Global Sheep Milk Powder Market – Industry Trends and Forecast to 2030

Report ID: MS-842 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

Sheep milk powder is dehydrated sheep's milk turned into powder to prolong its shelf life and ease storage and transport. The powder of sheep milk still offers many of the nutritional benefits of liquid sheep milk, such as higher protein, fat, vitamins, and minerals than cow's milk. It is pretty versatile, being used on different occasions as a nutrient-dense ingredient with a distinct flavour profile endowed by sheep milk.

The demand for this market is increasing due to rising consumer awareness of its nutritional benefits, such as higher calcium and essential vitamins, and potential suitability among sensitive populations toward cow's milk. The powder is used in the manufacture of infant formula, various dairy products including cheeses and yoghurts, baked goods, confectionery, and cosmetics owing to its rich nutrient content. With the rising demand for alternative and nutrient-dense food-grade ingredients, the sheep milk powder market witness’s growth. The versatility, along with health benefits, gives it an edge.

Sheep Milk Powder Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

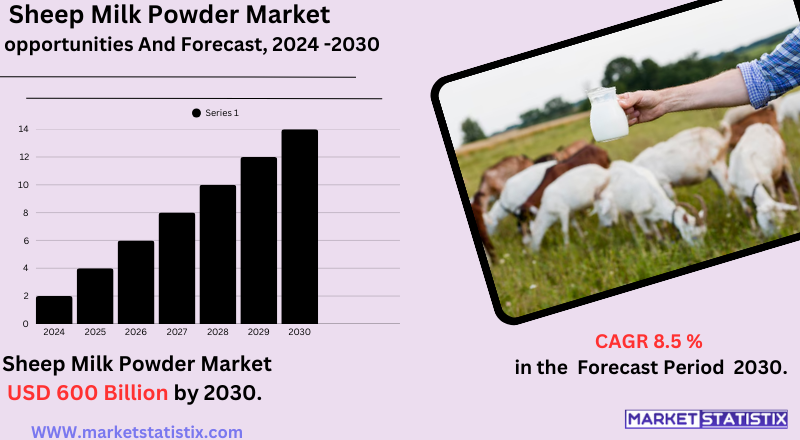

| Growth Rate | CAGR of 8.5% |

| Forecast Value (2030) | USD 600 Billion |

| By Product Type | Natural, Organic |

| Key Market Players |

|

| By Region |

|

Sheep Milk Powder Market Trends

Among holding trends is the increasing demand for organic and naturally processed sheep milk powder, keeping in line with a broader health-and-wellness movement. Beyond traditional dairy uses, the application of sheep milk powder is increasingly utilised in infant formula, nutritional supplements, and even in cosmetics, which reflects the market diversification.

Another considerable trend is the rising inclination toward artisanal and premium sheep milk powder types of products. Consumers preferring a particular flavour are ready to pay more, believing the smaller-scale production systems produce higher-quality products. The growth of online retailing has induced an extended market reach as producers utilise these scores to link directly to the consumers on a global level; in turn, higher-level emerging markets, mostly in the Asia-Pacific landscape, present greater acceptance due to increased disposable incomes and escalating nutrition-orientated demand for dairy replacements.

Sheep Milk Powder Market Leading Players

The key players profiled in the report are DGC, Secret Lands Farm, Danone, Origin earth Ltd, Fineboon, Ausnutria dairy, Ovino, Red Star, Shengfei, YaTai-PreciousGrowth Accelerators

The sheep milk powder market is growing due to several reasons. Having consumer preference tipping towards nutrient-rich alternatives over common cow's milk powder, the health-conscious status of consumers ought to be the first reason. With sheep milk naturally richer in proteins, calcium, vitamins such as A, B, and E, and good fats, the powdered form offers a great alternative for those pursuing a healthy lifestyle. This nutritional superiority certainly drives the market forward.

Another factor increasing demand for digestible alternatives such as sheep milk powder is the rise in the number of lactose-intolerant individuals and those allergic to cow's milk. It has slightly less lactose and a different protein structure as opposed to cow's milk, thus making it easier, albeit just for a few people with sensitivities, to tolerate. On another note, the demand for speciality and gourmet dairy products that take advantage of the unique taste and texture of sheep milk brings further development to sheep milk powder as an ingredient. Lastly, increasing uses of sheep milk powder are found in infant formulas, cosmetics, and sports nutrition, keeping pushes in the sheep's milk powder market.

Sheep Milk Powder Market Segmentation analysis

The Global Sheep Milk Powder is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Natural, Organic . The Application segment categorizes the market based on its usage such as Supermarkets and Malls, Online Shopping Sites, Brick & Mortar Retailers, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive profile of the market for sheep milk powder is dominated by a blend of long-established dairy firms and specialised small players. Some major players are New Zealand Sheep Milk Company (Blue River), Spring Sheep, Sheep Milk Company Ltd., Origin Earth, and Velvet Cloud, which are mainly located in countries having established industries of sheep dairy, such as Europe and New Zealand. These firms tend to concentrate on sheep milk's health benefits and exceptional characteristics, supplying niche markets such as infant foods, speciality cheese, and nutritionally aware customers.

The market is also experiencing growing interest from large dairy companies seeking to diversify their product portfolios with premium and alternative milk sources. The competition is based on milk quality, processing technology, innovation in products (e.g., varying protein concentration, organic alternatives), and efficient distribution channels, including online sales to tap into more consumers.

Challenges In Sheep Milk Powder Market

The sheep milk powder industry has a number of major challenges that affect its scalability and growth. One such major challenge is that it lacks sophisticated processing technology compared to the well-established cow milk powder industry, which makes it hard to ensure nutritional integrity and cost-effectiveness in the production process. Moreover, production is at a high cost and yields limited milk per sheep, making the sheep milk powder more expensive, limiting its affordability and greater market reach, particularly where prices are sensitive, such as in Europe. Raw material price volatility and the use of special infrastructure increase operational complexity and profitability issues.

Supply chain interruptions, including those resulting from international events like the COVID-19 pandemic and geopolitical tensions, have also introduced uncertainty in production and distribution, complicating producers' ability to ensure stable supply and pricing. In addition, the relatively high level of lactose in sheep milk can restrict its popularity among lactose-intolerant consumers, while strict quality control and food safety regulations necessitate continuous investment in technology and expertise. These combined elements require strong supply chain management, ongoing technological advancements, and strategic market positioning in order to overcome existing obstacles and take advantage of the market's growth potential.

Risks & Prospects in Sheep Milk Powder Market

The sheep milk powder industry is witnessing robust growth prospects. The demand for functional foods, particularly in the case of lactose-intolerant consumers, is enhancing the demand for sheep milk powder as a healthy alternative to cow milk. The scope of markets further expands considering its purchase in the growing industries of baby food, dietary supplements, and cosmetics. E-commerce and speciality retail channels have increased the accessibility of these products, with product innovation – the latest ones being dietary supplements and functional foods – continually providing opportunities for investment and entry.

In terms of revenue, Asia-Pacific markets lead due to higher sheep populations, increasing sheep farming activities, and rising demand for sheep milk products in populous countries such as China and India. The region is also favouring government policies, growing disposable incomes, and a large health-conscious consumer base. North America, although smaller in terms of market share at present, is expected to register the highest CAGR due to favourable dairy industry policies, increasing per capita income, and the presence of key market players. Europe remains an important market due to its well-established dairy traditions and preference for products derived from sheep milk. Market though is slated for a significant upsurge across all major regions, with each region contributing different drivers such as population growth, health trends, or regulatory support.

Key Target Audience

The market for sheep milk powder mainly focuses on consumers who are health-conscious, such as people who have lactose intolerance or allergies to cow milk and look for substitute dairy products. Sheep milk powder contains essential nutrients such as protein, calcium, and vitamins, so it is a desirable option for those who wish to increase their nutritional level. Furthermore, the infant nutrition segment is a very important target audience since the composition of sheep milk is similar to human milk, providing a hypoallergenic option for infants with sensitivity.

,

, Another primary target audience includes the food and beverages sector, especially gourmet and artisanal producers. Sheep milk powder's distinctive taste and nutritional attributes render it a luxury item of choice for superior cheese, yoghurt, and ice cream products. In addition, the cosmetics sector leverages sheep milk powder for its skin-caring benefits and adds it to creams and lotions. The market also attracts consumers in developing economies, where growing disposable incomes and expanding health consciousness drive demand for premium-quality, natural dairy alternatives.

Merger and acquisition

Though certain recent mergers and acquisitions specifically involving sheep milk powder businesses are not glaringly emphasised in the initial search results, the general sheep milk sector has experienced some action reflecting the patterns of its sub-segments. Indeed, towards the end of 2021, Yili Group, a giant dairy firm, purchased a sizeable shareholding in Ausnutria Dairy, a business recognised for its goat milk powder but also with activities in sheep milk products. This takeover indicates a shift by major dairy players to consolidate their presence in the alternative milk powder market, including sheep milk powder, to diversify product lines and take advantage of increasing demand for such products.

In addition, firms in the sheep milk industry are adopting strategies such as partnerships and expansions to increase their market presence. For example, Maui Milk signed a deal in 2021 to grow its sheep milk business in China, and Spring Sheep Milk established a new office in China in 2020 to increase exports of its sheep milk powder. These actions, though not explicit mergers or acquisitions of powder-specific companies, reflect a competitive environment in which firms are aggressively pursuing growth by expanding the market and forming strategic alliances, which in turn may ultimately result in further consolidation in the sheep milk powder segment as the market matures.

Analyst Comment

The worldwide sheep milk powder market is witnessing steady expansion, with its value expected to be around $8.76 billion by 2027 and grow at a notable compound annual rate between 2022 and 2027. This is driven by increasing consumer knowledge of the superior nutritional quality of sheep milk compared to goat and cow milk in terms of greater protein, calcium, and essential vitamins. Sheep milk powder is being used more and more in infant formulas, health supplements, and high-end dairy products like cheese, yoghurt, and ice cream. Demand is also driven by increasing demand for dairy alternatives among health-conscious and lactose-intolerant consumers, as well as by improvements in processing technologies that improve product quality and shelf life.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Sheep Milk Powder- Snapshot

- 2.2 Sheep Milk Powder- Segment Snapshot

- 2.3 Sheep Milk Powder- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Sheep Milk Powder Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Natural

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Organic

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Sheep Milk Powder Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Supermarkets and Malls

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Online Shopping Sites

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Brick & Mortar Retailers

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Sheep Milk Powder Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Red Star

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Danone

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 DGC

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Fineboon

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Ovino

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Secret Lands Farm

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Origin earth Ltd

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Ausnutria dairy

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Shengfei

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 YaTai-Precious

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Sheep Milk Powder in 2030?

+

-

Which type of Sheep Milk Powder is widely popular?

+

-

What is the growth rate of Sheep Milk Powder Market?

+

-

What are the latest trends influencing the Sheep Milk Powder Market?

+

-

Who are the key players in the Sheep Milk Powder Market?

+

-

How is the Sheep Milk Powder } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Sheep Milk Powder Market Study?

+

-

What geographic breakdown is available in Global Sheep Milk Powder Market Study?

+

-

How are the key players in the Sheep Milk Powder market targeting growth in the future?

+

-

The sheep milk powder market is growing due to several reasons. Having consumer preference tipping towards nutrient-rich alternatives over common cow's milk powder, the health-conscious status of consumers ought to be the first reason. With sheep milk naturally richer in proteins, calcium, vitamins such as A, B, and E, and good fats, the powdered form offers a great alternative for those pursuing a healthy lifestyle. This nutritional superiority certainly drives the market forward.

,

, Another factor increasing demand for digestible alternatives such as sheep milk powder is the rise in the number of lactose-intolerant individuals and those allergic to cow's milk. It has slightly less lactose and a different protein structure as opposed to cow's milk, thus making it easier, albeit just for a few people with sensitivities, to tolerate. On another note, the demand for speciality and gourmet dairy products that take advantage of the unique taste and texture of sheep milk brings further development to sheep milk powder as an ingredient. Lastly, increasing uses of sheep milk powder are found in infant formulas, cosmetics, and sports nutrition, keeping pushes in the sheep's milk powder market.

What are the opportunities for new entrants in the Sheep Milk Powder market?

+

-