Global Electrical Equipment Market – Industry Trends and Forecast to 2030

Report ID: MS-570 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Electrical Equipment Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

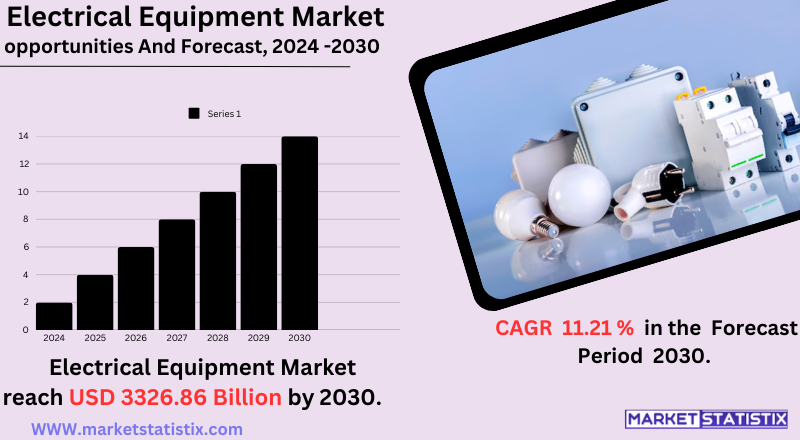

| Growth Rate | CAGR of 11.21% |

| Forecast Value (2030) | USD 3326.86 Billion |

| By Product Type | Wiring devices, Batteries and accumulators, Electronic and electrical wires and cables, Others |

| Key Market Players |

|

| By Region |

Electrical Equipment Market Trends

The electrical equipment market landscape is changing due to some important trends. Smart technologies integration would be the most critical, from IoT, AI, and real-time monitoring systems in electrical equipment toward making the system more efficient, reliable, and capable of predictive maintenance. One significant trend to be covered here is solar and wind and smart grid technologies. Another important trend is growing interest in energy efficiency and cost savings. There is also a variety of markets—industries and consumers who want electrical equipment that can save energy and operational costs. The expansion of electrification in areas such as motorised transport—cars—with electric driving and further automation of processes in industrial plants adds to that. In a geographic sense, it is the Asia-Pacific region that is coming up as a possible new hub for growth, given the advancement of industrialisation and urbanisation at a rapid rate. All these will prove good for infrastructure development and, hence, bring thousands of opportunities for market growth.Electrical Equipment Market Leading Players

The key players profiled in the report are Hitachi (Japan), Rockwell Automation (United States), General Electric (United States), ABB India (India), LG Electronics (South Korea), Philips (Netherlands), Panasonic (Japan), Larsen & Toubro (India), Samsung Electronics (South Korea), Havells India (India), Siemens (Germany), Honeywell (United States), ABB (Switzerland), Schneider Electric (France), Mitsubishi Electric (Japan), Emerson Electric (United States), WEG Electric (Brazil), Eaton (United States), Legrand (France), Toshiba (Japan), Chint Electric (China), Rexnord (United States), Schneider Electric India (India), OthersGrowth Accelerators

In the electrical equipment market, the escalating demand for electricity, especially for urbanisation and industrialisation in developing areas, remains its priority driver. The investments in infrastructure construction for generation, transmission, and distribution require an extensive range of electrical equipment. Renewable energy integration, with solar and wind energy being prime examples, needs advanced grid alignments and specialised equipment to manage power and stability efficiently. Smart grids with extensive monitoring and control systems are another area pushing the demand for intelligent electrical devices and automation solutions. The burgeoning EV sector further drives the demand, as huge investments will be needed in charging infrastructure and related electrical equipment. In conjunction with advancements in power electronics and digital control, these factors push the continued evolution and growth of the electrical equipment market.Electrical Equipment Market Segmentation analysis

The Global Electrical Equipment is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Wiring devices, Batteries and accumulators, Electronic and electrical wires and cables, Others . The Application segment categorizes the market based on its usage such as Transformers, Electricity meter, Circuit Breakers, Distribution boards, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

While the electrical equipment market is marked by competition among global conglomerates and regional players, there are really quiet a number of big players and quite a number of little players. Leverage these competitive advantages with product innovation and partnerships, and explore distribution network expansion, too. In most cases of larger companies, reliance is done to develop the new technologies and cost-effective options with an economy of scale as well as R&D-intensive activity. Importance of changing emphasis on sustainability and that companies will steer their way in new effective energy-efficient products and environment-friendly ones to meet the evolving regulations and requirements of customers.Challenges In Electrical Equipment Market

The electrical equipment market is going through trying times thanks to disruption in supply chains and high production costs. Shortages of raw materials, transportation delays, and related goods through global incidents have all resulted in increases in costs and delays in production, which negatively impacted the profitability of manufacturers. In addition, expensive advanced technologies and highly skilled workers jointly strain company finances and result in problems in maintaining a balance between cost efficiency and product quality. Competition in this saturated market is forcing prices and profit margins down. This extra pressure is further compounded by environmental concerns. Investment in sustainable solutions is now mandatory. On the production floor, scarcity of skilled labour constrains efficiency and curtails innovation. Collectively, these challenges slow the growth of the market even though the market is expected to grow.Risks & Prospects in Electrical Equipment Market

The electrical equipment market has huge opportunities for growth, propelled by smart technologies such as IoT, AI, and energy-efficient methods. The innovative electrical equipment market is witnessing a boost in demand from renewable energy infrastructure and smart grid investments. Growth in segments such as power generation and transmission equipment, smart appliances, and secondary batteries is expected to be highly significant. For instance, the transformer segment is expected to realise $82.5 billion in annual global sales by 2025. Asia-Pacific would lead the market with rapid industrialisation, urbanisation, and a focus on renewable energy projects, contributing greater than 38% to the global market share in 2024. Of these, China and India hold significant importance through their manufacturing power and infrastructure development. North America is strongly placed due to the advancement of industrial bases and technological innovation, whereas Europe makes the most from stringent regulatory standards and sustainable development programs. Meanwhile, emerging markets for Latin America, the Middle East, and Africa are expected to prosper at a slower pace than in other regions due to rising levels of urbanisation and increasingly invested infrastructure.Key Target Audience

, A key target audience in the electrical equipment market is very diverse, reflecting the wide spectrum of applications that electrical products apply to. Power utilities are one of the more significant segments, requiring high-voltage transmission and distribution equipment to maintain and upgrade their grids. On the other hand, manufacturing, oil and gas, and mining industries constitute another major audience that demands, particularly, rugged and safe electrical systems for their operations. Commercial and residential builders and contractors are also an important target audience needing different electrical products for newly constructed buildings and renovations., And with the sector encompassing the burgeoning renewables—a scenario of great interest to solar and wind power developers requiring equipment for grid interconnection and energy storage. Government agencies and infrastructure development companies are yet another substantial segment that pushes the demand for large-scale electrical projects. Finally, electrical wholesalers and distributors play a vital role in connecting manufacturers and end users, acting as a key intermediary in reaching far wider customers.Merger and acquisition

The mergers and acquisitions witnessed in the electrical equipment market have, to a good extent, consolidated the technological capabilities in the market while expanding the area of operation. On 12 December 2024, ABB announced a contract for the acquisition of Gamesa Electric's power electronics unit from Siemens Gamesa. According to ABB, this acquisition is meant to strengthen its position in cost-efficient growth in renewables through power conversion technology, Renewable Power Conversion Technology. The acquisition is expected to close in the second half of 2025, adding over 100 specialised engineers and two manufacturing facilities in Spain to ABB's portfolio. TE Connectivity acquired Richards Manufacturing with an expectation of about $2.3 million to net the hits from emerging electricity demands right now being triggered by artificial intelligence data centres. Richards Manufacturing is actually a supplier of the medium voltage utility grid products, which do even further bring in synergies into the current offerings in TE Connectivity's energy portfolio. It also denotes further investments of the company into renewable energy and grid reliability as critical growth segments that go towards the ever-rising need for strengthening the electrical infrastructure to support technological advancements. >Analyst Comment

The growth of the global electrical equipment market is growing steadily, driven by the drive for reliable and efficient power infrastructure anywhere in the world. Rapidly increasing electrification in various sectors and the expansion of renewable energy generation are key factors contributing to this growth, along with the modernisation of ageing power grids. Due to these factors, the demand for smart grid technologies, which enable better monitoring and control of power distribution, is also manifesting in the market. Also, the continuous demand from the industrial sector for automation and efficient power systems is another significant driver.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Electrical Equipment- Snapshot

- 2.2 Electrical Equipment- Segment Snapshot

- 2.3 Electrical Equipment- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Electrical Equipment Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Wiring devices

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Batteries and accumulators

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Electronic and electrical wires and cables

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Electrical Equipment Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Transformers

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Electricity meter

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Distribution boards

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Circuit Breakers

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 ABB (Switzerland)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 ABB India (India)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Chint Electric (China)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Eaton (United States)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Emerson Electric (United States)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 General Electric (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Havells India (India)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Hitachi (Japan)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Honeywell (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Larsen & Toubro (India)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Legrand (France)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 LG Electronics (South Korea)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Mitsubishi Electric (Japan)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Panasonic (Japan)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Philips (Netherlands)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Rexnord (United States)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Rockwell Automation (United States)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Samsung Electronics (South Korea)

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 Schneider Electric (France)

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 Schneider Electric India (India)

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 Siemens (Germany)

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

- 7.22 Toshiba (Japan)

- 7.22.1 Company Overview

- 7.22.2 Key Executives

- 7.22.3 Company snapshot

- 7.22.4 Active Business Divisions

- 7.22.5 Product portfolio

- 7.22.6 Business performance

- 7.22.7 Major Strategic Initiatives and Developments

- 7.23 WEG Electric (Brazil)

- 7.23.1 Company Overview

- 7.23.2 Key Executives

- 7.23.3 Company snapshot

- 7.23.4 Active Business Divisions

- 7.23.5 Product portfolio

- 7.23.6 Business performance

- 7.23.7 Major Strategic Initiatives and Developments

- 7.24 Others

- 7.24.1 Company Overview

- 7.24.2 Key Executives

- 7.24.3 Company snapshot

- 7.24.4 Active Business Divisions

- 7.24.5 Product portfolio

- 7.24.6 Business performance

- 7.24.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Electrical Equipment in 2030?

+

-

Which type of Electrical Equipment is widely popular?

+

-

What is the growth rate of Electrical Equipment Market?

+

-

What are the latest trends influencing the Electrical Equipment Market?

+

-

Who are the key players in the Electrical Equipment Market?

+

-

How is the Electrical Equipment } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Electrical Equipment Market Study?

+

-

What geographic breakdown is available in Global Electrical Equipment Market Study?

+

-

Which region holds the second position by market share in the Electrical Equipment market?

+

-

Which region holds the highest growth rate in the Electrical Equipment market?

+

-