Global Space Food Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-806 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Space Food Report Highlights

| Report Metrics | Details |

|---|---|

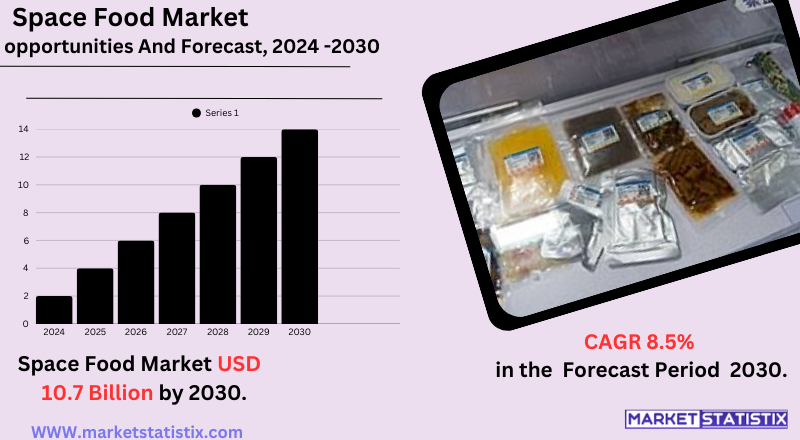

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 8.5% |

| Forecast Value (2030) | USD 10.7 Billion |

| By Product Type | Packaged Meals, Snacks, Thermostabilized Foods, Dehydrated Foods, Fresh Foods |

| Key Market Players |

|

| By Region |

|

Space Food Market Trends

The space food market is recently witnessing considerable trends propelled by increasing aspirations for space exploration and rising activities in commercial spaceflight. One major trend is an increased demand for advanced nutrition and variety in space food. Particularly as missions take longer, with aspirations for lunar bases and Mars expeditions, the need for food that keeps one's physical condition in check while promoting one's psychological well-being with pleasant, diverse options cannot be understated. Consequently, there is a push toward innovation of processing and preservation techniques to keep the food nutritious for longer. Another strong trend is the making of sustainable and efficient food systems for space. Among the things being researched are in-situ food production and the bioregenerative life-support systems that grow food in space and thereby limit dependency on Earth for resupply missions. These trends are the design board of the future space food market, which will forge relationships among space agencies, private corporations, and food technology innovators to meet the new challenges of space travel.Space Food Market Leading Players

The key players profiled in the report are Space Foundation Discovery Center, Nissin Foods, The Space Foods Company, Morinaga Milk Industry, Mission: Space Food, Astronaut Foods, Space Food Laboratory, House Foods Corporation, Onisi Foods, Mitsui Norin, Shanxi Shenzhou Space FoodGrowth Accelerators

Currently being fuelled by substantial factors such as the increasing investment in space exploration programmes by government agencies and private companies, one of these main factors is the rising demand for advanced, specialised food solutions for astronauts on long space missions. Another reason is the increased interest in space tourism, which is adding a new dimension to the market in itself and also demanding palatable and ready-to-eat food options for space travellers, not just for astronauts. Sustainability and resource efficiency are increasingly shaping this kind of market. This includes research into in-space food production methods such as bioregenerative systems and hydroponics that would establish long missions' supply independence from the Earth. Moreover, the demand for special or personalised nutrition has encouraged innovation in food formulations and delivery systems to ensure astronauts remain in peak health and performance throughout the adverse conditions of space. All of these factors are converging to create a competitive and expansive market for space food.Space Food Market Segmentation analysis

The Global Space Food is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Packaged Meals, Snacks, Thermostabilized Foods, Dehydrated Foods, Fresh Foods . The Application segment categorizes the market based on its usage such as Food for Research and Development, Astronaut Food for Space Missions, Survival Food Kits, Emergency Food Supplies, Training and Simulation Programs. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The space food market has a competitive landscape uniquely characterised by government space agencies, established aerospace and defence contractors, and the rising tide of enterprising private companies. This market has seen its traditional dominance shaped by governmental organizations such as NASA, ESA, and Roscosmos that have long experience in astronaut food development and supply. With the surge of private companies like SpaceX, Blue Origin, and Boeing, those said companies will also now have a stake in the space food business. Previously focused on space transport, these companies now recognise the importance of space food in the wake of commercial space travel and longer-duration missions. Key competitive areas include advanced food processing or preservation techniques, including freeze-drying, irradiation, and thermostabilisation, along with explorations into novel approaches such as 3D food printing and bioregenerative food systems for in-space production. On top of that, there is an insatiable interest in the well-being of astronauts on long-term missions, resulting in more emphasis on variety, taste, and the psychological comfort offered by space food, creating collaborations between space agencies and food technology companies to provide food that is more delicious and culturally relevant.Challenges In Space Food Market

The space food market faces a number of great challenges that stunt its growth and inhibit innovation. Most importantly, these include the rigorous regulatory and safety criteria to which all space food has to be subjected in order to promote astronaut health and the success of a given mission. The development of food that is safe, nutritious, and appropriate for the unique conditions prevailing in space – such as microgravity and limited storage space – calls for exhaustive testing, compliance with complex regulations, and collaboration of food scientists, regulatory bodies, and space agencies. Besides, the great cost and logistical complexity of R&D and supply chain activity for space food is yet another major challenge. Food must be lightweight, compact, shelf-stable, and easy to consume in microgravity. All these add further technical hurdles. Long-term storage also degrades vital nutrients; microgravity alters texture and flavour perceptions in food, hence accommodating diverse diets and tastes – all pose design constraints. These factors, thus compounded with limited budgets and niche characteristics of the market, create an entry barrier for a new entrant and inhibit economies of scale within the market.Risks & Prospects in Space Food Market

Both public possessors like NASA, ESA, etc., and private players like SpaceX and Blue Origin invest highly in developing advanced food systems that are nutritious and shelf-stable for long-duration missions. While the advances in food technology – including freeze-drying, 3D printing, and sustainable packaging – have really opened new doors for products designed to suit unique microgravity conditions. From a regional perspective, North America also accounts for more than 40% of the global revenue of this market, as it has been a pioneer in space exploration, with many key industry players continuing to play an important role. In Europe, with its space agencies and organizations, the demand for specialised space food products is all set to grow with an interest in space tourism. The rapidly growing Asia-Pacific region has its leading countries, like China, India, and Japan, all investing in space programmes and developing associated food technologies. Emerging markets of Latin America, the Middle East, and Africa are also starting to join in and so provide new avenues for international collaboration and transfer of technologies. Overall, the global space food market is bound to grow due to technological advancements coupled with increased commercialisation of space activities.Key Target Audience

Space food market targets: NASA, ESA, Roscosmos, and government space agencies that require high-nutrition food for astronauts to use during space missions and food storage long into the future. For these organizations, safety, space-saving packaging, and novel methods of preservation are paramount. The other category takes into account private aerospace companies like SpaceX and Blue Origin that push for active developments of commercial spaceflight programmes which will require targeted space food use for both crew and potential tourists.,, There is also growing interest in space food among increasingly niche groups of consumers on Earth. Those include survivalists, adventure travellers, and such tech-savvy, health-minded individuals who find space food so attractive because they promise convenience, durability, and novelty. This secondary market presents spaces for retail conversion of these space-grade meals, particularly in parts of the world with strong outdoor or prepper culture. Increasingly commercialised space travel will increase these target audiences and further lead to the diversification of products according to their needs.Merger and acquisition

The most significant recent development in the space food market is the acquisition of Kellanova by Mars Inc. for $35.9 billion, announced in August 2024. Kellanova was formed by the spin-off of Kellogg's in 2023 and owns brands such as Pringles, Cheez-It, and Pop-Tarts. This transaction is expected to close by mid-2025, at which point Kellanova will join Mars' Snacking segment, therefore providing greater strength to Mars in the global snack market and diversifying its portfolio outside confectionery. This acquisition signals Mars' intent to diversify into savoury snacks and healthier options and keep pace with changing consumer preferences. The merger is only a part in a greater role of increased M&A activities in the food and beverage sector and specifically in the snacking segment. Analysts are noticing an increasing number of strategic buyers and private equity firms interested in premium assets in this space. This Mars-Kellanova transaction – the largest ever in snacking – will likely push further consolidation as companies adapt to changing consumer preferences and expand their reach globally. >Analyst Comment

The growth of the global space food market is positively correlated to the amplitude of space missions, be it duration or frequency. Missions for the Moon and Mars, in addition to missions in Low Earth Orbit (LEO), contribute hugely to the growth of this space food market. The year 2023 sees the major market closing in on the valuation of around USD 611.66 million, and it shall have almost USD 1.34 billion by the year 2030. The driving forces behind such phenomenal growth are the technological advancements in food processing, like freeze-drying, thermostabilisation, and irradiation, all of which help prolong the shelf life, nutritional value, and safety of food in microgravity. The other aspect that favours the demand is space tourism and new private aerospace companies such as SpaceX and Blue Origin, which create fresh demand in this avenue for both innovative and tasty space food solutions.The growth of the global space food market is positively correlated to the amplitude of space missions, be it duration or frequency. Missions for the Moon and Mars, in addition to missions in Low Earth Orbit (LEO), contribute hugely to the growth of this space food market. The year 2023 sees the major market closing in on the valuation of around USD 611.66 million, and it shall have almost USD 1.34 billion by the year 2030. The driving forces behind such phenomenal growth are the technological advancements in food processing, like freeze-drying, thermostabilisation, and irradiation, all of which help prolong the shelf life, nutritional value, and safety of food in microgravity. The other aspect that favours the demand is space tourism and new private aerospace companies such as SpaceX and Blue Origin, which create fresh demand in this avenue for both innovative and tasty space food solutions.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Space Food- Snapshot

- 2.2 Space Food- Segment Snapshot

- 2.3 Space Food- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Space Food Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Dehydrated Foods

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Packaged Meals

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Snacks

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Thermostabilized Foods

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Fresh Foods

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Space Food Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Astronaut Food for Space Missions

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Food for Research and Development

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Emergency Food Supplies

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Survival Food Kits

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Training and Simulation Programs

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Space Food Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Nissin Foods

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Morinaga Milk Industry

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Onisi Foods

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 House Foods Corporation

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Mitsui Norin

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Mission: Space Food

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 The Space Foods Company

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Space Food Laboratory

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Space Foundation Discovery Center

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Astronaut Foods

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Shanxi Shenzhou Space Food

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Space Food in 2030?

+

-

Which type of Space Food is widely popular?

+

-

What is the growth rate of Space Food Market?

+

-

What are the latest trends influencing the Space Food Market?

+

-

Who are the key players in the Space Food Market?

+

-

How is the Space Food } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Space Food Market Study?

+

-

What geographic breakdown is available in Global Space Food Market Study?

+

-

How are the key players in the Space Food market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Space Food market?

+

-