Global Rail Wheel Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-115 | Automotive and Transport | Last updated: Nov, 2024 | Formats*:

Rail Wheel Report Highlights

| Report Metrics | Details |

|---|---|

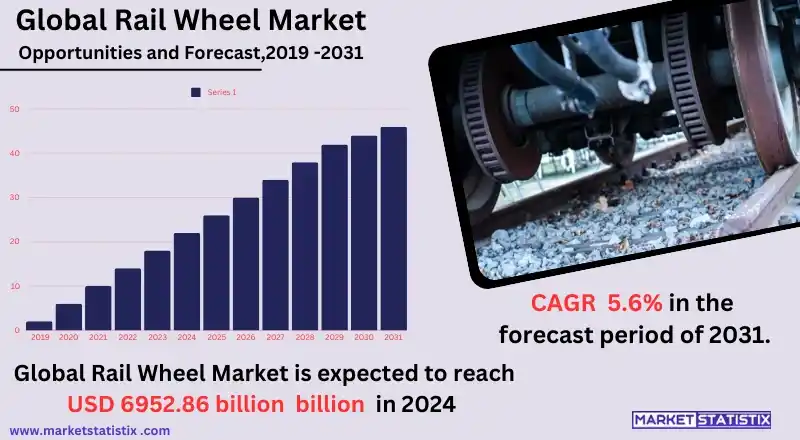

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 5.6% |

| Forecast Value (2031) | USD 6.2 Billion |

| By Product Type | High Speed, Freight Wagon, Passenger Wagon, Locos |

| Key Market Players | CRRC Corporation Limited (China), Bharat Forge Ltd (India), Alstom SA (France), Steel Authority of India Limited (India), Nippon Steel & Sumitomo Metal Corporation (Japan), Vyatka (Russia), Wabtec Corporation (United States), Bradken (Australia), Klöckner Pentaplast (Germany), Lucchini RS (Italy), ArcelorMittal A.S. (Luxembourg), Bonatrans Group A.S. (Czech Republic), Amsted Rail Company, Inc. (United States), Comsteel (Australia), Kolowag AD (Bulgaria). |

| By Region |

Rail Wheel Market Trends

The rail wheel market is witnessing a significant evolution with a keen focus on low-weight and high-strength materials due to technological advancement and increasing focus on energy efficiency. Manufacturers are wading into the likes of aluminium and composite materials that have lightweight rail vehicles while not compromising on performance and durability. This shift is in line with the industry’s quest for better fuel economy and lower emissions, as the lighter the train, the less energy it takes to run it. Moreover, the variations in the design and manufacturing processes of the wheels, such as 3D wheel printing, are improving efficiency of production and making it possible to make wheels designed for particular types of rails. Maintenance and retrofitting of existing rolling stock to enhance the long-term usability of the rail wheels also feature as one of the motive forces for the growth of the rail wheel market. With the aim of improving the performance and safety of the fleets possessed by railway operators, attention has also recently turned to predictive maintenance technology and real-time monitoring systems. These systems enable the condition of the rail wheels to be evaluated before they fail, thereby reducing the costs incurred after the breakdown that usually involve disruptions and unplanned repair work.Rail Wheel Market Leading Players

The key players profiled in the report are CRRC Corporation Limited (China), Bharat Forge Ltd (India), Alstom SA (France), Steel Authority of India Limited (India), Nippon Steel & Sumitomo Metal Corporation (Japan), Vyatka (Russia), Wabtec Corporation (United States), Bradken (Australia), Klöckner Pentaplast (Germany), Lucchini RS (Italy), ArcelorMittal A.S. (Luxembourg), Bonatrans Group A.S. (Czech Republic), Amsted Rail Company, Inc. (United States), Comsteel (Australia), Kolowag AD (Bulgaria).Growth Accelerators

Further, the growth of the rail wheel market can be associated with the growing need for rapid and effective modes of transportation, be it for passengers or freight. With the surge in urban population, the need for better modes of transport through public transport systems such as high-speed trains and even subways are on the increase. This longing for more sophisticated railway facilities calls for the manufacture of quality rail wheels that can carry heavy loads and provide better safety standards as well as performance. The other important factor is the growing emphasis on sustainable and environmentally safe means of transport. The railways, in most instances, are regarded as a less polluting mode of transport compared to the roads, as their greenhouse gas emissions are minimal per tonne mile of freight transported. With the tendency of most governments and institutions throughout the world to impose additional measures to give incentives for a decrease in carbon emissions, it is apparent that the preference to use rail transport will be on the increase. This development puts pressure on producers to come up with innovative designs that are durable and energy-saving rail wheels for the changing needs of the rail operators who are environmentally friendly.Rail Wheel Market Segmentation analysis

The Global Rail Wheel is segmented by Type, Application, and Region. By Type, the market is divided into Distributed High Speed, Freight Wagon, Passenger Wagon, Locos . The Application segment categorizes the market based on its usage such as OEM, Aftermarket. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The aforementioned growth is fuelled by the escalations in the production of rail passengers and investments on railways made by the government and the private sector as well. The increase in the demand for rail wheels is also supported by the efficiency in the transportation of goods, as well as the enhancement of various technological innovations like high-speed trains and eco-friendly materials that promote performance and energy efficiency. However, there are challenges in the market, such as the fluctuation of the prices of basic raw materials such as steel and rubber, which directly influence the cost of production and the pricing of the final product. The state of competition among the operators within the rail wheel markets comprises Amsted Rail Company Inc., Alstom SA, Bharat Forge Limited, and ArcelorMittal SA, among others. The companies are engaged in several expansion strategies, including mergers, acquisitions, and partnerships, to improve the product lines and gain a market share. The Asia-Pacific region is expected to lead the markets owing to rapid urbanisation and the need for rails in the growing countries like China and India. Furthermore, the demand for modernising the existing railway systems and improving connectivity through public-private partnerships is likely to make the competition among the constructors even more intense, as they will have to restructure their strategies to fit the modern rail market.Challenges In Rail Wheel Market

The rail wheel market is characterised by several challenges, most of which relate to the urge to innovate as well as comply with strict safety guidelines. The situation is changing as the rail network markets in the world grow. The manufacturers are compelled to carry out research and development of new wheels with improved operational efficiency, increased durability, and enhanced performance. This requires the incorporation of new and advanced materials and technologies, which are likely to be expensive and take time. Another factor is the changing prices of raw materials, for instance, the cost of steel and other alloys that go into the production of wheels. Changes in these raw materials' prices affect the bottom line, for instance, making it necessary for changes in the pricing policies, thus affecting the ability of the manufacturers to compete, especially in low-priced, average-quality goods. In addition, the concern of cleanness and the eco-friendliness of the processes and products in the industry has made the industry pursue clean materials and processes that rationally provide a challenge to the companies that wish to achieve high performance while being environmentally friendly. Addressing these challenges is important for the company’s intent on focusing on the smaller segments of the market or even growing the market in the rail wheel industry.Risks & Prospects in Rail Wheel Market

The growth of railway infrastructure and rising investment in infrastructure development create compelling prospects in the rail wheel industry. More governments and non-governmental entities are investing resources in modernising and electrifying the railways to promote efficiency and cut down carbon emissions. This trend creates windows for rail wheel makers to produce new wheels that are lightweight and durable, more efficient, and safe for use in both freight and passenger transportation. In addition, the need for high-speed trains and citywide transport may also provoke the development and acceptance of rail wheel systems, thus augmenting growth prospects even more. One more opportunity that is gaining traction is the increasing attention to fostering greener initiatives in the rail industries. While seeking to decrease their carbon footprint, the operators are undergoing a transition towards the use of recyclable and energy-efficient materials and production techniques. As a result, there are enhancing eco-friendly initiatives in the rail industry, such as investment in the rail wheel technology based on composite materials as well as wear- and tear-resistant materials.Key Target Audience

The primary users of the rail wheel market are railway operators and manufacturers, such as those in the freight and passenger rail industries. These players look for premium-quality train wheels to ensure the safe and reliable operations of their trains. Tetrarail systems are witnessing rapid growth due to the emergence of new metro and high-speed rail networks across the globe, which leads a lot of railway companies to look for rail wheels that are cheaper yet stronger to endure different weights and weather conditions.,, Another significant target group involves rail equipment and component manufacturers, including those who manufacture locomotives and rolling stock (OEMs). This group of companies intends to procure rail wheels that comply with the operating specifications required for various classes of rail trucks. In addition, this group of audiences is also leaning into appealing rail wheel solutions that are energy-saving and noise-free with the growing trends of sustainable transportation worldwide.Merger and acquisition

In the rail wheel market, recent mergers and acquisitions indicate a clear objective of pursuing additional consolidation and growth by many stakeholders. For instance, Hitachi Rail has secured the greenlight for the €1.66 billion takeover of Thales GTS, primarily to expand its technology and operations in Europe. In the same vein, the FS Group completed the purchase of Explores, becoming the second largest rail logistics player in Germany. This pattern suggests that in addition to growth in existing businesses, such acquisitions are also needed due to the increasing demand for better rail solutions and advanced technologies. Moreover, the acquisition spectrum also reveals Danobat's acquisition of Delta Wheel; this enables the Spanish company to expand its market penetration within North America. This is also seen where Norfolk Southern took over management of part of the Cincinnati Southern Railway for the purpose of controlling specific rail corridors. The rail wheel industry continues to consolidate, creating a scenario in which companies strive to advance their technological competencies and geographical presence in order to satisfy the market and offer better services.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Rail Wheel- Snapshot

- 2.2 Rail Wheel- Segment Snapshot

- 2.3 Rail Wheel- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Rail Wheel Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 High Speed

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Freight Wagon

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Passenger Wagon

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Locos

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Rail Wheel Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 OEM

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Aftermarket

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 CRRC Corporation Limited (China)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Bharat Forge Ltd (India)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Alstom SA (France)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Steel Authority of India Limited (India)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Nippon Steel & Sumitomo Metal Corporation (Japan)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Vyatka (Russia)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Wabtec Corporation (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Bradken (Australia)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Klöckner Pentaplast (Germany)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Lucchini RS (Italy)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 ArcelorMittal A.S. (Luxembourg)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Bonatrans Group A.S. (Czech Republic)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Amsted Rail Company

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Inc. (United States)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Comsteel (Australia)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Kolowag AD (Bulgaria).

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Rail Wheel in 2031?

+

-

How big is the Global Rail Wheel market?

+

-

How do regulatory policies impact the Rail Wheel Market?

+

-

What major players in Rail Wheel Market?

+

-

What applications are categorized in the Rail Wheel market study?

+

-

Which product types are examined in the Rail Wheel Market Study?

+

-

Which regions are expected to show the fastest growth in the Rail Wheel market?

+

-

What are the major growth drivers in the Rail Wheel market?

+

-

Is the study period of the Rail Wheel flexible or fixed?

+

-

How do economic factors influence the Rail Wheel market?

+

-