Global Sperm Donor Market – Industry Trends and Forecast to 2032

Report ID: MS-946 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The sperm donor market is a special segment within the broad fertility and assisted reproductive technologies (ART) industry, especially focusing on the supply side of sperm for breeding purposes. It contains individuals (sperm donors) who provide their semen to sperm banks or reproductive clinics for use by recipients that are unable to conceive naturally. This market is different from the overall "sperm bank market" in that it mainly addresses motivations, screening processes and compensation associated with donors.

The major elements of this market include the recruitment of eligible donors, who undergo rigorous medical, genetic and psychological screening to ensure the safety and quality of the donated sperm. Factors affecting the supply of donors include compensation, philanthropic motivations, awareness of reproductive requirements, and the legal and moral outline around oblivion vs. identity disclosure, which vary greatly in different fields. The demand side for donors is inspired by the increasing incidence of infertility, the increasing number of single women and the increasing number of LGBTQ+ individuals, demanding the creation of families and progress in art processes using donor sperm.

Sperm Donor Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

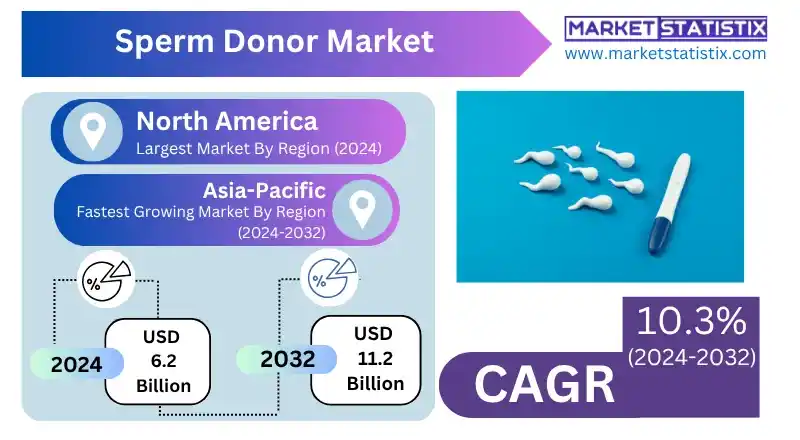

| Growth Rate | CAGR of 10.3% |

| Forecast Value (2032) | USD 11.2 Billion |

| By Product Type | Identity-release Donor, Known Donor, Directed Donor, Anonymous Donor, Open Donor |

| Key Market Players |

|

| By Region |

|

Sperm Donor Market Trends

The sperm donor market is undergoing significant changes driven by the evolution of social norms, technological advances and a growing understanding of reproductive health. A big trend is the growing demand for sperm donors from single women by choice and individuals LGBTQ+, LGBTQ+couples, particularly lesbian couples. This demographic change is leading sperm banks to create more inclusive services, including the offer of donors that align with LGBTQ+ values and expanding donor diversity to meet the varied preferences of recipients by characteristics such as ethnicity and background. This demand is also boosting the growth of known donor agreements, where recipients prefer to use a family friend or member, although sperm banks are still the main source.

Moreover, there is a growing focus on transparency in relation to the identity of donors, with many countries moving to "identity liberation" or "open identity" models, allowing individuals conceived by donors to access their donors' information to reach their adulthood, a trend that balances donors deprivation with their children's rights to know their genetic origin.

Sperm Donor Market Leading Players

The key players profiled in the report are Androcryos, Cryos International, Cryobio, Pride Angel, Indian Sperm Bank, Midwest Sperm Bank, Co-ParentMatch, PathCare Labs, ReproTech, Seattle Sperm Bank, Xytex Corporation, Nordic Cryobank, Manhattan Cryobank, New England Cryogenic Center, European Sperm Bank, Sperm Bank India, California Cryobank, Phoenix Sperm Bank, London Sperm BankGrowth Accelerators

The sperm donor market is driven mainly by the growing global incidence of infertility, affecting men and women. Changes in lifestyle, environmental factors and an increasing average age of conception contribute to a growing number of individuals and couples seeking assisted reproduction technologies such as IUI and in vitro fertilisation, which usually require sperm from the donor. This fundamental biological and social change creates a demand consistent with donated sperm, making it a crucial factor for the market. In addition, significant social and demographic changes are boosting this market forward.

The growing acceptance and desire for family construction between single women and LGBTQ+ couples led to a substantial increase in demand for donor sperm. These groups usually depend on sperm donation as their main path to paternity. In addition, advances in art and cryopreservation techniques have improved success rates and accessibility of fertility treatments, making donor sperm a more viable and attractive option for a wider range of potential parents, further stimulating market growth.

Sperm Donor Market Segmentation analysis

The Global Sperm Donor is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Identity-release Donor, Known Donor, Directed Donor, Anonymous Donor, Open Donor . The Application segment categorizes the market based on its usage such as Hospitals, Fertility Clinics, Cryobanks, Research Institutes, Personal/Home Insemination. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the sperm donor market is intrinsically linked to the broader sperm bank market and is shaped by several factors in supply (donor) and sides. The main actors are mainly the leading international sperm banks, such as Cryos International, Fairfax Cryobank, California Cryobank and the European Sperm Bank, as they are the main entities recruiting and actively managing donor pools. These institutions compete to attract and retain donors through factors such as compensation, comprehensive health and genetic screening and the level of anonymity or offered identity disclosure options, which may significantly influence donor arrangements.

In addition to direct financial incentives, competition between sperm banks for donors also revolves around the convenience of donation processes, the quality of the service provided to donors and their ethical policies. The legal and ethical scenario regarding donor identity dissemination (for example, anonymous donors vs. identification release) varies according to the region and influences the pool of available donors and preferences of recipients.

Challenges In Sperm Donor Market

The sperm donor market faces many major challenges that can disrupt its growth and reliability. The high cost associated with artificial insemination and aided reproduction remains a significant barrier, which limits access to many individuals and joints, especially in developing and underdeveloped areas. Stringent and often incompatible government regulations made the market expansion more complex, with different countries with different standards for compensation, privacy and the number of donors per donor family. This regulatory patchwork can cause delays, can increase compliance costs, and can prevent both donors and recipients from participating in the market.

Quality control and inspection also present the ongoing issues, as some areas may lead to incompatible standards and insufficient regulation of variable service and even moral concerns. Negative social outlook and stigma towards sperm donation remains in some cultures, further obstructs the donor recruitment and recipient acceptance. Additionally, challenges in donor recruitment are complicated by limitations on compensation, privacy concerns, and the need for compliance with legal framework. These factors with technical and logical obstacles in maintaining sperm viability during storage and transport, underline the need for greater standardization, public education and regulatory harmony to ensure safe, moral and effective operation of sperm donor market.

Risks & Prospects in Sperm Donor Market

Main opportunities include the expansion of sperm storage services and genetic screening, which are in high demand for fertility preservation before medical treatments and to ensure healthier pregnancies. Technological advances in cryopreservation and sorting of donors are increasing success rates, while the growing trend of late paternity and the normalisation of non-traditional family structures are expanding the market base.

North America remains the largest market, supported by advanced health infrastructure, comprehensive legal structures and high public awareness of reproductive health and preservation of fertility. The US, in particular, has a robust network of sperm banks and a growing demand for insemination of donors and in vitro fertilisation services. Europe is also a significant market, with countries such as the UK, Germany and France benefiting from well-established regulations and the demand for fertility services growing among aged populations. The Asia Pacific region is emerging as the fastest growing market, driven by increased infertility rates, increasing awareness and expansion of access to reproductive health care in countries such as China, India and Japan. While Latin America and the Middle East and Africa currently have lower actions, they have unexplored potential as awareness and access to fertility treatments improve.

Key Target Audience

,

The sperm donor market targets mainly healthy men from 18 to 39 years old who meet specific criteria for physical health, genetic origin and lifestyle. Donors are usually recruited on university campuses and in urban areas, with a preference for individuals with university education and desirable physical attributes. Motivations to donate sperm include financial compensation, altruistic reasons, and the desire to help others conceive. However, there are remarkable demographic disparities among donors; for example, Asian donors are over-represented in US sperm banks, while Hispanic and Black donors are under-represented, highlighting the need for more diverse donor recruitment strategies.

,, ,The recipient's base for donor sperm is different, covering heterosexual couples facing male infertility, single women and individuals and LGBTQ+ couples who seek to build families. The growing social acceptance of non-traditional family structures and advances in assisted reproduction technologies expanded the demand for donor sperm. Notably, single women and LGBTQ+ couples are a significant portion of sperm bank customers, with some clinics reporting more than 85% of recipients of these demographics. This growing demand emphasises the importance of meeting the diversity of donors and ensuring that sperm banks can meet the various needs of all potential parents.

Merger and acquisition

The sperm donor market has experienced remarkable merger and acquisition activities (M&A) in recent years, reflecting the growing demand for fertility services and advances in reproductive technologies. In June 2022, private equity firm Perwyn acquired Axcel's European sperm bank, with the aim of expanding its presence in the European fertility market and supporting bank growth in assisted reproduction technologies. Similarly, in March 2022, RO, a direct health company to the patient, acquired DADI, a specialised fertility startup in sperm testing, analysis and storage, to improve its offers in male fertility services.

These strategic acquisitions highlight the sector's focus on the integration of advanced technologies and the expansion of service portfolios to meet the growing demand for sperm donation and storage solutions. Companies are investing in innovations such as home sperm collection kits, digital donor platforms and comprehensive genetic screening to improve accessibility and user experience. The tendency to consolidate resources and knowledge through mergers and acquisition activities should continue, boosting growth and innovation in the sperm donor market.

>

Analyst Comment

The global sperm donor market is experiencing constant growth, with market ratings ranging from approximately $3.7 to $5.9 billion by 2025 and projections reaching up to $8 billion by 2030-2035. This growth is driven by increased infertility rates, greater awareness of assisted reproductive technologies, and greater social acceptance of alternative family structures, including Fente and LGBTQ+ families. Technological advances in cryopreservation, genetic screening and donor online correspondence are also making sperm donation services more affordable and effective, while the expansion of fertility clinics and the emergence of fertility tourism are further feeding demand.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Sperm Donor- Snapshot

- 2.2 Sperm Donor- Segment Snapshot

- 2.3 Sperm Donor- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Sperm Donor Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Known Donor

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Anonymous Donor

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Identity-release Donor

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Directed Donor

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Open Donor

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Sperm Donor Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Fertility Clinics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Hospitals

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Research Institutes

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Cryobanks

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Personal/Home Insemination

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Sperm Donor Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Midwest Sperm Bank

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 European Sperm Bank

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Cryos International

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Nordic Cryobank

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Pride Angel

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Indian Sperm Bank

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 California Cryobank

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Xytex Corporation

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 PathCare Labs

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Androcryos

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Manhattan Cryobank

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 New England Cryogenic Center

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 ReproTech

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Sperm Bank India

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Phoenix Sperm Bank

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Cryobio

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Seattle Sperm Bank

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Co-ParentMatch

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 London Sperm Bank

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Sperm Donor in 2032?

+

-

Which type of Sperm Donor is widely popular?

+

-

What is the growth rate of Sperm Donor Market?

+

-

What are the latest trends influencing the Sperm Donor Market?

+

-

Who are the key players in the Sperm Donor Market?

+

-

How is the Sperm Donor } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Sperm Donor Market Study?

+

-

What geographic breakdown is available in Global Sperm Donor Market Study?

+

-

Which region holds the second position by market share in the Sperm Donor market?

+

-

Which region holds the highest growth rate in the Sperm Donor market?

+

-