Global Proximity Sensors Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-573 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Proximity Sensors Report Highlights

| Report Metrics | Details |

|---|---|

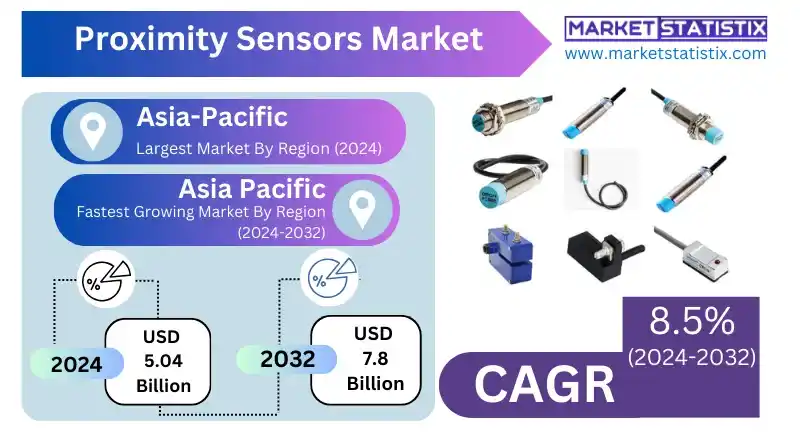

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.5% |

| Forecast Value (2032) | USD 7.8 Billion |

| By Product Type | Inductive Proximity Sensors, Laser Proximity Sensors, Photoelectric Proximity Sensors, Magnetic Proximity Sensors, Radar-Based Proximity Sensors, Capacitive Proximity Sensors, Ultrasonic Proximity Sensors, Optical Proximity Sensors |

| Key Market Players |

|

| By Region |

|

Proximity Sensors Market Trends

Across a range of industries, the major growth driver for the Proximity Sensors Market continues to be the increasing integration of automation and smart technologies. One key trend is the increasing demand for miniaturised and high-precision sensors, offering opportunities for implementation in small-scale consumer electronics and sophisticated industrial applications. Adoption of advanced sensing technologies, such as ToF and IR sensors, is increasingly augmenting the degree of accuracy and range detection. This moreover enhances the integration of proximity sensors with IoT platforms whose applications are now expanding to the domains of smart homes, building automation, and industrial monitoring. The market analysis indicates a strong emphasis on the enhancement of sensor capabilities through advanced materials and signal processing. On the demand side, the automotive industry ranks next as the largest driver with growing demand for proximity sensors in ADAS and autonomous vehicles. The increasing adoption of touchless interfaces in public places and healthcare facilities due to cleanliness concerns is another contributor to market growth.Proximity Sensors Market Leading Players

The key players profiled in the report are Delta Electronics Inc, Riko Opto-electronics Technology Co. Ltd, SICK AG, Schneider Electric, Honeywell International Inc, STMicroelectronics NV, Omron Corporation, Avago Technologies Inc, Rockwell Automation, Panasonic CorporationGrowth Accelerators

The growth of the Proximity Sensors Market can be attributed to the increasing automation trend in all industries, particularly manufacturing and automobile sectors; it brings about an imminent reliance on proximity sensors in detecting objects accurately and reliably in this toll towards Industry 4.0 and smart factories. In addition, growth in the advanced driver-assistance systems (ADAS) and autonomous driving will create requirements for more sophisticated proximity sensing applications for obstacle detection and collision avoidance. Furthermore, the developed IoT ecosystem and emerging smart devices in consumer electronics foster the installation of proximity sensors for features such as touchless interfaces and user interactive devices.Proximity Sensors Market Segmentation analysis

The Global Proximity Sensors is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Inductive Proximity Sensors, Laser Proximity Sensors, Photoelectric Proximity Sensors, Magnetic Proximity Sensors, Radar-Based Proximity Sensors, Capacitive Proximity Sensors, Ultrasonic Proximity Sensors, Optical Proximity Sensors . The Application segment categorizes the market based on its usage such as Consumer electronics, Aerospace & Defense, Automotive, Industrial, Food & beverage. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The proximity sensors market has a highly competitive environment with large global and region-based players. These key competitors commonly innovate their sensors in terms of performance, complexity, and power consumption, resulting in fierce competition. Companies enter into joint ventures, acquisitions, and partnerships to widen their product line and geographical reach. Thus, the market comprises well-established players with strong brand recognition and distribution networks, as well as new entrants who focus on niche applications and technological differentiation. The competitive analysis shows that it is focused on developing advanced sensing technologies for different industrial applications. Some of the major competitive efforts include the development of miniaturised sensors for consumer electronics, robust-quality sensors for harsh industrial environment applications, and ultra-precise sensors for automotive safety applications.Challenges In Proximity Sensors Market

The Proximity Sensors Market is primarily faced with an array of hurdles arising from differences in technology and application. One primary problem is accurate and reliable sensing for varied environmental conditions. Temperature changes, dust, moisture, and electromagnetism can severely affect the performance of the sensor, thus requiring robust design and calibration. Furthermore, these sensors should also be cost-effective, especially in high volumes for consumer applications. The performance needed versus price consideration remains an important element for the manufacturer. The other difficult advances with the market are miniaturisation and low power consumption, given that devices continue to become smaller and more portable. Increasingly more demanding integration into IoT devices and wearable technology will require sensors that consume less precious footprint and energy consumption. Keeping pace with fast-paced technological advances requires the promise of constant innovation and further investments on the part of companies in research and development.Risks & Prospects in Proximity Sensors Market

The proximity sensor market presents ample opportunities for growth, as Industry 4.0, automation, and the Internet of Things (IoT) penetrate manufacturing processes. These sensors do predictive maintenance, machine monitoring, and smart logistics, thereby becoming an integral part of industrial applications. The demand fuels more for smart infrastructures and building automation, together with integrating these sensors into consumer electronics, such as smartphones and wearables. The Asia Pacific region will be a growing market for proximity sensors, registering the highest CAGR because of aggressive industrialisation and initiatives like "Made in China 2025" that promote advanced manufacturing technology. The demand generation on consumer electronics, smart cities, and IoT infrastructure is mainly due to countries like China, Japan, and South Korea. North America and Europe hold significant shares as well, wherein advancements in automotive technologies like ADAS (Advanced Driver Assistance Systems) and industrial automation are taking place. In Europe, engineering countries like Germany lead in smart manufacturing applications, while the United States drives opportunities through its high adoption of proximity sensors in the healthcare and automotive industries.Key Target Audience

, The areas of convenience for the Proximity Sensors Market are widespread through different latitudes, diverse in sectors like industrial automation, automotive, consumer electronics, and health care. In industrial automation, manufacturers of robotics, automated assembly lines, and material handling systems are focused on the use of proximity sensors to perform activities like object detection, position sensing, and safe monitoring. OEMs within the area of Tier 1 suppliers are highly potential targets for proximity sensing applications in the automotive sector, which focus on the use of these sensors for features such as parking assistance, collision avoidance, and touchless entry systems., For instance, manufacturers of smartphones and wearable devices in the consumer electronics segment are the most compelling targets, as they use proximity sensors for features such as screen activation and gesture control. Healthcare providers and manufacturers of monitor devices constitute another audience because they use the sensors for patient monitoring, imaging, and touchless interfaces in medical devices. System integrators and distributors that comprise these different sectors are also critical targets because they deal with connecting sensor manufacturers to end users.Merger and acquisition

The proximity sensors market has witnessed significant mergers and acquisitions with the aim of expanding their technological capabilities and market reach. In March 2024, Sentech Inc., a position and proximity sensor manufacturer with bases in the U.S., has concluded acquiring the assets of Xensor LLC, a developer of motion sensors, to augment its industrial portfolio and develop an all-encompassing solution for the company's global clientele. Aside from that, companies like Murata Manufacturing and Gefran are also trying to look for acquisitions to increase their sensor technology offerings. Murata would consider more massive mergers and acquisitions to develop, under inductors and sensors, perhaps more than 100 billion yen. The Italian sensor producer is also looking at acquisition opportunities in Germany and North America with revenues between 10 and 20 million euros to strengthen the company's position in the sensor market. >Analyst Comment

The demand for automation and smart technologies across various sectors is triggering remarkable growth in the Proximity Sensors Market. The rise in industrial automation, consumer electronics employing touchless interfaces, and the growing penetration of advanced driver-assistance systems (ADAS) in vehicles are the major contributors to this growth. Rapid technological change defines this market, where manufacturers hone their focus on enhancing sensor accuracy, range, and power efficiency. Moreover, the increased focus on safety and efficiency in industrial and automotive applications creates a demand for trustworthy proximity sensing solutions.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Proximity Sensors- Snapshot

- 2.2 Proximity Sensors- Segment Snapshot

- 2.3 Proximity Sensors- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Proximity Sensors Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Inductive Proximity Sensors

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Capacitive Proximity Sensors

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Magnetic Proximity Sensors

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Photoelectric Proximity Sensors

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Ultrasonic Proximity Sensors

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Laser Proximity Sensors

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 Radar-Based Proximity Sensors

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Optical Proximity Sensors

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

5: Proximity Sensors Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Aerospace & Defense

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Consumer electronics

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Food & beverage

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Proximity Sensors Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Riko Opto-electronics Technology Co. Ltd

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Avago Technologies Inc

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Rockwell Automation

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Delta Electronics Inc

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Omron Corporation

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 SICK AG

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Schneider Electric

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Honeywell International Inc

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 STMicroelectronics NV

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Panasonic Corporation

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Proximity Sensors in 2032?

+

-

Which application type is expected to remain the largest segment in the Global Proximity Sensors market?

+

-

How big is the Global Proximity Sensors market?

+

-

How do regulatory policies impact the Proximity Sensors Market?

+

-

What major players in Proximity Sensors Market?

+

-

What applications are categorized in the Proximity Sensors market study?

+

-

Which product types are examined in the Proximity Sensors Market Study?

+

-

Which regions are expected to show the fastest growth in the Proximity Sensors market?

+

-

Which application holds the second-highest market share in the Proximity Sensors market?

+

-

Which region is the fastest growing in the Proximity Sensors market?

+

-