Global Sports Injury Prediction Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1023 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The sports injury prediction market focuses on advanced technologies and analytical solutions that help predict possible injuries to athletes before they occur. By leveraging weather data, biomechanics, training loads and AI-orientated models, these systems offer predictive insights that help minimise inactivity time and improve athletes' performance. This market is gaining strength as teams and organizations prioritize the health of players, longevity of performance and data-supported training strategies. The growing integration of machine learning and real-time monitoring tools is remodelling how sports professionals prevent injuries and optimise recovery plans.

Sports Injury Prediction Report Highlights

| Report Metrics | Details |

|---|---|

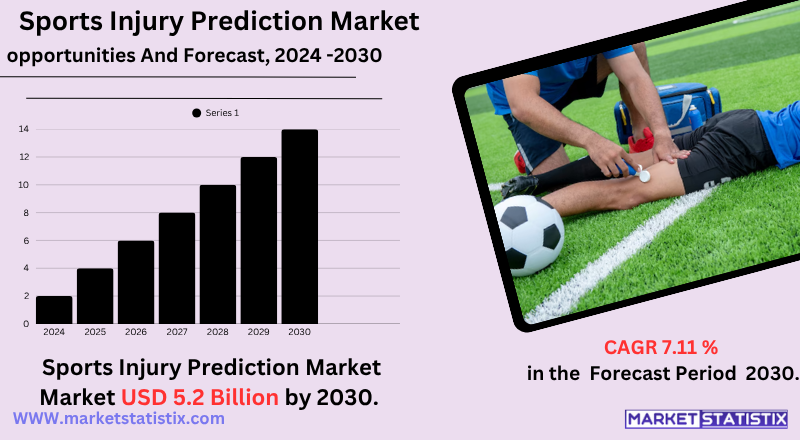

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 7.11% |

| Forecast Value (2030) | USD 5.2 Billion |

| Key Market Players |

|

| By Region |

|

Sports Injury Prediction Market Trends

Main trends include advances in wearable technology for real-time physiological data collection, the wide adoption of predictive machine analysis and learning algorithms for more accurate risk assessment and the integration of various data sources to provide a holistic view of athletes' health. Although hardware solutions, such as sensors and data acquisition systems, currently have significant participation, data analysis software solutions and injury forecasting are gaining traction rapidly due to their scalability. Currently North America dominates the market, but the Asia Pacific region is ready for faster growth, driven by increased investments in sports technology and increasing awareness between athletes and organizations.

Sports Injury Prediction Market Leading Players

The key players profiled in the report are Orreco (Ireland), Physimax Technologies (United States), Kitman Labs (Ireland), IMeasureU (New Zealand), STATSports (United Kingdom), Fusion Sport (Australia), Kinexon (Germany), Catapult Sports (Australia), Strive (United States), Zephyr Technology (United States)Growth Accelerators

- Rising occurrence of sports-related injuries

With athletes at all levels facing more frequent injuries, there is an intensified pressure to go from reactive treatment to proactive damage avoidance using predictive tools.

- Growing adoption of wearable sensor technology

Units such as smartwatches, heart rate monitors, GPS trackers and motion sensors deliver continuous physiological and biomechanical data, making the risk assessment in real time more precise and accessible.

- Demand for personal training and recovery plans

Teams, coaches and coaches now emphasise tailor-made training regimes and rehabilitation strategies powered by AI-driven analysis to optimise athletes and reduce downtime.

Sports Injury Prediction Market Segmentation analysis

The Global Sports Injury Prediction is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Injury prevention, Training optimization, Rehabilitation. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the sports injury forecast market is shaped by a mixture of technology giants and specialised sports analysis companies, all vying for AI, wearables and biomechanics for predictive insights. Established players such as Microsoft, IBM, Zebra Technologies and CA Technologies dominate with AI-orientated wide platforms and expansive partnerships. Meanwhile, niche suppliers such as FirstBeat, Kitman Labs, Sparta Science, Catapult Sports, Xsens, Fusion Sport, Orreco and Physimax stand out, focusing on targeted athletes' load analysis, motion capture and force plate technologies. Smaller startups such as PHAST, Protxx and Vald are also emerging with specialised algorithms and B2B solutions focused on rehab clinics and physiotherapists, often banking on innovation and scale agility. This dynamic mix of holders and agile experts of broad training creates a diverse ecosystem that is evolving rapidly in response to increased demand for proactive athletes' health solutions.

Challenges In Sports Injury Prediction Market

- High investment for advanced systems

High-tech wearables, sensors, and analytics platforms entail significant upfront and maintenance costs, which become unaffordable for smaller teams or grassroots organizations.

- Limited model accuracy and data quality

Maintaining their strength and being applicable in real settings, predictive algorithms remain hostage to their retrospective design, imbalanced datasets, and contradictory approaches to data collection.

- Inadequate Skilled Labour

Efficient integration requires expertise in the data, in interpreting ML, and biomechanical knowledge – most coaches and staff simply lack these.

Risks & Prospects in Sports Injury Prediction Market

Opportunities abound in the integration of cutting-edge technologies such as wearable sensors, AI and machine learning algorithms that analyse vast data sets – biomechanical metrics, training loads, and historical data – to mitigate risk and predict possible injuries. This proactive approach allows personalised training adjustments, personalised recovery programmes, and timely interventions, increasing the athlete's longevity and reducing the substantial financial load associated with injuries. The expansion of professional sports, in addition to increasing participation in recreational activities, further feeds the demand for innovative solutions that can accurately evaluate and mitigate the risk of injury, making it a dynamic and evolving market with considerable potential.

Key Target Audience

The competitive scenario of the sports injury forecast market is shaped by a mixture of technology giants and specialised sports analysis companies, all vying for AI, wearables and biomechanics for predictive insights. Established players such as Microsoft, IBM, Zebra Technologies and CA Technologies dominate with AI-orientated wide platforms and expansive partnerships. Meanwhile, niche suppliers such as FirstBeat, Kitman Labs, Sparta Science, Catapult Sports, Xsens, Fusion Sport, Orreco and Physimax stand out, focusing on targeted athletes' load analysis, motion capture and force plate technologies. Smaller startups such as PHAST, Protxx and Vald are also emerging with specialised algorithms and B2B solutions focused on rehab clinics and physiotherapists, often banking on innovation and scale agility. This dynamic mix of holders and agile experts of broad training creates a diverse ecosystem that is evolving rapidly in response to increased demand for proactive athletes' health solutions.

Merger and acquisition

- DarioHealth acquires Physimax: In January 2022, DarioHealth expanded its digital health suite by acquiring Israel-based Physimax, an AI-driven musculoskeletal performance assessment firm, to elaborate on its personal injury prevention capabilities.

- Strava acquires Recover Athletics: In 2021, fitness social network Strava acquired Recover Athletics, a prehab app for endurance athletes, and integrated injuries bought preventive routines in subscription services to improve the retention and safety of athletics and safety.

- Sword Health acquires Surgery Hero: In January 2025, digital musculoskeletal health leader SWORD Health acquired Surgery Hero, a British-based prehabilitation platform, to strengthen its portfolio for preventing surgical damage and enable partnerships with 18 NHS Trusts.

>

Analyst Comment

The sports injury prediction market is undergoing significant expansion, currently valued at approximately $2.1 billion in 2025. This robust growth is driven mainly by increased participation in sports worldwide, an increased focus on wellness of athletes and performance optimisation and rapid advances in technologies such as wearable sensors, biomechanical analysis and learning. The market is expected to reach about $2.74 billion by 2029. Main trends include the integration of real-time data monitoring with predictive analysis platforms and the development of more sophisticated algorithms for risks in various sports.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Sports Injury Prediction- Snapshot

- 2.2 Sports Injury Prediction- Segment Snapshot

- 2.3 Sports Injury Prediction- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Sports Injury Prediction Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Training optimization

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Injury prevention

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Rehabilitation

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Sports Injury Prediction Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Catapult Sports (Australia)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Fusion Sport (Australia)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 IMeasureU (New Zealand)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Kinexon (Germany)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Kitman Labs (Ireland)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Orreco (Ireland)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Physimax Technologies (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 STATSports (United Kingdom)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Strive (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Zephyr Technology (United States)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Sports Injury Prediction in 2030?

+

-

How big is the Global Sports Injury Prediction market?

+

-

How do regulatory policies impact the Sports Injury Prediction Market?

+

-

What major players in Sports Injury Prediction Market?

+

-

What applications are categorized in the Sports Injury Prediction market study?

+

-

Which product types are examined in the Sports Injury Prediction Market Study?

+

-

Which regions are expected to show the fastest growth in the Sports Injury Prediction market?

+

-

Which application holds the second-highest market share in the Sports Injury Prediction market?

+

-

What are the major growth drivers in the Sports Injury Prediction market?

+

-

- Rising occurrence of sports-related injuries

With athletes at all levels facing more frequent injuries, there is an intensified pressure to go from reactive treatment to proactive damage avoidance using predictive tools.

- Growing adoption of wearable sensor technology

Units such as smartwatches, heart rate monitors, GPS trackers and motion sensors deliver continuous physiological and biomechanical data, making the risk assessment in real time more precise and accessible.

- Demand for personal training and recovery plans

Teams, coaches and coaches now emphasise tailor-made training regimes and rehabilitation strategies powered by AI-driven analysis to optimise athletes and reduce downtime.

Is the study period of the Sports Injury Prediction flexible or fixed?

+

-