Global Service Station Retail and Foodservice in Sweden Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2555 | Service Industry | Last updated: Apr, 2025 | Formats*:

Service Station Retail and Foodservice in Sweden Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

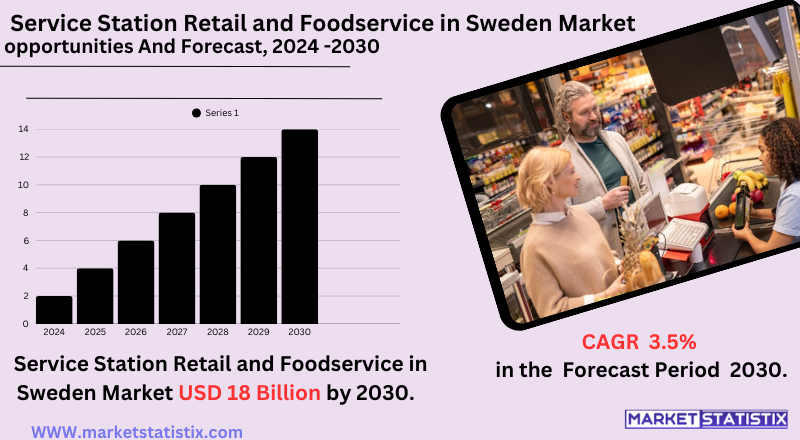

| Growth Rate | CAGR of 3.5% |

| Forecast Value (2030) | USD 18 billion |

| Key Market Players |

|

| By Region |

|

Service Station Retail and Foodservice in Sweden Market Trends

Consumer behaviour transformation and the increased focus on sustainability have served as the catalyst for changes in Sweden in the service station retail and foodservice market. One of the evident trends is the massive diversification of service station offerings beyond conventional fuel dispensing services. Service stations are now complementing their retail operations with a range of high-quality convenience goods, fresh and locally sourced products, and small grocery assortments to meet the needs of local communities and consumers on the go. With the rise in foodservice, the demand is for healthier and more diverse food options. The days of having a simple fast-food offering are gone. The service station operators are partnering with famous food brands or creating their own concepts centred on fresh ingredients, gourmet sandwiches, salads, and ethically sourced coffee. Developments such as mobile ordering and loyalty programmes for enhancing convenience and customer engagement are now becoming commonplace in the Swedish service station retail and foodservice arena.Service Station Retail and Foodservice in Sweden Market Leading Players

The key players profiled in the report are Din-X, Q-Star, Shell (St1), Circle K, Preem, INGO (Circle K), OKQ8, St1Growth Accelerators

Several key drivers propel the service station retail and foodservice market in Sweden. Firstly, with the growing mobility of the population and reliance on personal vehicles for both commuting and leisure travel, there exists a steady need for fuel and other ancillary services. With the growing distance people tend to travel, service stations become important stops to refuel, rest, and pick up some necessities. Secondly, another major driver is the consumer demand for convenience. Modern lifestyles are often highly strapped for time, making the one-stop-shop nature of service stations, retail shops providing fuel, food, and retail goods, extremely appealing for busy individuals and families. Further, the transformation of service stations into full-fledged convenience hubs is a major driver. These places are no longer just for filling up with fuel; many stations have also upgraded their retail and foodservice offerings to a significant degree. Offering high-quality coffee, fresh food options, and convenience goods has brought in clients beyond just fuel purchasers, generating additional revenue streams.Service Station Retail and Foodservice in Sweden Market Segmentation analysis

The Global Service Station Retail and Foodservice in Sweden is segmented by and Region. . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The retail and food service market for service stations in Sweden operates under moderately concentrated competition and offers a combination of major international and strong domestic fuel-retailing firms that have diversified their operations beyond fuel. Important national actors in this segment are OKQ8, Circle K (formerly Statoil), Preem, and Shell (operated by St1), and they have a great impact on competition across the country. These actors compete on fuel prices, convenience and quality of retail offerings, range and attractiveness of foodservice alternatives, and total customer experience at sites. Competition is heating up with a greater emphasis on non-fuel revenue streams that support service stations' profit-making potential, including upgrading the convenience store to provide groceries, snacks, and beverage offerings along with ever more sophisticated foodservice concepts from fast food to more substantial meals and coffee shops. Offering a variety of premium quality food & beverage choices in clean, charming premises and operating successful loyalty programmes are fast becoming key distinguishing features in the new trading environment.Challenges In Service Station Retail and Foodservice in Sweden Market

Structural changes and regulatory influence coupled with changing consumer behaviour have posed formidable barriers for the Swedish service station retail and food service market. One huge aspect concerning the industry is the expected gradual contraction of approximately 1,000 fuel retail sites over the next 10 years, especially in rural locations, generated by increasing legal obligations, profitability challenges, and the gradual transition toward fossil-free fuels. The potential closure of these stations threatens the provision of basic services for the residents, as well as impacting local economies and certain industries like tourism that rely on these stations for such services. E-commerce and digitalisation on a paradigmatic shift in retailing are pushing traditional service station models to either innovate or become obsolete. Companies face pressure to respond to evolving consumer expectations for convenience, sustainability, and differentiated experiences, as generic or undifferentiated simply won't cut it any longer. Integrating automation and digital solutions is a headache for labour adaptation, whilst regulatory compliance with labour standards and data privacy makes market operations even more complex.Risks & Prospects in Service Station Retail and Foodservice in Sweden Market

Increasing the average value of a customer visit is facilitated by service stations diversifying their offerings beyond fuel to include hot food, beverages, and convenience items. Industry leaders such as Circle K, Shell (St1), and OKQ8 are making the best out of this trend by further developing their foodservice and retail offerings, thus placing increasing importance on these two segments. It must also be noted that the car wash segment continues to develop, fuelled by increasing wash occasions per year and rising site-level sales. Regionally, the market remains dominated by only a few key players—OKQ8, Circle K, Shell (St1), and INGO—which maintain the largest networks and highest throughput per site. In 2023, the total number of service stations in Sweden has somewhat decreased to 2,898, but the convenience and foodservice trend is something that can bolster this sector as declining fuel volumes are now affected by fuel-efficient vehicles. Thus, urban and high-traffic areas show the best growth prospects, where demand for rapid good food and retail experiences is highest and where leading retailers have made investments in modernizing and expanding their non-fuel services to capture more of their share.Key Target Audience

Urban commuters, young professionals, and other travellers looking for convenience, quality, and speed are critical target audiences in Sweden's service station retail and foodservice market. In particular, this demographic group aged from 25 to 34 years is highly inclined toward quick-service food and speciality coffee. Because of the high disposable income levels in Sweden, customers are bent on quality and experience rather than cost; fresh, healthy, and local are the prevalent preferences. Service stations serving freshly prepared food, organic snacks, and premium drinks would have a much better chance to capture this market.,, Another significant audience would be the rural and family sections of society that service outstations not only for fuel but also for groceries, postal services, and pharmacy essentials. In such areas, these places act as the nerve centers of the community, providing everything but the traditional conveniences. The Swedish culture is such that any unethical treatment of the environment will not be tolerated, and the masses would flock to social and ecologically responsible businesses that promote natural products and are open and honest about sourcing and production procedures. With these kinds of service stations, they may create loyalty among the conscious consumers.Merger and acquisition

It seems that any recent mergers and acquisitions (M&As) directly related to the Swedish service station retail and foodservice market have not found considerable mention in the immediate very recent past. However, some context can be added by considering what is going on in the broader Swedish retail and foodservice sectors. Some mergers and acquisitions can thus be traced within the wider consumer goods as well as food retail space in Sweden; for example, the Swedish food retail major Axfood has been permitted to acquire the sole control of City Gross since November 2024, which could bear implications for foodservice offerings in those locations, while in May 2023, METRO AG expanded further into Sweden by acquiring Johan i Hallen and Bergfalk, thus pushing consolidation within the wider food supply chain that supports service station foodservice. While direct-and-major acquisitions of service station chains themselves may not be the immediate trend highlighted in the results, the overall retail-and-foodservice market of Sweden is very much alive. Key players in the sphere of service stations such as OKQ8, Circle K, Shell (St1), and Preem are likely going to internally evaluate their operations continuously, including smaller acquisitions or partnerships to enhance their retail and foodservice offerings. The trend that outward displays as the focus obviously seems toward the expansion of convenience retail and service station food service as a means of alternative growth opportunity away from fuel. >Analyst Comment

The evolution of the service station retail and foodservice market in Sweden in 2023 is recorded with a total of 2,898 service stations – a slight decrease of 0.9% over the previous year. The service station market is segmented into fuel, car wash, convenience retail, and food service. Fuel sales always take the lion's share due to vehicles using more fuel; however, it is beginning to note a slight decline due to many vehicles using lesser fuels. Whereas these convenience and foodservice lines have noted very steady growth, with these stations continually adding hot food, beverages, and general items into the mix to increase spending per visit. Circle K, Shell (St1), and OKQ8 all have the highest average value with respect to convenience and, of course, foodservice sales, and all of them have an impressive range of variety in terms of their non-fuel offerings.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Service Station Retail and Foodservice in Sweden- Snapshot

- 2.2 Service Station Retail and Foodservice in Sweden- Segment Snapshot

- 2.3 Service Station Retail and Foodservice in Sweden- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Service Station Retail and Foodservice in Sweden Market by Region

- 4.1 Overview

- 4.1.1 Market size and forecast By Region

- 4.2 North America

- 4.2.1 Key trends and opportunities

- 4.2.2 Market size and forecast, by Type

- 4.2.3 Market size and forecast, by Application

- 4.2.4 Market size and forecast, by country

- 4.2.4.1 United States

- 4.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.2.4.1.2 Market size and forecast, by Type

- 4.2.4.1.3 Market size and forecast, by Application

- 4.2.4.2 Canada

- 4.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.4.2.2 Market size and forecast, by Type

- 4.2.4.2.3 Market size and forecast, by Application

- 4.2.4.3 Mexico

- 4.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 4.2.4.3.2 Market size and forecast, by Type

- 4.2.4.3.3 Market size and forecast, by Application

- 4.2.4.1 United States

- 4.3 South America

- 4.3.1 Key trends and opportunities

- 4.3.2 Market size and forecast, by Type

- 4.3.3 Market size and forecast, by Application

- 4.3.4 Market size and forecast, by country

- 4.3.4.1 Brazil

- 4.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.3.4.1.2 Market size and forecast, by Type

- 4.3.4.1.3 Market size and forecast, by Application

- 4.3.4.2 Argentina

- 4.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.3.4.2.2 Market size and forecast, by Type

- 4.3.4.2.3 Market size and forecast, by Application

- 4.3.4.3 Chile

- 4.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.4.3.2 Market size and forecast, by Type

- 4.3.4.3.3 Market size and forecast, by Application

- 4.3.4.4 Rest of South America

- 4.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 4.3.4.4.2 Market size and forecast, by Type

- 4.3.4.4.3 Market size and forecast, by Application

- 4.3.4.1 Brazil

- 4.4 Europe

- 4.4.1 Key trends and opportunities

- 4.4.2 Market size and forecast, by Type

- 4.4.3 Market size and forecast, by Application

- 4.4.4 Market size and forecast, by country

- 4.4.4.1 Germany

- 4.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.1.2 Market size and forecast, by Type

- 4.4.4.1.3 Market size and forecast, by Application

- 4.4.4.2 France

- 4.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.2.2 Market size and forecast, by Type

- 4.4.4.2.3 Market size and forecast, by Application

- 4.4.4.3 Italy

- 4.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.3.2 Market size and forecast, by Type

- 4.4.4.3.3 Market size and forecast, by Application

- 4.4.4.4 United Kingdom

- 4.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.4.2 Market size and forecast, by Type

- 4.4.4.4.3 Market size and forecast, by Application

- 4.4.4.5 Benelux

- 4.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.5.2 Market size and forecast, by Type

- 4.4.4.5.3 Market size and forecast, by Application

- 4.4.4.6 Nordics

- 4.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.6.2 Market size and forecast, by Type

- 4.4.4.6.3 Market size and forecast, by Application

- 4.4.4.7 Rest of Europe

- 4.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 4.4.4.7.2 Market size and forecast, by Type

- 4.4.4.7.3 Market size and forecast, by Application

- 4.4.4.1 Germany

- 4.5 Asia Pacific

- 4.5.1 Key trends and opportunities

- 4.5.2 Market size and forecast, by Type

- 4.5.3 Market size and forecast, by Application

- 4.5.4 Market size and forecast, by country

- 4.5.4.1 China

- 4.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.1.2 Market size and forecast, by Type

- 4.5.4.1.3 Market size and forecast, by Application

- 4.5.4.2 Japan

- 4.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.2.2 Market size and forecast, by Type

- 4.5.4.2.3 Market size and forecast, by Application

- 4.5.4.3 India

- 4.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.3.2 Market size and forecast, by Type

- 4.5.4.3.3 Market size and forecast, by Application

- 4.5.4.4 South Korea

- 4.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.4.2 Market size and forecast, by Type

- 4.5.4.4.3 Market size and forecast, by Application

- 4.5.4.5 Australia

- 4.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.5.2 Market size and forecast, by Type

- 4.5.4.5.3 Market size and forecast, by Application

- 4.5.4.6 Southeast Asia

- 4.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.6.2 Market size and forecast, by Type

- 4.5.4.6.3 Market size and forecast, by Application

- 4.5.4.7 Rest of Asia-Pacific

- 4.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 4.5.4.7.2 Market size and forecast, by Type

- 4.5.4.7.3 Market size and forecast, by Application

- 4.5.4.1 China

- 4.6 MEA

- 4.6.1 Key trends and opportunities

- 4.6.2 Market size and forecast, by Type

- 4.6.3 Market size and forecast, by Application

- 4.6.4 Market size and forecast, by country

- 4.6.4.1 Middle East

- 4.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 4.6.4.1.2 Market size and forecast, by Type

- 4.6.4.1.3 Market size and forecast, by Application

- 4.6.4.2 Africa

- 4.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 4.6.4.2.2 Market size and forecast, by Type

- 4.6.4.2.3 Market size and forecast, by Application

- 4.6.4.1 Middle East

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 OKQ8

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Circle K

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 Preem

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Shell (St1)

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 INGO (Circle K)

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Q-Star

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Din-X

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 St1

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

| Aspects | Details |

|---|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Service Station Retail and Foodservice in Sweden in 2030?

+

-

How big is the Global Service Station Retail and Foodservice in Sweden market?

+

-

How do regulatory policies impact the Service Station Retail and Foodservice in Sweden Market?

+

-

What major players in Service Station Retail and Foodservice in Sweden Market?

+

-

What applications are categorized in the Service Station Retail and Foodservice in Sweden market study?

+

-

Which product types are examined in the Service Station Retail and Foodservice in Sweden Market Study?

+

-

Which regions are expected to show the fastest growth in the Service Station Retail and Foodservice in Sweden market?

+

-

What are the major growth drivers in the Service Station Retail and Foodservice in Sweden market?

+

-

Is the study period of the Service Station Retail and Foodservice in Sweden flexible or fixed?

+

-

How do economic factors influence the Service Station Retail and Foodservice in Sweden market?

+

-