Global Power Management IC (PMIC) Market - Industry Dynamics, Size, And Opportunity Forecast To 2030

Report ID: MS-605 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

This PMIC (Power Management Integrated Circuit) market is the design, manufacture, and sale of ICs that regulate and optimize power in electronic devices. PMIC is a key component of innumerable devices, from smartphone and laptop applications to automotive systems and industrial equipment. PMICs manage a variety of power functions, including voltage regulation, battery charging, power sequencing, and thermal management. In essence, they ensure that every device component gets enough voltage and current to optimize efficiency and prevent damage. PMICs are crucial in maximizing battery life, minimizing power consumption, and maximizing the performance of an entire system.

Power Management IC (PMIC) Report Highlights

| Report Metrics | Details |

|---|---|

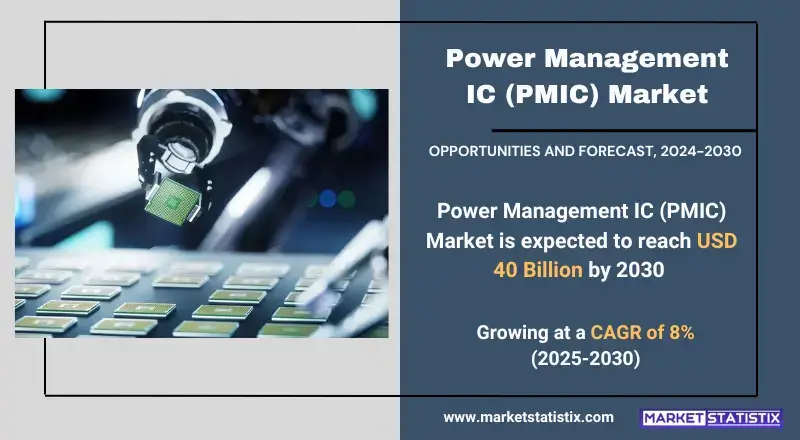

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8% |

| Forecast Value (2030) | USD 40 Billion |

| By Product Type | Voltage Regulators, Battery Management ICs, LED Driver ICs, Others |

| Key Market Players |

|

| By Region |

|

Power Management IC (PMIC) Market Trends

From an analysis of the market trends, miniaturization and integration are at the forefront, with manufacturers trying to minimize the size and power consumption of PMICs. Another trend worth mentioning is the surge in demand for PMICs that can work with advanced power management algorithms and adaptive voltage scaling, which enable devices to continuously adjust power consumption in relation to the workload. Equally noteworthy is the fast rise in using GaN (Gallium Nitride) and SiC (Silicon Carbide)-based PMICs for demanding efficiency and power density requirements, particularly concerning higher power applications like electric vehicles and renewable energy systems. Overall, the PMIC market is expected to grow with a continued focus on efficiency, integration, and performance improvements responding to fast-changing requirements in different electronic applications.

Power Management IC (PMIC) Market Leading Players

The key players profiled in the report are STMicroelectronics N.V., Infineon Technologies AG, Analog Devices, Inc., NXP Semiconductors N.V., Cypress Semiconductor Corporation, Texas Instruments Inc., Microchip Technology Inc., Renesas Electronics Corporation, Maxim Integrated Products, Inc., Qualcomm Incorporated, Rohm Co., Ltd., Fairchild Semiconductor International, Inc., Linear Technology Corporation, Dialog Semiconductor PLC, Toshiba Corporation, Skyworks Solutions, Inc., ON Semiconductor Corporation, Semtech CorporationGrowth Accelerators

Ever-increasing complexity and power demand of modern electronic devices are the prime movers of the PMICs market. Smartphones, tablets, wearables, and other modern ultra-performant consumer electronics should power an ever-broadening functionality using power management solutions of striking sophistication. In addition, the proliferation of electric vehicles and HEVs further boosts the demand for very powerful PMICs with the ability to drive high-power systems and efficient energy conversion. Another important factor that propels the market is the prodigiously growing IoT ecosystem, in which many connected devices will soon be in need of power-efficient PMICs in order to sustain battery life. Increasing focus on energy efficiency and sustainability will be driving industries to consume newer generations of PMICs, seeing that they usually tend to reduce power consumption and heat dissipation. Apart from this, the demand for high-performance computing (HPC) in data centers and AI applications calls for power management in the growth of power density and thermal management challenges, which, as a result, drives the market of PMICs.

Power Management IC (PMIC) Market Segmentation analysis

The Global Power Management IC (PMIC) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Voltage Regulators, Battery Management ICs, LED Driver ICs, Others . The Application segment categorizes the market based on its usage such as Telecommunications, Consumer Electronics, Automotive, Industrial, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Moreover, strategic initiatives in the competitive landscape further add to its diversity, such as mergers and acquisitions, partnerships, and product diversification. The acquisition of International Rectifier by Infineon Technologies will add power management solution capabilities and strengthen the market position of this company. Companies are broadening their product lines, which now include specific solutions, such as voltage regulators, battery management ICs, and LED drivers. They addressed niche markets and certain customer needs. Collaborations with technology providers will also provide firms access to complementary technologies for improved product capability and market reach. That, in addition to cost-competitive manufacturing capabilities and strong customer relationships, creates the mark of a dynamic and competitive PMIC market.

Challenges In Power Management IC (PMIC) Market

The PMIC market presently has many challenges, such as the increasing complexity in designs and the need for higher power efficiency. The electronic devices are small and consume more power; thus, PMIC is expected to integrate several functions but at very low power and better thermal efficiency. Employing such complexity drives increased costs of development and increases the overall time to market for manufacturers' products. Another challenge is supplying chain disruptions and shortages of semiconductors, which are also causing a scarcity of appropriate components for PMIC production. Manufacturing processes rely on very few production foundries, and hence there are uncertain possibilities in supply chains due to uneven geopolitical tension and fluctuation in costs of raw materials. PMICs in automotive, consumer electronics, and industrial applications are finding increasing demand, and thus competition is becoming stiffer, urging companies to innovate quickly and maintain cost-effectiveness. All these together formulate the market environment and influence the strategies of key companies operating in the PMIC market.

Risks & Prospects in Power Management IC (PMIC) Market

Such changes in technology as the adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) are intensifying the need for sophisticated power management solutions. Another cause would be the proliferation of 5G networks and IoT devices, which open further doors for PMIC applications in communication infrastructure as well as in connection with the devices themselves. On the other hand, Asia-Pacific is the leading region for PMIC, propelled by a solid consumer electronics manufacturing base and rapid development of technology in countries such as China, Japan, and South Korea. North America holds a strong position since its advanced semiconductor industry keeps growing along with the adoption of electric cars. The European region is recording relatively steady growth due to stringent regulations on energy efficiency and considerable emphasis on renewable energy initiatives. The PMIC market in India has been growing leaps and bounds, especially with the consumer electronics sector contributing significantly and regions such as North and South India emerging as important contributors—due mainly to their manufacturing ecosystems and technological hubs.

Key Target Audience

The Power Management IC (PMIC) market's prime target audience is consumer electronics manufacturers, automotive companies, and industrial equipment providers. Smartphone, tablet, and wearable manufacturers rely on PMICs to optimize power consumption, extend battery life, and improve the efficiency of their devices. Automotive companies also integrate PMICs into electric vehicles (EVs), advanced driver-assistance systems (ADAS), and infotainment units to ensure reliable power distribution and energy-efficient operation. Another market segment comprises semiconductor companies, telecom infrastructure providers, and data center operators searching for advanced power management solutions that could enhance the energy efficiency and reliability of systems. The emergence of 5G networks and AI-dependent applications, along with renewable energy systems, further extended the PMIC demand for advanced power regulation, thermal management, and integration capabilities. Owing to continuous miniaturization and efficient power conversion, manufacturers are now inclined toward working on next-generation PMICs with higher power density, lower heat dissipation, and better safety features.

Merger and acquisition

Strategic attempts to enhance technical capabilities and increase market outreach are reflected in the merger and acquisition (M&A) activity on the PMIC market in recent years. In September 2022, Allegro MicroSystems bought Heyday Integrated Circuits for around $19 million, thus intending to additionally strengthen its portfolio with advanced isolated gate drivers-direction sources for energy-efficient systems. In another similar move, Renesas Electronics completed the acquisition of Dialog Semiconductor in August 2021, integrating Dialog's expertise in low-power mixed-signal products and connectivity to consolidate its position in the PMIC market further. Other consolidations include Nexperia's acquisition of Nowi in November 2022, thereby enhancing its own power management integrated circuits capabilities. Also, ABB is contemplating the acquisition of the power electronics business from Siemens Gamesa in December 2024, further strengthening its stake in renewable power conversion technology. These strategic inclinations depict the industry's aim for the forward march of power management technologies for bringing efficient energy solutions in demand.

>Analyst Comment

An exceptional increase in the consumption of power management integrated circuits (PMICs) is now being witnessed due to their widespread adoption in the consumer electronics, automotive, and industrial automation fields, increasingly advocating energy-efficient systems. PMICs act as the most crucial components in optimizing power distribution, regulating voltage supply, and improving battery operation in modern electronic devices. The key factors driving this market are improvements in semiconductor technology, the burgeoning number of electric vehicles (EVs), and the rising adoption of various IoT devices and smart home systems. These are very much complemented by the integration of renewable energy sources and smart grids that further demand PMICs specific to applications in sustainability.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Power Management IC (PMIC)- Snapshot

- 2.2 Power Management IC (PMIC)- Segment Snapshot

- 2.3 Power Management IC (PMIC)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Power Management IC (PMIC) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Voltage Regulators

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Battery Management ICs

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 LED Driver ICs

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Power Management IC (PMIC) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Consumer Electronics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Automotive

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Telecommunications

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Power Management IC (PMIC) Market by End use

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 OEMs

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Aftermarket

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Power Management IC (PMIC) Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Texas Instruments Inc.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Analog Devices

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Inc.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Infineon Technologies AG

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 ON Semiconductor Corporation

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 NXP Semiconductors N.V.

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 STMicroelectronics N.V.

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Maxim Integrated Products

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Inc.

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Renesas Electronics Corporation

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Qualcomm Incorporated

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Dialog Semiconductor PLC

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Microchip Technology Inc.

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Rohm Co.

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Ltd.

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 Toshiba Corporation

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 Skyworks Solutions

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 Inc.

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

- 9.19 Linear Technology Corporation

- 9.19.1 Company Overview

- 9.19.2 Key Executives

- 9.19.3 Company snapshot

- 9.19.4 Active Business Divisions

- 9.19.5 Product portfolio

- 9.19.6 Business performance

- 9.19.7 Major Strategic Initiatives and Developments

- 9.20 Cypress Semiconductor Corporation

- 9.20.1 Company Overview

- 9.20.2 Key Executives

- 9.20.3 Company snapshot

- 9.20.4 Active Business Divisions

- 9.20.5 Product portfolio

- 9.20.6 Business performance

- 9.20.7 Major Strategic Initiatives and Developments

- 9.21 Fairchild Semiconductor International

- 9.21.1 Company Overview

- 9.21.2 Key Executives

- 9.21.3 Company snapshot

- 9.21.4 Active Business Divisions

- 9.21.5 Product portfolio

- 9.21.6 Business performance

- 9.21.7 Major Strategic Initiatives and Developments

- 9.22 Inc.

- 9.22.1 Company Overview

- 9.22.2 Key Executives

- 9.22.3 Company snapshot

- 9.22.4 Active Business Divisions

- 9.22.5 Product portfolio

- 9.22.6 Business performance

- 9.22.7 Major Strategic Initiatives and Developments

- 9.23 Semtech Corporation

- 9.23.1 Company Overview

- 9.23.2 Key Executives

- 9.23.3 Company snapshot

- 9.23.4 Active Business Divisions

- 9.23.5 Product portfolio

- 9.23.6 Business performance

- 9.23.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End use |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Power Management IC (PMIC) in 2030?

+

-

How big is the Global Power Management IC (PMIC) market?

+

-

How do regulatory policies impact the Power Management IC (PMIC) Market?

+

-

What major players in Power Management IC (PMIC) Market?

+

-

What applications are categorized in the Power Management IC (PMIC) market study?

+

-

Which product types are examined in the Power Management IC (PMIC) Market Study?

+

-

Which regions are expected to show the fastest growth in the Power Management IC (PMIC) market?

+

-

Which region is the fastest growing in the Power Management IC (PMIC) market?

+

-

What are the major growth drivers in the Power Management IC (PMIC) market?

+

-

Ever-increasing complexity and power demand of modern electronic devices are the prime movers of the PMICs market. Smartphones, tablets, wearables, and other modern ultra-performant consumer electronics should power an ever-broadening functionality using power management solutions of striking sophistication. In addition, the proliferation of electric vehicles and HEVs further boosts the demand for very powerful PMICs with the ability to drive high-power systems and efficient energy conversion. Another important factor that propels the market is the prodigiously growing IoT ecosystem, in which many connected devices will soon be in need of power-efficient PMICs in order to sustain battery life. Increasing focus on energy efficiency and sustainability will be driving industries to consume newer generations of PMICs, seeing that they usually tend to reduce power consumption and heat dissipation. Apart from this, the demand for high-performance computing (HPC) in data centers and AI applications calls for power management in the growth of power density and thermal management challenges, which, as a result, drives the market of PMICs.

Is the study period of the Power Management IC (PMIC) flexible or fixed?

+

-