Global Telemedicine Monitoring Systems Market – Industry Trends and Forecast to 2030

Report ID: MS-883 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The telemedicine monitoring systems market is a broad array of technological solutions that allow healthcare professionals to remotely monitor and manage patients' health status and vital signs from outside the conventional clinical environment. These systems utilise a variety of devices, software platforms, and communications technologies to gather, transmit, store, and analyse patient-created health data. This enables ongoing or episodic tracking of physiological parameters, symptoms, medication compliance, and general health, facilitating anticipatory interventions and individualised care management remotely.

These systems extend beyond mere data transmission, frequently providing alerts for out-of-range readings, secure communication channels for patient-doctor interaction, and integration with electronic health records (EHRs) for smooth data flow. The market has applications to address a broad range of needs, ranging from chronic disease management such as diabetes and hypertension through post-surgical care to home monitoring of elderly individuals.

Telemedicine Monitoring Systems Report Highlights

| Report Metrics | Details |

|---|---|

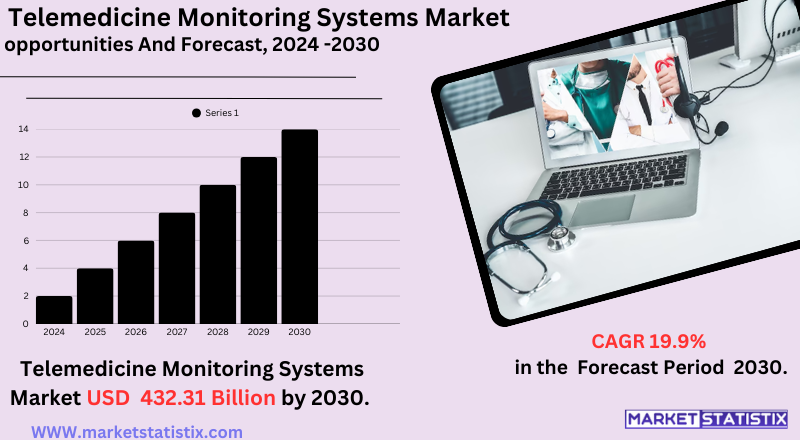

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 19.9% |

| Forecast Value (2030) | USD 432.31 Billion |

| By Product Type | Blood Pressure Telemedicine Monitoring Systems, Glucose Level Telemedicine Monitoring Systems, COPD Telemedicine Monitoring Systems, Cardiac Telemedicine Monitoring Systems, Others |

| Key Market Players |

|

| By Region |

|

Telemedicine Monitoring Systems Market Trends

The telemedicine monitoring systems market is presently witnessing strong growth fuelled by a number of major trends. One such strong trend is the rising use of remote patient monitoring (RPM) technologies, which are being driven by the increasing incidence of chronic diseases, a burgeoning geriatric population, and an increased focus on home healthcare. Both patients and healthcare professionals are seeing the value of ongoing health monitoring, early identification of changes in health, and lower requirements for face-to-face consultations. This is complemented by improvements in wearable sensors, Internet of Things (IoT)-based medical devices, and simple-to-use mobile health apps that integrate smoothly with monitoring systems.

Another trend is the incorporation of sophisticated technologies such as artificial intelligence (AI) and data analysis into telemedicine monitoring systems. AI algorithms are being employed to dig into the tremendous quantities of patient-generated data to search for patterns, forecast probable health hazards, and tailor treatment regimens. This leads to more anticipatory and effective healthcare management. In addition, interoperability and sharing of data between monitoring devices and electronic health records (EHRs) are increasingly emphasised to provide an integrated perspective of patient well-being and enable free communication between care teams.

Telemedicine Monitoring Systems Market Leading Players

The key players profiled in the report are Honeywell Lifesciences, Cardiocom, Shimmer, Aerotel Medical Systems, Intouch Technologies, AMD Global Telemedicine, Medtronic, Philips, Biotelemetry Inc, Tyto Care Inc.Growth Accelerators

The market for telemedicine monitoring systems is presently being driven by some major factors. First, the increasing population of the elderly all over the world requires uninterrupted health monitoring for age-related health issues, and distant solutions are growing more and more essential for coordinating with their care while avoiding overloading regular healthcare centers. Second, growing incidences of chronic diseases like diabetes, cardiovascular diseases, and respiratory diseases require ongoing monitoring and early intervention, which telemedicine systems effectively provide in patients' homes.

In addition, better telecommunications and wearable technology are increasingly making remote monitoring easier and precise, with the capacity to monitor a larger number of vital signs. The growth in smartphone uses and increased internet penetration, including into remote areas, widens their coverage and applicability. Lastly, the increasing popularity and need for easy, affordable healthcare options by patients as well as providers, further fuelled by the recent pandemic, presents a significant impetus for the mass-scale adoption of telemedicine monitoring systems.

Telemedicine Monitoring Systems Market Segmentation analysis

The Global Telemedicine Monitoring Systems is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Blood Pressure Telemedicine Monitoring Systems, Glucose Level Telemedicine Monitoring Systems, COPD Telemedicine Monitoring Systems, Cardiac Telemedicine Monitoring Systems, Others . The Application segment categorizes the market based on its usage such as Clinics, Hospitals, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market landscape for telemedicine monitoring systems is dynamic and growing more crowded, with a combination of well-established medical device firms, healthcare IT vendors, and upstart tech firms. The areas of competition include the reliability and precision of the monitoring devices, the depth of data analytics and AI-based insights, the ease of integration with legacy EHR systems, and the ease of use of both patient-facing and provider-facing platforms.

The market is also seeing a focus towards specialisation, with certain players concentrating on particular disease management (e.g., diabetes, cardiac diseases) or patient categories (e.g., elderly care, post-acute monitoring). Collaborations and tie-ups between technology firms and healthcare providers are becoming the order of the day to widen product offerings and tap newer markets. Pricing models that can go from subscription to per-device fees also play an important role in the competitive landscape. Overall, the intense competition is leading to innovation and the creation of more holistic and patient-focused remote monitoring solutions.

Challenges In Telemedicine Monitoring Systems Market

The market for telemedicine monitoring systems is plagued by a number of serious challenges that limit large-scale adoption and successful implementation. Excessive expense of buying, installing, and maintaining telehealth equipment is still a significant hindrance, particularly in lower- and middle-income nations where there is limited capital investment. Limited technology infrastructure, including poor internet connectivity and limited data storage, also limits the accessibility and quality of telemedicine services, especially in underdeveloped and rural areas. These constraints undermine the efficacy of remote consultations and the integration of medical data between platforms.

Furthermore, organisational and legislative barriers complicate the market environment. Healthcare professionals frequently receive resistance to changing workflows, staff shortages, and acquiring thorough training in operating new digital systems. Concerns regarding data protection and privacy, combined with scattered legislative environments, introduce additional layers of complexity since providers have to navigate differences in regulations in order to maintain compliance and patient confidence. Resolving these issues is critical for telemedicine monitoring systems to achieve their maximum potential in providing accessible, high-quality care on a worldwide basis.

Risks & Prospects in Telemedicine Monitoring Systems Market

Some of the key opportunities for growth are remote patient monitoring for the management of chronic diseases, AI-based diagnostics, and virtual mental health care, all of which are finding greater adoption on account of their potential to improve patient outcomes and lower the cost of healthcare. New technologies like blockchain-enabled health records and chatbot consultation are also broadening the market, while favourable government policies and investments in digital healthcare infrastructure are catalysing adoption in both developed and emerging economies.

Regionally, North America dominates the telemedicine monitoring systems market, driven by well-developed healthcare infrastructure, high penetration of the internet, and robust government support for telehealth services. Europe is also growing at a steady pace, fuelled by supportive policies and the imperative to bridge the gap in healthcare access, especially in rural regions. The Asia Pacific is one of the fastest-growing markets, with China and India adopting telemedicine to enhance accessibility and affordability of healthcare for the masses. The Middle East, Africa, and Latin America are experiencing growth due to government investment and reforms toward developing modern healthcare systems, although issues like digital literacy and regulatory barriers are some of the challenges facing them in some regions.

Key Target Audience

The telemedicine monitoring systems market focuses mainly on two primary markets: patients and healthcare providers. Healthcare providers—such as long-term care facilities, clinics, and hospitals—implement these systems to better care for patients, improve operations, and save costs. Telemedicine integration enables the real-time monitoring of patients' vital signs, which allows for timely interventions and minimises hospital readmissions. This is especially useful in chronic disease management like diabetes and cardiovascular diseases, which need constant monitoring.

,

, Patients, particularly in underserved or remote locations, are the other major segment. Telemedicine monitoring systems provide these patients with access to health care services without the necessity for travel, which is important for the elderly, disabled, or mobility-impaired patients. The accessibility and convenience of telemedicine have resulted in greater acceptance among patients who are looking for timely and cost-efficient health care solutions. Additionally, increased consumer electronics and better connectivity to the internet have made it easier for telemedicine services to expand, and now it is a feasible solution for an increased patient population.

Merger and acquisition

The telemedicine monitoring systems market saw a significant upsurge in mergers and acquisitions (M&A) during 2024, reflecting the trend toward consolidation and technological development. One major highlight was Getinge's acquisition of Paragonix Technologies for $477 million, the biggest disclosed Q3 2024 deal in the remote patient monitoring space. Remote patient monitoring-linked M&A in the medical devices sector overall witnessed a big jump, with six transactions announced in Q3 2024 amounting to $478.3 million. This growth is an indication of increased focus on adopting sophisticated monitoring solutions to leverage improved patient care and operational efficiency.

Early in 2025, the pace accelerated with strategic buys to boost AI features on telemedicine platforms. Stryker's acquisition of Care.ai is a case in point for the trend of augmenting hospital workflows via AI-driven monitoring. Teladoc Health furthered its mental health offerings by buying UpLift for $30 million in April 2025. These examples mark a larger industry shift toward intelligent care orchestration systems, which position telemedicine providers to deliver more holistic and effective healthcare solutions.

>

Analyst Comment

The market for telemedicine monitoring systems is growing rapidly, fuelled by the accelerating use of remote patient monitoring technologies, advances in telecommunication infrastructure, and the rising incidence of chronic diseases. The worldwide market is expected to expand at a strong CAGR of nearly $180.86 billion during 2030, compared to $94.14 billion in 2024. The top drivers are the convergence of AI and IoT devices, government backing in the form of encouraging rules and reimbursement schemes, and patient-centric, value-based care. These platforms facilitate real-time collection of health data, improve the accuracy of diagnoses, and offer affordable options for healthcare providers as well as patients.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Telemedicine Monitoring Systems- Snapshot

- 2.2 Telemedicine Monitoring Systems- Segment Snapshot

- 2.3 Telemedicine Monitoring Systems- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Telemedicine Monitoring Systems Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 COPD Telemedicine Monitoring Systems

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Glucose Level Telemedicine Monitoring Systems

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Blood Pressure Telemedicine Monitoring Systems

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Cardiac Telemedicine Monitoring Systems

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Telemedicine Monitoring Systems Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hospitals

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Clinics

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Others

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Telemedicine Monitoring Systems Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 AMD Global Telemedicine

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Intouch Technologies

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Medtronic

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Aerotel Medical Systems

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Shimmer

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Philips

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Honeywell Lifesciences

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Biotelemetry Inc

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Cardiocom

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Tyto Care Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Telemedicine Monitoring Systems in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Telemedicine Monitoring Systems market?

+

-

How big is the Global Telemedicine Monitoring Systems market?

+

-

How do regulatory policies impact the Telemedicine Monitoring Systems Market?

+

-

What major players in Telemedicine Monitoring Systems Market?

+

-

What applications are categorized in the Telemedicine Monitoring Systems market study?

+

-

Which product types are examined in the Telemedicine Monitoring Systems Market Study?

+

-

Which regions are expected to show the fastest growth in the Telemedicine Monitoring Systems market?

+

-

Which application holds the second-highest market share in the Telemedicine Monitoring Systems market?

+

-

What are the major growth drivers in the Telemedicine Monitoring Systems market?

+

-

The market for telemedicine monitoring systems is presently being driven by some major factors. First, the increasing population of the elderly all over the world requires uninterrupted health monitoring for age-related health issues, and distant solutions are growing more and more essential for coordinating with their care while avoiding overloading regular healthcare centers. Second, growing incidences of chronic diseases like diabetes, cardiovascular diseases, and respiratory diseases require ongoing monitoring and early intervention, which telemedicine systems effectively provide in patients' homes.

In addition, better telecommunications and wearable technology are increasingly making remote monitoring easier and precise, with the capacity to monitor a larger number of vital signs. The growth in smartphone uses and increased internet penetration, including into remote areas, widens their coverage and applicability. Lastly, the increasing popularity and need for easy, affordable healthcare options by patients as well as providers, further fuelled by the recent pandemic, presents a significant impetus for the mass-scale adoption of telemedicine monitoring systems.