Global Tomato Seeds Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-812 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Tomato Seeds Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

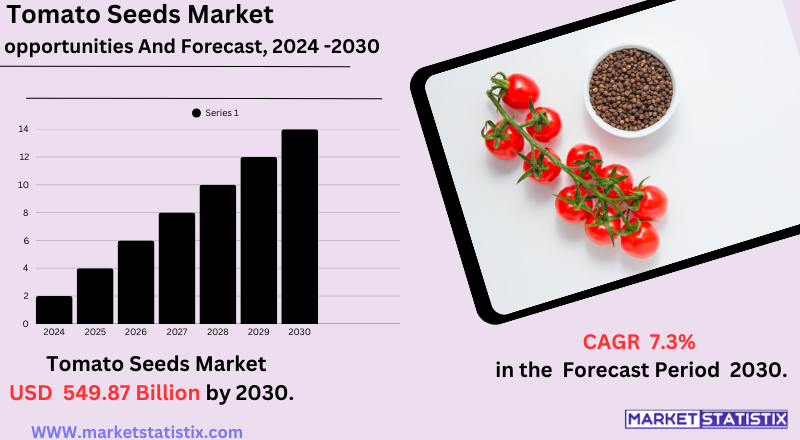

| Growth Rate | CAGR of 7.3% |

| Forecast Value (2030) | USD 549.87 Billion |

| By Product Type | Large Tomato Seed, Cherry Tomato Seed |

| Key Market Players |

|

| By Region |

Tomato Seeds Market Trends

Prominent market trends include a growing hybrid-seed preference with the greatest share in 2024 owing to their superior traits. Another trend is the increasing demand for disease- and climate-resistant seeds addressing environmental changes. Moreover, the rising interest in organic farming and home gardening is creating niche demands for heirloom and open-pollinated varieties. The Asia-Pacific region currently occupies a considerable share of the market, with countries such as China and India being large producers and consumers of tomatoes, thereby implying a strong regional demand for tomato seeds.Tomato Seeds Market Leading Players

The key players profiled in the report are Enza Zaden, UPL Limited(Advanta Seeds ), Groupe Limagrain, Syngenta AG, Bejo Zaden BV, Takii & Co. Ltd, Bayer AG, BASF SE, Sakata Seed Corporation, East-West Seed International, Abundant Seeds Pty Ltd.Growth Accelerators

The tomato seeds market is dominated mostly by increasing world demand for tomatoes, fresh or otherwise processed into multiple food products such as sauces, ketchups, canned tomatoes, etc. It is growing continuously with the population and preference shifts to healthier diets rich in vegetables. Therefore, this has necessitated the increase in tomato production for consumption and increased demand for tomato seeds. These sparks awareness of the nutritional benefits derived from tomatoes, as these fruits are rich in vitamins and antioxidants. The majority of farmers are adopting hybrid tomato seeds, which served as another stimulus. Compared to open-pollinated varieties, hybrids have several advantages: they are high-yielding and better resistant to diseases and pests, they produce seeds almost uniformly, and their shelf life is comparatively longer. These characteristics increase productivity and income for the growers; hence, hybrid seeds have increased demand, particularly for commercial agriculture.Tomato Seeds Market Segmentation analysis

The Global Tomato Seeds is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Large Tomato Seed, Cherry Tomato Seed . The Application segment categorizes the market based on its usage such as Open-field, Protected Cultivation. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

A solid manifestation of the movement towards consolidation in the tomato seeds business has been the recent maelstrom of merger-acquisition activity. One example of this is the 2022 merger of the Israeli companies Nirit Seeds and TomaTech with the assistance of AP Partners Fund to create the largest vegetable breeding seed company in Israel through combined research and development. Combined, it's two leading innovators emerging as a new powerhouse for global market development. Also, some others of the largest participants in agricultural business have been in mergers and acquisitions intended to consolidate industry position in the tomato seed market. An example would suffice, such as BASF SE, which announced its acquisition of Bayer vegetable seed business Nunhems – with many kinds of tomatoes – in May 2018. These mergers are expected to give stronger voices and larger portfolios to capture a degree of market share and develop broader capacities for research and development so as to build a competitive landscape in the tomato seeds market.Challenges In Tomato Seeds Market

Climate change, on the other hand, has created abnormal climatic conditions that hamper seed-growing operations and reduce yield. The reduction of yields is also affected by extreme temperatures, droughts, and floods. Due to very high pressures from pests and diseases, particularly in countries like India, crop quality and yield are further threatened with disease-resistant varieties. Besides the above, the industry must contend with high production costs due to the advanced infrastructure needed for, say, greenhouses, irrigation and storage facilities, coupled with a high requirement of manual labour. Constantly interrupting supply chains have been added to the mix, along with difficult-to-predict farmgate prices and economic and geopolitical challenges. These continuous disturbances have led, among other things, to changes in regulatory compliance and narrow profit margins being a perpetual concern to the producer and supplier.Risks & Prospects in Tomato Seeds Market

Increasing interest in controlled environments, like greenhouses and high-tech farming systems like hydroponics and vertical farming, has further revolutionised the demand for specialised tomato seeds. Unlike other seed types, hybrid seeds have gained much acceptance nowadays due to their high yield, better disease resistance, and superior shelf-life characteristics. Geographically, Asia Pacific leads the market, with China accounting for around 30% of the global share, with over 50% of its tomato production occurring in greenhouses. North America and Europe also represent significant markets, which can be attributed to advances in agricultural practices and high adoption of hybrid seeds. The Middle East and Africa are gradually becoming important emerging markets because of increasing investments in protected cultivation and improving crop productivity. Key players such as Bayer, Limagrain, Syngenta, and Rijk Zwaan are mainly focusing on the regional adaptation of seed varieties and strong distribution networks to meet the diverse needs of the market.Key Target Audience

The major target segments of the tomato seeds market comprise commercial growers and residential gardeners. Commercial growers, such as large-scale farms and greenhouse operators, seek high-yield, disease-resistant, climate-resilient hybrid varieties for maximum productivity and profitability. Farmers are often enticed by advanced methods in hydroponics and vertical farming that provide year-round production of tomatoes.,, Residential gardeners and small-scale farmers are emerging market segments due to greater interest in home gardening and urban farming. Top sellers to these consumers are usually open-pollinated or heirloom varieties that promise unique tastes, colours, and storage for future planting. With the rapid growth of organic farming as well as the farm-to-table movement, many people are now encouraged to grow in individual spaces. Seed companies are responding by developing competency in offering varied seeds of tomatoes that have been adapted to those needs, which are also appropriate for container gardening and miniature spaces.Merger and acquisition

A solid manifestation of the movement towards consolidation in the tomato seeds business has been the recent maelstrom of merger-acquisition activity. One example of this is the 2022 merger of the Israeli companies Nirit Seeds and TomaTech with the assistance of AP Partners Fund to create the largest vegetable breeding seed company in Israel through combined research and development. Combined, it's two leading innovators emerging as a new powerhouse for global market development. Also, some others of the largest participants in agricultural business have been in mergers and acquisitions intended to consolidate industry position in the tomato seed market. An example would suffice, such as BASF SE, which announced its acquisition of Bayer vegetable seed business Nunhems – with many kinds of tomatoes – in May 2018. These mergers are expected to give stronger voices and larger portfolios to capture a degree of market share and develop broader capacities for research and development so as to build a competitive landscape in the tomato seeds market. >Analyst Comment

The worldwide tomato seed market continues its progressive uptrend due to fresh vegetable consumption increase and health consciousness as well as the adoption of plant-based diets. The market is estimated at around $1.51 billion in 2025, while projections estimate it to grow to $2.15 billion by 2029. Among the most significant trends propelling this market growth are urbanisation, the increasing greenhouse and protected cultivation, and organic or non-GMO seeds. Among the top players in this market are Bayer, Limagrain, Syngenta, and East-West Seed, while the largest regional share is held by China, and product types encompass a wide range of tomato seeds.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Tomato Seeds- Snapshot

- 2.2 Tomato Seeds- Segment Snapshot

- 2.3 Tomato Seeds- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Tomato Seeds Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Large Tomato Seed

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Cherry Tomato Seed

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Tomato Seeds Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Open-field

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Protected Cultivation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Syngenta AG

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Enza Zaden

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Sakata Seed Corporation

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Bayer AG

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 UPL Limited(Advanta Seeds )

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 BASF SE

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Bejo Zaden BV

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 East-West Seed International

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Takii & Co. Ltd

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Groupe Limagrain

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Abundant Seeds Pty Ltd.

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Tomato Seeds in 2030?

+

-

Which type of Tomato Seeds is widely popular?

+

-

What is the growth rate of Tomato Seeds Market?

+

-

What are the latest trends influencing the Tomato Seeds Market?

+

-

Who are the key players in the Tomato Seeds Market?

+

-

How is the Tomato Seeds } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Tomato Seeds Market Study?

+

-

What geographic breakdown is available in Global Tomato Seeds Market Study?

+

-

Which region holds the second position by market share in the Tomato Seeds market?

+

-

How are the key players in the Tomato Seeds market targeting growth in the future?

+

-