Global Video Compressor Market – Industry Trends and Forecast to 2030

Report ID: MS-2276 | Automation and Process Control | Last updated: Dec, 2024 | Formats*:

Video Compressor Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

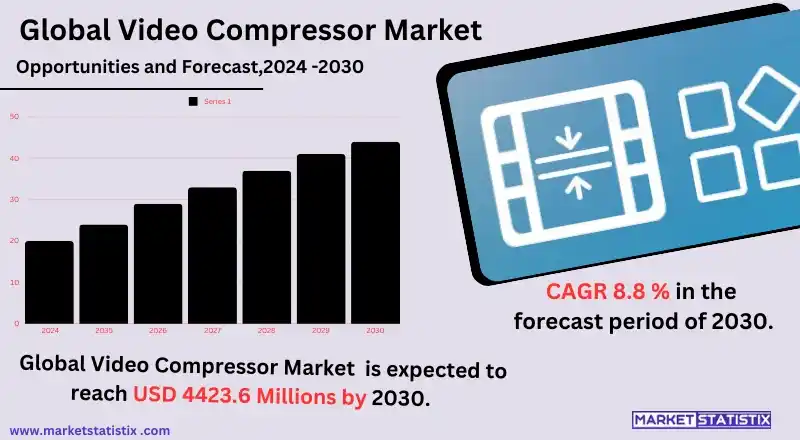

| Growth Rate | CAGR of 8.8% |

| Forecast Value (2030) | USD 4423.6 Million |

| By Product Type | Lossy, Lossless |

| Key Market Players |

|

| By Region |

|

Video Compressor Market Trends

The video compressor market is now increasingly growing under the high demand for both HD and UVD content for the various industries, including media and entertainment, telecommunications, and social media. Increased video streaming platforms and content creation tools have caused the need for more highly efficient video compression technologies that can automatically reduce the size of the data while still maintaining high-quality levels within the video. The shift to advanced compression algorithms such as HEVC (high-efficiency video coding) and AV1 has become common as the compression rates and quality of video have been found to be more outstanding at meeting the demand for seamless streaming and bandwidth optimization. On the other hand, a substantive trend that is increasingly shaping the video compressor industry from time to time is the movement of the market toward the cloud or real-time video processing. With increasing numbers of both businesses and consumers relying on cloud services for video storage, editing, and dissemination, the techniques being leveraged in video compression tools are in the set of cloud platforms for the processing of videos faster and more scalable.Video Compressor Market Leading Players

The key players profiled in the report are ANALOG, Any-video-converter, Clipchamp Utilities, ConverterFiles, FFmpeg, Freemake, HandBrake, Microsoft, Movavi, SQUARED 5, VSDC, Wondershare, ZamzarGrowth Accelerators

Consumers' demands are increasing for high-quality video content as well as the consumption of videos on digital platforms, thereby increasing the market of video compressors. This is because the emergence of streaming services and social media platforms, coupled with the abundance of video-on-demand channels, creates a dire need for more efficient video compression technologies. Video compression reduces the size of a file while retaining quality, allowing storage and transmission of high-definition (HD) and 4K content over the Internet, and thus directly supports the growth of global video consumption. Another major factor driving demand for video coding systems is the rapid advancement of newer technologies such as 5G that quickly and efficiently transmit data with lower latency. These then demand the introduction of new and more efficient video compression techniques to conserve bandwidth and provide satisfactory experiences to users streaming high-resolution video.Video Compressor Market Segmentation analysis

The Global Video Compressor is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Lossy, Lossless . The Application segment categorizes the market based on its usage such as Media and Entertainment, Online Streaming, Video Conferencing, Surveillance, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive space between the companies under consideration is characterised by ongoing collaboration and partnerships in the industry. For example, Harmonic Inc. and ATEME SA are seeking possibilities to merge their products and services with high quality in video compression solutions through vigorous acquisition activities. Increasing demand for streaming services and progressing cloud-based solutions with real-time compression technology are the major reasons fuelling the companies to find strands for possible acquisitions. Hunger for growth in business continues for such developments and thus will be very crucial in shaping the future of video compression technology.Challenges In Video Compressor Market

Compression efficiency versus the quality of video has always been one major challenge in the video compressor market. Compression technologies are supposed to allow processing of very large data sizes without grossly affecting visual quality as the demand to watch higher-defined video contents such as 4K and 8K increases. There are very few ways that one can achieve high compression ratios and clarity of detail in the video, this being a challenge in technology considering that streaming services and video content producers expect their products to be seamless and high-quality delivery across platforms and devices. The challenges are also integrating video compression solutions with varied hardware and software environments. Possible shifts revealed by the speedy assimilation of new technologies, including virtual reality (VR), augmented reality (AR), and cloud-based streaming services, mean video compressors will now cover a wide diversity of devices and network conditions. A must-have for providers to meet what consumers expect and optimise user experience is that such compatibility must also come with real-time performance across different platforms like mobile devices, smart TVs, and low-latency networks.Risks & Prospects in Video Compressor Market

Opportunities are abundant in the video compressor market, driven mainly by the increasing demand for high-quality video across different platforms, especially social media, streaming, and video conferencing, among others. The transition from video consumption by businesses and consumers increases the demand for an efficient and quality video compression technology that reduces file sizes without compromising on quality. The same consumer demands bring a great opportunity for video compression solutions, offering faster upload and download, optimising storage, and improving the user experience across industries such as entertainment, advertising, and remote communication. With rising cloud adoption and the evolution of 5G technologies, new opportunities for video compressor market growth are emerging. Robust compression algorithms are ascendant as market conditions necessitate dealing with enormous volumes of information in the wake of burgeoning cloud-based platforms and the upcoming launch of ultra-high-definition video formats such as 4K and 8K. Video compression technologies will be indispensable in the next generation of virtual reality (VR) and augmented reality (AR) applications, where real-time video streaming and low latency are powerful assets.Key Target Audience

The video compressor market has a core target audience of media and entertainment organisations that include broadcasters, streaming platforms, and content creators. They are in need of technologies that compress video so that they can deliver and store high-quality video content across multiple devices and networks. Video compression typically reduces the size of video files and achieves seamless quality in the compressed version, which is so important for streaming, broadcasting, and distribution models with low-bandwidth networks.,, In addition to enterprises or organisations from different sectors such as education, health, and business communication, another target audience comprises disciplines that use video for training, telemedicine, having virtual meetings, and presentation. Video content in its various applications requires video compressors to help in understanding and analysing large video files so the whole communication and storage of data can be achieved optimally. Cloud service providers and IT companies with video-sharing capabilities within a consumer base where large amounts of video data are being processed need scalable, efficient video-compressor techniques and easy methods to transport data to store such content.Merger and acquisition

Recently in the video compressor industry, merger-and-acquisition frenzy marks a strategic concentration on technological and product improvement to cater to the ever-increasing applications. Among the most recent acquisitions took place in March 2023, when Apple Inc. bought WaveOne, which is concerned with technology in AI-compressed video. This acquisition would advance its efficiency and have a great impact on its streaming services, such as Apple TV and others. Such strategic innovations predict an integrating storyline along which all key players will be moving with advanced technology to gain a competitive edge in the fast-evolving environment of video content delivery. >Analyst Comment

"The video compressor industry grows at a remarkable speed, as it depends a lot on video content viewed on devices and platforms. Video files are getting bigger, and the complexity is growing, which increases the technical need for compression to allow for seamless, smooth downloads and storage features. Many factors, such as a rise in video streaming services, social media proliferation, and the increasing adoption of high-resolution video formats, are driving this market growth. Moreover, the advent of on-demand cloud service for video compression is shaping up in the market. On-demand cloud video compression services help in providing flexible as well as scalable solutions for an enterprise and individuals."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Video Compressor- Snapshot

- 2.2 Video Compressor- Segment Snapshot

- 2.3 Video Compressor- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Video Compressor Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Lossy

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Lossless

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Video Compressor Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Media and Entertainment

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Online Streaming

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Video Conferencing

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Surveillance

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Video Compressor Market by Deployment Mode

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 On-Premises

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Cloud

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Video Compressor Market by End-User

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 BFSI

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Healthcare

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Retail and E-commerce

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Media and Entertainment

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

- 7.6 IT and Telecommunications

- 7.6.1 Key market trends, factors driving growth, and opportunities

- 7.6.2 Market size and forecast, by region

- 7.6.3 Market share analysis by country

- 7.7 Others

- 7.7.1 Key market trends, factors driving growth, and opportunities

- 7.7.2 Market size and forecast, by region

- 7.7.3 Market share analysis by country

8: Video Compressor Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 ANALOG

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Any-video-converter

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Clipchamp Utilities

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 ConverterFiles

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 FFmpeg

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Freemake

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 HandBrake

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Microsoft

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Movavi

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 SQUARED 5

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 VSDC

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Wondershare

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Zamzar

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Deployment Mode |

|

By End-User |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Video Compressor in 2030?

+

-

What is the growth rate of Video Compressor Market?

+

-

What are the latest trends influencing the Video Compressor Market?

+

-

Who are the key players in the Video Compressor Market?

+

-

How is the Video Compressor } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Video Compressor Market Study?

+

-

What geographic breakdown is available in Global Video Compressor Market Study?

+

-

Which region holds the second position by market share in the Video Compressor market?

+

-

How are the key players in the Video Compressor market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Video Compressor market?

+

-