Global Spice & Seasonings Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-808 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Spice & Seasonings Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

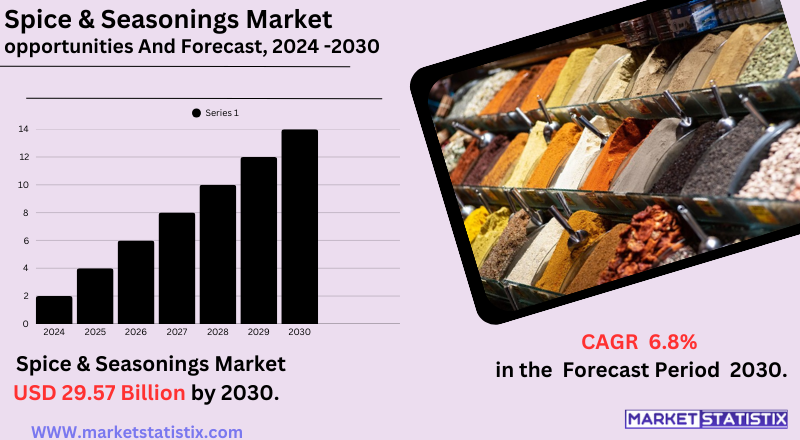

| Growth Rate | CAGR of 6.8% |

| Forecast Value (2030) | USD 29.57 Billion |

| By Product Type | Ginger, Chili, Cinnamon, Pepper, Cumin |

| Key Market Players |

|

| By Region |

|

Spice & Seasonings Market Trends

Dynamic trends are occurring in the spice & seasonings market at present. One of the major drivers has been the continuous tendency of consumers to demand natural and organic products owing to increased health consciousness and improved living conditions coupled with a shift into clean-label ingredients free of additives or preservatives. Ethical and sustainable sources have the same relevance for spices. Transparency based on consumer protection is becoming more appreciated by nearly all consumers in their supply chains. Another important trend is the trend for ethnic and foreign cuisines. This results in a constant demand for spices of many varieties and combinations of flavours. People now become more experimental in their cooking as they will crave the taste of regional spices, and this is becoming more popular thanks to the increasing number of speciality stores and e-commerce. So, with that amount of spice available to the public, ingredients once thought too niche are being shared more widely.Spice & Seasonings Market Leading Players

The key players profiled in the report are Kerry Group Plc (Ireland), ARIAKE Japan Co. Ltd. (Japan), McCormick & Company, Inc. (U.S.), Watkins Incorporated (U.S.), SHS Group (U.K.), Sensient Technologies Corporation (U.S.), Olam International (Singapore), Associated British Foods PLC (U.K.), Ajinomoto Co., Inc. (Japan), Worlée Group (Germany)Growth Accelerators

Consumers increasingly favour different and authentic flavours in their food, which prompts growth in the market. International exposure through travel, media, and immigration has demanded a more diversified mix of spices and seasonings to recreate international dishes at home. Interest in ethnic and exotic cuisines further pushes demand toward certain regional spices and blends. Notably, growing awareness of the health benefits of some spices is a critical driver. Most spices have antioxidant properties, anti-inflammatory properties, and other medicinal values that many consumers are mindful about and are working to incorporate into their diets. This trend is enhanced with the increasing preference for natural and organic products in which consumers want spices that do not contain artificial additives and pesticides. The processed food industry and foodservice sectors expand the market in big volumes since spices and seasonings will be needed in several food products and restaurant menus.Spice & Seasonings Market Segmentation analysis

The Global Spice & Seasonings is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Ginger, Chili, Cinnamon, Pepper, Cumin . The Application segment categorizes the market based on its usage such as Meat and Poultry, Snacks & Convenience Foods, Bakery and Confectionery, Frozen Foods, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition within this spice and seasoning market at the global level is evident in having big, giant international companies alongside little regional businesses. This market has the big names like McCormick & Company, Olam International, Ajinomoto Co., and Associated British Foods controlling most parts of it because of vast portfolio products, distribution networks, and brand equity. Such companies adopt strategies like innovations in products, mergers, and acquisitions to remain competitive and increase market share. It also consists of many local and niche companies focusing on particular regional tastes or preferences for organic or ethically sourced products. The demand for variants and ethnic flavours along with the increasing trend of online retail channels opened doors for smaller players to reach veritable audiences. Competition thus increases due to changing consumer buying behaviour, where they prefer to buy natural and clean label ingredients, along with making the entire industry realise the increased importance of sustainability and ethical sourcing practices.Challenges In Spice & Seasonings Market

In the year 2025, the market for spices and seasonings will be highly challenged, largely resulting from continuous supply chain disruptions, fluctuating tariffs, and geopolitical uncertainties. The trade flows and price volatility of key spices have remained impacted by the tariff hikes from significant exporting countries like Vietnam and China. Climate events, as well as their logistical delays, further threaten the raw materials' continuous availability, causing unpredictable costs and supply shortages in the industry. Those competitive market pressures are exacerbated by a narrow profit margin which stands in the face of vibrant consumer demand. Quality and safety concerns are yet another big challenge given that regulatory standards are becoming stricter worldwide. Furthermore, cases of spice adulteration and contamination, such as the recent bans on products as a result of ethylene oxide contamination, are damaging consumer confidence and prompting expensive recalls. Health incidences from excessive spice consumption, such as gastrointestinal irritation, are also adverse to market perception and demand. In this regard, industries must adopt digitalisation of processes and enhance resilience in the supply chain, as well as cooperation across the value chain for compliance to remain competitive in a quickly changing market environment.Risks & Prospects in Spice & Seasonings Market

The markets have scope due to trends in favour of organic, clean labels and sustainably sourced products; innovation in spice blends and flavours; and opportunities for market expansion due to growth in e-commerce and direct-to-consumer sales channels. The food service and processed food industries are using more spices and seasonings to accommodate the growing tastes of consumers. Regarding regions, Asia Pacific is leading the market, with a share of more than 78% by 2024, thanks to its culinary traditions, a large population, and growing disposable income. North America is another region acquiring considerable growth, especially the United States, benefiting from a diverse immigrant population and an increasing interest in ethnic foods. Europe remains a key market in view of its established food processing industry and the rising demand for natural and organic ingredients. Steady market growth is observed in Latin America as well as the Middle East & Africa, as global trade and culinary globalisation pave the way for introducing new flavours and consumption patterns.Key Target Audience

, The spices and seasonings market caters to a diverse audience, with health-conscious consumers emerging as a significant segment. Natural, organic, or clean-label products from spices are the main preferences of this group since they want spices with no synthetic additives or pesticides. Organic spices such as turmeric, cinnamon, and garlic seem to be in demand in North America and Europe, where consumers choose products that fit their health and wellness agendas. Moreover, with growing interest in functional spices offering health benefits in addition to flavouring, the preference for organic spices gains further momentum., Culinary artists and adventurous eaters also represent another significant demographic exploring world cuisines. Globalisation of food culture has sparked an increasing interest in the so-called "standard" ethnic spices, such as garam masala, five-spice, or taco seasoning. These allow reconstruction of international fare at home, thus finding favour among consumers demanding diverse spice blends and exotic tastes. Fast-casual dining trends coupled with fusion cuisines also deliver global flavours to a customer base eager for novel taste experiences.Merger and acquisition

The global spices and seasonings market is experiencing mergers and acquisitions – the latest strategy adopted by companies to expand their products and markets. For instance, notable was the US$ 950 million acquisition of Olde Thompson by Olam International, one of the leading private-label spices suppliers in North America, in May last year. The acquisition was part of Olam's strategy to further penetrate the U.S. spices market with value-added offerings. Private equity firms continue to be active in this space; for example, Incline Equity Partners acquired Starwest Botanicals in April 2021, focusing on organic and botanical spices, while Audax Group purchased Urban Accents in March 2021 but emphasised gourmet seasonings. Such acquisitions fall within the purview of a general trend to consolidate niche players able to contribute significantly as they cater to changing consumer demand for ever greater diversity and quality. One of the largest deals in this space was between ITC Ltd and Kolkata-based Sunrise Foods Pvt Ltd, which was finalised for ₹2,150 crore in July 2020 entirely in cash. Sunrise was a family-run firm and had been in business for the past 70 years, significantly strong in the spices market of eastern India. The merger permitted ITC to neatly add on to its spices-bursting portfolio through the Aashirvaad brand and broaden its footprint across the country. This acquisition also enabled ITC to gain access to Sunrise's established distribution channels and consumer base, making it even more competitive in the rapidly growing Indian spices market. >Analyst Comment

The global spices and seasonings market is booming: depending on the source, 2024 market valuations are forecasted to be bridging an incredible USD 20 billion and over USD 31 billion, and by 2030, the market is anticipated to reach anything between USD 34 billion and USD 45 billion. This boom is because of the increased consumer appetite for diverse and authentic flavours, the appeal of international cuisines, and greater acceptance of naturally produced, organic, and health-conscious ingredients. The Asia Pacific region leads the market, claiming over 75% of the global share, being driven by production and consumption, while North America and Europe are also significant markets owing to changing culinary trends and increased disposable income.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Spice & Seasonings- Snapshot

- 2.2 Spice & Seasonings- Segment Snapshot

- 2.3 Spice & Seasonings- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Spice & Seasonings Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Pepper

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Chili

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Ginger

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Cinnamon

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Cumin

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Spice & Seasonings Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Meat and Poultry

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Bakery and Confectionery

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Frozen Foods

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Snacks & Convenience Foods

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Spice & Seasonings Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 McCormick & Company

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Inc. (U.S.)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Kerry Group Plc (Ireland)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Watkins Incorporated (U.S.)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Olam International (Singapore)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Associated British Foods PLC (U.K.)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Ajinomoto Co.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Inc. (Japan)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Sensient Technologies Corporation (U.S.)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 ARIAKE Japan Co. Ltd. (Japan)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 SHS Group (U.K.)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Worlée Group (Germany)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Spice & Seasonings in 2030?

+

-

Which type of Spice & Seasonings is widely popular?

+

-

What is the growth rate of Spice & Seasonings Market?

+

-

What are the latest trends influencing the Spice & Seasonings Market?

+

-

Who are the key players in the Spice & Seasonings Market?

+

-

How is the Spice & Seasonings } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Spice & Seasonings Market Study?

+

-

What geographic breakdown is available in Global Spice & Seasonings Market Study?

+

-

Which region holds the second position by market share in the Spice & Seasonings market?

+

-

How are the key players in the Spice & Seasonings market targeting growth in the future?

+

-