Global Rice Flour Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-802 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Rice Flour Report Highlights

| Report Metrics | Details |

|---|---|

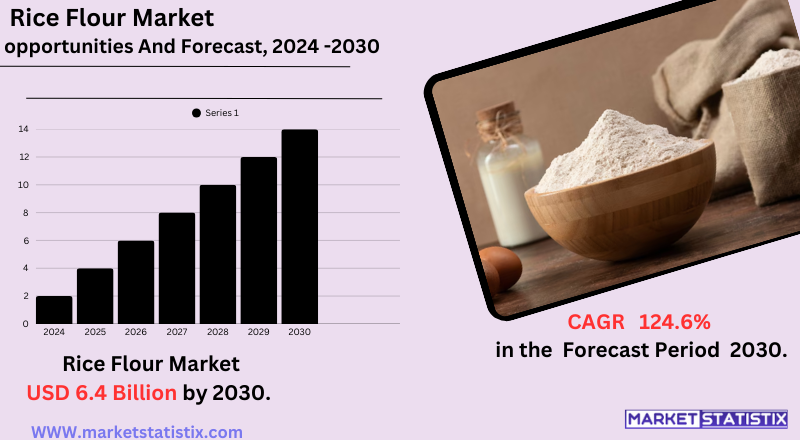

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 6.4% |

| Forecast Value (2030) | USD 124.6 Billion |

| By Product Type | Medium & Short Grain, Long Grain, Pre-gelatinize |

| Key Market Players |

|

| By Region |

|

Rice Flour Market Trends

A few prominent trends are shaping the rice flour market. One major trend is the increasing demand for gluten-free foods, which is primarily a result of heightened awareness around coeliac disease and gluten intolerance worldwide. Consequently, rice flour has become an ideal substitute for wheat flour in various applications of food. Besides, there is increasing preference for organic and natural food ingredients, thus leading to the growth in the demand for organic rice flour, which has been produced without any pesticides or artificial additives. Another trend is the widening scope of application of rice flour beyond its traditional scope in Asia. The flour is now being used in Western-style bakeries and confectioneries, breakfast foods, baby foods, and snacks as a thickening agent and gluten-free base. In addition, an increasing number of households earn more disposable income that allows them to spend on speciality and healthy food items like rice flour, further propelling the growth of the market.Rice Flour Market Leading Players

The key players profiled in the report are Shipton Mill Ltd., Archer-Daniels-Midland Co. Bunge Ltd., General Mills, Inc., The Soufflet Group, Whitworth Bros. Ltd., Associated British Foods PLC, Wilmar International Limited, Ebro Foods, S.A., Ingredion Incorporated.Growth Accelerators

There are various underlying reasons responsible for the growth of the market for rice flour. Demand for gluten-free food products is steadily increasing, creating a strong driver for rice flour being a natural, versatile alternative to wheat flour for people with coeliac disease or gluten sensitivities. Inevitably, global familiarity with Asian cuisine boosts this market, with rice flour being an ingredient in most traditional Asian delicacies. Awareness of health benefits such as digestibility and accessibility as a carbohydrate source has also piqued health-conscious consumers' interests. The primary forces behind the market are the food and beverage industry, which consistently goes in search of chemicals that will make their products more significantly high quality – in terms of texturing and cohesiveness, for example. The clean label, all of which focus on natural and minimally processed ingredients, also favour rice flour.Rice Flour Market Segmentation analysis

The Global Rice Flour is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Medium & Short Grain, Long Grain, Pre-gelatinize . The Application segment categorizes the market based on its usage such as Sauces and Dressings, Baby Foods, Bakery, Snacks, Breakfast Products. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Of the rice flour markets, very competitive among many other well-established major players and small developing companies, continue with Archer Daniels Midland (ADM), Ingredion, Ebro Foods, and Associated British Foods, to name a few of these global players, all relying mainly on different distribution networks and product portfolios to hold on to quite a good market share. Thus, established companies often focus more on diversification of products where organic and gluten-free products develop along to impress the taste of clients. Business agility and responsiveness to market changes have been kept as the norm for established players following increased dynamic activity coming from the line of emerging businesses. Such smaller competitors usually specialise in either organic rice flour or speciality in combination with either novel technology or green practices for differentiation. Product quality, pricing strategies, and brand recognition are critical to market share. In recommendations set up, compliance with food safety or quality regulations is also emphasised for maintaining customers' trust and meeting industry standards as the market keeps desiring complianceChallenges In Rice Flour Market

The rice flour market is beset with a variety of problems that threaten its structuration and growth. The most important of these problems is the fluctuation in the prices of raw materials for rice, the determined raw material. This frequently varies due to changes in climate, the vagaries of weather patterns, diseases, and changing energy and fertiliser prices. Disruption in the supply chain could easily escalate prices with manufacturers finding it hard to price consistently and make profits. The market challenges prove tough with the emerging options of other gluten-free flours, such as almond, coconut, and quinoa flour, which eventually spell less market for rice flour, especially in regions where consumer awareness of rice flour is underdeveloped. Along with these, the market suffers from concerns regarding adulteration of products and adverse health effects due to excess consumption of rice flour. Profit margins remain narrow despite high consumer demand, forcing manufacturers to be innovative, efficient, and sustainable to compete.Risks & Prospects in Rice Flour Market

There are many market opportunities in developing regions, where gluten intolerance is becoming more and more recognised, and manufacturers can find new avenues for marketing innovative and fortified rice flour products. The online retail and e-commerce platforms also provide extensive reach and accessibility; diversification of products such as ready-to-cook mixes and nutritionally enhanced variants can also help draw a wider consumer base. By region, Asia-Pacific leads the global rice flour market. The market is buoyed by the fact that rice is a staple food and very well integrated into the local cuisines, especially in countries like China, India, and Southeast Asia. But also, the Americas and Europe are steadily marching forward, where changing diets toward health consciousness and allergenic awareness, as well as regulatory promotion for gluten-free labelling, all have contributed to that growth. For the innovations in processing and packaging, plus the implementation of modern distribution channels in these regions, this then becomes the growth catalyst. Each region thus provides its opportunities and challenges, necessitating the formulation of strategies tailored to capitalise on local trends and regulatory environments.Key Target Audience

, Key aimed target audiences for rice flour are health-conscious individuals, gluten intolerants, including coeliacs, and those adhering to speciality diets like vegan, paleo or plant-based. Such consumers are now seeking more gluten-free alternatives, and rice flour fits perfectly into cooking and baking versatility. Following that, it was discovered that people living in cities with increasing awareness about natural and allergen-free ingredients are therefore growing the demand for rice flour items both in developed and newly emerging economies., Another group includes food manufacturers and commercial bakers who consume rice flour as part of functional ingredients in finished or ready-to-eat foods as well as snacks. Participants in this audience are focused on texture-enhancing properties to properly label them as gluten-free. There is also an ethnic and Asian cooking buff or restaurant with core markets, as rice flour is a component of many traditional dishes, which can further reinforce the international demand for it.Merger and acquisition

The rice flour market is seeing a lot of mergers and acquisitions as a result of heightened demand for gluten-free and clean-label products. U.S.-based ingredient supplier Ingredion wants to further strengthen its portfolio by acquiring companies like Sun Flour Industry Co. in Thailand, allowing them to enhance their capabilities with respect to rice starch and flour production. Similarly, Western Foods LLC bought American Sunny Foods in 2019 in furtherance of strengthening its allergen-free and gluten-free product portfolios. Besides acquisitions, companies are also working on product innovations targeting evolving consumer preferences. For example, Ingredion has developed Homecraft Create multifunctional rice flours primarily for clean-label baby food products. In addition, demand for sustainable and clean-label ingredients has prompted Bunge Ltd. to introduce organic and non-GMO options for its white rice flour products. These strategic initiatives signify a willingness on the industry's part to innovate and improve quality in a bid to ride on the expanding health-orientated and speciality rice flour products. >Analyst Comment

The global rice flour market is propelling because the consumer demand for gluten-free and health-orientated products is increasing tremendously. In 2024, the market is profiled to be worth about USD 905.66 million and is expected to reach USD 1,172.43 million by the year 2030. The increase is fuelled by heightened health consciousness, the growth of the food and beverage sector, and the increasing acceptance of vegan and organic diets. Asia-Pacific has remained the most dominant region, owing to the staple status of rice and its deep integration with local cuisines, while Europe and North America are gradually adopting rice flour as a gluten-free substitute for use in bakery and other processed foods.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Rice Flour- Snapshot

- 2.2 Rice Flour- Segment Snapshot

- 2.3 Rice Flour- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Rice Flour Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Long Grain

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Medium & Short Grain

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Pre-gelatinize

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Rice Flour Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Bakery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Baby Foods

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Sauces and Dressings

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Snacks

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Breakfast Products

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Rice Flour Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Associated British Foods PLC

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Shipton Mill Ltd.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Ebro Foods

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 S.A.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 The Soufflet Group

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Whitworth Bros. Ltd.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Archer-Daniels-Midland Co. Bunge Ltd.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Wilmar International Limited

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 General Mills

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Ingredion Incorporated.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Rice Flour in 2030?

+

-

Which type of Rice Flour is widely popular?

+

-

What is the growth rate of Rice Flour Market?

+

-

What are the latest trends influencing the Rice Flour Market?

+

-

Who are the key players in the Rice Flour Market?

+

-

How is the Rice Flour } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Rice Flour Market Study?

+

-

What geographic breakdown is available in Global Rice Flour Market Study?

+

-

Which region holds the second position by market share in the Rice Flour market?

+

-

How are the key players in the Rice Flour market targeting growth in the future?

+

-