Global Spain Fast Food Market – Industry Trends and Forecast to 2030

Report ID: MS-807 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Spain Fast Food Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

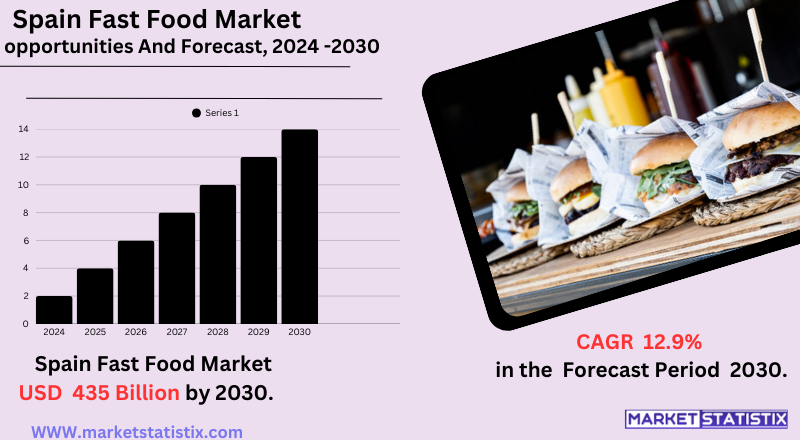

| Growth Rate | CAGR of 12.9% |

| Forecast Value (2030) | USD 435 Billion |

| By Product Type | Takeout, Dine-in |

| Key Market Players |

|

| By Region |

|

Spain Fast Food Market Trends

The Spain Fast Food Market is evolving with ever-changing consumer trends and technological advances. Such a key trend involves the increasing consumer demand for healthier and sustainable options, further prompting fast-food operators to introduce plant-based alternatives and locally sourced ingredients into their menu offerings. Digital transformation would also be exclaimed as one of the key trends in which a wider number of restaurants are adopting online ordering, delivery services, and even ghost kitchens for added convenience and outreach purposes. Intense competition from international chains and from local players alike necessitates constant reinvention in menu offerings and customer experience. Other challenges that lie ahead for the Spanish fast-food market include adapting to the increase in demand for sustainable practices and being able to afford and implement healthier and environmentally friendly options.Spain Fast Food Market Leading Players

The key players profiled in the report are McDonald's - (U.S.), KFC - (U.S.), TGB Burger - (Spain), Hamburguesa Nostra - (Spain), Goiko Grill - (Spain), Tommy Mel's - (Spain), Burger King - (U.S.), Foster's Hollywood - (Spain), Peggy Sue's - (Spain)Growth Accelerators

Rising urbanisation and shifting lifestyles of Spanish consumers are propelling the growth of the fast-food market in Spain. An increasing number of Spanish individuals are looking for convenient and inexpensive meal solutions owing to hectic schedules. This growth has also been enhanced by the popularity and expansion of international fast-food chains and strong domestic players across urban and suburban areas that provide a familiar and easily accessible option. Another fundamental driver is that rising disposable income among the Spanish population is appealing to fast food, especially to younger consumers who characterise fast food as cheap, convenient, and versatile. Healthier and plant-based products are gaining traction among consumers, thus increasing popularity, and fast-food operators are shifting their menus to focus on healthier choices. Such changes concerning consumers' evolving preferences, coupled with continual technological innovations in food preparations and delivery, will put the Spain Fast Food Market in the front row for further development.Spain Fast Food Market Segmentation analysis

The Global Spain Fast Food is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Takeout, Dine-in . The Application segment categorizes the market based on its usage such as Pizza, Sandwich, Hamburger, Alcoholic drinks, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Spanish fast-food market is characterised by a highly competitive environment, consisting of prominent international brands and well-established domestic players. Global giants such as McDonald's, Burger King, and KFC command a significant share of the market using their brand power and established networks. On the other hand, local and national chains like Telepizza and Goiko Grill have established themselves strongly by satisfying local tastes and preferences. This makes for an interesting setting in which the big boys spar with regional favourites for consumer attention through innovations in menus, pricing strategies, and expansions of outlet networks. Competitive intensity increases with the growing popularity of online food delivery services, which have lowered the entry barriers for new players while simultaneously intensifying competition for existing ones. Ghost kitchens have sprung up alongside an increasing demand for convenience-driven innovation in delivery models and digital ordering systems.Challenges In Spain Fast Food Market

The fast-food business in Spain has some unique challenges to tackle, which seem to be somewhat shaping the competitive landscape in the industry. Rising food prices and supply chain disruptions generally apply pressure on profit margins, while labour constraints restrict operations, especially disturbing smaller or independent outlets. Fragmentation of the market – a large number of small and medium players competing alongside international giants – will also keep several businesses from achieving scale and continuity in quality and service standards. All of these factors also add health concerns, as increasingly more Spanish consumers will consider nutrition and wellness when choosing what foods to eat, resulting in healthier and plant-based menu demands. This troubling phenomenon enjoys increased competition from the growing casual dining entries and the need for innovations in a fast-food brand concept. And, of course, in the market, rapid changes in technologies, such as the digital ordering and delivery platforms, require much investment in operations to stay flexible in a fast-changing environment.Risks & Prospects in Spain Fast Food Market

The major growth propellers are the quick-service restaurants, innovations in products, and delivery or takeout services becoming more popular among consumers. Changing consumer preferences toward healthier plant-inspired food offerings will bring in new niches within the rest of the market, so fast-food players now have to introduce salads, wraps, and vegan options to their menus. Currently, the Spanish fast-food market has four geographical divisions: North, South, East, and West, with the North holding the maximum market share at 35% and the fastest-growing being the South. The industry is quite fragmented with a lot of small and medium players, but with dominance from big chains such as McDonald's, Burger King, and KFC. It is in rapidly urbanising areas where time demands and lifestyle changes have had their effects most profoundly on consumer foodservice and chained outlets: these two segments have 55% and 60% market shares, respectively. There's a certain government regulation also that borders the business of food safety, sanitation, and hygiene and how these internationally shape operational standards from region to region.Key Target Audience

The demographic that this fast-food market concerns the most is the young adult, and most of its patronage is within the age 18-34. In numbers, it is estimated that 51.4% of quick-service restaurant (QSR) users are aged 18 to 24, while 37 per cent are between 25 and 34. A majority of them, 79.9%, are male and found in urban areas where convenience factors and digital accessibility are important. They are heavy consumers of mobile technology, whereby they access food delivery through Glovo, Uber Eats, and Just Eat. However, they eat such products as burgers, pizzas, and sandwiches at affordable and quick service, showing an interest in health improvement in which the consumption will include plant-based and organic foods.,, Health-conscious eaters are the other unique market segment that leads to increased eco-friendliness and health-consciousness. This will grow demand for varied menus that will lead fast food companies to offer low-calorie, vegetarian, and organic food choices. The increase of fast-casual dining establishments, like Flax & Kale and Honest Greens, is evidence that fast food is gearing up towards fresher, customizable meals. Modern households with both partners employed cannot afford time to prepare meals at home; hence, busy lifestyles opened space for fast-food solutions and also multiplied fast-food growth in Spain.Merger and acquisition

The Spanish nation fast food market has been familiar with notable merger and acquisition (M&A) activity in recent years, which would mirror larger trends in the domain of food and beverage. A relevant kind of development consisted of the acquisition of Monbake Grupo Empresarial Group CVC Advisers for £772 million, which is an avenue to enhance CVC's position in Europe's frozen bakery scenery by establishing Monbake distribution competencies and a range of products. Such acquisitions serve as testimonies to the attractiveness of Spain's food industry to those harvesting international funds for their European expansion drives. Also, the fast-food image of Spain has been shaped by global mammoths such as McDonald's and Burger King and local chains such as Pans & Company and Rodilla. The fragmentation of the market permits consolidation opportunities, with firms looking to improve their market share and increase operational efficiencies. Digital transformation was accelerated by the COVID-19 pandemic, promoting the use of online ordering and delivery services. This modernised model created avenues for fast food outlets to demonstrate their resilience and become attractive investment prospects for investors prioritising digital capabilities and consumer convenience. >Analyst Comment

The Spain fast-food market is a considerable and steadily growing sector valued at around USD 145.58 billion in 2024 and expected to grow to USD 435 billion by 2033. Factors supporting such growth include the increase in urbanisation, higher disposable incomes, and lifestyle changes that prefer convenience and quick meal options. The market sees the presence of big international chains such as McDonald's, Burger King and KFC, and an increasing number of domestic and niche brands that are catering to changing consumer trends such as healthy dietary habits or choices, including plant-based food options. Urban areas, with a particular focus on the northern part of Spain, are eating into the market, while the southern region is being considered the fastest-growing segment.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Spain Fast Food- Snapshot

- 2.2 Spain Fast Food- Segment Snapshot

- 2.3 Spain Fast Food- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Spain Fast Food Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Takeout

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Dine-in

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Spain Fast Food Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hamburger

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pizza

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Sandwich

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Alcoholic drinks

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Spain Fast Food Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Goiko Grill - (Spain)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 McDonald's - (U.S.)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Foster's Hollywood - (Spain)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Burger King - (U.S.)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Hamburguesa Nostra - (Spain)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 KFC - (U.S.)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 TGB Burger - (Spain)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Tommy Mel's - (Spain)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Peggy Sue's - (Spain)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Spain Fast Food in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Spain Fast Food market?

+

-

How big is the Global Spain Fast Food market?

+

-

How do regulatory policies impact the Spain Fast Food Market?

+

-

What major players in Spain Fast Food Market?

+

-

What applications are categorized in the Spain Fast Food market study?

+

-

Which product types are examined in the Spain Fast Food Market Study?

+

-

Which regions are expected to show the fastest growth in the Spain Fast Food market?

+

-

Which application holds the second-highest market share in the Spain Fast Food market?

+

-

What are the major growth drivers in the Spain Fast Food market?

+

-