North America FPGA Design Software Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-994 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The FPGA design software market covers specialised tools used to program, simulate and optimise FPGA hardware components, which are essential for customizable and high-performance digital circuits. These software solutions allow engineers to design, check, and implement logic circuits on FPGA chips, offering a flexible alternative to traditional ASICs (application-specific integrated circuits). With increasing demand for reconfigurable computing in sectors such as telecommunications, automotive, aerospace and industrial automation, the market is witnessing constant growth. FPGAs' modern design platforms now support advanced features, such as hardware description languages (HDLs), IP core integration, AI acceleration and high-level synthesis, meeting prototyping and final implementation of products. Since computing, IoT, and proliferated devices, the importance of efficient and powerful FPGA design tools continues to grow.

FPGA Design Software Report Highlights

| Report Metrics | Details |

|---|---|

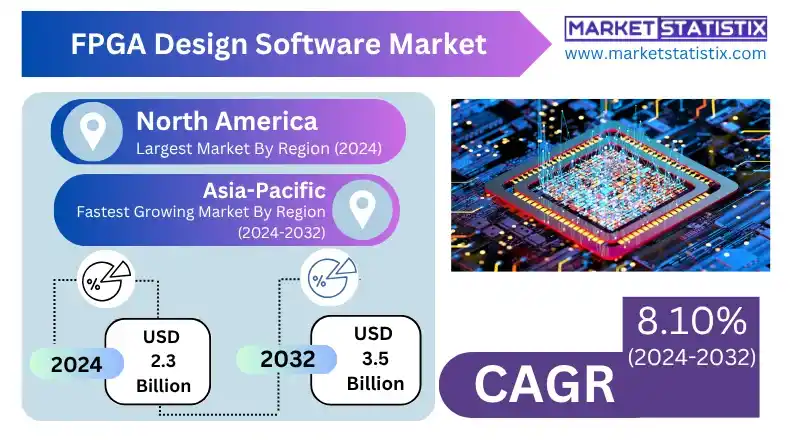

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.10% |

| Forecast Value (2032) | USD 3.5 Billion |

| By Product Type | Subscription-based, Cloud-based, Standalone, On-premises, Enterprise-grade |

| Key Market Players |

|

| By Region |

|

FPGA Design Software Market Trends

The FPGA design software market is currently seeing robust growth, driven by the growing demand for high-performance AI, machine learning and data centers. Main trends include the adoption of advanced technologies from us (16 Nm and below), increasing the complexity of the project that requires sophisticated tools and expanding automotive (ADAS), 5G and IoT apps for real-time processing. Although high licensing costs remain a challenge, continuous innovation in FPGA technology and tools, including high-level synthesis (HLS) and cloud-based platforms, are boosting market expansion, especially in the Asia Pacific region. The market is expected to continue its robust expansion, with a remarkable change towards advanced node technologies (16 Nm and below) and increasing adoption in the Asia-Pacific region.

FPGA Design Software Market Leading Players

The key players profiled in the report are SiliconBlue Technologies, Altium Limited, Lattice Semiconductor, Synopsys Inc., Microsemi Corporation, Aldec Inc., Sigasi, S2C Inc., Gowin Semiconductor Corporation, Achronix Semiconductor Corporation, Tabula Inc., Flex Logix Technologies, MathWorks, Xilinx, Mentor Graphics, Cadence Design Systems, Intel Corporation, Blue Pearl Software, QuickLogic Corporation, National InstrumentsGrowth Accelerators

- The growing demand for customizable and reconfigurable hardware: Industries are increasingly adopting FPGAs for applications where performance, speed and performance optimisation are critical, boosting the need for advanced design tools.

- Growth of AI, Machine Learning, and Edge Computing: FPGA-based accelerators are favoured for low latency processing and high yields on AI and edge devices, feeding the demand for specialised design software that supports these use cases.

- 5G expansion and high-speed networks: FPGAs play a key role in signal processing and network infrastructure, especially in 5G base stations and routers, increasing the need for efficient design and verification tools.

FPGA Design Software Market Segmentation analysis

The North America FPGA Design Software is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Subscription-based, Cloud-based, Standalone, On-premises, Enterprise-grade . The Application segment categorizes the market based on its usage such as Aerospace and Defense, Telecommunications, Industrial, Consumer Electronics, Automotive, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

FPGA's design software market is mainly driven by some major players, especially AMD (with Xilinx) and Intel (with Altera), along with significant contributions from the Technology and Lattice Semiconductor microchip. Competition focuses on offering increasingly sophisticated software suites with high-level synthesis (HLS) for simplified design, advanced check tools and robust energy optimisation. Main competitive strategies include strategic acquisitions for expanding product portfolios and market reach, continuous innovation to support new FPGA architectures and advanced processes (for example, 16nm and below) and a strong focus on high-growth applications such as AI/ML, 5G and automotive. Although high licensing costs and design complexity remain barriers, suppliers are actively working on friendly tools and cloud-based platforms to expand adoption.

Challenges In FPGA Design Software Market

- High Complexity – FPGA design requires advanced skills in HDLs and timing analysis, limiting talent availability. This makes onboarding and scaling teams difficult, especially in fast-paced innovation environments.

- Rising Costs – Expensive software licenses create barriers for startups and SMEs.

High upfront investment often restricts experimentation and R&D flexibility.

- Geopolitical Risks – Export restrictions (e.g., U.S. on China) disrupt market access and vendor operations. Such constraints increase uncertainty in global collaboration and distribution.

Risks & Prospects in FPGA Design Software Market

There are significant opportunities in the FPGA design software market, driven mainly by the growing need for AI hardware acceleration and machine learning, particularly for real-time inference in data centers and the limit. The overall launch of 5G infrastructure is also an important catalyst, as FPGAs are crucial for high-speed data processing and low-latency communication. In addition, the growing adoption of ADAS and autonomous steering in the automotive sector has a profitable market due to the flexibility and performance of FPGAs in the processing of complex sensor data.

Key Target Audience

- , ,

- Telecommunications equipment suppliers: FPGA design software is essential for the development of programmable hardware used in 5G infrastructure, base stations and signal processing equipment due to its ability to meet high bandwidth requirements and low latency. , ,

- Semiconductor and electronics manufacturers: These companies depend on FPGA design software for prototypes and develop custom hardware solutions for various applications, from consumer electronics to high-speed network devices.

, - Automotive and aerospace engineers: As advanced driver assistance systems (ADAS) and avionics become more complex, engineers in these industries use FPGA tools for real-time data processing, critical security system design and flexibility in hardware updates.

,

Merger and acquisition

- Intel Sells Majority Stake in Altera to Silver Lake: In April 2025, Intel sold a 51% stake in its company from Altera FPGA to the private equity company Silver Lake for $8.75 billion. This movement restored Altera as an independent entity, positioning it as the largest pure game FPGA company, focusing on AI markets, edge and 5G computing.

- AMD Acquires Xilinx: AMD has completed the acquisition of Xilinx, a leading FPGA manufacturer, improving its portfolio with adaptive computing technologies. This strategic movement allows AMD to offer a comprehensive set of high-performance and adaptive computing solutions in multiple markets, including data centers and incorporated systems.

- Synopsys Acquires Ansys: In January 2024, Synopsys announced its intention to purchase Ansys for $35 billion. The European Commission approved the agreement in January 2025, dependent on Synopsys stripping its optical and photonic software and ANSYS selling its PowerTist software to solve competition concerns.

Analyst Comment

The FPGA design software market is undergoing robust growth, driven by the growing demand for high-performance AI, machine learning and data centers. The global FPGA market, which influences software demand, was valued at approximately $10.1 billion by 2023 and is expected to reach about $11.64 billion by 2024. Main trends include widespread adoption of 5G infrastructure FPGAs, IoT devices and advanced driver assistance systems (ADS) due to their ability to offer high-speed and low-latency data processing. There is also a significant change for advanced technologies of node (16 nm and below) and increased use of high-level synthesis tools (HLS), as well as increasing interest in cloud-based FPGA design platforms for accessibility and improved collaboration.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 FPGA Design Software- Snapshot

- 2.2 FPGA Design Software- Segment Snapshot

- 2.3 FPGA Design Software- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: FPGA Design Software Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Cloud-based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 On-premises

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Subscription-based

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Standalone

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Enterprise-grade

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: FPGA Design Software Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Aerospace and Defense

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Consumer Electronics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Industrial

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Telecommunications

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Others

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: FPGA Design Software Market by Component

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Software

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Services

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: FPGA Design Software Market by Enterprise Size

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Small and Medium Enterprises

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Large Enterprises

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: FPGA Design Software Market by End-User

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 BFSI

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Healthcare

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Retail

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Media and Entertainment

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

- 8.6 Manufacturing

- 8.6.1 Key market trends, factors driving growth, and opportunities

- 8.6.2 Market size and forecast, by region

- 8.6.3 Market share analysis by country

- 8.7 IT and Telecommunications

- 8.7.1 Key market trends, factors driving growth, and opportunities

- 8.7.2 Market size and forecast, by region

- 8.7.3 Market share analysis by country

- 8.8 Others

- 8.8.1 Key market trends, factors driving growth, and opportunities

- 8.8.2 Market size and forecast, by region

- 8.8.3 Market share analysis by country

9: FPGA Design Software Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 Sigasi

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 Intel Corporation

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 Blue Pearl Software

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Cadence Design Systems

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 S2C Inc.

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 Mentor Graphics

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Achronix Semiconductor Corporation

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Synopsys Inc.

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 MathWorks

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 QuickLogic Corporation

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 Aldec Inc.

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 Microsemi Corporation

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 Gowin Semiconductor Corporation

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 Xilinx

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

- 11.15 SiliconBlue Technologies

- 11.15.1 Company Overview

- 11.15.2 Key Executives

- 11.15.3 Company snapshot

- 11.15.4 Active Business Divisions

- 11.15.5 Product portfolio

- 11.15.6 Business performance

- 11.15.7 Major Strategic Initiatives and Developments

- 11.16 Altium Limited

- 11.16.1 Company Overview

- 11.16.2 Key Executives

- 11.16.3 Company snapshot

- 11.16.4 Active Business Divisions

- 11.16.5 Product portfolio

- 11.16.6 Business performance

- 11.16.7 Major Strategic Initiatives and Developments

- 11.17 Tabula Inc.

- 11.17.1 Company Overview

- 11.17.2 Key Executives

- 11.17.3 Company snapshot

- 11.17.4 Active Business Divisions

- 11.17.5 Product portfolio

- 11.17.6 Business performance

- 11.17.7 Major Strategic Initiatives and Developments

- 11.18 Flex Logix Technologies

- 11.18.1 Company Overview

- 11.18.2 Key Executives

- 11.18.3 Company snapshot

- 11.18.4 Active Business Divisions

- 11.18.5 Product portfolio

- 11.18.6 Business performance

- 11.18.7 Major Strategic Initiatives and Developments

- 11.19 Lattice Semiconductor

- 11.19.1 Company Overview

- 11.19.2 Key Executives

- 11.19.3 Company snapshot

- 11.19.4 Active Business Divisions

- 11.19.5 Product portfolio

- 11.19.6 Business performance

- 11.19.7 Major Strategic Initiatives and Developments

- 11.20 National Instruments

- 11.20.1 Company Overview

- 11.20.2 Key Executives

- 11.20.3 Company snapshot

- 11.20.4 Active Business Divisions

- 11.20.5 Product portfolio

- 11.20.6 Business performance

- 11.20.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Component |

|

By Enterprise Size |

|

By End-User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of FPGA Design Software in 2032?

+

-

Which type of FPGA Design Software is widely popular?

+

-

What is the growth rate of FPGA Design Software Market?

+

-

What are the latest trends influencing the FPGA Design Software Market?

+

-

Who are the key players in the FPGA Design Software Market?

+

-

How is the FPGA Design Software } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the FPGA Design Software Market Study?

+

-

What geographic breakdown is available in North America FPGA Design Software Market Study?

+

-

Which region holds the second position by market share in the FPGA Design Software market?

+

-

Which region holds the highest growth rate in the FPGA Design Software market?

+

-