Global Formula Milk Powder Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-771 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Formula Milk Powder Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

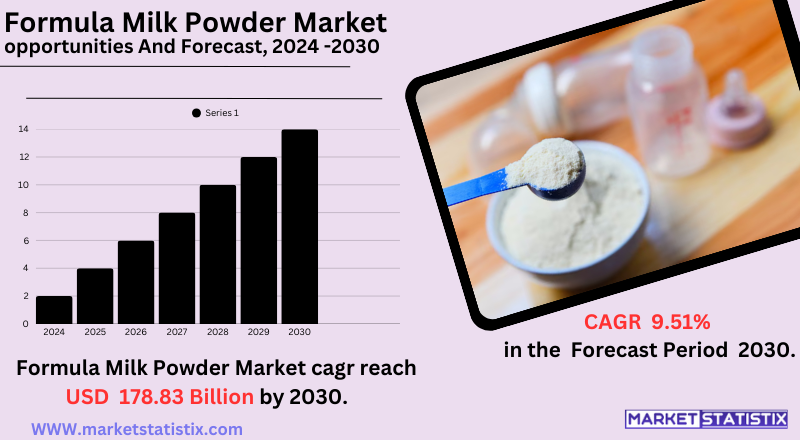

| Growth Rate | CAGR of 9.51% |

| Forecast Value (2030) | USD 178.83 Billion |

| By Product Type | Organic, Conventional |

| Key Market Players |

|

| By Region |

|

Formula Milk Powder Market Trends

A key driver is the rising demand for premium and organic products, which is a growing parental interest in natural and clean-label ingredients for their babies. This trend is compelling manufacturers to innovate and provide formulations with high-quality ingredients, such as organic milk sources and speciality proteins. At the same time, a growing incidence of speciality formulas serving particular dietary needs, including lactose-free, hypoallergenic, and sensitive tummy formulas, demonstrates a shift towards the market of treating various infant health issues. Another important trend is the increasing role of online shopping and e-commerce websites as main distribution channels. This provides convenience and greater product variety for parents, particularly in urban and remote areas. In addition, there is a growing demand from emerging economies with high birth rates and rising disposable incomes, which makes these markets appealing growth markets for formula milk powder producers.Formula Milk Powder Market Leading Players

The key players profiled in the report are Danone (France), Nestle (Switzerland), Perrigo (Ireland), Mead Johnson (United States), FrieslandCampina (Netherlands), Heinz (United States), Arla Food (Denmark), Abbott (United States), HiPP (Germany), Bellamy (Australia), Topfer (Germany)Growth Accelerators

First and foremost, the rise in women entering the labour force across the world makes convenient and accessible substitutes to breastfeeding essential, further increasing demand for formula milk powder. Second, increased urbanisation and altered lifestyles tend to result in fewer hours available for conventional practices of childcare, thus making formula feeding a more viable alternative for most households. In addition, the increasing awareness about infant nutrition and the presence of scientifically designed products that closely match breast milk enable parents to be confident in their decision to choose formula as an alternative or complementary source of sustenance for infants. The second major force driving the demand for formula milk powder is the rise in disposable incomes in emerging markets, enabling families to spend money on formula milk powder, perceived as a quality product providing optimum nutrition to their children.Formula Milk Powder Market Segmentation analysis

The Global Formula Milk Powder is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Organic, Conventional . The Application segment categorizes the market based on its usage such as Infant, Adult. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market environment of the formula milk powder industry is dominated by a number of major international players who occupy considerable market share because of their established brand names, high research and development capabilities, and extensive distribution networks. Some of the major players are Nestlé, Danone, Abbott Laboratories, and Reckitt Benckiser (owner of Mead Johnson). They fight hard on product innovation, frequently launching specialised formulas for particular needs such as allergies or varying age groups and emphasising scientific progress and high-quality ingredients. The competition level is also enhanced by rising consumer awareness about infant nutrition, expanding demand for natural and organic products, and the increasing power of e-commerce retail channels. All industry participants are required to respond continuously through adaptation and innovation to achieve and maintain market share in this essential and highly controlled sector.Challenges In Formula Milk Powder Market

The formula milk powder industry is subject to a number of serious issues that affect both producers and industry development. One of the most serious concerns is stringent regulatory requirements and quality control, as governments and healthcare authorities impose demanding standards to confirm product safety, especially for infant nutrition. Adherence to compliance may prove expensive and complicated and act as a barrier to entry, as well as raise operating costs for manufacturers. Another key threat is competition from breastfeeding promotion and increasing demand for natural feeding, which can constrain market growth as public campaigns promote the advantage of breastfeeding over formula. The market is also vulnerable to supply chain vagaries, raw material price fluctuations, and increasing popularity of plant-based products, all of which can impact production stability and profitability. For organic formula milk powder in particular, high production expenses, certification limitations, and constant supply chain issues create additional layers of complexity.Risks & Prospects in Formula Milk Powder Market

The growing infant formula market, combined with increasing disposable incomes and a desire for organic and speciality formulas, also drives market growth further. Firms are making investments in product innovation, such as natural ingredients and improved nutritional benefits, to address changing consumer tastes and regulatory requirements, presenting a huge opportunity for market growth. Geographically, Asia-Pacific leads the market with a huge population base and the rising use of infant nutrition products, complemented by government support and rising consumer awareness. North America and Europe too provide opportunities through organic and premium product segments, fuelled by health-aware customers. The rising presence of e-commerce sites and strategic product offerings in these geographies are likely to enhance sales further, thus making the market extremely attractive for established players and new entrants.Key Target Audience

, The business context of the formula milk powder sector is controlled by a host of global giants that hold significant market share due to their established brands, superior research and development activities, and massive distribution channels. The leading global players include Nestlé, Danone, Abbott Laboratories, and Reckitt Benckiser, owner of Mead Johnson. They battle fiercely on product innovation, often introducing specialised formulas for specific needs like allergies or different age groups and highlighting scientific advancements and quality ingredients., Competition intensity is further fuelled by increased consumer education on infant nutrition, growing demand for natural and organic foods, and the growing strength of e-commerce retail channels. All industry stakeholders must constantly respond through innovation and adaptation to acquire and sustain market share in this critical and heavily regulated market.Merger and acquisition

The formula milk powder industry has seen significant merger and acquisition (M&A) activity over the past few years, a reflection of strategic realignment and market consolidation. Bobbie, a U.S.-based infant formula startup, in 2023 acquired paediatric nutrition firm Nature's One after a $70 million Series C funding to widen its range of products and consolidate its organic formula segment presence. Likewise, in 2024, Lactalis Group signed the deal to acquire General Mills' U.S. yoghurt business with the intent to expand its dairy portfolio and strengthen its footprint in the U.S. market. In the meantime, Reckitt Benckiser has been weighing selling off its infant formula division, Mead Johnson, as it deals with legal woes and strategic realignment initiatives. Reckitt has been litigated against in the U.S. regarding its Enfamil brand, resulting in a serious financial impact and forcing a strategic re-examination of its nutrition division. All this points to an active M&A environment within the formula milk powder market as companies look to rationalise their portfolios and meet changing consumer needs. >Analyst Comment

The world formula milk powder market is witnessing stable growth, driven by rising birth rates, expanding population, and heightened demand for convenient, nutritionally complete infant nutrition products. In 2024, the infant formula milk and powder market was about USD 25.55 billion and is expected to grow to about USD 39.90 billion by 2030. The major drivers are urbanisation, an increased role of women in the workforce, and hectic lifestyles, which have contributed to increased dependence on formula milk as an easy substitute for breast milk, particularly in developing economies.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Formula Milk Powder- Snapshot

- 2.2 Formula Milk Powder- Segment Snapshot

- 2.3 Formula Milk Powder- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Formula Milk Powder Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Organic

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Conventional

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Formula Milk Powder Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Infant

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Adult

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Formula Milk Powder Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Abbott (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Arla Food (Denmark)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Bellamy (Australia)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Danone (France)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 FrieslandCampina (Netherlands)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Heinz (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 HiPP (Germany)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Mead Johnson (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Nestle (Switzerland)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Perrigo (Ireland)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Topfer (Germany)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Formula Milk Powder in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Formula Milk Powder market?

+

-

How big is the Global Formula Milk Powder market?

+

-

How do regulatory policies impact the Formula Milk Powder Market?

+

-

What major players in Formula Milk Powder Market?

+

-

What applications are categorized in the Formula Milk Powder market study?

+

-

Which product types are examined in the Formula Milk Powder Market Study?

+

-

Which regions are expected to show the fastest growth in the Formula Milk Powder market?

+

-

Which application holds the second-highest market share in the Formula Milk Powder market?

+

-

What are the major growth drivers in the Formula Milk Powder market?

+

-