Global SIP Trunking Services Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-957 | IT and Telecom | Last updated: May, 2025 | Formats*:

The Session Initiation Protocol (SIP) trunking service market refers to the sector that provides virtual telephone lines and communication services with an internet connection, effectively replacing traditional linear phones (such as ISDN and analogue lines). In essence, SIP trunking uses the session initiation protocol to establish, manage and end real-time multimedia communication sessions, including voice calls, video conferencing and instant messages, all transmitted as digital data packets on an IP network. This allows companies to connect their existing PBX (Private Bank Exchange) systems to the Switched Public Telephone Network (PSTN) via the internet, offering a more flexible, scalable and often more economical alternative to physical copper lines.

As more companies seek to modernise their communication infrastructure and adopt cloud-based solutions, the demand for SIP trunking services continues to increase, making it a crucial segment within the broader scenario of telecommunications and corporate communication.

SIP Trunking Services Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

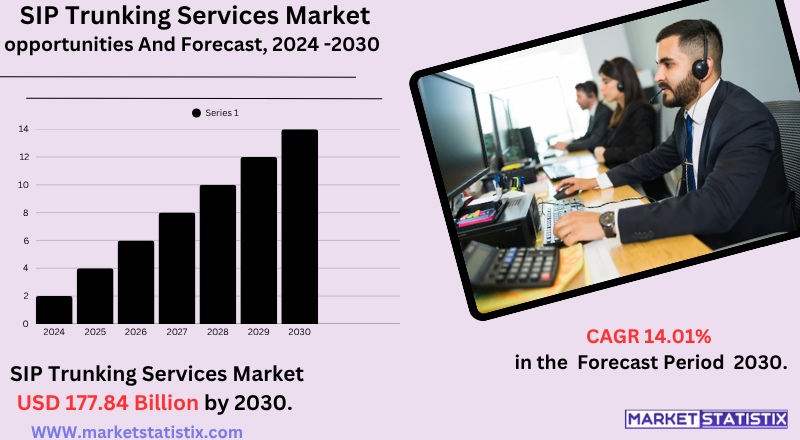

| Growth Rate | CAGR of 14.01% |

| Forecast Value (2030) | USD 177.84 Billion |

| By Product Type | Hosted, On Premise |

| Key Market Players |

|

| By Region |

|

SIP Trunking Services Market Trends

Companies are increasingly migrating away from traditional, expensive and less flexible connections from the commuted telephone network (PSTN) to leverage the cost efficiency, scalability and advanced features offered by SIP trunking. This change is particularly evident with the widespread hug from Unified Communications Platforms (UC) and unified communications as a service (UCAAS), where SIP enters as the critical bridge for voice connectivity into the outside world, allowing perfect voice, video and messaging in various devices and locations.

Looking to the future, the main trends in the market include a greater focus on cyber security and compliance to address specific VoIP threats, the growing 5G networks to enable advanced SIP services and the increasing incorporation of artificial intelligence (AI) and machine learning for enhanced calls, fraud detection and communication analysis.

SIP Trunking Services Market Leading Players

The key players profiled in the report are IBM Corporation (U.S.), CenturyLink (U.S.), BT (U.K.), ORANGE (France), Vonage (U.S.), Colt Technology Services Group Limited (U.K.), Verizon (U.S.), Intrado Corporation (U.S.), TELSTRA (Australia), Rogers Communications (Canada), Intelepeer Cloud Communications LLC. (U.S.), Mitel Networks Corp. (Canada), Fusion Incorporated (U.S.), TWILIO Inc. (U.S.), NET2PHONE (U.S.), GTT Communications, Inc. (U.S.), Nextiva (U.S.), Voyant Communications (U.S.)Growth Accelerators

The SIP service market is mainly driven by the convincing cost savings and efficiency gains it offers compared to traditional telephone systems. Companies are increasingly recognising that SIP Trunking eliminates the need for expensive physical lines, reduces call rates (especially for long-range and international calls) and consolidates voice and data traffic to a single internet connection. Not only does this reduce operating expenses (OPEX) and reduce recurring costs and maintenance, but it also releases capital expenses (CAPEX) that would otherwise be spent on legacy hardware, allowing companies to realise resources for more strategic initiatives.

Another significant factor is the growing adoption of cloud-based communication solutions and unified communications (UC). As organizations adopt cloud services for greater flexibility, scalability and remote work resources, SIP becomes a natural adjustment, allowing a perfect integration between cloud-based applications, UC platforms (which combine voice, video, instant messages and collaboration tools) and public telephone networks. The scalability inherent in SIP's junction allows companies to quickly adjust the up or down communication channels based on their evolutionary needs, supporting dynamic labour forces and ensuring business continuity, all crucial factors in the current digital transformation scenario.

SIP Trunking Services Market Segmentation analysis

The Global SIP Trunking Services is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Hosted, On Premise . The Application segment categorizes the market based on its usage such as Video, Voice, Web Conferencing, Streaming Media, Desktop Sharing. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The SIP service market is characterised by intense competition between a diversified range of providers, including large telecommunications operators, cloud communication companies and unified communications suppliers. Leading players such as AT&T, Verizon, Twilio, 8x8, Vonage, Bandwidth and RingCentral are at the forefront, offering scalable and economical solutions adapted to companies that transition from traditional IP-based communications. These companies are focused on improving service reliability, security and integration with unified communication platforms to meet business evolution needs.

The competitive scenario is even more intensified by the rise of cloud-based solutions and the integration of SIP junction with unified communications and collaboration tools (UC & C). Suppliers are investing in technological advances to offer perfect communication experiences on voice, video and messaging platforms, meeting the growing demand for remote and hybrid work environments.

Challenges In SIP Trunking Services Market

The SIP Service Market faces several remarkable challenges that can affect its growth and adoption. An important issue is the lack of awareness among small and medium-sized businesses (SMEs) about the benefits and implementation of SIP junction, which limits market penetration in certain segments. In addition, security concerns are significant, as SIP Set solutions depend greatly on internet connectivity, making companies vulnerable to cyber threats such as fraud, call sequestration and data violations. The need for robust cyber security and continuous monitoring measures is essential but adds complexity and cost to providers and service users.

Competition from alternative communication solutions such as Unified Communications as a Service (UCaaS) also has challenges, as these platforms offer similar benefits and can attract potential customers away from traditional SIP tombs services. Regulatory and legal complexities, including compliance with data protection laws and varied government policies, further complicate market expansion and service provision. Finally, the reliable and high-speed infrastructure requirement on the Internet can be a barrier in regions with limited connectivity, making it difficult to adopt the broader in developing markets.

Risks & Prospects in SIP Trunking Services Market

Rapid expansion in remote work; demand for scalable and economic communication solutions; and integration with advanced technologies such as artificial intelligence and IoT are further feeding market growth. The main sectors, such as BFSI, health, IT and telecommunications, and retail, are increasingly leveraging SIP Services for enhanced connectivity, better customer involvement, and operational efficiency.

Regionally, Pacific Asia is emerging as a high-growth market, with a respected CAGR in some subregions, driven by rapid digitisation, government initiatives and robust telecommunications infrastructure investments. North America and Europe continue to maintain substantial market quotas due to early adoption and the strong presence of major telecommunications suppliers. Meanwhile, emerging markets in South America and Africa are witnessing rapid growth, supported by increased internet penetration, investments in telecommunications infrastructure and the rise of remote work culture.

Key Target Audience

,

The main target audience for the SIP trunking service market covers companies of all sizes, including small and medium-sized businesses (SMEs) and large corporations. SMEs are increasingly adopting SIP entertainment services due to their cost-benefit and scalability, allowing them to improve communication resources without significant infrastructure investments. Large companies, on the other hand, leverage the junction to optimise communications in various locations, ensuring uninterrupted connectivity and efficient management of high call volumes. These organizations prioritize resources such as reliability, security and integration with existing systems to support their complex communication needs.

, Another significant segment includes telecommunications operators, cloud service providers and system integrators. These entities play a crucial role in providing SIP Set solutions to end users, offering services ranging from infrastructure provision to custom communication solutions. They focus on the development of scalable, safe and interoperable services of SIP tombs that can meet various industry requirements. In addition, managed service providers (MSPs) and IT consulting firms are public, as they usually work as intermediaries, helping companies implement and manage SIP trunking services effectively. Understanding the needs and preferences of these stakeholders is essential for suppliers aimed at expanding their presence in the market and providing value-added services.

Merger and acquisition

The SIP Service Market has witnessed remarkable merger and acquisition activities (mergers and acquisitions) in recent years, reflecting the dynamic nature of the sector and the strategic movements of major participants to improve their positions in the market. In January 2024, Siris Capital acquired Bearcom to reinforce its technology portfolio, indicating a focus on expanding resources in the SIP domain. In addition, in March 2021, RingCentral, Inc. acquired Kindite's technology and engineering team, a developer of cryptographic technologies, to improve security resources on its global communication platform. These acquisitions highlight the importance of integrating advanced technologies to meet the evolution of safe and efficient communication services.

In addition, the market has seen strategic acquisitions designed to expand service offers and geographical reach. In June 2020, SMBS AB acquired ACL Mobile Limited, a supplier of cloud communication services in India and Southeast Asia, to strengthen its presence in emerging markets. Similarly, in November 2020, Net2phone, Inc. launched its fully localised solution of cloud communications in Peru and announced plans to expand to six new cities in Brazil, reflecting a strategic measure to capture growth opportunities in Latin America. These developments highlight the ongoing consolidation and expansion efforts in the SIP Services market, driven by the need to offer comprehensive, safe and scalable communication solutions around the world.

Analyst Comment

The SIP Service Market is witnessing robust growth, fuelled by the ongoing digital transformation of commercial communications, the increase in the adoption of cloud-based voice solutions, and the change in telephone systems inherited to more flexible, economic and scalable alternatives. The global market was valued at approximately $16.6-18.7 billion by 2025, with some predictions that the market can reach as high as $255 billion by 2034, depending on the scope and segmentation considered. This expansion is driven by the demand for unified communications, improving business agility and the need for remote work solutions.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 SIP Trunking Services- Snapshot

- 2.2 SIP Trunking Services- Segment Snapshot

- 2.3 SIP Trunking Services- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: SIP Trunking Services Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hosted

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 On Premise

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: SIP Trunking Services Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Voice

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Video

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Streaming Media

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Web Conferencing

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Desktop Sharing

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: SIP Trunking Services Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 BT (U.K.)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 CenturyLink (U.S.)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Colt Technology Services Group Limited (U.K.)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Fusion Incorporated (U.S.)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 GTT Communications

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Inc. (U.S.)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 IBM Corporation (U.S.)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Intelepeer Cloud Communications LLC. (U.S.)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Intrado Corporation (U.S.)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Mitel Networks Corp. (Canada)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 NET2PHONE (U.S.)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Nextiva (U.S.)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 ORANGE (France)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Rogers Communications (Canada)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 TELSTRA (Australia)

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 TWILIO Inc. (U.S.)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Verizon (U.S.)

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Vonage (U.S.)

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Voyant Communications (U.S.)

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of SIP Trunking Services in 2030?

+

-

Which application type is expected to remain the largest segment in the Global SIP Trunking Services market?

+

-

How big is the Global SIP Trunking Services market?

+

-

How do regulatory policies impact the SIP Trunking Services Market?

+

-

What major players in SIP Trunking Services Market?

+

-

What applications are categorized in the SIP Trunking Services market study?

+

-

Which product types are examined in the SIP Trunking Services Market Study?

+

-

Which regions are expected to show the fastest growth in the SIP Trunking Services market?

+

-

Which application holds the second-highest market share in the SIP Trunking Services market?

+

-

What are the major growth drivers in the SIP Trunking Services market?

+

-

The SIP service market is mainly driven by the convincing cost savings and efficiency gains it offers compared to traditional telephone systems. Companies are increasingly recognising that SIP Trunking eliminates the need for expensive physical lines, reduces call rates (especially for long-range and international calls) and consolidates voice and data traffic to a single internet connection. Not only does this reduce operating expenses (OPEX) and reduce recurring costs and maintenance, but it also releases capital expenses (CAPEX) that would otherwise be spent on legacy hardware, allowing companies to realise resources for more strategic initiatives.

Another significant factor is the growing adoption of cloud-based communication solutions and unified communications (UC). As organizations adopt cloud services for greater flexibility, scalability and remote work resources, SIP becomes a natural adjustment, allowing a perfect integration between cloud-based applications, UC platforms (which combine voice, video, instant messages and collaboration tools) and public telephone networks. The scalability inherent in SIP's junction allows companies to quickly adjust the up or down communication channels based on their evolutionary needs, supporting dynamic labour forces and ensuring business continuity, all crucial factors in the current digital transformation scenario.