Global Satin Fabric Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2282 | Manufacturing and Construction | Last updated: Dec, 2024 | Formats*:

Satin Fabric Report Highlights

| Report Metrics | Details |

|---|---|

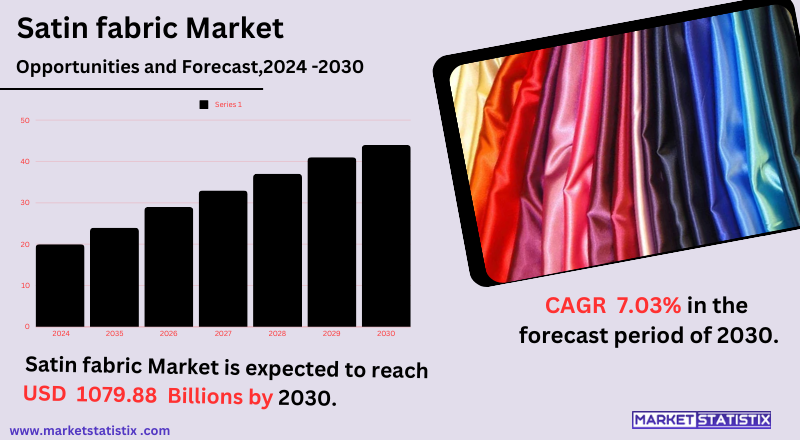

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 7.03% |

| Forecast Value (2030) | USD 1079.88 Billion |

| By Product Type | Natural Fiber, Synthetic Fiber |

| Key Market Players |

|

| By Region |

|

Satin Fabric Market Trends

The satin fabric market is witnessing a gradual increase in the demand for fabrics for absolutely luxurious environments and the usage of satin in evening wear, bridal gowns, and high-end items for both fashion and home textiles, such as bed linens, curtains, and upholstery. Very smooth, satin, and glossy finishes are much required by consumers, especially in markets such as evening wear, bridal gowns, and up-market fashion. As consumer tastes are changing towards gaining fabrics with a more natural, tactile feel, the satin fabric market continues to thrive with rising disposable income and increased luxury spending on both developed and emerging markets. Another trend in the satin fabric market that is becoming more pronounced is going for sustainable or non-pollutants. Because of such trends, the companies are now developing satin fabrics from organic fibres, such as organic cotton, bamboo, and recycled polyester, from that specific consumer demand for sustainability. Innovations in fabric production technologies help in maintaining the trend through advancements offering satin fabrics that are more durable and with additional comfort and performance characteristics. Framing this shift is a broader picture of the movement of the whole industry to ethical and environmentally conscious fashion and interior design.Satin Fabric Market Leading Players

The key players profiled in the report are Dupont, Freudenberg, Fitesa, Kimberly-Clark, Glatfelter, Toray, Low & Bonar, Lydall, Hollingsworth & Vose, Georgia-Pacific, Ahlstrom, Avintiv, AvgolGrowth Accelerators

Luxury and high-end fashion are presently the lifeblood for leading satin fabric markets. It is the smooth, bright sheen and elegance of satin that enhances the beauty of clothes made from it, not limited to evening gowns and wedding dresses but also extending up to formal attire. As the trend in fashion changes, so do people's preferences for satin fabric, and for that, even couture-design collections and ready-to-wear collections would satisfy their inclination, thus keeping the satin fabric in high demand in the textile industry. Satin home décor applications, including bed sheets, curtains, and upholstery, are other reasons for market expansion. The economic indicators that improve the revenue per capita whereby people progress toward luxury consumption are also another driving factor, with emerging markets showing increasing footprints in these higher segments. This made consumers self-dedicated to the purchase of fabrics as assets that are way above non-satin ones. Other applications for satin that would include activewear, interiors, and even automotive textiles further enhance the market presence of satin.Satin Fabric Market Segmentation analysis

The Global Satin Fabric is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Natural Fiber, Synthetic Fiber . The Application segment categorizes the market based on its usage such as Construction, Clothing, Automotive, Other. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for satin fabric is a combination of old and new entrants focusing their efforts on innovation, quality, and cost. In particular, primary textile manufacturers have adopted various advanced technologies and production methods in order to use satin fabrics for industries like fashion, interior design, and home textiles. Also, these major companies take into consideration variation in different satin types, such as silk satin, polyester satin, and acetate satin, for different consumer preferences and market needs. Similarly, such manufacturers generally emphasise production standards within which the company maintains and has held to being environmentally friendly, using sustainable practices.Challenges In Satin Fabric Market

Satin fabrics have some serious constraints, and one of them would be the considerable production costs involved in their production. Satin fabrics feature the specialised weaving techniques employing rather luxurious threads of either silk or synthetic alternatives that make them quite impractical when compared to other fabrics. Because of the thus-associated high costs, their use will be limited in most price-sensitive markets. Another competition is presented by different fabrics that render a similar look at a much lower price. Such is the case of synthetic satin fabrics, which can closely imitate the luxurious look and touch of silk satin but are much less expensive. The more recently discussed trend of sustainable textiles is expected to further study the environmental-adoptive frameworks against concerns about materials and processes in producing satin fabrics. Thus, all these aspects contribute to the complexity of the industry in which satin fabric is dealt with.Risks & Prospects in Satin Fabric Market

The satin fabric market is a booming market with significant demand growth for satin in the fashion and textile markets. The lustrous sheen and smoothness of satin rendered it suitable in the making of high-end fashion apparel, evening outfits, and bridal gowns. Increased luxury fashion trends and rising disposable incomes of consumers in emerging markets provide an opportunity for manufacturers to take the chance and serve affluent customer segments looking for premium and fashionable satin fabric products. These trends will moreover be a driving factor for the satin fabric market, as increased numbers of people are going green and desire sustainable fashions. Increased consumer awareness of the environment will see a climb in the need for eco-friendly satin made from organic silk or recycled fibres. So aside from this new segment, one could also appeal to more consumers by focusing on making their satin more eco-friendly options. There is no stopping the tremendous growth of applications of satin, be it for fashion or home décor; therefore, the future market becomes brighter with a prospect of growth in all respects.Key Target Audience

The audience group directly targeted by the satin fabric market is in the women's fashion and garments industry, more specifically the luxury brands, designers, and manufacturers of evening, bridal, or formal wear apparel that rely on high-gloss fabric quality. Satin's smooth, sheen finish is preferred for premium clothing, accessories, and special occasion garments. Fashion houses and boutiques also use satin for the creation of such luxury products as it helps keywords enrich their offerings with even the customers' most discerning.,, Apart from the fashion end, satin fabric finds another significant audience for its market from home decoration. Satin finds its use in soft touches such as cushions, curtains, bed linens, and upholstery. The improved aesthetic quality it adds to interiors, along with its smooth texture and shine, adds to its demand in sumptuous high-end residential and commercial projects.Merger and acquisition

As per the latest news, mergers and acquisitions strategies in the satin fabric market will enhance the capabilities of production and market reach. In February 2023, **Archroma** acquired the Textile Effects business of **Huntsman Corporation**, which gives it a considerable operational footprint in the textile industry. This merger provides an assembly of strength, bringing the joint workforce to over 5,000 employees across 42 countries and offering a wider portfolio of sustainable textile solutions that will be increasingly relevant with growing demand for the eco-friendly satin fabric. From the requirement of the new corporation, Maharashtra is going to establish it by merging three existing corporation histories regarding textiles in such an action in raising investments and developing the textile sector. This falls under the state Integrated and Sustainable Textile Industry Policy 2023-28, which, among other things, aims at significant investment attraction and resource consolidation in the sector. The establishment of the Maharashtra State Textile Development Corporation (MSTDC) is part of a much larger pattern of consolidation in the textile market intended to position it better in dealing with the challenges and opportunities of fabric production, including satin, for the future. >Analyst Comment

"The satin fabric market globally is growing remarkably, driven by the increased demand for quality fabrics with an aesthetic look in all the different sectors. Rising disposable incomes, consumer preferences towards luxury and comfort, and the trend of fast fashion are some of the key factors leading to market growth. The market comprises a variety of players, including textile manufacturers, apparel brands, and home furnishing companies. These players innovate to meet the rapidly changing needs of consumers in terms of sustainable, eco-friendly satin fabrics, new designs and textures, and entry into new market segments."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Satin Fabric- Snapshot

- 2.2 Satin Fabric- Segment Snapshot

- 2.3 Satin Fabric- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Satin Fabric Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Natural Fiber

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Synthetic Fiber

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Satin Fabric Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Construction

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Clothing

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Automotive

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Other

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Satin Fabric Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Dupont

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Freudenberg

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Fitesa

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Kimberly-Clark

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Glatfelter

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Toray

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Low & Bonar

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Lydall

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Hollingsworth & Vose

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Georgia-Pacific

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Ahlstrom

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Avintiv

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Avgol

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Satin Fabric in 2030?

+

-

Which type of Satin Fabric is widely popular?

+

-

What is the growth rate of Satin Fabric Market?

+

-

What are the latest trends influencing the Satin Fabric Market?

+

-

Who are the key players in the Satin Fabric Market?

+

-

How is the Satin Fabric } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Satin Fabric Market Study?

+

-

What geographic breakdown is available in Global Satin Fabric Market Study?

+

-

Which region holds the second position by market share in the Satin Fabric market?

+

-

Which region holds the highest growth rate in the Satin Fabric market?

+

-