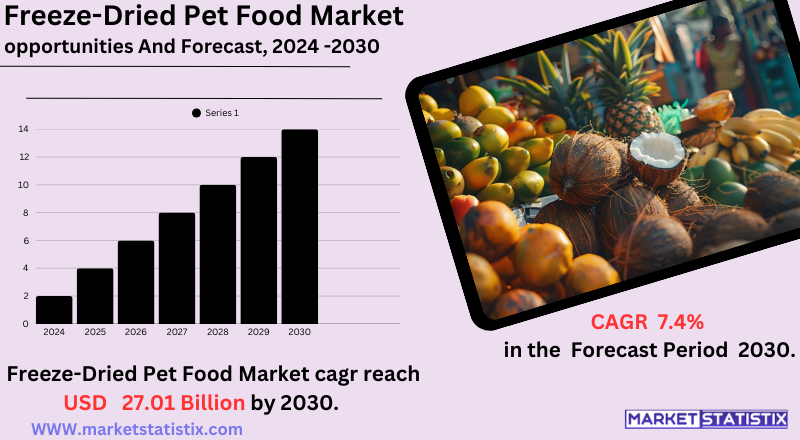

| Growth Rate | CAGR of 7.4% |

| Forecast Value (2030) | USD 27.01 Billion |

| By Product Type | Cat, Dog |

| Key Market Players |

|

| By Region |

|

Freeze-Dried Pet Food Market Trends

The most notable trend is the growing pet humanisation, where pet owners consider their pets as members of their family and are therefore more inclined to spend money on high-end, high-quality food products that reflect human dietary trends for natural and minimally processed foods. This has created a boom in demand for freeze-dried food, as it is seen as a healthier option compared to regular kibble because of its ability to retain nutrients and flavour and its lack of any artificial additives or preservatives. Yet another notable trend is that consumers are becoming increasingly aware of pet nutrition and health. Pet owners are increasingly well-informed concerning ingredients in pet food and actively look for products with high protein levels, single or restricted ingredients, and targeted health advantages in the form of enhanced digestion, allergy control, and increased energy levels. Added to these are the convenience and long shelf life of freeze-dried pet food and the ease of buying on the internet and getting it delivered to the doorstep.Freeze-Dried Pet Food Market Leading Players

The key players profiled in the report are Natural Pet Food Group (New Zealand), Grandma Lucy's (United States), Carnivore Meat Company (United States, Canature Processing (Canada), Champion Pet Foods (Canada), Stella & Chewy's (United States), Primal Pet Foods (United States), Bravo. (United States), Steve's Real Food (United States)Growth Accelerators

The market for freeze-dried pet food is witnessing strong growth as a result of the ongoing pet humanisation trend. Pet owners, looking at their pets as members of their family, are more willing to spend money on high-end food that they consider healthier and more nutritious. Freeze-drying, with the least amount of processing and keeping natural nutrients and flavour intact, is the most fitting choice of food for such a trend since it offers the owners "human-grade" quality for their pets. This is compounded by increasing concern for pet health and nutrition, with owners increasingly seeking foods that contain high-quality ingredients and fewer artificial additives. Another primary driver is the convenience of freeze-dried pet food. It is light, has a prolonged shelf life without refrigeration, and is simple to serve, thus perfect for active pet owners and on-the-go use. The cultural perception of freeze-dried food as a desirable choice, even for finicky eaters, and its flexibility as a complete meal, topper, or treat also fuel its increasing popularity.Freeze-Dried Pet Food Market Segmentation analysis

The Global Freeze-Dried Pet Food is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cat, Dog . The Application segment categorizes the market based on its usage such as Application I, Application II. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market rivalry in the freeze-dried pet food space is growing more dynamic, with a combination of well-established pet food behemoths and increasing numbers of small, niche players. Large players such as Nestlé Purina, Mars, and General Mills (Blue Buffalo) are moving into or increasing their roles in this market, taking advantage of their powerful distribution channels and name recognition. But the market also faces strong competition from niche players like Stella & Chewy's, Primal Pet Foods, and Northwest Naturals, which have established solid reputations for their high-quality, raw-inspired, and frequently single-ingredient freeze-dried products.Challenges In Freeze-Dried Pet Food Market

The freeze-dried pet food industry is plagued by a number of major issues, such as high regulatory barriers and fierce competition between major players. Firms need to be continually innovating in order to respond to changing consumer needs for health, safety, and convenience, which demands huge investment in research and development. Compliance with multiple complex sets of regulations within different regions may hold up the launch of new products and add compliance costs, complicating entry by smaller or new players. Further, the market is under pressure due to the demand for continuous product differentiation as customer awareness and expectation increase. Integration of new technology and the trend towards sustainability also contribute to increasing complexity, forcing manufacturers to move rapidly while not compromising on product quality and safety. These demands are further intensified by volatile raw material prices and supply chain issues, which affect pricing and availability.Risks & Prospects in Freeze-Dried Pet Food Market

Major trends driving market growth include demand for high-quality, minimally processed foods, advances in freeze-drying technology, and interest in convenient, nutrient-dense products with shelf lives. Demand is also helped by expansion in e-commerce and online retail platforms, allowing customers to readily purchase a diverse array of freeze-dried pet food products. Geographically, North America dominates the market with the largest share driven by high disposable incomes, solid pet humanisation trends, and a well-developed retail infrastructure. Europe comes second, with Germany, France, and the U.K. experiencing strong demand fuelled by strict pet food regulation and a preference for quality. Asia-Pacific is the region with the fastest growth, driven by urbanisation, increasing disposable incomes, and growing pet adoptions in countries like China, Japan, and India. Latin America and the Middle East & Africa are also becoming potential markets, with expansion propelled by higher awareness of pet health and growing retail networks.Key Target Audience

, The primary target consumers of the freeze-dried pet food industry are pet owners who value premium nutrition, convenience, and natural ingredients for their pets. This group consists mostly of millennials and Gen Z consumers who consider their pets as part of the family and are more than happy to pay extra for high-quality, raw, and minimally processed pet food products. These consumers value health, do their research, and are generally driven by pet wellness trends, social media, and veterinarian referrals., A second significant audience consists of pet owners with pets that suffer from dietary sensitivities or have special nutritional requirements. Such consumers seek hypoallergenic, grain-free, or single-protein foods that freeze-dried food typically offers. Urban residents, who value the extended shelf life and convenient storage of freeze-dried foods, also represent an expanding customer base. Retailers and speciality pet stores also play a significant role in shaping purchasing decisions through education and one-on-one service.Merger and acquisition

The freeze-dried pet food sector has experienced substantial merger and acquisition activity, consistent with its fast growth and premium status. Thrive Foods bought Canature, a Canadian manufacturer with NutriBites, UBite, and Hoopla brands, in December 2023. This acquisition strengthened Thrive's technical capabilities and offered access to a state-of-the-art facility outside Vancouver, strengthening its presence in the freeze-dried pet food category. Previously, in October 2022, BrightPet Nutrition Group acquired Bravo Pet Foods, an innovator in frozen raw and freeze-dried pet foods, enhancing its portfolio in high-growth segments. In the Asia-Pacific region, L Catterton made a capital investment in China's top freeze-dried pet food firm, Partner Pet, in February 2023. This was to take advantage of China's fast-growing pet food market fuelled by growing disposable incomes and pet humanisation. Separately, New Zealand-based ZIWI purchased Freeze Dried Foods NZ in 2022 to expand its capacity and support international growth plans. Such strategic investment points to rising demand for quality, healthy pet food and the company's aim to increase manufacturing and distribution capabilities to fulfil that demand. >Analyst Comment

The market for freeze-dried pet food is growing strongly, spurred by growth in pet ownership, recognition of the importance of pet nutrition, and an expanding trend toward premium, minimally processed pet foods. Freeze-dried pet food retains the nutrients and taste of fresh ingredients and provides convenience and shelf life, appealing to pet owners concerned about health. The industry, encompassing products ranging from freeze-dried raw food, kibble, and treats, is expected to expand from $95.68 billion in 2024 to $104.68 billion in 2025 with the prospect of reaching $148.15 billion by 2029.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Freeze-Dried Pet Food- Snapshot

- 2.2 Freeze-Dried Pet Food- Segment Snapshot

- 2.3 Freeze-Dried Pet Food- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Freeze-Dried Pet Food Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cat

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Dog

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Freeze-Dried Pet Food Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Application I

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Application II

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Freeze-Dried Pet Food Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Bravo. (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Canature Processing (Canada)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Carnivore Meat Company (United States

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Champion Pet Foods (Canada)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Grandma Lucy's (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Natural Pet Food Group (New Zealand)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Primal Pet Foods (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Stella & Chewy's (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Steve's Real Food (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Freeze-Dried Pet Food in 2030?

+

-

Which type of Freeze-Dried Pet Food is widely popular?

+

-

What is the growth rate of Freeze-Dried Pet Food Market?

+

-

What are the latest trends influencing the Freeze-Dried Pet Food Market?

+

-

Who are the key players in the Freeze-Dried Pet Food Market?

+

-

How is the Freeze-Dried Pet Food } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Freeze-Dried Pet Food Market Study?

+

-

What geographic breakdown is available in Global Freeze-Dried Pet Food Market Study?

+

-

Which region holds the second position by market share in the Freeze-Dried Pet Food market?

+

-

How are the key players in the Freeze-Dried Pet Food market targeting growth in the future?

+

-