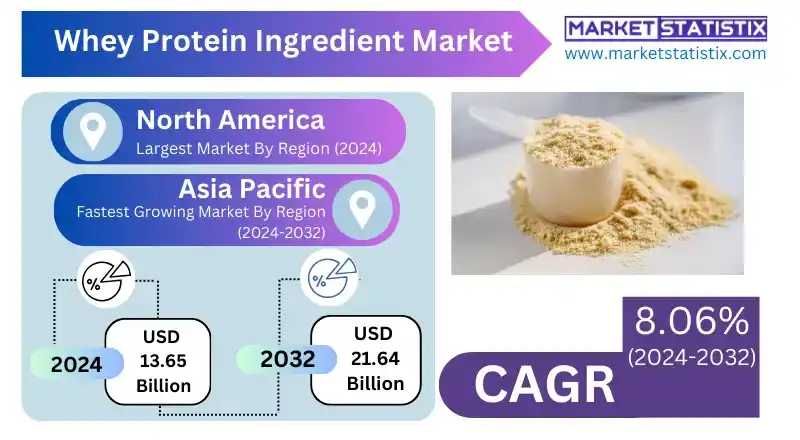

Global Whey Protein Ingredient Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2032

Report ID: MS-533 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Whey Protein Ingredient Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.06% |

| Forecast Value (2032) | USD 21.64 Billion |

| By Product Type | Hydrolyzed Whey Protein, Whey Protein Concentrate, Demineralized Whey Protein, Whey Protein Isolate |

| Key Market Players |

|

| By Region |

|

Whey Protein Ingredient Market Trends

The whey protein ingredient market has robust growth owing to the increase in demand for protein-rich products among various population segments. A major trend in this market is the rise in the application of whey proteins in functional foods and beverages beyond traditional sports nutrition usage, specifically for health-conscious consumers who are likely looking for amenities such as a portable protein source. Innovations in processing technologies are developing purified whey protein isolates and hydrolysates, meeting particular consumer needs such as those regarding rapid muscle recovery and digestion sensitivity. Increased disposable incomes and growing awareness about health and wellness are fuelling the increase in demand for whey protein supplements in developing countries. Customized nutrition is also increasing the momentum in the whey protein sector, providing consumers with a variety of products that target their dietary preferences and fitness goals. Another new trend pertinent to the market is the popularity of e-commerce, for it has improved access to the market, enabling more streamlined and direct communication with the consumer through sales without intermediaries.Whey Protein Ingredient Market Leading Players

The key players profiled in the report are Saputo Inc., Hilmar Cheese Company, Inc., Davisco Foods International, Inc., LACTALIS Ingredients, Wheyco GmbH, Milkaut SA, Arla Foods, Olam International, Milk Specialties, Leprino Foods Company, Alpavit, Glanbia plc, Fonterra Co-operative Group Ltd., Carbery GroupGrowth Accelerators

The accelerating demand for protein-rich food products among health-conscious consumers and athletes is largely driving the whey protein ingredients market. This increasing demand is triggered by healthy consumer awareness of protein functionalities in muscle growth, weight management, and general well-being. On the other hand, a burgeoning sports nutrition market, with a focus on protein supplementation, is also seen as one of the key drivers. In addition, the conspicuous lifestyles of growing numbers of consumers and the elderly population's greater attention to maintaining muscle can significantly contribute to market growth. Innovations in the food and beverage industry in nutrition-fortified products such as protein bars, ready-to-drink beverages, and functional foods are expected to further propel the market growth.Whey Protein Ingredient Market Segmentation analysis

The Global Whey Protein Ingredient is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Hydrolyzed Whey Protein, Whey Protein Concentrate, Demineralized Whey Protein, Whey Protein Isolate . The Application segment categorizes the market based on its usage such as Food and Beverages, Animal Feed, Clinical Nutrition, Infant Formulation. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The ingredient for whey protein is highly competitive, as all the major players have been working vigorously towards an increase in demand for protein supplements globally. Some of the largest companies in the industry include Glanbia Nutritionals, Hilmar Cheese Company, and Arla Foods Ingredients they primarily produce a whole line of whey protein products, encompassing concentrates, isolates, and hydrolysates, for their various applications in sports nutrition, functional foods, and infant formulas. All these industry leaders focus on innovative product development, strategic partnerships, and geographical expansion to maintain their competitive edge. Emerging players and area-specific manufacturers are now capturing sufficient market share on account of sustainability in sourcing, clean labels, and affordability. Besides, these trends of plant-based protein alternatives will also drive the competition with the production of whey proteins by highlighting the better amino acid profile and higher bioavailability of their products. In total, whey protein ingredient market dynamics have both well-established and newly emerging players in continuous improvement to maximize the market portion targeted at health-conscious consumers.Challenges In Whey Protein Ingredient Market

Primary among the challenges faced by the whey protein ingredient market are erratic raw material prices and supply chain irregularities. Availability and pricing issues of whey are consequently dependent upon dairy industry outlooks and worldwide milk production patterns. This translates into volatility in ingredient prices and loss of profit for manufacturers. The other major concern is increasing demand and sustainability from environmental viewpoints since whey protein production practices have begun to come under the spotlight. More demand is shifting toward plant-based protein substitutes and "clean label" products, which is a competitive challenge to whey protein market dominance.Risks & Prospects in Whey Protein Ingredient Market

The whey protein ingredients market has emerged to present considerable opportunities for growth and development due to the increasing demand for protein-enriched products in various sectors. Among the key opportunity factors are the increasing spectrum of sports nutrition products, the development of functional foods and beverages for health-conscious consumption, and the growing use of whey protein in nutrition for the elderly and infant formulas. At present, North America and Europe account for a considerable share, with an established fitness culture and awareness of protein benefits among consumers. The market for sports nutrition products and protein-fortified foods has grown exponentially in China and India. While this trend is also observed in Latin America and the Middle East & Africa, urbanization and increasing awareness of health and wellness are driving the threat. Such variances across regions underscore the need for a focus on product and marketing strategy customized to specific consumer preferences and market dynamics.Key Target Audience

The main target audiences for the constituents of the whey protein ingredient can vary depending on consumer segments. Mainly athletes and fitness enthusiasts are a huge target segment, seeking whey protein for muscle recovery, growth, and performance enhancement. This category contains professional athletes, bodybuilders, and recreational fitness participants who value high-quality protein sources. Next on the list comes the health-conscious public, who are equally focused on weight management and overall wellness. This important target audience includes consumers who are likely to be using whey protein in their dietary regimens to promote satiety, lean muscle maintenance, and nutritional support.Merger and acquisition

The market for whey protein ingredients has experienced extreme mergers and acquisitions involving companies with plans to bring their market share together and enhance product offerings. The said acquisition emphasizes Arla's interest in reinforcing itself in the burgeoning protein ingredients market. In April 2024, Arla Foods Ingredients put forth an announcement that it intended to acquire Volac's Whey Nutrition Business, meant to enhance Arla's capacities in performance, health, and food. Thereupon, in November 2024, this merger was approved by the Competition and Markets Authority in the UK (CMA), stating that there will still be enough competition left in the whey protein concentrate market after acquisition. This regulatory clearance highlighted how dynamic the industry is and why such consolidation was significant strategically. >Analyst Comment

The whey protein ingredient market is experiencing substantial growth, driven by the rising demand for protein-enriched products across various sectors. The sports nutrition segment remains a dominant force, with athletes and fitness enthusiasts increasingly incorporating whey protein into their diets for muscle recovery and performance enhancement. However, the market's expansion is also fuelled by the growing popularity of functional foods and beverages, as well as the increasing use of whey protein in dietary supplements for weight management and healthy aging. The demand for clean label and natural ingredients is also influencing product development, with manufacturers focusing on high-quality, minimally processed whey protein ingredients.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Whey Protein Ingredient- Snapshot

- 2.2 Whey Protein Ingredient- Segment Snapshot

- 2.3 Whey Protein Ingredient- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Whey Protein Ingredient Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Demineralized Whey Protein

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Hydrolyzed Whey Protein

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Whey Protein Concentrate

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Whey Protein Isolate

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Whey Protein Ingredient Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Animal Feed

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Clinical Nutrition

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Food and Beverages

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Infant Formulation

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Whey Protein Ingredient Market by Nature

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Conventional

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Organic

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Whey Protein Ingredient Market by Product

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Animal/Diary Proteins

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Insect Proteins

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Microbe-Based Proteins

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Plant Proteins

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

8: Whey Protein Ingredient Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Milk Specialties

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Glanbia plc

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Leprino Foods Company

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Fonterra Co-operative Group Ltd.

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Hilmar Cheese Company

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Inc.

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Saputo Inc.

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Milkaut SA

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 LACTALIS Ingredients

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Arla Foods

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Davisco Foods International

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Inc.

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Olam International

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

- 10.14 Wheyco GmbH

- 10.14.1 Company Overview

- 10.14.2 Key Executives

- 10.14.3 Company snapshot

- 10.14.4 Active Business Divisions

- 10.14.5 Product portfolio

- 10.14.6 Business performance

- 10.14.7 Major Strategic Initiatives and Developments

- 10.15 Alpavit

- 10.15.1 Company Overview

- 10.15.2 Key Executives

- 10.15.3 Company snapshot

- 10.15.4 Active Business Divisions

- 10.15.5 Product portfolio

- 10.15.6 Business performance

- 10.15.7 Major Strategic Initiatives and Developments

- 10.16 Carbery Group

- 10.16.1 Company Overview

- 10.16.2 Key Executives

- 10.16.3 Company snapshot

- 10.16.4 Active Business Divisions

- 10.16.5 Product portfolio

- 10.16.6 Business performance

- 10.16.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Nature |

|

By Product |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Whey Protein Ingredient in 2032?

+

-

How big is the Global Whey Protein Ingredient market?

+

-

How do regulatory policies impact the Whey Protein Ingredient Market?

+

-

What major players in Whey Protein Ingredient Market?

+

-

What applications are categorized in the Whey Protein Ingredient market study?

+

-

Which product types are examined in the Whey Protein Ingredient Market Study?

+

-

Which regions are expected to show the fastest growth in the Whey Protein Ingredient market?

+

-

Which application holds the second-highest market share in the Whey Protein Ingredient market?

+

-

Which region is the fastest growing in the Whey Protein Ingredient market?

+

-

What are the major growth drivers in the Whey Protein Ingredient market?

+

-