Global Structured Finance Market – Industry Trends and Forecast to 2031

Report ID: MS-262 | Chemicals And Materials | Last updated: Dec, 2024 | Formats*:

Structured Finance Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

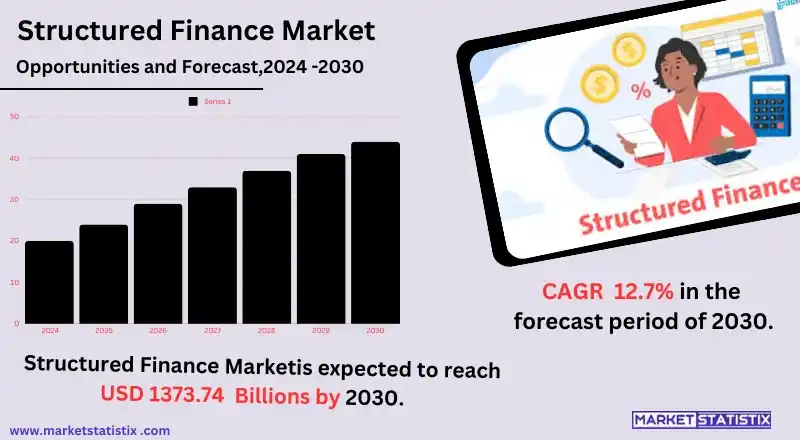

| Growth Rate | CAGR of 12.7% |

| Forecast Value (2031) | USD 1373.74 Billion |

| By Product Type | Residential Mortgage-Backed Securities (RMBS), Commercial Mortgage-Backed Securities (CMBS), Collateralized Debt Obligations (CDOs), Others, Collateralized Loan Obligations (CLOs), Collateralized Debt Obligations (CDOs), Asset-Backed Securities (ABS), Mortgage-Backed Securities (MBS), Structured Asset-Backed Securities (SABS |

| Key Market Players |

|

| By Region |

Structured Finance Market Trends

Structured finance is growing rapidly due to the reasons mentioned above, which necessitate customised financial solutions and risk mitigation strategies. The existing activity has intensified in areas such as asset-backed securities (ABS), collateralised debt obligations (CDOs), and mortgage-backed securities (MBS), owing to an attractive interest rate environment and investors hungry for yield. Emerging technologies—blockchain and AI—are also streamlining processes, increasing transparency, and improving risk assessments, thus opening structured finance products to a wider range of investors. Include this: sustainability or greening that will make the definition hybridised between these products. The innovative products are acquiring steam in the market by incorporating different green and ESG-linked structured products. Increased transparency and alleviation of systemic risks through regulations from major economies are shoring up confidence among prospective investors in this developing market. They are all features of a vibrant and innovative market, likely to witness even more transformations toward growth.Structured Finance Market Leading Players

The key players profiled in the report are Barclays, BNP Paribas, Nomura Securities, JPMorgan Chase Co, Deutsche Bank, UBS, Royal Bank of Scotland, Morgan Stanley, Credit Suisse, Bank of America Merrill Lynch, Goldman Sachs, Societe Generale, CitigroupGrowth Accelerators

Structured finance is developed under the specific requirements of capital efficiency and risk management in financial markets. It is through structured finance that assets are pooled and subsequently securitised to gain liquidity while transferring risks to investors. The increasing demands for asset-backed securities (ABS), collateralised debt obligations (CDOs), and, more recently, mortgage-backed securities (MBS) arise as a reaction to diversification vis-à-vis risk-return appetite among the investors. Besides that, technological developments would improve structuring and distribution and consequently enhance the standards of transparency and efficiency in the space. Emerging economies are increasingly reshaping the market through greater regulatory support and reforms in these territories. Securitisation suits a range of needs across growing credit-dependent areas such as real estate, automobiles, and infrastructure. Perhaps more critically, above all, it will construct a pillar on which structured finance should develop and thrive in the financial landscape across the continents.Structured Finance Market Segmentation analysis

The Global Structured Finance is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Residential Mortgage-Backed Securities (RMBS), Commercial Mortgage-Backed Securities (CMBS), Collateralized Debt Obligations (CDOs), Others, Collateralized Loan Obligations (CLOs), Collateralized Debt Obligations (CDOs), Asset-Backed Securities (ABS), Mortgage-Backed Securities (MBS), Structured Asset-Backed Securities (SABS . The Application segment categorizes the market based on its usage such as Securitization, Risk Transfer, Liquidity Management, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for structured finance is very competitive and best described as being dominated by the heavyweights of the financial industry—including investment banks and insurance companies—since that is how their business is done. These financial institutions specialise in the designing and pricing of specific financial products, such as ABS, CDOs, and MBS, which cater to the sometimes very different needs of the selling corporations, governments, and investors. They compete for these products on the basis of various key differentiators that they can offer, such as structural innovation capabilities, risk management, and the ability to provide, or give access to, different asset classes. Now technology will be the most important aspect of these companies, as it happens to be the most effective in terms of drawing in data analytics and AI for operating, credit risk assessment, and providing transparency to clients.Challenges In Structured Finance Market

There are several obstacles the structured finance market must grapple with for its growth, development, and sustainability. The primary problem is that people will understand very little about the financial intricacies of such instruments as asset-backed securities (ABS) and collateralised debt obligations (CDOs). As a result, there is little understanding about how some underlying assets are associated with certain risks. In addition, the risks of market illiquidity. It becomes hard to sell structured finance instruments during times of financial stress, which lowers their attractiveness to investors. Credit rating agency assessments of these instruments, furthermore, result in dependence on flawed and perhaps inaccurate ratings. In this line of argument, players in the market have to concentrate on improving transparency, developing risk management practices, and adopting innovative technologies for resilience.Risks & Prospects in Structured Finance Market

The structured finance market is the place to be, given that the rising demand for tailor-made financial solutions has created significant scopes to address specific business needs. Innovative funding mechanisms are sought by organisations to optimise cash flows, lower borrowing costs, and mitigate risks. Some types of opportunities that have opened because of this are growth in asset-backed securities (ABS), collateralised loan obligations (CLOs), and mortgage-backed securities (MBS). Aside from them, the emerging markets and digitisation of financial services present further avenues for structured finance to be made available by companies in these emerging markets to have liquidity access and diversify funding sources. Besides, the aspect of sustainability and green financing is an additional avenue that remains unexplored in structured finance. Investors and issuers would hence increasingly depend on the structured finance mechanism to identify sources of funds for environmentally sustainable projects through green bonds and other ESG-compliant instruments. This circumstance involves worldwide regulatory support for sustainable initiatives, which, scientifically, will lure capital from socially responsible investors.Key Target Audience

The primary audience for the entire structured finance market remains institutional investors, which include banks, insurance companies, pension funds, and asset management firms that invest in specific risk-return profiles and requirements from those varied instruments. Structured finance products such as asset-backed securities (ABS), mortgage-backed securities (MBS), and collateralised obligations (CDOs) give them the chance to improve portfolio performance, manage risks, and pursue long-term investment goals.,, Also, among other participants, corporations, governments, and major financial institutions are issuers in the structured finance market. This classification encompasses all those cases where a structured finance solution is used to source funding for large projects or operations and optimise the balance sheet. Such an issuer is capable of reducing his funding costs, diversifying his sources of funds, and achieving flexibility in financing or otherwise by converting illiquid assets into tradable securities. In the interplay between issuers and investors, the essence of the structured finance ecosystem is behind the growth and innovation it bears.Merger and acquisition

Recently, significant mergers and acquisitions have taken place in the structured finance market, showing a strategic move by companies in order to better position themselves relative to one another and in the economic challenges they are facing. The largest merger is HDFC Bank and Housing Development Finance Corporation (HDFC), which combined the two into about $60 billion. The companies included were HDFC, and now through this merger, they would become one of the largest lenders globally by market capitalization. Another such merger is Prologis, which went on acquiring Duke Realty for almost $26 billion, which exemplifies efforts within the logistics sector to consolidate and enter key markets, partly indicating strategic alignments toward operational synergies. Beneath economic volatility and interest hikes, the general sentiment in the structured finance sector was cautious. These have affected the deal-making space. 2023 saw a company M&A slowdown as companies adapted to refinancings and further rid their sails of the new realities. However, expectations began to grow for the year 2024, stating that distressed acquisitions would regain popularity or energy as buyers would then seek opportunities on the ground to enter a market dislocation. >Analyst Comment

"During the recent years, there has been phenomenal growth in the market for structured finance owing to the increasingly complicated financial deals as well as the requirements for new and creative ways that count as financing options. This market includes a whole range of products and techniques—from securitisation to derivatives and SPVs. Securitisation, which is a major application of transforming illiquid assets into tradable securities, has done marvels to enhance liquidity and risk management."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Structured Finance- Snapshot

- 2.2 Structured Finance- Segment Snapshot

- 2.3 Structured Finance- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Structured Finance Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Residential Mortgage-Backed Securities (RMBS)

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Commercial Mortgage-Backed Securities (CMBS)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Collateralized Debt Obligations (CDOs)

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Collateralized Loan Obligations (CLOs)

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Collateralized Debt Obligations (CDOs)

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 Asset-Backed Securities (ABS)

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Mortgage-Backed Securities (MBS)

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

- 4.10 Structured Asset-Backed Securities (SABS

- 4.10.1 Key market trends, factors driving growth, and opportunities

- 4.10.2 Market size and forecast, by region

- 4.10.3 Market share analysis by country

5: Structured Finance Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Securitization

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Risk Transfer

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Liquidity Management

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Structured Finance Market by Rating

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Investment Grade

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 High Yield

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Non-Rated

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Barclays

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 BNP Paribas

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Nomura Securities

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 JPMorgan Chase Co

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Deutsche Bank

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 UBS

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Royal Bank of Scotland

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Morgan Stanley

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Credit Suisse

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Bank of America Merrill Lynch

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Goldman Sachs

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Societe Generale

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Citigroup

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Rating |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Structured Finance in 2031?

+

-

Which type of Structured Finance is widely popular?

+

-

What is the growth rate of Structured Finance Market?

+

-

What are the latest trends influencing the Structured Finance Market?

+

-

Who are the key players in the Structured Finance Market?

+

-

How is the Structured Finance } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Structured Finance Market Study?

+

-

What geographic breakdown is available in Global Structured Finance Market Study?

+

-

Which region holds the second position by market share in the Structured Finance market?

+

-

How are the key players in the Structured Finance market targeting growth in the future?

+

-