Global Transfer Case Market – Industry Trends and Forecast to 2030

Report ID: MS-2158 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Transfer Case Report Highlights

| Report Metrics | Details |

|---|---|

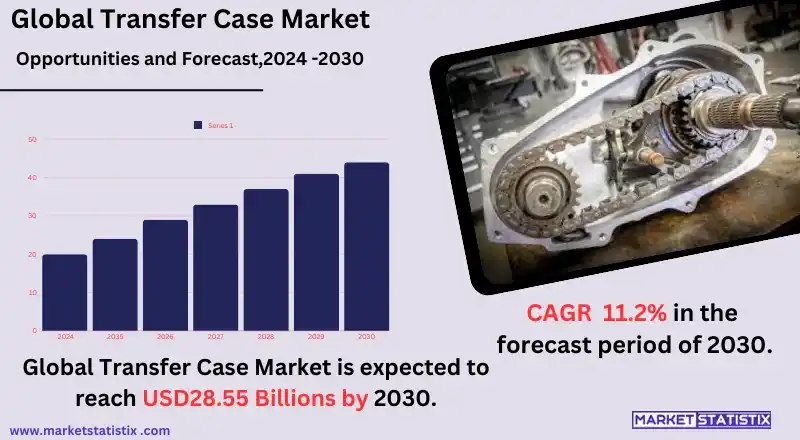

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 11.2% |

| Forecast Value (2030) | USD 28.55 Billion |

| By Product Type | All-Wheel Drive (AWD), Four-Wheel Drive (4WD) |

| Key Market Players |

|

| By Region |

|

Transfer Case Market Trends

The global transfer case market is expanding rapidly as a result of growing demand for all-terrain vehicles (ATVs) and sports utility vehicles (SUVs), majorly in the developing countries and the regions with a rough terrain. The appetite for devices that enhance performance, safety, and ability to manoeuvre off-road cuts across all consumers, and this has seen the advanced transfer cases adoption grow. Such a move is also fuelled by the growth in the sales of SUVs, crossovers, and even pickups that also have advancements in the transfer cases to enhance the efficiency in the power delivery between the front and rear axles for better stability and control. Other than that, another sued and irrefutable recent trend is the emergence of electric and hybrid vehicles, which tends to change the case transfer market. With the expansion in the electrification of SUVs and trucks, such manufacturers are coming up with electric transfer cases specifically for electric drive trains in which the optimal torque is efficiently transmitted without any mechanical parts. On top of that, there is also an increasing focus on energy-efficient, lightweight, and compact transfer cases to improve fuel economy and cut down emissions in both traditional and hybrid electric vehicles.Transfer Case Market Leading Players

The key players profiled in the report are BorgWarner Inc., ZF Friedrichshafen AG, Melrose Industries PLC (GKN Ltd), Aisin Corporation, Dana Incorporated, Divgi TorqTransfer Systems Limited, Magna International Inc., American Axle & Manufacturing, Inc., JTEKT Corporation, Schaeffler AGGrowth Accelerators

The expansion of the transfer case market can be attributed to the rising demand for all-wheel-drive and four-wheel-drive vehicles, especially among the geographical regions with tough terrains and extreme weather. Given consumers’ preferences for vehicles with improved performance, more advanced transfer case structures are being implemented in vehicle parts to improve the efficacy of the driveline and safety. This is especially true of the SUVs and other similar segments, such as pickup trucks and off-road vehicles, that are on a rapid growth journey around the globe. Moreover, the growing trend of electric vehicles (EVs) and hybrid electric vehicles (HEVs) presents another transfer case market opportunity due to the fact that these vehicles require different transfer cases to facilitate the portioning of the electric motor and the conventional engine outputs. Automotive manufacturers are increasingly focused on innovations as they aim at designing sustainable vehicles and enhancing their performance, which increases the need for advanced transfer case systems.Transfer Case Market Segmentation analysis

The Global Transfer Case is segmented by Type, and Region. By Type, the market is divided into Distributed All-Wheel Drive (AWD), Four-Wheel Drive (4WD) . Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The prevailing competitive setting is marked by a fairly consolidated market where only a handful of firms are able to command a significant share of the market. Volumes of operations do go up, and companies such as BorgWarner Inc., American Axle & Manufacturing Inc., and ZF Friedrichshafen AG, for example, stand strong and healthy in the marketplace, with a focus on building alliances and developing new products to strengthen their position. The demand for this particular market is driven by the Asia Pacific region as a result of the rising automotive manufacturing and changing car consumers to AWDs and 4WDs. In contrast, the increasing adoption of electric vehicles provides a competitive threat to the traditional transfer case manufacturer, thus forcing changes in the product range offered to meet the changing consumer needs and policy requirements.Challenges In Transfer Case Market

Several factors inhibit the growth of the global transfer case market, especially on the curves of the growing population of electric vehicles (or EVs). Conventional transfer cases that are used in all-wheel-drive and four-wheel-drive systems of internal combustion engine cars are now witnessing less demand as electric vehicle manufacturers are opting for simple single-motor designs or even different drive technologies. This development brings in ambiguity in the increase of the market and poses constraints on the companies that depend much on the internal combustion engine vehicles. Another drawback is the costly advanced materials and technologies required for the making of better and heavy-duty transfer cases. It is the manufacturer’s responsibility, however, to come up with lightweight, compact, economical transfer cases that have higher performance capabilities because modern vehicles are becoming more demanding in terms of high torque and off-road use.Risks & Prospects in Transfer Case Market

There are immense opportunities in the global transfer case market since there is a growing trend of all-wheel-drive and four-wheel-drive vehicles due to the customer’s desire for high-performance vehicles that can also tackle difficult terrains. The focus of the automotive industry on the production of multipurpose and high-performing vehicles has directly led to the increased need for sophisticated transfer cases that are capable of better torque management and traction control. Further prospects for growth can be found in the further development of new markets, in particular those with rugged terrains, for example, certain subsets of Asia Pacific, Latin America, and the Middle East. These regions are experiencing the growing use of sport utility vehicles, trucks, and all-terrain vehicles, which are important for business and leisure. Moreover, the new trends in manufacturing transfer cases, including lightweight materials, better energy efficiency, and electronic control systems, create improvement possibilities for the companies willing to offer advanced and cheaper solutions. As the market pressure mounts on vehicle makers to make eco-friendly, efficient, and high-performance vehicles, there is likely to be a transition in the transfer case market that will benefit traditional automobile manufacturers as well as new players in the electric mobility market.Key Target Audience

The foremost segmentation of the global transfer case market is easily identifiable as automotive manufacturers, with particular emphasis on those manufacturers who have designed and engineered their automobiles for all-wheel drive and four-wheel drive (AWD and 4WD, respectively). Since these manufacturers need such transfer cases to enhance torque management between the front and rear axles for better overall performance, handling, and off-road performance. This is further supported by the trend of rising demand for SUVs, trucks, and off-road vehicles in general across various regions, more particularly in the regions of difficult terrains and harsh weather climates where AWX/4WD systems are a necessity.,, Apart from the OEMs, the collateral market also covers automotive aftermarket suppliers and repair shops that provide replacement or enhancement parts for vehicles with transfer case systems fitted. There is another significant audience of consumers looking to modify their vehicles for off-road or heavy-duty use. Furthermore, the increasing trend towards the adoption of electric vehicle (EV) technology has also led to a surge of interest in transfer case-related technologies addressing electric drivetrain configurations, thereby creating a new segment in the market for the manufacturers that are able to change and offer new solutions.Merger and acquisition

As the global transfer case market continues to grow, new noteworthy mergers and acquisitions are taking place, altering the dynamics of competition. For instance, Cummins Inc. announced the acquisition of Meritor Inc. for a cash consideration of $3.7 billion in August, 2022. Through this transaction, Cummins seeks to develop its drivetrain and mobility solutions business by incorporating Meritor’s axles and braking systems into its product portfolio. Now, this makes Cummins more competitive than ever in regard to the internal combustion and electric vehicle market, which is in line with other growing companies in the automotive industry aiming to consolidate in order to cut costs and grow their technological base. The transfer case industry is set for healthy growth, with the latest projection estimating the market will grow from 13.25 billion U.S. dollars in 2023 to 20.75 billion by 2028, which is expected due to increased purchases of SUVs and AWD vehicles. Od companies such as ZF Friedrichshafen AG, Magna International, and Aisin Seiki are also engaged in such strategic initiatives to broaden their operational scope. The focus will extend towards investment in research and development on such technologies as lightweight materials and smart control systems, which will also increase the growth of the market and innovations within it.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Transfer Case- Snapshot

- 2.2 Transfer Case- Segment Snapshot

- 2.3 Transfer Case- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Transfer Case Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 All-Wheel Drive (AWD)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Four-Wheel Drive (4WD)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Transfer Case Market by Vehicle type

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Passenger Vehicle

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Light Commercial Vehicle

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Heavy Commercial Vehicle

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Off-Road Vehicles

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Buses and Trucks

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Transfer Case Market by Drive type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Gear driven

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Chain driven

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Transfer Case Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 BorgWarner Inc.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 ZF Friedrichshafen AG

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Melrose Industries PLC (GKN Ltd)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Aisin Corporation

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Dana Incorporated

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Divgi TorqTransfer Systems Limited

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Magna International Inc.

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 American Axle & Manufacturing

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Inc.

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 JTEKT Corporation

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Schaeffler AG

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Vehicle type |

|

By Drive type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Transfer Case in 2030?

+

-

What is the growth rate of Transfer Case Market?

+

-

What are the latest trends influencing the Transfer Case Market?

+

-

Who are the key players in the Transfer Case Market?

+

-

How is the Transfer Case } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Transfer Case Market Study?

+

-

What geographic breakdown is available in Global Transfer Case Market Study?

+

-

Which region holds the second position by market share in the Transfer Case market?

+

-

How are the key players in the Transfer Case market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Transfer Case market?

+

-