Global Smart Sensor Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-603 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Smart Sensor Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

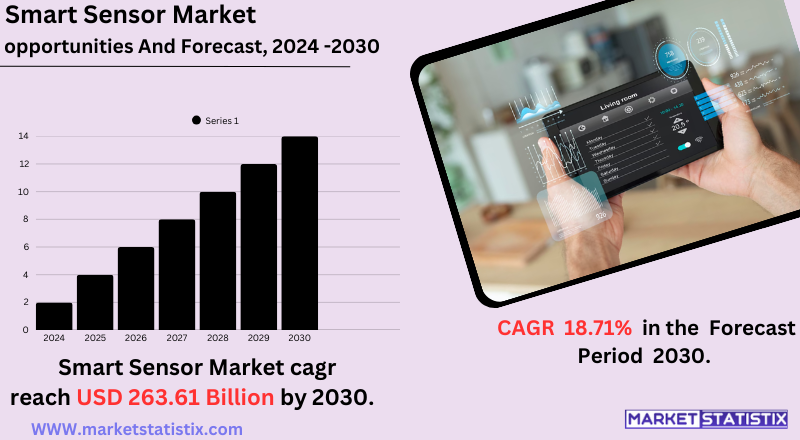

| Growth Rate | CAGR of 18.71% |

| Forecast Value (2030) | USD 263.61 Billion |

| By Product Type | Image Sensors, Smart Motion Sensors, Smart Temperature Sensors, Smart Position Sensors, Smart Pressure Sensors, Touch Sensors |

| Key Market Players |

|

| By Region |

Smart Sensor Market Trends

The smart sensor market is growing at a remarkable rate, primarily attributable to the rapid adoption of IoT devices and the growing demand for real-time data analysis. A prominent trend is the development of enhanced AI and machine learning applications on smart sensors to conduct more advanced tasks, such as predictive maintenance and anomaly detection. Industrial automation and healthcare are two prime examples in which valuable insights are drawn from smart sensors to foster process optimization and patient care improvements. Another prominent trend is the growing emphasis on low-power sensors, primarily induced by the need for energy efficiency in battery-operated devices and remote monitoring applications, consequently enhancing the innovations in microelectronics and energy harvesting.Smart Sensor Market Leading Players

The key players profiled in the report are ABB Ltd. (Switzerland), Eaton Corporation (Ireland), NXP Semiconductors N.V. (Netherlands), Analog Devices Inc. (United States), STMicroelectronics (Switzerland), Infineon Technologies AG (Germany), General Electric Co. (United States), Siemens AG (Germany), Honeywell International Inc. (United States), TE Connectivity Ltd. (SwitzerlandGrowth Accelerators

The key driver of growth in the smart sensors market is IoT itself. With an increase in the number of connected devices, there would be a surge in demand for sensors for data collection, manipulation, and transmission. Phenos that fuel the growing importance of the field supply real-time data alongside automation in industry sectors such as manufacturing, health care, and smart cities. Advances in microelectronics and AI are major driving forces, but within this category, a rapidly growing area encompasses procurements of smaller and more power-efficient devices having intelligent processing that can be extended to many applications in many devices. AI and machine learning algorithms embedded in sensors make the process of obtaining, analysing, and recognizing data such patterns through predictive analytics much smarter and closer to autonomy. This growth, combined with a demand for more data-driven decisions, continues to push the smart sensor market forward.Smart Sensor Market Segmentation analysis

The Global Smart Sensor is segmented by Type, and Region. By Type, the market is divided into Distributed Image Sensors, Smart Motion Sensors, Smart Temperature Sensors, Smart Position Sensors, Smart Pressure Sensors, Touch Sensors . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of this smart sensor market currently comprises both pure-play sensor manufacturers as well as big players worldwide in the semiconductor space, and the competition is vigorous. The competition is enhanced by aspects such as both product innovation and strategic partnerships and acquisitions. Differentiation is a function of sensor accuracy and power competence, integration capability, and software support. The development of novel sensors mostly focuses on advanced features, including artificial intelligence-powered analytical techniques and better communication protocols, necessitated by heavy R&D investment by companies. Furthermore, increased association among sensor manufacturers and software providers to deliver innovative solutions to meet wide-ranging domains for applications in IoT and industrial automation is being noted in the smart sensor market.Challenges In Smart Sensor Market

The smart sensor market suffers from many hindrances to development. One major obstacle is the cost of deployment and maintenance, as it calls for smart components, batteries, and software integration. Furthermore, these costs increase the requirement for frequent calibrating, testing, and skilled personnel for accuracy and functionality, all of which make adoption very expensive for businesses. Rather, short battery life, a poor wireless radio range, and incompatibility with existing systems are among the various technical limitations that inhibit wide implementation of smart sensors.Risks & Prospects in Smart Sensor Market

The smart sensor market offers vast opportunities because of technological advancements in IoT, Industry 4.0, and the increased adoption of smart devices across industries. This growing demand is attributed to applications in consumer electronics, automotive, healthcare, and industrial automation, while innovations such as predictive maintenance and energy-efficient solutions create attractive opportunities. Furthermore, with the rise in the use of wearable devices and smart home solutions, growth potential remains untapped for manufacturers intending to miniaturize and integrate advanced functionalities. Regionally, the North American market is technologically advanced and hosts a massive IoT market and hence leads in smart sensors, while Asia-Pacific has emerged as the fastest-growing region due to rapid industrialization and a growing manufacturing sector in China and India. The other important market growing due to the environmental sustainability agenda and industrial domains embracing digital transformation is Europe. Adoption of automation solutions will continue to rise in the Middle East & Africa and Latin America; however, challenges such as high costs and regulatory bottlenecks remain. Trends in these regional markets point to diverse opportunities for these smart sensors to be configured to substantially differ from each other.Key Target Audience

In addition to all these, the key audience targeted for the smart sensor market includes industries like automotive, consumer electronics, health care, and industrial automation. In automotive, smart sensors find their usage in ADAS for intelligent vehicles, automated vehicles, and electric vehicles, which work by monitoring specific parameters such as temperature, pressure, and motion in order to improve safety and efficiency. The consumers' electronic manufacturers cover a significant area of draws as demand increases for smart devices such as smartphones, wearables, and home automation systems.,, Thus, it includes smart consumer and home installations relying on sensors for activities such as gesture recognition, energy, and health management. Healthcare and industrial automation are also critical segments that drive demand. Smart sensors are applied in healthcare to medical devices for patient monitoring, diagnostics, and robotic surgery. These sensors also play roles in industrial automation for real-time sensor monitoring of machinery, predictive maintenance, and energy optimization.Merger and acquisition

In the last few years, there have been extraordinary M&A activities in the smart sensor market, showcasing a strategic tactic to enhance technology and capture a greater market share. In December 2023, Motorola Solutions acquired IPVideo Corporation, which is known for its HALO Smart Sensor, an all-in-one safety solution that offers vape detection, air quality monitoring, and gunshot detection among other services. ABB planned the acquisition of Eve Systems, a smart home automation solutions provider, in June 2023 to strengthen its offerings in smart sensors and energy management solutions. DiscoverIE Group has also pursued several strategic acquisitions aimed at expanding its sensor capabilities. In January 2023, it acquired Magnasphere in the US for the design and manufacture of high-performance magnetic sensors and switches for access control and specialized vehicles. August 2023 saw the acquisition of Silver Telecom Limited by DiscoverIE, a designer and manufacturer of Power-over-Ethernet components, and in September, DiscoverIE acquired 2J Antennas Group, with headquarters in Slovakia and focused on wireless connectivity solutions for industrial applications. These acquisitions highlight a more massive trend of sensor technology integration industry-wide to improve product offerings and respond to the growing demand across industries for smart sensor applications. >Analyst Comment

The smart sensor market is gravitating towards a growth spurt in view of the spiking adoption of IoT and the requirement for real-time data analysis in various sectors. Pivotal in this growth trend is the adoption of smart sensors for industrial automation, maintenance prognostics, process efficiencies, and improved productivity. It is also noteworthy that the healthcare industry contributes significantly to the revenue generation. Smart sensors are used in wearables, telemedicine, and diagnostic machinery. Progressive implementation of smart sensors is evidently seen in the automotive industry regarding advanced driver-assistance systems (ADAS) and fully automated vehicles for safety and performance.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Smart Sensor- Snapshot

- 2.2 Smart Sensor- Segment Snapshot

- 2.3 Smart Sensor- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Smart Sensor Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Image Sensors

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Smart Motion Sensors

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Smart Position Sensors

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Smart Pressure Sensors

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Smart Temperature Sensors

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Touch Sensors

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 ABB Ltd. (Switzerland)

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Analog Devices Inc. (United States)

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 Eaton Corporation (Ireland)

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 General Electric Co. (United States)

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 Honeywell International Inc. (United States)

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Infineon Technologies AG (Germany)

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 NXP Semiconductors N.V. (Netherlands)

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Siemens AG (Germany)

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 STMicroelectronics (Switzerland)

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 TE Connectivity Ltd. (Switzerland

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Smart Sensor in 2030?

+

-

How big is the Global Smart Sensor market?

+

-

How do regulatory policies impact the Smart Sensor Market?

+

-

What major players in Smart Sensor Market?

+

-

What applications are categorized in the Smart Sensor market study?

+

-

Which product types are examined in the Smart Sensor Market Study?

+

-

Which regions are expected to show the fastest growth in the Smart Sensor market?

+

-

What are the major growth drivers in the Smart Sensor market?

+

-

Is the study period of the Smart Sensor flexible or fixed?

+

-

How do economic factors influence the Smart Sensor market?

+

-