Global Railway Maintenance Machinery Market – Industry Trends and Forecast to 2031

Report ID: MS-1727 | Manufacturing and Construction | Last updated: Sep, 2024 | Formats*:

Railway Maintenance Machinery Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

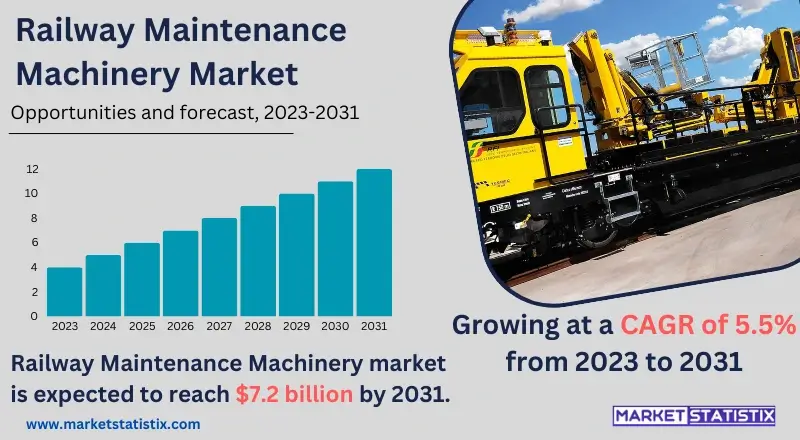

| Growth Rate | CAGR of 5.5% |

| By Product Type | Rail handling machinery, Tamping machine, Stabilizing machinery, Catenary Maintenance Machine, Ballast cleaning machine, Others |

| Key Market Players | Sinara Transport Machines Holding Loram Maintenance of Way Inc. System7 Rail Holding GmbH Geatech Group s.r.l. CRRC Corporation Limited Plasser & Theurer Harsco Corporation Fluor Corporation (American Equipment Company) MER MEC S.p.A. China Railway Construction Corporation Limited (CRCC High- Tech Equipment Co. Ltd) |

| By Region |

|

Railway Maintenance Machinery Market Trends

Demand for efficient and reliable rail transportation stays current, and the railway maintenance machinery market has been seeing remarkable growth of late. With the advent of the modernisation process, maintenance equipment is on a fast track to specialisation these days. The influences under consideration will be economic growth with infrastructure development and governmental investments in railway infrastructure. All of this, however, continues to reinforce market dynamics due to key challenges in material price rises, new technological solutions, and the need for highly qualified personnel. These latter risks could only be overcome with the innovation of products, automation, and sustainable solution development. This report projects that business in the railway sector would keep pace with ever-improving upgrading of its systems while improving safety and efficiency.Railway Maintenance Machinery Market Leading Players

The key players profiled in the report are Sinara Transport Machines Holding, Loram Maintenance of Way Inc., System7 Rail Holding GmbH, Geatech Group s.r.l., CRRC Corporation Limited, Plasser & Theurer, Harsco Corporation, Fluor Corporation (American Equipment Company), MER MEC S.p.A., China Railway Construction Corporation Limited (CRCC High- Tech Equipment Co. Ltd)Growth Accelerators

Increasing demand from competent and efficient railway transportation: this is mainly because of increasing infrastructure improvement on efficient rail networks as a result of global trade and population growth. Growing concern for safety and compliance: With increasingly strict safety regulations and the desire to prevent or avoid accidents, the need for frequent maintenance and inspection drives the demand for niche machinery to even higher levels. Infrastructure construction and modernisation: development and expansion in the number of railways require modernised machinery for both maintenance and performance duration.Railway Maintenance Machinery Market Segmentation analysis

The Global Railway Maintenance Machinery is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Rail handling machinery, Tamping machine, Stabilizing machinery, Catenary Maintenance Machine, Ballast cleaning machine, Others . The Application segment categorizes the market based on its usage such as Ballast track, Non-ballast Track. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Railway maintenance machinery is a relatively competitive market due to the global competitors the industry has. The major global competitors that the market would house would be the multinational corporations, the equipment-specific manufacturers, and the regional suppliers. The competition among the firms involves respect for the technologies involved, levels of innovation, prices, and customer service. The market is divided between already-standing players and emerging companies that need to develop new solutions that most likely will be in demand within the railway sector.Challenges In Railway Maintenance Machinery Market

High investment costs: The railway maintenance machinery is quite specialised, making it relatively expensive to purchase and maintain. Regulatory compliance: Ensuring conformance with safety regulations and standards is complex and costly for manufacturers and operators. Economic Fluctuations: The economy, in particular demand and investment fluctuations, conditions the market, and these work in the qualification of market growth. Competitiveness: The market is competitive; a large category of players offers the same good or service.Risks & Prospects in Railway Maintenance Machinery Market

This segment offers good promise: all works related to the expansion and modernisation of railway networks radically increase the demand for productive and reliable mechanisms for maintenance. Implementation of modern technologies in automation and remote monitoring greatly helps to bring effectiveness and precision to these kinds of work. Also, the current focus on strict safety and compliance regulations opened up more pathways for the formulation of new and sophisticated solutions that are strictly compliant on the market. It also grew, with rising demand for sustainable and eco-friendly maintenance practices inspiring the production of greener technologies.Key Target Audience

Railroad operators and infrastructure providers—this includes all stakeholders responsible for maintaining and ensuring the railroad installations, which involve all types of infrastructural components for the tracks, bridges, etc. They will always need access to special machinery in the effort to complement the safe and efficient railway transportation.,, Government, The government agencies are the largest purchasers of railway maintenance machinery. They primarily operate in the transportation and infrastructure development sectors and set standards, regulations, and funding of rail infrastructure at large.,, Rail contractors, These are companies engaging in the maintenance and construction of railroads and, therefore, the immediate customers of the equipment. They use the rail maintenance equipment for various operations such as track renewal, ballast cleaning, and bridge inspection.Merger and acquisition

In regard to the above, the railway maintenance machinery market has witnessed several major mergers and acquisitions over the past years. It is fuelled by motivations for market share, a better portfolio, and ultimately entry into a different technology. Players in the industry have significantly invested in strategic acquisitions to benefit their standings in the emerging sector of railway maintenance. It was the nature of the global market that firms from different regions entered into such contracts. These further company mergers that have been facilitated within companies specialising in different fields of railway maintenance, such as track maintenance, signalling systems, and electrification, lead to a complete solution for all the operators of the rail industry. Strategic partnerships are at the heart of the competitive landscape for the railway maintenance machinery market. This landscape is continually painted in new colours because of frequent examples of mergers and acquisitions.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Railway Maintenance Machinery- Snapshot

- 2.2 Railway Maintenance Machinery- Segment Snapshot

- 2.3 Railway Maintenance Machinery- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Railway Maintenance Machinery Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Rail handling machinery

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Tamping machine

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Stabilizing machinery

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Catenary Maintenance Machine

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Ballast cleaning machine

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Railway Maintenance Machinery Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Ballast track

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Non-ballast Track

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Railway Maintenance Machinery Market by sales type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 New sales

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Aftermarket sales

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Railway Maintenance Machinery Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Sinara Transport Machines Holding

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Loram Maintenance of Way Inc.

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 System7 Rail Holding GmbH

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Geatech Group s.r.l.

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 CRRC Corporation Limited

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Plasser & Theurer

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Harsco Corporation

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Fluor Corporation (American Equipment Company)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 MER MEC S.p.A.

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 China Railway Construction Corporation Limited (CRCC High- Tech Equipment Co. Ltd)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By sales type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which application type is expected to remain the largest segment in the Global Railway Maintenance Machinery market?

+

-

How do regulatory policies impact the Railway Maintenance Machinery Market?

+

-

What major players in Railway Maintenance Machinery Market?

+

-

What applications are categorized in the Railway Maintenance Machinery market study?

+

-

Which product types are examined in the Railway Maintenance Machinery Market Study?

+

-

Which regions are expected to show the fastest growth in the Railway Maintenance Machinery market?

+

-

What are the major growth drivers in the Railway Maintenance Machinery market?

+

-

Is the study period of the Railway Maintenance Machinery flexible or fixed?

+

-

How do economic factors influence the Railway Maintenance Machinery market?

+

-

How does the supply chain affect the Railway Maintenance Machinery Market?

+

-