Global Tobacco Heated Products Market – Industry Trends and Forecast to 2030

Report ID: MS-811 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Tobacco Heated Products Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

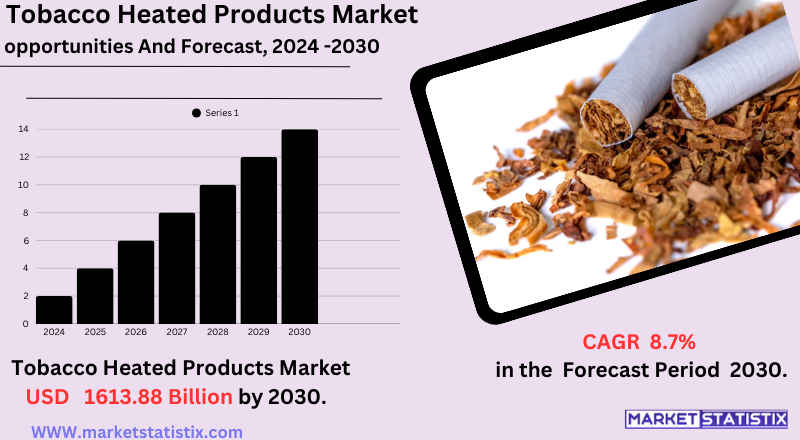

| Growth Rate | CAGR of 8.7% |

| Forecast Value (2030) | USD 1613.88 Billion |

| By Product Type | Heated Cigarettes, Non-Combustible Tobacco Sticks, Heat-not-Bu Products, Accessories for Heated Tobacco Devices |

| Key Market Players |

|

| By Region |

|

Tobacco Heated Products Market Trends

The market for Tobacco Heated Products (THPs) has several key trends presently active. A major trend in this area is that consumers are currently shifting toward potentially less harmful alternatives to cigarettes. Health consciousness and the imposition of strict rules and regulations on smoking lead to this view of the individuals. As a result, most of the people have turned toward products that would provide a smoking-type experience but are free of combustion and are seen to lessen their exposure to some harmful chemicals. Another strong trend going on right now is the peculiar strategic targeting placed upon the THP market by big tobacco companies. These players have been investing heavily in the respective research and development, marketing, and expansion of the product portfolios incorporating different THP devices and consumables. This also includes novel flavor introduction methods of heating, such as induction heating, as well as hybrid products. The market is also seeing geographical differences in adoption, with Asia Pacific, especially Japan and Korea, experiencing high growthTobacco Heated Products Market Leading Players

The key players profiled in the report are JT International S.A., KT&G Corp., Shenzhen Yukan Technology Co., Ltd., PAX Labs, Inc., BAT, Imperial Brands plc, Philip Morris Products S.A., Vapor Tobacco Manufacturing LLC, China National Tobacco Corporation, Altria Group, Inc.Growth Accelerators

The Tobacco Heated Products (THP) market finds itself in the list of growth industries presently, mainly due to a host of reasons. First, consumers are becoming aware of and demanding less harmful alternatives to cigarette smoking. Smokers are increasingly trying to reduce their exposure to harmful chemicals that are generated from burning tobacco, and THPs are perceived to be one avenue in that direction, albeit not a risk-free one. Coupled with this is an increasing health consciousness on the part of some people, which really forces some smokers to look for and switch to alleged reduced-risk alternatives. Government regulations in many countries controlling the sale of traditional cigarettes (e.g., increasing taxes, banning public smoking, and limiting advertisements) also drive consumers toward alternative nicotine delivery systems like THPs. Major tobacco companies are investing heavily in the marketing and promotion of THPs, mostly portraying the products as modern and sophisticated alternatives, which helps fuel adoption and, ultimately, growth.Tobacco Heated Products Market Segmentation analysis

The Global Tobacco Heated Products is segmented by Type, and Region. By Type, the market is divided into Distributed Heated Cigarettes, Non-Combustible Tobacco Sticks, Heat-not-Bu Products, Accessories for Heated Tobacco Devices . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Currently, the competitive situation in the THP sector is dominated by a handful of major international tobacco companies. Philip Morris International, PMI with the IQOS brand, had gained a sizeable market share worldwide, usually working as a first mover in several regions. Japan Tobacco International, JTI, has been a competitor with its Ploom, and British American Tobacco, BAT, with its glo brand, are also vying for market share. These companies will be capitalising on their brand name, distribution, and research and development to develop a stronger foothold in this emerging market. Competition in the THP market is multidimensional; the focus is on product innovation, namely, the technology of heating and design, the variety and appeal of tobacco stick flavour, and pricing strategies. Although the market is currently monopolised by these big companies, there are opportunities for new entrants and smaller firms to gain respect in the market given their focus on niche markets, unique product features, or regional preferences and regulatory opportunities.Challenges In Tobacco Heated Products Market

Concerns regarding regulations and competition from alternative products have posed great challenges for the HTP market. Governments across the world are imposing strict regulations, which include curbs on sales, pack design, and advertising, thus clearly targeting the exposure of youth to tobacco products. Besides competition from smokeless alternatives such as snus and chewable tobacco, the HTP industry is poised to compete with vaping devices, often perceived as less harmful due to the absence of real tobacco. By and large, traditional products such as gutkha would also greatly impede the penetration of HTPs. Health concerns and scientific uncertainties are obstacles too. While HTPs advertise themselves as less harmful alternatives to cigarettes, these still release toxic chemicals, such as nicotine and benzene, into the atmosphere, making long-term health issues questionable. The credibility problems of the industry—exemplified by their past misleading product claims—have deepened the scepticism held by regulators and consumers alike. In addition to this, inconclusiveness regarding HTPs causing less harm than conventional cigarettes make it even harder to suggest and promote them as substitute products. These conditions, coupled with a growing sensitivity regarding health, put pressure on companies to keep innovating within ever-changing compliance frameworksRisks & Prospects in Tobacco Heated Products Market

There are opportunities identified in herbal consumables that navigate around regulatory constraints, such as cannabis or CBD-infused heat sticks, and premiumisation strategies with exclusive targeting of high-income consumers. North America leads the pack because of having established players and increasing health consciousness as a contributing factor; Asia-Pacific is fast-growing, led by Japan and South Korea, owing to sound regulations and shifting consumer behaviour. The emerging trends therefore show Japan holds the leading position as far as APAC is concerned, with IQOS locking significant shares in the market, while the U.S. is giving strong potential, as far as the market is concerned, pending FDA approvals on modified-risk claims. Other challenges comprise opposing laws concerning cigarette taxes and public use restrictions, which might hurt the incentives for adoption. Nonetheless, herbal heat sticks and planned entry into virgin markets like India and China should open new areas of growth, considering increased disposable income alongside the adoption of Western lifestyles in the developing economies.Key Target Audience

The primary target for the Tobacco Heated Products (THP) market are adult smokers in search of alternatives to traditional cigarette products. Many of these individuals feel that THPs are less harmful than combustible tobacco as they heat tobacco rather than burn it. Health-conscious smokers not willing to quit nicotine in favour of options that may expose them to less harmful chemicals constitute a big chunk of the market.,, Along with smokers, the industry also tempts ex-smokers who are looking for less intense nicotine experiences or products that behave more like smoking without actual smoke and ash. The marketing strategy usually focuses on "reduced exposure" to certain harmful substances and the technological features of the heating devices to attract these groups. And in some countries with aggressive anti-smoking legislation, THPs are sometimes described in the news as a way of circumventing the restrictions while still taking in tobacco. This narrative is, in many ways, about balancing the familiarity of tobacco with the hope of a less hazardous alternative.Merger and acquisition

More recent mergers and acquisitions in the tobacco heated products (THPs) arena showcase the strategic shift of the industry toward risk-reduced products. The big tobacco players, Philip Morris International (PMI), British American Tobacco (BAT), and Japan Tobacco International (JTI), have engaged with technology companies or small manufacturers of vaping or heat-not-burn products so as to broaden their THP portfolios. PMI's acquisition of Fertin Pharma and BAT's investment in biotech firms exemplify that these companies are innovating and diversifying to seize the opportunity presented by the increasing demand for smoke-free alternatives. The idea behind such consolidation is to strengthen their R&D capabilities, reduce the time needed to launch new products into the marketplace, and broaden their geographical reach. They are also acquiring companies through M&As to gain leverage in regulatory matters and to capture intellectual property in emerging markets. The competition has reached such a level that these actions have to be done in order to keep a long-term foothold in the market as the tobacco industry restructures itself while cigarette consumption is fast waning. >Analyst Comment

The global market for heated tobacco products (HTP) is opening to spectacular growth from the changing consumer preference toward perceived reduced-risk alternatives to traditional cigarettes. Valued at $33.3 billion to $49.14 billion in 2024, the market is expected to reach phenomenal growth by 2030. Health-conscious consumers who want to use products whose main function is to heat tobacco without combustion and which thus result in fewer harmful chemicals are the main driving force behind these products. Also, regulatory pressures placed against conventional smoking act as a prime mover. The stick segment continues to dominate, with 72 per percent of the market share in 2024, supported by a variety of flavours and premium positioning, while the leaf segment is growing the fastest due to costs and technological advancements in heating devices.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Tobacco Heated Products- Snapshot

- 2.2 Tobacco Heated Products- Segment Snapshot

- 2.3 Tobacco Heated Products- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Tobacco Heated Products Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Heat-not-Bu Products

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Heated Cigarettes

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Non-Combustible Tobacco Sticks

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Accessories for Heated Tobacco Devices

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Tobacco Heated Products Market by consumer

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Current Smokers

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Former Smokers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 New Adult Users

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Health-Conscious Consumers

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Tobacco Heated Products Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 BAT

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Philip Morris Products S.A.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 JT International S.A.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 PAX Labs

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Vapor Tobacco Manufacturing LLC

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Shenzhen Yukan Technology Co.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Ltd.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 KT&G Corp.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 China National Tobacco Corporation

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Imperial Brands plc

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Altria Group

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Inc.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By consumer |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Tobacco Heated Products in 2030?

+

-

How big is the Global Tobacco Heated Products market?

+

-

How do regulatory policies impact the Tobacco Heated Products Market?

+

-

What major players in Tobacco Heated Products Market?

+

-

What applications are categorized in the Tobacco Heated Products market study?

+

-

Which product types are examined in the Tobacco Heated Products Market Study?

+

-

Which regions are expected to show the fastest growth in the Tobacco Heated Products market?

+

-

What are the major growth drivers in the Tobacco Heated Products market?

+

-

Is the study period of the Tobacco Heated Products flexible or fixed?

+

-

How do economic factors influence the Tobacco Heated Products market?

+

-