Global Radiation Hardened FPGA (Field-Programmable Gate Array) Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-2553 | Aerospace and Defence | Last updated: Apr, 2025 | Formats*:

Radiation Hardened FPGA (Field-Programmable Gate Array) Report Highlights

| Report Metrics | Details |

|---|---|

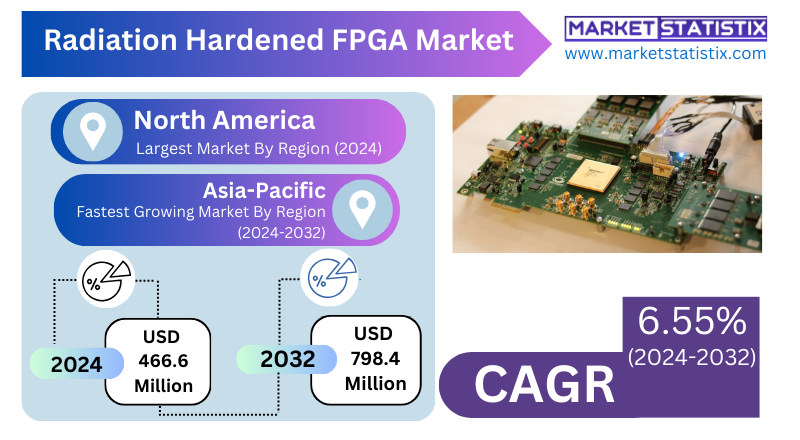

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 6.55% |

| Forecast Value (2032) | USD 798.4 Million |

| By Product Type | Flash-based, Antifuse-based, SRAM |

| Key Market Players |

|

| By Region |

|

Radiation Hardened FPGA (Field-Programmable Gate Array) Market Trends

At present, several major trends are active within the radiation-hardened FPGA space market. One of these trends is related to many customers demanding higher amounts of logic density, and hence performance, in these products. Space and defence applications today require very sophisticated data processing or signal processing capabilities. Because of these factors, there is now a demand for more advanced architectures and greater gate-count FPGAs. Therefore, coming innovations have had a tremendous motivating factor in creating future-generation radiation-hardened FPGAs with much more processing power and memory. Another similar trend is the trend for COTS components to have superior radiation tolerance. Fully radiation-hardened FPGAs are not yet fully replaced whenever extremely high missions are concerned. They are being superseded by the less expensive COTS FPGAs, which would then selectively harden or radiation-test those in applications of lesser relevance or shorter missions. For regulatory purposes, cost-saving and shortening of development schedules in such emerging small satellite and NewSpace avenues are drivers for this trend. As such, the measure would depend on the reliability and suitability of these COTS-forged solutions.Radiation Hardened FPGA (Field-Programmable Gate Array) Market Leading Players

The key players profiled in the report are Microchip Technology, Northrop Grumman, Honeywell Aerospace, STMicroelectronics, CAES, BAE Systems, Airbus Defence and Space, NanoXplore, Cobham Advanced Electronic Solutions, AMD (Xilinx), Teledyne Technologies Incorporated, Atmel CorporationGrowth Accelerators

The driving force behind the radiation-hardened FPGA market is the rising need for credible electronics in harsh radiation environments. The fast-growing space industry – including government-led missions, commercial satellite constellations for communications and Earth observation, and those of deep-space exploration – requires these specialised FPGAs for critical onboard systems. Rising demand for advanced electronic warfare systems, missile guidance and secure communication networks from the defence sector adds to the growth of this market, as they sometimes operate in radiation-rich environments. The increasing application complexity and performance requirements found in these industries require flexibility and processing power on the part of FPGA offerings. Their ability to be reprogrammed confers upon them the important qualities of in-flight updates and adaptability, which are pertinent in long-duration space missions and changing military requirements. The rigorous reliability and safety requirements of nuclear power plants, where radiation-hardened FPGAs are being used for control and monitoring systems, will be another reason for the continuous demand for these specialised components.Radiation Hardened FPGA (Field-Programmable Gate Array) Market Segmentation analysis

The Global Radiation Hardened FPGA (Field-Programmable Gate Array) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Flash-based, Antifuse-based, SRAM . The Application segment categorizes the market based on its usage such as Defense, Space Exploration, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive atmosphere in the radiation-hardened FPGA market is typified by a small number of highly specialised players. These key players include Microchip Technology (through Mirosemi), BAE Systems, and Xilinx (which is now part of AMD). Each of these companies has its own unique technology for radiation hardening and concentrates on a particular segment of the larger aerospace, defence and nuclear markets. These companies invest heavily in research and development to improve the radiation tolerance, performance, and power efficiency of their FPGAs while using, in many cases, their own proprietary design and manufacturing processes. Because of complicated technical requirements and strict reliability standards, barriers to entry are high and limit new entrants into this niche market. The competition centres around the degree of radiation hardness guaranteed (total ionising dose, single event effects); performance (speed, logic density); power efficiency; and FPGA solution size, weight, and cost efficiency. Furthermore, the trend toward the use of COTS with improved radiation tolerance for some less critical applications introduces another level of competition for pure-play radiation-hardened FPGA suppliers, forcing them to concentrate their efforts on the most demanding, mission-critical applications.Challenges In Radiation Hardened FPGA (Field-Programmable Gate Array) Market

Significant challenges exist in the radiation-hardened FPGA market that inhibit its growth and acceptance. High production and qualification costs of FPGAs are among the chief obstacles since they render the devices uncommercial, especially for small players and cost-sensitive projects. Additionally, the stringent regulatory/practical standards imposed on manufacturers and the complex certification processes required for use in aerospace, defence, and nuclear settings tend to extend the time to market and increase developmental costs. Other challenges impacting this business are also technological: sustaining adequate radiation resistance and feature sets while achieving reduced dimensions. With the evolving demand for more customisation, more performance, and integration of cutting-edge technologies like AI, manufacturers are pressed into constantly innovating to keep their sales prospects bright. The scenario is further complicated by the growing competition from alternate technologies and solutions that may, for specific applications, provide cost or performance advantages.Risks & Prospects in Radiation Hardened FPGA (Field-Programmable Gate Array) Market

The increasing number of satellites launches together with advancements in space exploration comprise important elements driving growth, as these applications use FPGAs that can tolerate high levels of ionising radiation. The demand for these radiation-hardened components for missile systems and other military hardware has been swelled by ever-increasing defence budgets and an escalating global arms race. Technological developments in miniaturisation, durability, and energy efficiency present further opportunities for market expansion. In terms of region, North America is the largest radiation-hardened FPGA market, with the largest market share, owing to a well-developed aerospace and defence sector, strong government support, and the presence of key industry players such as Honeywell and Microchip Technology. Europe and Asia Pacific are emerging markets, and Asia Pacific is expected to register very rapid growth owing to expanding space programmes, rising defence budgets, and increasing nuclear power infrastructure. The proliferation of satellites with more than 8,200 satellites currently orbiting the Earth, nearly half of them active further enables market expansion across the globe, especially in the regions that are known for heavy investments in satellite technology and space exploration. While highlighting North America's leadership in the dynamics of the regions, it also hints at potential expansion in Asia and Europe.Key Target Audience

The radiation-hardened FPGA market mainly focuses on high-radiation environment activities, especially aerospace, defence, and space exploration. In these applications, space agencies, defence contractors, and satellite manufacturers require FPGAs highly resistant to stress due to cosmic radiation and thermal cycling. Such FPGAs find enormous application in fields of satellite communications, missile guidance systems, and deep-space missions, where extreme reliability and resilience must be assured.,, Another key customer for radiation-hardened FPGAs is nuclear power generation facilities, along with manufacturers of imaging equipment. For these very reasons, radiation-hardened FPGAs are important in maintaining and monitoring control systems in nuclear power plants exposed to high radiation levels. In medical devices such as MRI and CT scanners, these FPGAs maintain accurate and reliable imaging in environments that are concerned about radiation exposure. The demand for these two sectors emphasises the role radiation-hardened FPGAs play in ensuring safety and performance levels for radiation-laden applications.Merger and acquisition

In the radiation-hardened FPGA marketplace, several strategic alliances were formed in recent times to plant the flag of technology pertinent to defence and aerospace applications. In December 2024, QuickLogic Corporation received a $6.575 million contract, the fourth tranche of a programme that commenced in August 2022, for the development of high-reliability radiation-hardened FPGA technology for the DoD. This award brought QuickLogic's funding for the programme to over $33 million, demonstrating its commitment to providing innovative FPGA solutions geared to the high demands of the Aerospace and Defence Industrial Base (DIB). In support of this effort, Everspin Technologies announced in July 2024 that it secured a $1.8 million contract to provide its AgILYST MRAM technology, logic design, and manufacturing services for the development of Strategic Radiation Hardened (SRH) high-reliability FPGA technology. This partnership between QuickLogic, Honeywell, and Everspin focuses on integrating MRAM directly into FPGA products to improve their performance in radiation-sensitive environments. Everspin's involvement comes on the heels of more than a decade of experience in providing MRAM IP for strategic radiation-hardened and space applications. >Analyst Comment

The steady growth of the radiation-hardened FPGA (Field Programmable Gate Array) market is driven primarily by increasing demand for reliability, high-performance electronics at mission-critical atmospheric operational conditions, and aerospace, defence, industrial, and telecommunications applications. The FPGAs are designed robustly to survive very extreme conditions such as radiation and temperature ranges beyond ordinary commercial designs. Such electronic equipment is used for applications like satellite communications, unmanned space exploration, and military systems where conventional electronics fail. The market overall reflects technology advancement, stringent engineering practices, and considerations for miniaturisation combined with improved onboard processing capabilities.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Radiation Hardened FPGA (Field-Programmable Gate Array)- Snapshot

- 2.2 Radiation Hardened FPGA (Field-Programmable Gate Array)- Segment Snapshot

- 2.3 Radiation Hardened FPGA (Field-Programmable Gate Array)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Radiation Hardened FPGA (Field-Programmable Gate Array) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Antifuse-based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Flash-based

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 SRAM

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Radiation Hardened FPGA (Field-Programmable Gate Array) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Space Exploration

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Defense

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Others

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Radiation Hardened FPGA (Field-Programmable Gate Array) Market by Material

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Silicon (Si)

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Silicon Carbide (SiC)

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Gallium Nitride (GaN)

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Radiation Hardened FPGA (Field-Programmable Gate Array) Market by Manufacturing Technique

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Radiation-Hardening by Design

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Radiation-Hardening by Process

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Radiation-Hardening by Software

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Radiation Hardened FPGA (Field-Programmable Gate Array) Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Microchip Technology

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 AMD (Xilinx)

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Cobham Advanced Electronic Solutions

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Honeywell Aerospace

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 BAE Systems

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 STMicroelectronics

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 NanoXplore

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Teledyne Technologies Incorporated

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Northrop Grumman

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Airbus Defence and Space

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 CAES

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Atmel Corporation

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Material |

|

By Manufacturing Technique |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Radiation Hardened FPGA (Field-Programmable Gate Array) in 2032?

+

-

How big is the Global Radiation Hardened FPGA (Field-Programmable Gate Array) market?

+

-

How do regulatory policies impact the Radiation Hardened FPGA (Field-Programmable Gate Array) Market?

+

-

What major players in Radiation Hardened FPGA (Field-Programmable Gate Array) Market?

+

-

What applications are categorized in the Radiation Hardened FPGA (Field-Programmable Gate Array) market study?

+

-

Which product types are examined in the Radiation Hardened FPGA (Field-Programmable Gate Array) Market Study?

+

-

Which regions are expected to show the fastest growth in the Radiation Hardened FPGA (Field-Programmable Gate Array) market?

+

-

Which region is the fastest growing in the Radiation Hardened FPGA (Field-Programmable Gate Array) market?

+

-

What are the major growth drivers in the Radiation Hardened FPGA (Field-Programmable Gate Array) market?

+

-

Is the study period of the Radiation Hardened FPGA (Field-Programmable Gate Array) flexible or fixed?

+

-