Global Single Pair Ethernet Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-654 | Energy and Natural Resources | Last updated: Mar, 2025 | Formats*:

Single Pair Ethernet Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

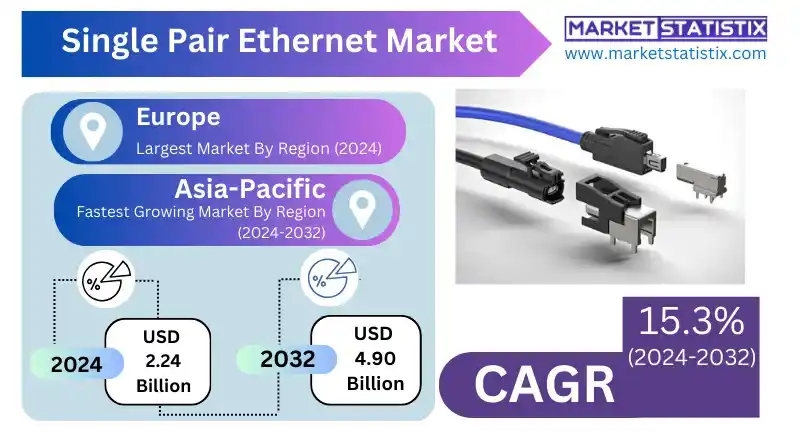

| Growth Rate | CAGR of 15.3% |

| Forecast Value (2032) | USD 4.90 Billion |

| By Product Type | Infrastructure and Device Components, Solutions and Services |

| Key Market Players |

|

| By Region |

|

Single Pair Ethernet Market Trends

The SPE industry is consensus to be among the fastest-growing industries, with huge demand for its efficient and lightweight communication arrangements arising from various industrial applications. A primary one is increasing applications of SPE in industrial automation, allowing undisturbed connectivity for sensors and actuators and hence its contributions toward Industry 4.0. Moreover, applications of SPE have been growing at an unprecedented rate in the automotive sector for in-vehicle networking; this is being driven by requirements for reduced cabling congestion and weight in electric and fully automatic vehicles. The process of developing and standardizing SPE technology, especially by IEEE 802.3, will serve as a major driver for the market. Another important trend affecting the market is interoperability and standardization to make sure that SPE devices from different vendors can seamlessly integrate. The market is witnessing growing innovations in SPE chipsets and connectors to enhance performance and keep costs down. In addition, the adoption of SPE for smart building applications in building automation is steadily advancing, providing great solutions for lighting, HVAC, and security systems.Single Pair Ethernet Market Leading Players

The key players profiled in the report are Würth Elektronik, Intel Corporation, Belden Inc., Broadcom Inc., HARTING Technology Group, Weidmüller Interface GmbH & Co. KG, Bosch Rexroth AG, Texas Instruments, OMRON Corporation, Phoenix Contact, Molex LLC, TE Connectivity, Analog Devices Inc., Siemens AG, Microchip Technology Inc.Growth Accelerators

The forces driving the market for Single Pair Ethernet (SPE) are mainly the demand for comparatively more efficient and cost-effective data communication in the industrial and automotive sectors. Industry 4.0 and the explosion of IoT devices require a simplified cabling solution that SPE can provide by trimming down cable weight and space requirements. This simplification of cabling architectures is vital where it is necessary to integrate sensors and actuators into restricted spaces for higher automation and data compilation. Moreover, the demand for standardized, interoperable communication protocols across a variety of industrial applications is giving SPE traction. The technology is also essential for data transfer with longer distances and lower power consumption in applications like building automation and process control. The economic benefits of reduced installation costs and cheap maintenance, coupled with an increasing number of SPE-ready devices, will further drive its market growth.Single Pair Ethernet Market Segmentation analysis

The Global Single Pair Ethernet is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Infrastructure and Device Components, Solutions and Services . The Application segment categorizes the market based on its usage such as Machinery, Smart Buildings, Industrial Automation, Energy, Robotics & Automation, Energy & Utilities, Automotive & Transportation, Healthcare. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Competitive landscape of the market Single Pair Ethernet consists of a blend of established entities garnering footprints along with developing firms, all thriving in a race for coffers by establishing their bright positions in this dynamic corporate ecosystem. Competitors would comprise semiconductor manufacturing companies oriented in supplying SPE chips, cable and connector providers involved in developing optimized SPE cabling solutions, and industrial automation companies joining SPE into their product portfolios. The competitive arena is churning with strategic alliances and partnerships around the standardization of SPE technology and its rapid adoption in several industries. All of these factors shall eventually create a breeding ground for innovation as well as low-cost, high-performance SPE solutions.Challenges In Single Pair Ethernet Market

The production of the Single Pair Ethernet (SPE) market is desperately challenged, resulting in slow proliferation. One important factor is the absence of awareness and knowledge regarding SPE technology among potential end-users. Many industries are still working under traditional communication protocols and may refrain from moving to a new technology without a clear comprehension of its advantages and requirements for implementation. Because of this knowledge gap, the product adoption rate suffers since organizations may avoid investing in infrastructure that is new to them. Another major issue relates to integration with existing infrastructure and devices. Industries that have made significant investments in traditional Ethernet and other communication protocols may encounter difficulty in their SPE integration into existing systems. To avoid time and money, the transition to SPE may require major alterations to the infrastructure. Restraints on the SPE market include the availability of alternative communication technology, namely traditional Ethernet, Wi-Fi, and cellular communication.Risks & Prospects in Single Pair Ethernet Market

The Single Pair Ethernet (SPE) market has huge growth potential across various sectors, especially industrial automation and automotive. The industrial segment gains significantly from SPE in terms of simplified cabling and effective integrations of sensors and actuators, which form the basis of Industry 4.0 applications. Lastly, SPE is lightweight and space-saving, making it a need for advanced driver-assistance systems (ADAS) and in-vehicle networking in the automotive industry. The further development of common technologies for SPE and increasing demand for efficient and low-cost communication technologies are some important market-driving factors. Europe thus takes the pole position in SPE attraction, given the strong demand for this technology in the automotive and industrial automation sectors, underpinned by active standardization efforts. The burgeoning countries of Asia-Pacific are also in very fertilizing ground, nurturing rapid growth within their borders through the expansive manufacturing base and increasingly mobilizing investments in industrial automation and smart city initiatives. North America is also fast contributing because of the increasing interest in SPE for industrial and building-related applications, especially with regard to IoT deployment. The global expansion of this market will continue as SPE matures and becomes widely accepted in different sectors.Key Target Audience

The SPE market targets industries that demand efficient and scalable communication solutions, especially for industrial automation and automotive sectors. In industrial automation, SPE ensures reliable high-speed data transfer between devices like sensors, actuators, and controllers, hence streamlining the entire manufacturing process and improving operational efficiency. Furthermore, it delivers power and data over one pair of wires, reducing installation work and infrastructure complications; thus, SPE is ideal for Industry 4.0.,, In the automotive sector, SPE adoption is being driven by increasing electronic control unit (ECU) and sensor integration into modern vehicles. Conventional communication methods often fail under the increasing data demand posed by advanced driver-assistance systems (ADAS) and infotainment platforms. SPE provides a scalable, future-proof solution for onboard high-speed data transmission while enabling mass reduction and less complexity in vehicle cabling.Merger and acquisition

Very recently alliances have been formed in the Single Pair Ethernet (SPE) market to advance building automation. In January 2024, Honeywell International Inc. and Analog Devices Inc. entered into a partnership to incorporate Analog Devices' SPE and software-configurable input/output solutions into Honeywell's building management systems. In effect, it aims to advance building automation through the SPE technology's efficient means of transmitting data over a single twisted pair of wires. Then, in January 2021, Belden Inc. acquired automation networking infrastructure solution provider OTN Systems N.V. for about $71 million. This acquisition is purportedly to enhance Belden's already considerable industrial automation and networking portfolio and may have implications for the SPE market by strengthening the company's abilities to provide integrated networking solutions. >Analyst Comment

The Single Pair Ethernet (SPE) market continues to grow rapidly. Adoption in the industrial and automotive sectors for more efficient and cost-effective communication drives this market. The major factors that drive the market include the weight-and-space-saving cabling systems, the rise of Industry 4.0, IoT applications, and the connectivity requirement for automation environments. Technological advancements in standards and components SPE are enabling more widespread adoption and allowing for more efficient and streamlined data transmission.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Single Pair Ethernet- Snapshot

- 2.2 Single Pair Ethernet- Segment Snapshot

- 2.3 Single Pair Ethernet- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Single Pair Ethernet Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Infrastructure and Device Components

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Solutions and Services

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Single Pair Ethernet Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Robotics & Automation

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive & Transportation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Energy

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Machinery

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Industrial Automation

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Smart Buildings

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Energy & Utilities

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Healthcare

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

6: Single Pair Ethernet Market by Technology Type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Single Pair Etheet (SPE)

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Power over Data Line (PoDL)

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 2-Pair Etheet

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Advanced Etheet Technologies

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Single Pair Ethernet Market by Connectivity Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Wired Connectivity

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Wireless Connectivity

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Single Pair Ethernet Market by End-User Industry

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Manufacturing

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Transportation & Logistics

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Telecommunications

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Oil & Gas

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

- 8.6 Building Automation

- 8.6.1 Key market trends, factors driving growth, and opportunities

- 8.6.2 Market size and forecast, by region

- 8.6.3 Market share analysis by country

9: Single Pair Ethernet Market by Component Type

- 9.1 Overview

- 9.1.1 Market size and forecast

- 9.2 Cabling

- 9.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.2 Market size and forecast, by region

- 9.2.3 Market share analysis by country

- 9.3 Connectors

- 9.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.2 Market size and forecast, by region

- 9.3.3 Market share analysis by country

- 9.4 Switches

- 9.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.2 Market size and forecast, by region

- 9.4.3 Market share analysis by country

- 9.5 Adapters

- 9.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.2 Market size and forecast, by region

- 9.5.3 Market share analysis by country

- 9.6 Network Interface Cards (NICs)

- 9.6.1 Key market trends, factors driving growth, and opportunities

- 9.6.2 Market size and forecast, by region

- 9.6.3 Market share analysis by country

10: Single Pair Ethernet Market by Region

- 10.1 Overview

- 10.1.1 Market size and forecast By Region

- 10.2 North America

- 10.2.1 Key trends and opportunities

- 10.2.2 Market size and forecast, by Type

- 10.2.3 Market size and forecast, by Application

- 10.2.4 Market size and forecast, by country

- 10.2.4.1 United States

- 10.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.1.2 Market size and forecast, by Type

- 10.2.4.1.3 Market size and forecast, by Application

- 10.2.4.2 Canada

- 10.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.2.2 Market size and forecast, by Type

- 10.2.4.2.3 Market size and forecast, by Application

- 10.2.4.3 Mexico

- 10.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.2.4.3.2 Market size and forecast, by Type

- 10.2.4.3.3 Market size and forecast, by Application

- 10.2.4.1 United States

- 10.3 South America

- 10.3.1 Key trends and opportunities

- 10.3.2 Market size and forecast, by Type

- 10.3.3 Market size and forecast, by Application

- 10.3.4 Market size and forecast, by country

- 10.3.4.1 Brazil

- 10.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.1.2 Market size and forecast, by Type

- 10.3.4.1.3 Market size and forecast, by Application

- 10.3.4.2 Argentina

- 10.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.2.2 Market size and forecast, by Type

- 10.3.4.2.3 Market size and forecast, by Application

- 10.3.4.3 Chile

- 10.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.3.2 Market size and forecast, by Type

- 10.3.4.3.3 Market size and forecast, by Application

- 10.3.4.4 Rest of South America

- 10.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.3.4.4.2 Market size and forecast, by Type

- 10.3.4.4.3 Market size and forecast, by Application

- 10.3.4.1 Brazil

- 10.4 Europe

- 10.4.1 Key trends and opportunities

- 10.4.2 Market size and forecast, by Type

- 10.4.3 Market size and forecast, by Application

- 10.4.4 Market size and forecast, by country

- 10.4.4.1 Germany

- 10.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.1.2 Market size and forecast, by Type

- 10.4.4.1.3 Market size and forecast, by Application

- 10.4.4.2 France

- 10.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.2.2 Market size and forecast, by Type

- 10.4.4.2.3 Market size and forecast, by Application

- 10.4.4.3 Italy

- 10.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.3.2 Market size and forecast, by Type

- 10.4.4.3.3 Market size and forecast, by Application

- 10.4.4.4 United Kingdom

- 10.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.4.2 Market size and forecast, by Type

- 10.4.4.4.3 Market size and forecast, by Application

- 10.4.4.5 Benelux

- 10.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.5.2 Market size and forecast, by Type

- 10.4.4.5.3 Market size and forecast, by Application

- 10.4.4.6 Nordics

- 10.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.6.2 Market size and forecast, by Type

- 10.4.4.6.3 Market size and forecast, by Application

- 10.4.4.7 Rest of Europe

- 10.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 10.4.4.7.2 Market size and forecast, by Type

- 10.4.4.7.3 Market size and forecast, by Application

- 10.4.4.1 Germany

- 10.5 Asia Pacific

- 10.5.1 Key trends and opportunities

- 10.5.2 Market size and forecast, by Type

- 10.5.3 Market size and forecast, by Application

- 10.5.4 Market size and forecast, by country

- 10.5.4.1 China

- 10.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.1.2 Market size and forecast, by Type

- 10.5.4.1.3 Market size and forecast, by Application

- 10.5.4.2 Japan

- 10.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.2.2 Market size and forecast, by Type

- 10.5.4.2.3 Market size and forecast, by Application

- 10.5.4.3 India

- 10.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.3.2 Market size and forecast, by Type

- 10.5.4.3.3 Market size and forecast, by Application

- 10.5.4.4 South Korea

- 10.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.4.2 Market size and forecast, by Type

- 10.5.4.4.3 Market size and forecast, by Application

- 10.5.4.5 Australia

- 10.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.5.2 Market size and forecast, by Type

- 10.5.4.5.3 Market size and forecast, by Application

- 10.5.4.6 Southeast Asia

- 10.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.6.2 Market size and forecast, by Type

- 10.5.4.6.3 Market size and forecast, by Application

- 10.5.4.7 Rest of Asia-Pacific

- 10.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 10.5.4.7.2 Market size and forecast, by Type

- 10.5.4.7.3 Market size and forecast, by Application

- 10.5.4.1 China

- 10.6 MEA

- 10.6.1 Key trends and opportunities

- 10.6.2 Market size and forecast, by Type

- 10.6.3 Market size and forecast, by Application

- 10.6.4 Market size and forecast, by country

- 10.6.4.1 Middle East

- 10.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 10.6.4.1.2 Market size and forecast, by Type

- 10.6.4.1.3 Market size and forecast, by Application

- 10.6.4.2 Africa

- 10.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 10.6.4.2.2 Market size and forecast, by Type

- 10.6.4.2.3 Market size and forecast, by Application

- 10.6.4.1 Middle East

- 11.1 Overview

- 11.2 Key Winning Strategies

- 11.3 Top 10 Players: Product Mapping

- 11.4 Competitive Analysis Dashboard

- 11.5 Market Competition Heatmap

- 11.6 Leading Player Positions, 2022

12: Company Profiles

- 12.1 OMRON Corporation

- 12.1.1 Company Overview

- 12.1.2 Key Executives

- 12.1.3 Company snapshot

- 12.1.4 Active Business Divisions

- 12.1.5 Product portfolio

- 12.1.6 Business performance

- 12.1.7 Major Strategic Initiatives and Developments

- 12.2 Texas Instruments

- 12.2.1 Company Overview

- 12.2.2 Key Executives

- 12.2.3 Company snapshot

- 12.2.4 Active Business Divisions

- 12.2.5 Product portfolio

- 12.2.6 Business performance

- 12.2.7 Major Strategic Initiatives and Developments

- 12.3 HARTING Technology Group

- 12.3.1 Company Overview

- 12.3.2 Key Executives

- 12.3.3 Company snapshot

- 12.3.4 Active Business Divisions

- 12.3.5 Product portfolio

- 12.3.6 Business performance

- 12.3.7 Major Strategic Initiatives and Developments

- 12.4 Analog Devices Inc.

- 12.4.1 Company Overview

- 12.4.2 Key Executives

- 12.4.3 Company snapshot

- 12.4.4 Active Business Divisions

- 12.4.5 Product portfolio

- 12.4.6 Business performance

- 12.4.7 Major Strategic Initiatives and Developments

- 12.5 Bosch Rexroth AG

- 12.5.1 Company Overview

- 12.5.2 Key Executives

- 12.5.3 Company snapshot

- 12.5.4 Active Business Divisions

- 12.5.5 Product portfolio

- 12.5.6 Business performance

- 12.5.7 Major Strategic Initiatives and Developments

- 12.6 Weidmüller Interface GmbH & Co. KG

- 12.6.1 Company Overview

- 12.6.2 Key Executives

- 12.6.3 Company snapshot

- 12.6.4 Active Business Divisions

- 12.6.5 Product portfolio

- 12.6.6 Business performance

- 12.6.7 Major Strategic Initiatives and Developments

- 12.7 Phoenix Contact

- 12.7.1 Company Overview

- 12.7.2 Key Executives

- 12.7.3 Company snapshot

- 12.7.4 Active Business Divisions

- 12.7.5 Product portfolio

- 12.7.6 Business performance

- 12.7.7 Major Strategic Initiatives and Developments

- 12.8 TE Connectivity

- 12.8.1 Company Overview

- 12.8.2 Key Executives

- 12.8.3 Company snapshot

- 12.8.4 Active Business Divisions

- 12.8.5 Product portfolio

- 12.8.6 Business performance

- 12.8.7 Major Strategic Initiatives and Developments

- 12.9 Broadcom Inc.

- 12.9.1 Company Overview

- 12.9.2 Key Executives

- 12.9.3 Company snapshot

- 12.9.4 Active Business Divisions

- 12.9.5 Product portfolio

- 12.9.6 Business performance

- 12.9.7 Major Strategic Initiatives and Developments

- 12.10 Würth Elektronik

- 12.10.1 Company Overview

- 12.10.2 Key Executives

- 12.10.3 Company snapshot

- 12.10.4 Active Business Divisions

- 12.10.5 Product portfolio

- 12.10.6 Business performance

- 12.10.7 Major Strategic Initiatives and Developments

- 12.11 Siemens AG

- 12.11.1 Company Overview

- 12.11.2 Key Executives

- 12.11.3 Company snapshot

- 12.11.4 Active Business Divisions

- 12.11.5 Product portfolio

- 12.11.6 Business performance

- 12.11.7 Major Strategic Initiatives and Developments

- 12.12 Belden Inc.

- 12.12.1 Company Overview

- 12.12.2 Key Executives

- 12.12.3 Company snapshot

- 12.12.4 Active Business Divisions

- 12.12.5 Product portfolio

- 12.12.6 Business performance

- 12.12.7 Major Strategic Initiatives and Developments

- 12.13 Molex LLC

- 12.13.1 Company Overview

- 12.13.2 Key Executives

- 12.13.3 Company snapshot

- 12.13.4 Active Business Divisions

- 12.13.5 Product portfolio

- 12.13.6 Business performance

- 12.13.7 Major Strategic Initiatives and Developments

- 12.14 Intel Corporation

- 12.14.1 Company Overview

- 12.14.2 Key Executives

- 12.14.3 Company snapshot

- 12.14.4 Active Business Divisions

- 12.14.5 Product portfolio

- 12.14.6 Business performance

- 12.14.7 Major Strategic Initiatives and Developments

- 12.15 Microchip Technology Inc.

- 12.15.1 Company Overview

- 12.15.2 Key Executives

- 12.15.3 Company snapshot

- 12.15.4 Active Business Divisions

- 12.15.5 Product portfolio

- 12.15.6 Business performance

- 12.15.7 Major Strategic Initiatives and Developments

13: Analyst Perspective and Conclusion

- 13.1 Concluding Recommendations and Analysis

- 13.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Technology Type |

|

By Connectivity Type |

|

By End-User Industry |

|

By Component Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Single Pair Ethernet in 2032?

+

-

What is the growth rate of Single Pair Ethernet Market?

+

-

What are the latest trends influencing the Single Pair Ethernet Market?

+

-

Who are the key players in the Single Pair Ethernet Market?

+

-

How is the Single Pair Ethernet } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Single Pair Ethernet Market Study?

+

-

What geographic breakdown is available in Global Single Pair Ethernet Market Study?

+

-

Which region holds the second position by market share in the Single Pair Ethernet market?

+

-

Which region holds the highest growth rate in the Single Pair Ethernet market?

+

-

How are the key players in the Single Pair Ethernet market targeting growth in the future?

+

-