Global Sodium Reduction Ingredient Market – Industry Trends and Forecast to 2030

Report ID: MS-843 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The sodium reduction ingredient industry covers a range of products and technologies applied by the food sector to reduce the sodium level in processed foods without affecting taste, texture, and safety. These ingredients may be generally classified as salt replacers (e.g., potassium chloride, magnesium chloride, and calcium chloride); flavour enhancers (e.g., yeast extracts, hydrolysed vegetable proteins, and amino acids that impart umami notes); and masking agents that assist in minimising the saltiness perception without drastically changing the overall flavour. The aim is to meet health issues related to excessive sodium consumption, including hypertension and cardiovascular disease, without sacrificing the taste of food products.

The market for sodium reduction ingredients is rich, with manufacturers providing specialised solutions for a range of food uses, from processed meat and snacks to sauces and bakery products. Demand for these ingredients will continue its growth path as the attention on healthier foods continues to increase across the world.

Sodium Reduction Ingredient Report Highlights

| Report Metrics | Details |

|---|---|

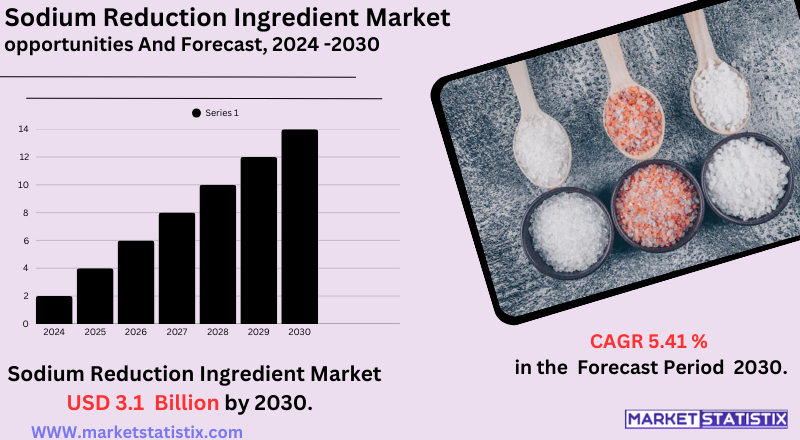

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 5.41% |

| Forecast Value (2030) | USD 3.1 Billion |

| By Product Type | Mineral salts, Yeast extracts, Amino acids, Others |

| Key Market Players |

|

| By Region |

|

Sodium Reduction Ingredient Market Trends

The market for sodium reduction ingredients is presently facing a number of important trends driving its development and transformation. One major trend is the growing demand from consumers for natural and clean-label sodium reduction alternatives. This is leading manufacturers to seek and use alternatives to conventional sodium-containing ingredients, like potassium chloride, natural sea salt replacers, yeast extracts, and plant-derived flavour enhancers, to fulfil consumer demands for healthier and more familiar ingredients.

Another key trend is the increasing worldwide focus on regulatory programmes and public health campaigns to decrease sodium consumption. Governments and health agencies across the globe are adopting policies and guidelines to reduce sodium content in food products. This mounting regulatory pressure is making food producers actively search for and implement sodium reduction ingredients to meet these requirements and serve a health-driven consumer segment, further fuelling innovation and business growth in this category.

Sodium Reduction Ingredient Market Leading Players

The key players profiled in the report are Archer Daniels Midland Company (ADM) (United States), Angel Yeast Co., Ltd. (China), Tate & Lyle PLC (United Kingdom), Chr. Hansen Holding A/S (Denmark), Sensient Technologies Corporation (United States), International Flavors & Fragrances Inc. (IFF) (United States), Kerry Group plc (Ireland), Ajinomoto Co., Inc. (Japan), K+S Minerals GmbH (Germany), DuPont de Nemours, Inc. (United States), Dr. Paul Lohmann GmbH & Co. KGaA (Germany), Cargill, Inc. (United States), Advanced Food Systems Inc. (United States), Givaudan (Switzerland), Ingredion Incorporated (United States), OthersGrowth Accelerators

The market for sodium reduction ingredients is largely influenced by rising consumer awareness about the harmful health implications of excessive sodium consumption, including hypertension and cardiovascular diseases. With this growing health awareness, consumers are increasingly seeking and preferring low-sodium foods, thus forcing food companies to reformulate their products. In addition, the increasing incidence of lifestyle-related diseases linked with high sodium intake is further boosting demand for sodium reduction ingredients in various food applications.

Yet another major driver is the mounting regulatory pressure and supportive government actions to lower sodium levels in processed foods. Global health bodies are introducing guidelines and recommendations for lower sodium consumption, compelling food manufacturers to implement sodium reduction plans and add these ingredients to their product formulations. This regulatory environment, combined with public health campaigns emphasising the dangers of high sodium intake, provides a compelling incentive for the expansion of the sodium reduction ingredient market as companies seek to satisfy both consumer needs and changing legal requirements.

Sodium Reduction Ingredient Market Segmentation analysis

The Global Sodium Reduction Ingredient is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Mineral salts, Yeast extracts, Amino acids, Others . The Application segment categorizes the market based on its usage such as Dairy & frozen foods, Sauces, Bakery & confectionery, Meat products, seasonings & snacks, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market's competitive environment for the sodium reduction ingredient industry is dynamic and becoming more competitive, fuelled by increasing health consciousness and regulatory pressure to reduce sodium levels in foods. The major players are major ingredient companies like Cargill, Kerry Group, DSM, and Tate & Lyle, which provide a wide range of salt replacers, flavour enhancers, and other sodium reduction solutions. These mature companies tend to have large R&D resources and international distribution networks, giving them a huge head start.

Still, the market also witnesses the presence of innovative and niche companies such as Ajinomoto (famous for umami ingredients), Innophos, and small startups targeting niche applications or new technologies. Competition is increasing in the form of product innovation, with firms formulating natural and clean-label variants, as well as blends designed to mimic the taste and functionality of salt better. Strategic partnerships, acquisitions, and expansion into new areas of application are also important strategies that firms are adopting to consolidate their market position in this changing scenario.

Challenges In Sodium Reduction Ingredient Market

The sodium reduction ingredient industry is confronted with some major challenges that may hinder its growth and use. One of the main challenges is the taste and flavour modification when sodium is reduced in foods since sodium has a vital role to play in improving palatability and sensory appeal. Consumers tend to be sensitive to taste changes, and sodium reduction ingredients like potassium chloride can contribute a bitter aftertaste, resulting in lower acceptance of reformulated foods. Furthermore, keeping foods' texture and shelf life intact while reducing sodium content poses technical challenges for food manufacturers, needing innovative ingredient solutions and proper formulation to maintain product quality.

Another key issue is the increased cost of production and lower profit margins for sodium reduction ingredients over traditional salt, which can deter massive industry use, particularly in price-sensitive sectors. Additionally, there is poor consumer knowledge and appreciation of the health gain from sodium reduction, especially in rural and poor communities, leading to reduced market demand and low adoption of sodium-reduced products. These challenges will need to be overcome through ongoing technological innovation, consumer education, and enabling regulatory regimes to spur greater acceptance and market expansion.

Risks & Prospects in Sodium Reduction Ingredient Market

Innovations in food formulation, for example, through the use of potassium chloride, yeast extracts, and amino acids, allow manufacturers to decrease sodium without affecting taste or texture, creating new opportunities in bakery, dairy, snack foods, and ready-to-eat meals. Government regulations and dietary guidelines advocating sodium reduction also are driving food companies to reformulate products, further fuelling market growth.

Region-wise, North America dominates the market with approximately 33% global value, with the help of high consumer consciousness, government programmes, and extensive processed food industries. Europe ranks second because of its health-orientated consumers and heavy demand for processed foods. The Asia-Pacific market, especially China and India, is the quickest-growing market because of high urbanisation, increased disposable incomes, and growing rates of lifestyle diseases. In China, the strong consumption of noodles, sauces, and processed meats offers strong opportunities, with yeast extracts becoming increasingly popular as sodium alternatives. Australia is also experiencing growth, particularly in the bakery market, driven by innovation and retail growth. Key players are using acquisitions, alliances, and R&D spending to enhance their presence in these dynamic markets.

Key Target Audience

Furthermore, food producers and the food and beverage industry as a whole are a key target market for sodium reduction ingredients. Businesses are reformulating products across categories—such as bakery, dairy, snacks, and processed meats—to satisfy consumers' demands for healthier choices without sacrificing flavour. For example, the bakery and confectionery market contributed 29% of the market share in 2023, indicating increased demand for healthier baked foods. This two-pronged pressure from consumers and regulators is propelling innovation and uptake of sodium reduction ingredients in the food industry.,,

,

The sodium reduction ingredient industry mainly addresses health-aware consumers, such as elderly people and hypertensive or cardiovascular patients. Such consumers are more frequently looking for low-sodium food products to treat their health because there is heightened awareness of the hazards posed by high sodium consumption. Indeed, 22% of global consumers actively look for low-salt, low-sugar, and low-fat foods, with the number of those cutting back on sodium doubling from ages 18–24 to 55+. This demographic trend emphasises the role that sodium reduction ingredients play in fulfilling the dietary requirements of an ageing population that cares about heart health.

,,

Merger and acquisition

Recent merger and acquisition (M&A) move in the sodium reduction ingredient space indicate an increasing focus on health-orientated product innovation and strategic growth. Specifically, in November 2023, Ajinomoto Co., Inc., a world leader in food and biotechnology, acquired US-based Forge Biologics for $620 million. The acquisition strengthens Ajinomoto's biotechnology capabilities, which could influence the development of sodium reduction ingredients using cutting-edge fermentation and bioengineering technologies.

Also, Ajinomoto has shown dedication to nutritional enhancement and sustainability. In December 2020, the company purchased Nualtra Limited, an Irish supplement firm, to penetrate Europe's oral nutritional supplements market. Also, in May 2023, Ajinomoto inked a letter of intent for a strategic partnership with Solar Foods, a firm that created Solein, a microbial protein that feeds on CO₂ as a source of nutrients. These strategic decisions reflect a direction in which companies are making investments in new-age technologies and alliances to create healthier food ingredients, such as solutions for sodium reduction.

>

Analyst Comment

The market for sodium reduction ingredients is growing strongly, with rising consumer awareness of health and regulatory pressure to reduce sodium levels in processed food. The market size was approximately $1.46 billion in 2024 and is estimated to grow to between $3.1 billion and $3.66 billion during 2031–2033. Growing health concerns regarding hypertension and cardiovascular diseases, combined with initiatives by the World Health Organisation and government regulations, have greatly driven demand for sodium-reducing ingredients across various food products, such as snacks, sauces, baked foods, and processed meat.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Sodium Reduction Ingredient- Snapshot

- 2.2 Sodium Reduction Ingredient- Segment Snapshot

- 2.3 Sodium Reduction Ingredient- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Sodium Reduction Ingredient Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Mineral salts

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Amino acids

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Yeast extracts

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Sodium Reduction Ingredient Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Bakery & confectionery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Dairy & frozen foods

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Meat products

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Sauces

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 seasonings & snacks

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Others

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Sodium Reduction Ingredient Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Advanced Food Systems Inc. (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Ajinomoto Co.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Inc. (Japan)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Angel Yeast Co.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Ltd. (China)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Archer Daniels Midland Company (ADM) (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Cargill

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Inc. (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Chr. Hansen Holding A/S (Denmark)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Dr. Paul Lohmann GmbH & Co. KGaA (Germany)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 DuPont de Nemours

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Inc. (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Givaudan (Switzerland)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Ingredion Incorporated (United States)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 International Flavors & Fragrances Inc. (IFF) (United States)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Kerry Group plc (Ireland)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 K+S Minerals GmbH (Germany)

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Sensient Technologies Corporation (United States)

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Tate & Lyle PLC (United Kingdom)

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 Others

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Sodium Reduction Ingredient in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Sodium Reduction Ingredient market?

+

-

How big is the Global Sodium Reduction Ingredient market?

+

-

How do regulatory policies impact the Sodium Reduction Ingredient Market?

+

-

What major players in Sodium Reduction Ingredient Market?

+

-

What applications are categorized in the Sodium Reduction Ingredient market study?

+

-

Which product types are examined in the Sodium Reduction Ingredient Market Study?

+

-

Which regions are expected to show the fastest growth in the Sodium Reduction Ingredient market?

+

-

Which application holds the second-highest market share in the Sodium Reduction Ingredient market?

+

-

What are the major growth drivers in the Sodium Reduction Ingredient market?

+

-

The market for sodium reduction ingredients is largely influenced by rising consumer awareness about the harmful health implications of excessive sodium consumption, including hypertension and cardiovascular diseases. With this growing health awareness, consumers are increasingly seeking and preferring low-sodium foods, thus forcing food companies to reformulate their products. In addition, the increasing incidence of lifestyle-related diseases linked with high sodium intake is further boosting demand for sodium reduction ingredients in various food applications.

Yet another major driver is the mounting regulatory pressure and supportive government actions to lower sodium levels in processed foods. Global health bodies are introducing guidelines and recommendations for lower sodium consumption, compelling food manufacturers to implement sodium reduction plans and add these ingredients to their product formulations. This regulatory environment, combined with public health campaigns emphasising the dangers of high sodium intake, provides a compelling incentive for the expansion of the sodium reduction ingredient market as companies seek to satisfy both consumer needs and changing legal requirements.