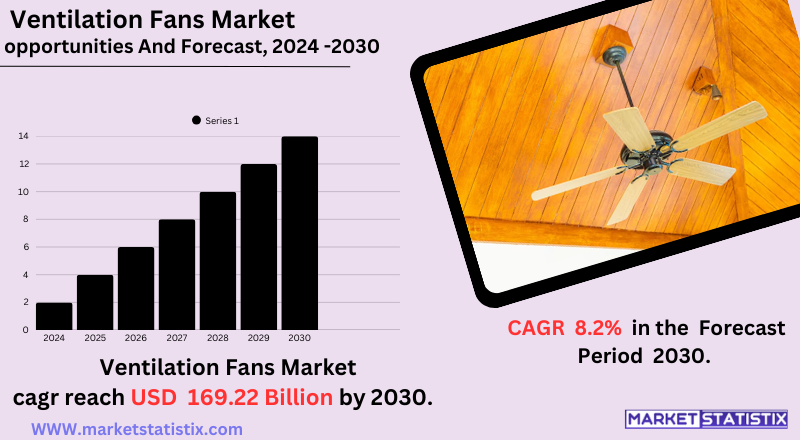

Global Ventilation Fans Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-585 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Ventilation Fans Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 7.51% |

| Forecast Value (2030) | USD 5.28 Billion |

| By Product Type | Centrifugal ventilation fans, Axial ventilation fans |

| Key Market Players |

|

| By Region |

Ventilation Fans Market Trends

The ventilation fans market is witnessing a tectonic shift toward energy-efficient and smart solutions. The increasing adoption of electronically commutated (EC) motors is one of the key trends, as they save more energy compared to conventional AC motors. Further, the integration of several smart technologies, such as sensors and connectivity, is enabling unique features that promote automated operation based on humidity or air quality levels, as well as remote control operation via mobile apps. Such emphasis on smart and energy-efficient products is in tune with the rising awareness among consumers around sustainability and reducing energy consumption. Another big trend is that the demand for IAQ solutions is rising owing to increasing concerns regarding health and well-being. This will motivate the development of ventilation fans that would include filtration systems such as HEPA capable of removing particulates and allergens. Moreover, the increasing emphasis on quiet operation is becoming popular in the residential applications market.Ventilation Fans Market Leading Players

The key players profiled in the report are Emerson Electric Co. (USA), Greenheck Fan Corporation (USA), Toshiba Carrier Corporation (Japan), Vervent, Inc. (USA), Acme Engineering (India), Broan-NuTone LLC (USA), Panasonic Corporation (Japan), Lutron Electronics Co., Inc. (USA), Systemair AB (Sweden), Airmaster Fan Company (USA), Hunter Fan Company (USA), Centrifugal Systems Inc. (USA), VELUX Group (Denmark), Aerovent, Inc. (USA), Vornado Air LLC (USA)Growth Accelerators

Increasing awareness of indoor air quality (IAQ) and its health impacts, especially for residential, commercial, and industrial purposes, is currently driving the entire ventilation engineer market. Issues related to pollutants, allergens, and respiratory problems have increased the demand for ventilation systems that can effectively dilute stale air, odours, and other contaminants. Rapid urbanization and a construction boom in emerging economies such as India and China are propelling the market, with new buildings needing sophisticated ventilation systems to meet regulatory standards and ensure occupant comfort. Compact living space with restricted natural airflow has therefore increased the need for mechanical ventilation, which is, in turn, supporting increased fan sales. Customers, with a relatively good disposable income, are more concerned about healthy lifestyles and are investing in efficient modern ventilation systems to create a pleasant environment for living and working. This attention to air quality has surged after COVID-19.Ventilation Fans Market Segmentation analysis

The Global Ventilation Fans is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Centrifugal ventilation fans, Axial ventilation fans . The Application segment categorizes the market based on its usage such as Commercial, Industrial, Residential. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The ventilation fans market is witnessing a tectonic shift toward energy-efficient and smart solutions. The increasing adoption of electronically commutated (EC) motors is one of the key trends, as they save more energy compared to conventional AC motors. Further, the integration of several smart technologies, such as sensors and connectivity, is enabling unique features that promote automated operation based on humidity or air quality levels, as well as remote control operation via mobile apps. Such emphasis on smart and energy-efficient products is in tune with the rising awareness among consumers around sustainability and reducing energy consumption. Another big trend is that the demand for IAQ solutions is rising owing to increasing concerns regarding health and well-being. This will motivate the development of ventilation fans that would include filtration systems such as HEPA capable of removing particulates and allergens. Moreover, the increasing emphasis on quiet operation is becoming popular in the residential applications market.Challenges In Ventilation Fans Market

The demand for energy-efficient and smart ventilation solutions across residential, commercial, and industrial applications has generated substantial opportunities for the ventilation fan market. Developments in urbanization, particularly in emerging economies, increase the demand for better indoor air quality in small living spaces, making room for advanced fans having features such as IoT integration and low energy consumption. Among various geographical regions, Asia-Pacific stands out as an area with strong growth due to rapid urbanization, rising income, and large-scale infrastructure construction in nations such as China and India. North America, particularly the U.S., has a strong grip on the market on the back of stringent building codes and the prevalence of energy-efficient technologies. This is closely followed by Europe, where it thrived mainly due to environmental regulations and its already mature market of smart home solutions. The Middle East and Africa would have all that potential, and even now, a construction boom has started in the Gulf region, but growth is inhibited because of the differences in the economy.Risks & Prospects in Ventilation Fans Market

The demand for energy-efficient and smart ventilation solutions across residential, commercial, and industrial applications has generated substantial opportunities for the ventilation fan market. Developments in urbanization, particularly in emerging economies, increase the demand for better indoor air quality in small living spaces, making room for advanced fans having features such as IoT integration and low energy consumption. Among various geographical regions, Asia-Pacific stands out as an area with strong growth due to rapid urbanization, rising income, and large-scale infrastructure construction in nations such as China and India. North America, particularly the U.S., has a strong grip on the market on the back of stringent building codes and the prevalence of energy-efficient technologies. This is closely followed by Europe, where it thrived mainly due to environmental regulations and its already mature market of smart home solutions. The Middle East and Africa would have all that potential, and even now, a construction boom has started in the Gulf region, but growth is inhibited because of the differences in the economy.Key Target Audience

The ventilation fans market serves all segments in every possible way in residential, commercial, and industrial aspects. In the residential sector, homeowners needing ventilation solutions for indoor air quality, moisture reduction, and mold prevention look for energy-efficient and quiet models. This segment has witnessed growing demand due to the increasing awareness of health-related issues associated with poor indoor air quality.,, In commercial establishments, such as offices, hospitals, and educational institutions, proper ventilation systems are needed to keep up air quality and meet health and safety regulations. Such clients demand systems that can efficiently move large volumes of air, are able to ensure advanced controls, and sustain green practices. In the industrial sector, factories and manufacturing units require superior ventilation for the safety of the workers and to provide maximum efficiency in the operations; hence, the preference for heavy-duty-type metal fans that can survive the harsh conditions.Merger and acquisition

Considerable merger and acquisition activity has been taking shape recently within the ventilation fans market, aimed at increasing market share and product offerings. In April 2024, Mitsubishi Electric Corporation acquired French air-conditioning company AIRCALO through its subsidiaries, looking to offer AIRCALO's wide range of products and customization capabilities to cement Mitsubishi Electric's position in the European hydronic HVAC systems market. Another significant deal took place in December 2023 when Panasonic Corporation went into exclusive partnership with Atmosphere Vortex for the distribution of its full line of dryer venting and inline fans in the U.S. This partnership highlights Panasonic's commitment to improving indoor air quality offerings. Furthermore, in April 2022, Multi-Wing Group, a U.S.-based manufacturer of adaptable axial fans, acquired its longtime partner Fabrika Special Motors in Denmark. This strategic move gears Multi-Wing toward improving the global offering of efficient fan solutions as a consolidation trend within the industry, aiming to improve efficiency and broaden technological capabilities. >Analyst Comment

The market for ventilation fans remains on the steady growth path, in part due to the escalating indoor air quality worries and increased demand for energy-efficient solutions for ventilation. Major contributing factors comprise stringent building codes and regulations addressing the circulation of fresh air within residential and commercial buildings. Another segment under discussion includes the need for smarter homes and integrated HVAC systems, which is also influencing the market. The advancement in fan technology offers features that include remote control, automated sensors, and energy-saving mode. The Asia-Pacific region shows signs of becoming a leading market because urbanization and industrialization have increased construction activity and led to greater awareness about indoor air quality.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Ventilation Fans- Snapshot

- 2.2 Ventilation Fans- Segment Snapshot

- 2.3 Ventilation Fans- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Ventilation Fans Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Centrifugal ventilation fans

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Axial ventilation fans

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Ventilation Fans Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Industrial

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Residential

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Acme Engineering (India)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Aerovent

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Inc. (USA)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Airmaster Fan Company (USA)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Broan-NuTone LLC (USA)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Centrifugal Systems Inc. (USA)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Emerson Electric Co. (USA)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Greenheck Fan Corporation (USA)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Hunter Fan Company (USA)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Lutron Electronics Co.

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Inc. (USA)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Panasonic Corporation (Japan)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Systemair AB (Sweden)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Toshiba Carrier Corporation (Japan)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 VELUX Group (Denmark)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Vervent

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Inc. (USA)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Vornado Air LLC (USA)

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Ventilation Fans in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Ventilation Fans market?

+

-

How big is the Global Ventilation Fans market?

+

-

How do regulatory policies impact the Ventilation Fans Market?

+

-

What major players in Ventilation Fans Market?

+

-

What applications are categorized in the Ventilation Fans market study?

+

-

Which product types are examined in the Ventilation Fans Market Study?

+

-

Which regions are expected to show the fastest growth in the Ventilation Fans market?

+

-

Which application holds the second-highest market share in the Ventilation Fans market?

+

-

What are the major growth drivers in the Ventilation Fans market?

+

-