Global Tonic Wine Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-813 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Tonic Wine Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

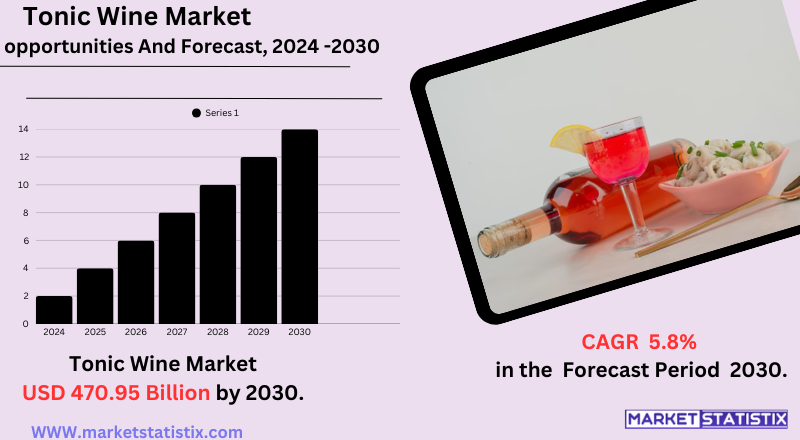

| Growth Rate | CAGR of 5.8% |

| Forecast Value (2030) | USD 470.95 Billion |

| By Product Type | Red Tonic Wine, White Tonic Wine, Rose Tonic Wine |

| Key Market Players |

|

| By Region |

|

Tonic Wine Market Trends

Currently, the tonic wine market is growing with various trends. There is a growing interest among consumers in their health, which has led to the demand for drinks that are interpreted as natural remedies and health benefits, typically tied closely to the ways and types of herbs and botanicals found in tonic wines. There is also the trend of premiumisation of seeking better quality tonic wine with a very unique flavour and craftsmanship. Availability of tonic wine on e-commerce sites is also widening consumer access and convenience. In addition, the market will have to deal with cultural variations and alternative alcoholic beverages that compete for consumer expenditure. In spite of the challenges presented, the tonic wine market has kept evolving into innovation in new flavours, natural status, and using online media to reach a wider audience.Tonic Wine Market Leading Players

The key players profiled in the report are Herb Affair, Sainsbury's, Leonard J Russell Snr, Scotland's, Dee Bee Wholesale, Bristol, Reggae Treats, Jingjiu, Campari Group, Zhangyu, Portman Group, AhmadiAnswers, WuliangyeGrowth Accelerators

The growing demand of the tonic-wine market is based on various factors, such as changing customer requirements and market shifts. The most important factor in this situation is that health obsession and wellness among consumers are being transferred into beverage demand. Most of such beverages now usually have the herbal and plant ingredients that are used in almost all tonic wines. Culture and society also come as part of those variables. Some of the regions where tonic wine is consumed link such wines to local culture and social events, thereby guaranteeing business. Also, such marketing snubs focused on flavour, health benefits, and heritage could spur such consumers to try tonic-brand wines. Such complemented availability through wider channels of distribution – including online retail – produces a further impact on demand.Tonic Wine Market Segmentation analysis

The Global Tonic Wine is segmented by Type, and Region. By Type, the market is divided into Distributed Red Tonic Wine, White Tonic Wine, Rose Tonic Wine . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The tonic wine market is also peculiar in terms of competitive landscape, which does not usually have too many global megabrands. Instead, there are a few strong regional players. Some of these are Buckfast tonic wine, which holds a big chunk of the market – especially in places like the UK and Ireland, where it has cultural associations; Magnum Tonic Wine, which is much appreciated in the Caribbean and shows prospects of being marketed outside its borders; and Wincarnis, another age-old brand that comes from the early connections between alcohol and health benefits. Brands compete mainly on price, brand loyalty, and distribution networks within their core markets.Challenges In Tonic Wine Market

The tonic wine market faces several challenges that may impede its growth story. One of the greatest impediments is the constantly evolving regulatory landscape, where changes in the rules concerning alcohol content, labelling, and advertising might limit the market's movement forward and create further compliance hurdles for the producers. These climate vagaries, along with supply chain interruptions, can affect the availability and quality of certain key ingredients, having a direct bearing on production costs and product consistency. High import tariffs in various regions, i.e., India, impede the access of premium tonic wines and limit market penetration. Another key challenge would be the consumer market characterised by health-conscious trends, which are generating demand for low-alcohol or non-alcoholic substitutes for tonic. That has put traditional tonic wine products under pressure to innovate or face extinction. The rivalry between established brands and newer players is severe in the market for artisanal, functional, and wellness-focused beverages, thus making it almost improbable for any single player to create lasting leadershipRisks & Prospects in Tonic Wine Market

Innovative flavour profiles coupled with organic formulations and sustainable packaging attract health-conscious young neophytes. The growing wellness trend with functional drink ingredients also boosts demand. Direct-to-consumer channels, easy access to tonic wines, and the emerging popularity of social media brand discovery are some other aspects that spell out growth. The above benefits of the country supplement the market. The regions include the USA, the UK, the European Union, Japan, and South Korea, where tonic wines have stood for different meanings in their cultures as part of mushrooming celebrations and wellness practices. North America tops the market share with Europe due to more consumption habits established and existing top-end names such as Buckfast in the UK. However, Asia Pacific goes on the fast track with increased disposable income per person and easier acceptance of premium and craft alcoholic beverages. Within the home segment, strong shares are dominated by associations with cultural events—for example, Magnum Tonic Wine's link with reggae festivals. In all these ways, they are increasing local growth.Key Target Audience

, The tonic wine market caters to diverse consumer segments, each with its own peculiarities and whims. Traditional tonic wines, exceedingly potent, like Buckfast wine, are very famous among working-class people, students, and bohemian classes in the UK and Ireland. The other group, which is also often associated with traditional tonic wines, are premium tonic wines sold for responsible health-conscious consumers, who might want a beverage that simultaneously imparts some potential wellness benefits by drinking it. They will often add herbal ingredients like ginseng and ginger to their tonic wines. Furthermore, flavoured tonic wines will entice the youthful demographic pursuing one-of-a-kind taste experiences and mixology, adding versatility to cocktail and culinary applications., Distribution channels are of utmost importance in reaching these different audiences. Speciality stores hold their own as an important sales channel, offering an edited selection and expert advice, resonating with the enthusiast’s seeking quality and authenticity. Yet online retail, on the rise, has opened up accessibility for those wanting to stay at home and search for tonic wines – a compelling option for those who enjoy technology or simply prefer convenience.Merger and acquisition

Today's mergers and acquisitions in the tonic wine market are indications of the companies' drive towards diversification and market expansion, as Fratelli Branca has recently bought a nearby distillery to extend its tonic wine product range; Pernod Ricard is said to be seeking alliances that will enhance its reach. Clearly, this is part of a wider trend in which the beverage industry corporates seek consolidation and complementarity in product offerings to cater to the changing tastes of consumers. The tonic wine industry is witnessing rapid growth, being bolstered by main players in the industry, such as Britvic, Morrisons, and Wincarnis – companies creating a boom for the market – which is now said to be consuming very high interest from consumers about new and premium tastes. The various developments in the industry indicate its competitive trends, creating strategic acquisitions and partnerships as the major tools for such companies looking to grow the market base and target the very dynamic nature of taste within consumers. >Analyst Comment

The tonic wine market is experiencing steady growth worldwide; it will be valued at around USD 2.1 billion in 2025 and is expected to reach around USD 3.7-4.8 billion by 2032-2035. The aforementioned expansion is primarily due to increasing interest in herbal and functional alcoholic beverages among consumers, the rise of speciality liquor stores, and cocktail trends. The market is filled with a varied range of products in terms of unique flavour, alcohol level, and other botanicals like ginseng and goji berries, mostly in a region like Japan. Key brands such as Buckfast, Magnum, Sanatogen, and Wincarnis compete through innovation, health-orientated formulations, and strong cultural affiliation.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Tonic Wine- Snapshot

- 2.2 Tonic Wine- Segment Snapshot

- 2.3 Tonic Wine- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Tonic Wine Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Red Tonic Wine

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 White Tonic Wine

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Rose Tonic Wine

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Tonic Wine Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Leonard J Russell Snr

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Campari Group

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Scotland's

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Sainsbury's

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Portman Group

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Reggae Treats

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Dee Bee Wholesale

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 AhmadiAnswers

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Herb Affair

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Bristol

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Jingjiu

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Zhangyu

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Wuliangye

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Tonic Wine in 2030?

+

-

How big is the Global Tonic Wine market?

+

-

How do regulatory policies impact the Tonic Wine Market?

+

-

What major players in Tonic Wine Market?

+

-

What applications are categorized in the Tonic Wine market study?

+

-

Which product types are examined in the Tonic Wine Market Study?

+

-

Which regions are expected to show the fastest growth in the Tonic Wine market?

+

-

What are the major growth drivers in the Tonic Wine market?

+

-

Is the study period of the Tonic Wine flexible or fixed?

+

-

How do economic factors influence the Tonic Wine market?

+

-