Global Real-Time Bidding Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-274 | Chemicals And Materials | Last updated: Dec, 2024 | Formats*:

Real-Time Bidding Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

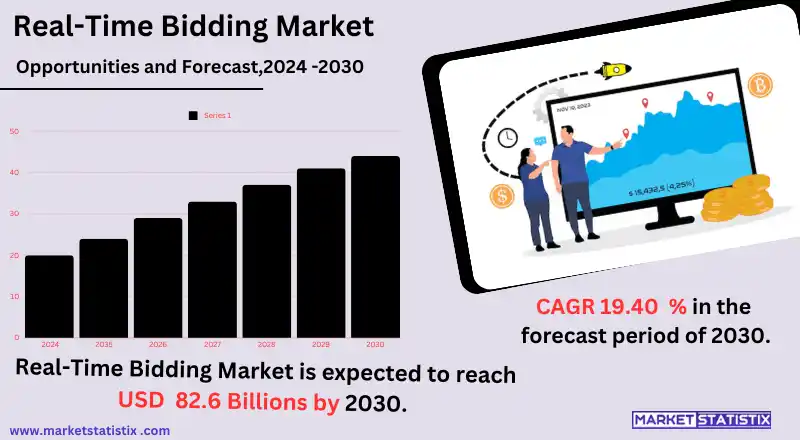

| Growth Rate | CAGR of 19.40% |

| Forecast Value (2031) | USD 82.6 Billion |

| By Product Type | Open Auction, Private Auction, Automated Guaranteed |

| Key Market Players |

|

| By Region |

Real-Time Bidding Market Trends

The market for real-time bidding (RTB) is maturing and growing quickly because of the adoption of programmatic advertising in all industries. It is made easier for advertisers to reach appropriate audiences through data analysis and artificial intelligence while becoming more economical and impactful at ad campaigns. With increased reliance on mobile devices, video advertising, and connected televisions, the RTB platform is evolving to provide ad technologies that can be more dynamic and engaging.Real-Time Bidding Market Leading Players

The key players profiled in the report are WPP Plc, Match2one, Facebook, Mopub, Smaato , Verizon Media, Yandex , Salesforce, Rubicon Project , Google, Adobe, Pubmatic, CRITEO, MediaMath, Platform OneGrowth Accelerators

Increasingly, the growth of real-time bidding business is explored through personalisation and data-driven advertising. As advertisers and marketers strive to communicate their messages to the target audience in real-time, they get their ad budgets allocated more efficiently and end up with a better return on their investments. Digital platforms, mobile devices, and programmatic advertising technologies have encouraged companies to use RTB to present their advertisements most effectively across several channels and formats. The other emerging triggers include increased importance given to advertising and strong performance-orientated advertising. RTB delivers transparency and goes granular, allowing the measurement of advertisement impressions, clicks, and conversions that help advertisers create effective strategies. The increased penetration of the internet by users and reliance on media consumption in digital form has also contributed to this increase in demand for RTB.Real-Time Bidding Market Segmentation analysis

The Global Real-Time Bidding is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Open Auction, Private Auction, Automated Guaranteed . The Application segment categorizes the market based on its usage such as E-commerce, Entertainment, Healthcare, Travel. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario in the RTB market is characterized by high technology investments coupled with strategic alliances among companies. Criteo, for example, did not shy away from engaging in acquisitions with the view of expanding its service bouquet. In this case, Criteo acquired Manage, the provider of app installs advertising solutions, for the express purpose of complementing its already-robust app business and growing its portfolio in diverse verticals. In addition, companies like the above have been channelling organic growth and mergers into their efforts to further strengthen their presence in the market; it is part of a greater consolidation strategy in the advertising industry, which is fast changing its shape.Challenges In Real-Time Bidding Market

The real-time bidding market has some challenges. Mostly, it's about data privacy and compliance with rules. As regulations worldwide are becoming tighter on data protection—think of the GDPR and the CCPA—advertisers have to adapt their customer data collection to the complexity of these new regulations. It requires money for compliance work, and suddenly, the third-party cookies fail to be there for targeting ads well. Among many other issues, platform and technology fragmentation is a major hurdle for RTB. With multiple demand-side platforms (DSPs), supply-side platforms (SSPs), and ad exchanges, different factors become important for stakeholders in devising what they want—quite difficult for actually unitary but effective joint campaigns. Addressing these things is a vital region for safety in the RTB economy.Risks & Prospects in Real-Time Bidding Market

The market is endowed with enormous growth potential, being propelled by the rising demand for personalised advertising and programmatic ad solutions, especially with the growing use of internet-enabled devices and the digital shift of consumption. Real-time bidding has afforded advertisers the opportunity to target a narrower audience in real time by the nature of the technology spreading like wildfire. The adoption of artificial intelligence and machine learning on RTB platforms enhances accuracy in targeting audiences and ad placement, which translates into more returns for advertisers. The emerging avenues for real-time bidding in the area of video advertising are being blazed open by the burgeoning connected TV (CTV) and over-the-top (OTT) platforms. These platforms attract spectacular audience engagement and thus have created fertile ground to plant the seeds of real-time advertising. Emerging economies that are utilising the digital interface at an ever-accelerated rate offer great untapped potential for RTB, as these markets outside the developed nations have releasing budgets toward programmatic advertising at an increasing rate. The integration of RTB with DMPs (data management platforms) and CDPs (customer data platforms) creates seamless opportunities for brands to optimise their advertising strategies, thereby ensuring sustainable growth in the market.Key Target Audience

In principle, the intended audiences for a real-time bidding market comprise consumers, publishers, and ad exchanges. Advertisers arm themselves with RTB in order to find specific audiences by buying ad impressions in real time. Thus, optimized campaigns must maximize returns from investments by targeting users using demographic, behavioural, and other data. Publishers own the property of the audience through the viewer, and at the same time, they sell ad space in the digital inventory by collecting bids using RTB. An ad exchange acts as an intermediary so that it can provide access to the advertisers while ensuring that both the advertisers and publishers transact seamlessly.,, Demand-side platforms (DSPs) and supply-side platforms (SSPs) are also part and parcel of the RTB ecosystem. DSPs have software solutions that enhance the businesses' bidding process, while SSPs connect the publishers into a platform to optimize and manage their inventory. Other stakeholders include the DMPs (database management platforms), which refine segments of audiences. Some agencies conduct ad strategy data, making such a huge organization that drives the scalability and efficiency of the RTB ecosystem into programmatic advertising.Merger and acquisition

Another recent trend attributable to the change in the Real-Time Bidding (RTB) market is the rising curve of mergers and acquisitions, which is considerably increasing competition among key players. For instance, one of the significant announcements was made by Google in September 2023 when it proclaimed that it would transfer ad auctions for applications into real-time bidding auctions. This change is expected to completely boost advertisers' returns while at the same time driving more total spending into the ecosystem. Moreover, for example, Discovery Inc. acquired ZEDO's assets in December 2021, boosting its direct-to-consumer platforms in terms of advanced ad technology, including supply-side platforms and real-time bidding capabilities. That merger denotes the trend in which large companies are merging innovative technologies with business practices towards bringing down their costs and more effectively monetising their businesses. >Analyst Comment

"The marketplace for real-time bidding is a very emerging part of digital advertising that allows advertisers to bid on the impression of advertisements at this current moment. This technology automated the entire process of buying and selling of advertising space by revolutionizing it with a real-time auction model. This brings in an advantage such as highly accurate audience targeting, cost-effectiveness, and measurable results, thus obtaining status from advertisers aiming to maximize their return on investment (ROI). The market is driven by increased adoption of programmatic advertisements, increasing number of mobile and video ad consumption, and manoeuvring advancements in AI and analytics to making ad placement and audience engagement more effective."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Real-Time Bidding- Snapshot

- 2.2 Real-Time Bidding- Segment Snapshot

- 2.3 Real-Time Bidding- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Real-Time Bidding Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Open Auction

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Private Auction

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Automated Guaranteed

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Real-Time Bidding Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 E-commerce

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Entertainment

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Healthcare

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Travel

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Real-Time Bidding Market by Auction Type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Open auction

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Invited auction

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 WPP Plc

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Match2one

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Facebook

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Mopub

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Smaato

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Verizon Media

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Yandex

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Salesforce

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Rubicon Project

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Google

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Adobe

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Pubmatic

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 CRITEO

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 MediaMath

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Platform One

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Auction Type |

|

Report Licenses

Frequently Asked Questions (FAQ):

What is the estimated market size of Real-Time Bidding in 2031?

+

-

Which type of Real-Time Bidding is widely popular?

+

-

What is the growth rate of Real-Time Bidding Market?

+

-

What are the latest trends influencing the Real-Time Bidding Market?

+

-

Who are the key players in the Real-Time Bidding Market?

+

-

How is the Real-Time Bidding } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Real-Time Bidding Market Study?

+

-

What geographic breakdown is available in Global Real-Time Bidding Market Study?

+

-

Which region holds the second position by market share in the Real-Time Bidding market?

+

-

Which region holds the highest growth rate in the Real-Time Bidding market?

+

-