Global Retail Ice Cream Market – Industry Trends and Forecast to 2030

Report ID: MS-2551 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Retail Ice Cream Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

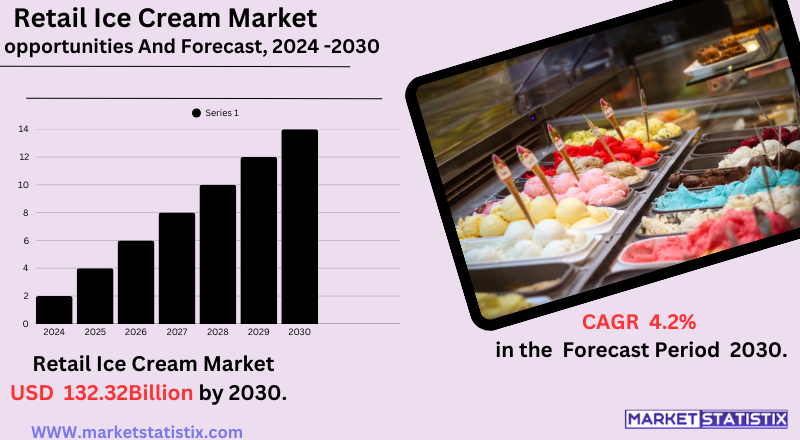

| Growth Rate | CAGR of 4.2% |

| Forecast Value (2030) | USD 132.32 Billion |

| By Product Type | Dairy & Water-based, Vegan |

| Key Market Players |

|

| By Region |

|

Retail Ice Cream Market Trends

The retail ice cream world is currently undergoing several major trends that will shape its future. One major trend right now is the increase in demand for healthier options. Consumers in India and around the world are becoming increasingly health-conscious and are thereby turning to low-sugar, low-fat, and plant-based ice cream alternatives, including dairy-free and vegan varieties made from almond, soy, oat, or coconut milk. This shift is being fuelled by increased general health awareness, increasing lactose intolerance, and the growing prominence of vegan and flexitarian diets. Another important trend is increasing consumer demand for premium and artisanal-quality ice cream. Consumers want unique flavours created from the best-quality ingredients with innovative methods of preparation that often stress the natural, local, or organic. This trend comes from a demand for something that is indulgent yet also genuine. Added to this is the convenience aspect, as e-commerce and quick commerce make it easy for consumers to order ice cream straight to their doorstep.Retail Ice Cream Market Leading Players

The key players profiled in the report are Nestlé SA, Danone S.A., American Dairy Queen Corporation, General Mills, Inc., Inspire Brands, Inc. (Baskin Robbins), Wells Enterprises, Blue Bell Creameries, Unilever PLC, Cold Stone Creamery, NadaMooGrowth Accelerators

Currently, the retail ice cream market in India is witnessing tremendous growth driven by various factors. First, rising disposable incomes are enabling consumers to afford discretionary spending on treats like ice cream. The economic environment is ever so slightly better for a larger section of the society, and ice cream is transforming from a luxury to a more common indulgence for some. Increased buying power, therefore, comes into play, increasing sales volume at the retail level. Next, on the axis of demand, there is a corresponding shift in consumer preference toward recreation. Consumers, especially the young, are taking to new exciting flavours, formats, and premium offerings. This includes increasing interest in artisanal ice creams, novelties with interesting textures, and inclusions, as well as healthier versions such as low-sugar or dairy-free alternatives that still provide a guilt-free indulgence. With hot and tropical weather prevailing almost everywhere in India for a large part of the year, demand for cooling and refreshing products like ice cream comes naturally, and such products are well appreciated by consumers of all ages.Retail Ice Cream Market Segmentation analysis

The Global Retail Ice Cream is segmented by Type, and Region. By Type, the market is divided into Distributed Dairy & Water-based, Vegan . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Intense competition in the retail ice cream market is defined by many small and regional or artisanal brands among large, well-established international players. Such key organizations are Unilever (Kwality Walls, Magnum), Nestlé, and local giants like Amul and Mother Dairy in India, where their benefit comes from extensive distribution networks, strong brand recognition, and a very wide range of products – from mass-market tubs to premium novelties. Companies often compete in price, new product innovations (newer flavours, newer formats), and reach of marketing. The market is also alive with competition from smaller, more boutique-style players who sell indulgent gourmet ingredients, artisanal production methods, or organic or natural products with flavour profiles designed for the niche consumer. Competitive best practices also lie in the distribution networks targeted for both modern formats and very fast-growing channels such as e-commerce and quick-commerce within this volatile market.Challenges In Retail Ice Cream Market

growth rate and profitability potential. Key obstacles include continuous supply chain smoothness, fluctuating costs of raw materials, especially dairy and sugar, skyrocketing production and ingredient costs, and very low profit margins. All this gets compounded by ongoing economic and geopolitical situations such as tariff changes and inflation causing sourcing problems and increased operational costs. Furthermore, in all operational definitions, seasonality and short shelf-life present great challenges, in that high demand occurs during summer and then rapidly declines in winter; hence, the sales cycle tends to be very uneven, with higher storage costs. This sector is crowded with competition, exerting increased pressure from both established brands as well as new entrants that aim to capture market share by innovating, such as dairy-free and low-sugar options. Therefore, players will need to invest in digitalisation, supply chain resilience, and product innovation, and then work intra- and cross-competitively along the value chain to meet regulatory and sustainability objectives.Risks & Prospects in Retail Ice Cream Market

The development of the market benefits from all trends which go from plant-based and alternative ingredients to health- and premium-minded products, customisation, and sustainable practices. Product flavours are changing, while functional and nutrient-enhanced products are emerging. Online and direct-to-consumer sales are fast evolving in this ever-changing marketplace. The Asia Pacific leads regionally with its huge and expanding consumer base, mainly in countries like China and India, while premium and artisanal products retain strong demand in North America and Europe. In developed markets, a shift toward indulgent and high-quality products, with sophisticated flavour profiles, is being observed, and convenience stores and supermarkets are the main channels of distribution. Growth in these markets is contrasted with the emerging markets in Latin America, the Middle East, and Africa, which are undergoing rapid growth due to urbanisation and rising disposable income. Innovations in cold chain logistics and packaging are facilitating greater market reach and product quality across various climates and regions. Alignment with laws and community standards will assure a consumer's desire for safety and hygienic products.Key Target Audience

, Diverse demographics are served in the retail ice cream market, with key segments being families with children, teenagers, young adults, and adults. Families purchase ice cream in bulk for home consumption, valuing variety and price. Trendy Instagrammable options and uncommon flavours attract teenage and young adult attention, with ice cream shops being a frequent hangout among friends. Adults aged 25 to 44, a large group of consumers, mainly prefer premium or artisanal products to be indulged in as special treats or comfort food., There is an inclination toward impulse ice cream in the Indian market, with this tendency especially strong in the 25-to-34-year age group, who eat it often. Less frequency of consumption is noted for the older age group of 35-to-45-year-olds, who may provide opportunities for targeted marketing. This group constitutes another segment of consumers beginning to make a mark in the ice cream market by demanding low-sugar, dairy-free, and functional ice cream options. The retailers are responding by providing convenient packaging for these health-orientated options and extending product lines with healthier alternatives.Merger and acquisition

The recent past of the retail ice cream market stood witness to considerable merger and acquisition activities, alongside some strategic separations. In March 2024, Unilever announced its plans to spin off the ice cream division, comprising brands such as Ben & Jerry's, Magnum, and Wall's, into a separate entity by the end of 2025. The decision followed the difficulty of having private equity firms consider the division as a sale: the size of the division, its diverse and complex supply chain, and the political issues surrounding the brands, like Ben & Jerry's. Hindustan Unilever Ltd has also decided to demerge its ice cream business, with brands like Kwality Wall's and Cornetto, into a separate listed entity to maximise growth opportunities in India. The presence of private equity activity is noteworthy in the Indian market. In March 2024, Kedaara Capital took a stake in Dairy Classic Ice Creams Pvt. Ltd. (Dairy Day), an ice cream brand in India that is operational in quite a few states. Also, Lotte Confectionery, a South Korean company, plans to invest ₹550 crore over five years to develop its ice cream business in India, setting up a state-of-the-art facility in Maharashtra. These activities mark the emerging trends of a revamped retail ice cream sector, with major global and regional players constantly evolving new strategies through mergers, acquisitions, and investments. >Analyst Comment

Diverse demographics are served in the retail ice cream market, with key segments being families with children, teenagers, young adults, and adults. Families purchase ice cream in bulk for home consumption, valuing variety and price. Trendy Instagrammable options and uncommon flavours attract teenage and young adult attention, with ice cream shops being a frequent hangout among friends. Adults aged 25 to 44, a large group of consumers, mainly prefer premium or artisanal products to be indulged in as special treats or comfort food. There is an inclination toward impulse ice cream in the Indian market, with this tendency especially strong in the 25-to-34-year age group, who eat it often. Less frequency of consumption is noted for the older age group of 35-to-45-year-olds, who may provide opportunities for targeted marketing. This group constitutes another segment of consumers beginning to make a mark in the ice cream market by demanding low-sugar, dairy-free, and functional ice cream options. The retailers are responding by providing convenient packaging for these health-orientated options and extending product lines with healthier alternatives.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Retail Ice Cream- Snapshot

- 2.2 Retail Ice Cream- Segment Snapshot

- 2.3 Retail Ice Cream- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Retail Ice Cream Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Dairy & Water-based

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Vegan

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Retail Ice Cream Market by Product

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cartons

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Tubs

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Cups

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Cones

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Bars

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Retail Ice Cream Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Unilever PLC

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 American Dairy Queen Corporation

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Wells Enterprises

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Nestlé SA

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Blue Bell Creameries

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 General Mills

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Inc.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Inspire Brands

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Inc. (Baskin Robbins)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Cold Stone Creamery

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Danone S.A.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 NadaMoo

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Product |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Retail Ice Cream in 2030?

+

-

How big is the Global Retail Ice Cream market?

+

-

How do regulatory policies impact the Retail Ice Cream Market?

+

-

What major players in Retail Ice Cream Market?

+

-

What applications are categorized in the Retail Ice Cream market study?

+

-

Which product types are examined in the Retail Ice Cream Market Study?

+

-

Which regions are expected to show the fastest growth in the Retail Ice Cream market?

+

-

What are the major growth drivers in the Retail Ice Cream market?

+

-

Is the study period of the Retail Ice Cream flexible or fixed?

+

-

How do economic factors influence the Retail Ice Cream market?

+

-