Global Robot Sensor Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-584 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Robot Sensor Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

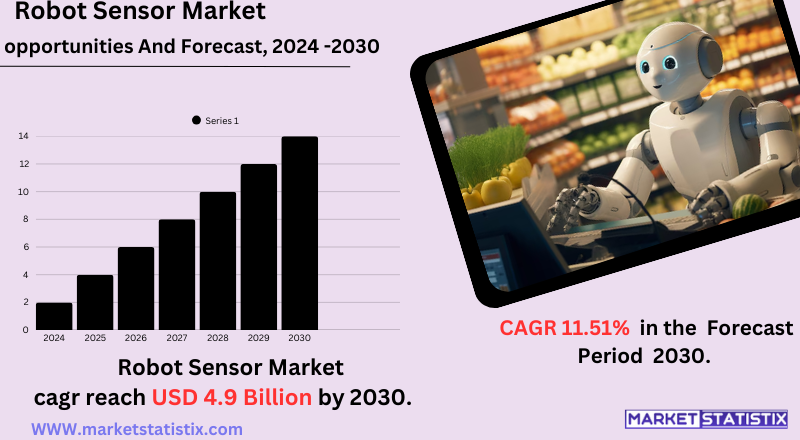

| Growth Rate | CAGR of 11.51% |

| Forecast Value (2030) | USD 4.9 Billion |

| By Product Type | Vision Sensor, Position Sensor, Proximity Sensor, Temperature Sensor, Force (Torque) Sensor, Others |

| Key Market Players |

|

| By Region |

Robot Sensor Market Trends

As a global trend in sensor fusion, the robot sensor market is starting to trend strongly toward the concept of combining data from two or more types of sensors to gain a complete and accurate view of the robot's environment. This is especially important for advanced applications such as autonomous navigation and complex object manipulation. Another important trend is the increasing participation of artificial intelligence and machine learning algorithms with sensor data, leading to robots carrying out more complex tasks such as predictive maintenance and instant decision-making capacity. The miniaturization and cost-effectiveness of sensors have also been an important factor in the proliferation of robot technology across industries. In addition, the demand for application-specific sensors has reached another level. High-resolution 3D vision systems, for example, are slowly becoming a must-have for pick-and-place operations within the logistics and e-commerce world, while advanced force/torque sensors have become a prime necessity for precision assembly operations in manufacturing. The market is also witnessing a growing trend toward wireless sensor networks, providing more flexibility and scalability in robot deployments.Robot Sensor Market Leading Players

The key players profiled in the report are Baumer Group (Switzerland), Futek Advanced Sensor Technology, Inc. (United States), Infineon Technologies (Germany), Tekscan, Inc. (United States), Omron Corporation (Japan), TE Connectivity Ltd. (Switzerland), Sensata Technologies, Inc (United States), Honeywell International Inc. (United States), Industrial Automation & Robotics:Growth Accelerators

The growing trend towards automation across manufacturing, healthcare, and even logistics industries is impacting the rise of the robot sensor market. More advanced sensors, including vision, force/torque, and proximity, are acquiring higher demand to increase the precision, efficiency, and safety in professional driverless robots. Customers now rely increasingly on the available options to meet their real-time data-processing and decision-making capabilities with advanced sensor technology, which integrates AI and IoT to enable predictive maintenance and adaptability in dynamic environments. The upsurge in robots developing new applications like autonomous vehicles, agriculture, and services is another market driver. In automotive, sensors like LIDAR and radar perform a crucial role in navigation and safety in self-driving cars. In healthcare, such devices ensure precision in surgical robots. Thus, all these factors, coupled with the increasing focus on workplace safety and productivity, would form the backbone for a strong growth platform for the robot sensor market as industries try to optimize operations and to reduce human intervention.Robot Sensor Market Segmentation analysis

The Global Robot Sensor is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Vision Sensor, Position Sensor, Proximity Sensor, Temperature Sensor, Force (Torque) Sensor, Others . The Application segment categorizes the market based on its usage such as Manufacturing, Aerospace and Defense, Logistics, Healthcare, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The robot sensor industry is experiencing a diverse and competitive scenario that pairs established technology giants with specialized sensor makers and innovative startups alike. Key players are investing large amounts of capital in research and development to increase sensor performance, lower costs, and widen their product range. Sensor types compete fiercely within various categories, with companies fighting for market share for vision systems, LiDAR, and force/torque sensing. Strategic partnerships, acquisitions, and collaborations are among the commonly utilized strategies to enable strengthened market positioning and entry into new technologies.Challenges In Robot Sensor Market

Significant challenges are faced by the robot sensor market, which is highly hindering the adoption and growth of these devices. High upfront costs of advanced sensor technology, particularly LiDAR and 4D vision, are major deterrents for most small and medium enterprises with inadequate budgets. Maintenance and integrations are also relatively expensive, as they would require highly skilled manpower to run these systems, which adds to operational complexity and costs. Another major inhibitor is related to the regulatory and environmental aspect. To comply with various stringent and non-repetitive safety, performance, and environmental standards, testing and adaptation across regions are tremendously extensive and raise costs and time for development. Also, bringing in complexity are the possible economic recession and day-to-day varying raw material prices against the investment in automation. But concerns are raised here thanks to information privacy and security regarding sensor-enabled robotics. In totality, these hurdles are creating a challenge in the efficient and scalable meeting of the growing demand across industries—manufacturing, healthcare, logistics, and so on.Risks & Prospects in Robot Sensor Market

The increasing use of automation and robotics in several industries worldwide fosters a robust growth environment for the robot sensor market. North America led with almost 40% market share in 2024, as manufacturing industries started integrating sensors into assembly lines, quality control, and material handling to optimize efficiency and precision. The process and packaging sector is fast-growing, with an estimated CAGR of around 10% between 2024 and 2029, riding on the wave of automation in pharmaceuticals, food and beverage, and consumer goods. Due to rapid industrialization and the growth of the manufacturing sector in the likes of China, Japan, and South Korea. North America remains a significant market, holding about 14% of the global market share in 2024, due to advanced technology and heavy investments in automation and robotics. Europe shares a significant space too, growing at a rate of about 8% from 2019 to 2024, with Germany taking the lead on the adoption of industrial automation.Key Target Audience

, Industry verticals benefiting from automation like manufacturing & automotive, healthcare, and logistics are the prime customers for the robot sensor market. Manufacturers, which are a major segment, depend on force/torque, proximity, and vision sensors for enhancing the precision and efficiency of the robots with applications in assembly lines and quality control. Automotive companies—the giants—integrate these sensors into robots for welding and material handling, driven by the need for high productivity and safety., Technology developers and system integrators represent another major audience segment: they design and deploy robotic solutions. This includes companies such as Honeywell, FANUC, and SICK AG, which serve industrial customers by developing sensor technologies such as 3D vision and tactile sensors. Small and medium-sized enterprises would provide an emerging audience, although slow to adopt these technologies due to high costs. This diverse audience reflects the well-spread-out applicability of the market into both industrial and service-oriented fronts.Merger and acquisition

The sensor market for robots witnessed notable mergers and acquisitions in 2019 onwards, reflecting a strategic focus on technological advancement and expansion in markets. As part of its merger in February 2023, Ouster and Velodyne Lidar, both major companies involved in lidar technology, came together to augment their collective efforts in lidar adoption applicable to such fields as robotics and autonomous vehicles. The purpose of such merger action was to improve their products as well as strengthen their hold on the competitive sensor market. To address the aforementioned, in September 2024, Italian sensor maker Gefran planned to acquire several companies in Germany and North America whose earnings range between €10-20 million to increase its international presence as well as diversify its technology offering on sensors. Also, ABB bought Eve Systems in June 2023 to augment the smart home automation solutions within its offerings, while Real Tech was bought by ABB in January 2024 to improve the firm's water monitoring sensor technologies, both acquisitions reflecting ABB's push into sensor technology. These acquisitions tell of a growing industry trend in consolidation-slash-consolidation in the robot sensor market through innovation and broad market reach. >Analyst Comment

Moreover, the industrial robot sensor market is exhibiting high growth on the heels of rapid adoption of automation across various industries. The demands for greater efficiency, precision, and safety in manufacturing, logistics, and healthcare are creating the need for advanced sensor technologies. Key trends include the growing integration of advanced vision systems, LiDAR, and force/torque sensors that enable robots to execute complex tasks. Additionally, the increasing popularity of collaborative robots (cobots) has necessitated advanced sensing capabilities to ensure safe human-robot interaction, thereby spurring the market growth even further.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Robot Sensor- Snapshot

- 2.2 Robot Sensor- Segment Snapshot

- 2.3 Robot Sensor- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Robot Sensor Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Proximity Sensor

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Vision Sensor

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Position Sensor

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Temperature Sensor

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Force (Torque) Sensor

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Robot Sensor Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Logistics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Aerospace and Defense

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Manufacturing

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Healthcare

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Baumer Group (Switzerland)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Futek Advanced Sensor Technology

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Inc. (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Honeywell International Inc. (United States)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Infineon Technologies (Germany)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Omron Corporation (Japan)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Sensata Technologies

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Inc (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 TE Connectivity Ltd. (Switzerland)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Tekscan

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Inc. (United States)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Industrial Automation & Robotics:

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Robot Sensor in 2030?

+

-

Which type of Robot Sensor is widely popular?

+

-

What is the growth rate of Robot Sensor Market?

+

-

What are the latest trends influencing the Robot Sensor Market?

+

-

Who are the key players in the Robot Sensor Market?

+

-

How is the Robot Sensor } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Robot Sensor Market Study?

+

-

What geographic breakdown is available in Global Robot Sensor Market Study?

+

-

How are the key players in the Robot Sensor market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Robot Sensor market?

+

-