Global Pharmaceutical Plant Extracts Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-941 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The pharmaceutical plant extract market includes the industry focused on extraction, purification and standardisation of active compounds from botanical sources for use in pharmaceutical products. These extracts obtained from different parts of plants, such as leaves, roots, flowers and fruits, have a wide array of phytochemicals, such as alkaloids, flavonoids, terpenes and glycosides, which have medical properties. Unlike the preparation of raw herbs, the extracts of the pharmaceutical plant are continuously processed to ensure potency, purity, and safety, making them suitable for medicinal applications and often regulated as activities of activated drug material (API) or drug totals.

The market is inspired by increasing global acceptance of natural and herbal drugs, increasing consumer preference for plant-based healthcare solutions and continuous research in the therapeutic capacity of botany. The extracts of the pharmaceutical plant find applications in various medical fields, including anti-inflammatory, antioxidant, antimicrobial, antigen and immunomodulatory drugs. The market also includes extracts used in traditional medical systems such as Ayurveda and traditional Chinese medicine, which are rapidly integrated into modern healthcare.

Pharmaceutical Plant Extracts Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

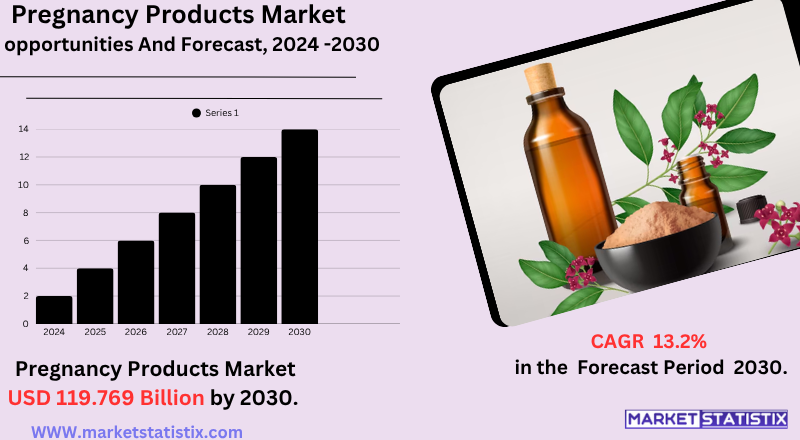

| Growth Rate | CAGR of 13.2% |

| Forecast Value (2030) | USD 119.769 Billion |

| By Product Type | Essential oils, Oleoresins, Alkaloids, Flavonoids, Carotenoids, Other |

| Key Market Players |

|

| By Region |

|

Pharmaceutical Plant Extracts Market Trends

The pharmaceutical plant extracts market is mainly inspired by the growing global demand for natural and plant-based healthcare products. Consumers are rapidly looking for options for synthetic drugs, increasing awareness about potential side effects and a priority for "clean-labelled" products. This trend is evident in increasing traditional systems such as herbal medicines and Ayurveda, especially in areas with a rich history of botanical medicine, such as India. Alleged protection, efficacy and low side effects of plant-rich compounds contribute significantly to this demand.

Another major driver is the continuous progress in scientific research and extraction technologies. Ongoing R&D efforts are validated by the medical benefits of various plant compounds, which is identifying new active ingredients and comprehensive applications in modern pharmaceuticals. In addition, superior extraction methods such as supercritical fluid extraction and enzyme-anticid extraction increase the purity, strength and yield of these extracts, making them more suitable for drug emotions and ensuring frequent quality. This is accelerating the growth of the market, combined with increasing investment in technological progress, assistant government initiatives and philanthropic innovations.

Pharmaceutical Plant Extracts Market Leading Players

The key players profiled in the report are Symrise AG, Tokiwa Phytochemical Co. Ltd., Synthite Industries Private Ltd., Sensient Technologies, Givaudan, Martin Bauer GmbH & Co. KG, Native Extracts Pty. Ltd., Pt. Indesso Aroma, Kangcare Bioindustry Co. Ltd., International Flavours and Fragrances Inc.Growth Accelerators

The pharmaceutical plant extracts market is mainly inspired by the growing global demand for natural and plant-based healthcare products. Consumers are rapidly looking for options for synthetic drugs, increasing awareness about potential side effects and a priority for "clean-labelled" products. This trend is evident in increasing traditional systems such as herbal medicines and Ayurveda, especially in areas with a rich history of botanical medicine, such as India. Alleged protection, efficacy and low side effects of plant-rich compounds contribute significantly to this demand.

Another major driver is the continuous progress in scientific research and extraction technologies. Ongoing R&D efforts are validated by the medical benefits of various plant compounds, which is identifying new active ingredients and comprehensive applications in modern pharmaceuticals. In addition, superior extraction methods such as supercritical fluid extraction and enzyme-anticid extraction increase the purity, strength and yield of these extracts, making them more suitable for drug emotions and ensuring frequent quality. This is accelerating the growth of the market, combined with increasing investment in technological progress, assistant government initiatives and philanthropic innovations.

Pharmaceutical Plant Extracts Market Segmentation analysis

The Global Pharmaceutical Plant Extracts is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Essential oils, Oleoresins, Alkaloids, Flavonoids, Carotenoids, Other . The Application segment categorizes the market based on its usage such as Pharmaceuticals, Dietary Supplements, Cosmetics, Food & beverages, Other. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The pharmaceutical plant extracts market is mainly inspired by the growing global demand for natural and plant-based healthcare products. Consumers are rapidly looking for options for synthetic drugs, increasing awareness about potential side effects and a priority for "clean-labelled" products. This trend is evident in increasing traditional systems such as herbal medicines and Ayurveda, especially in areas with a rich history of botanical medicine, such as India. Alleged protection, efficacy and low side effects of plant-rich compounds contribute significantly to this demand.

Another major driver is the continuous progress in scientific research and extraction technologies. Ongoing R&D efforts are validated by the medical benefits of various plant compounds, which is identifying new active ingredients and comprehensive applications in modern pharmaceuticals. In addition, superior extraction methods such as supercritical fluid extraction and enzyme-anticid extraction increase the purity, strength and yield of these extracts, making them more suitable for drug emotions and ensuring frequent quality. This is accelerating the growth of the market, combined with increasing investment in technological progress, assistant government initiatives and philanthropic innovations.

Challenges In Pharmaceutical Plant Extracts Market

The pharmaceutical plant extracts market is mainly inspired by the growing global demand for natural and plant-based healthcare products. Consumers are rapidly looking for options for synthetic drugs, increasing awareness about potential side effects and a priority for "clean-labelled" products. This trend is evident in increasing traditional systems such as herbal medicines and Ayurveda, especially in areas with a rich history of botanical medicine, such as India. Alleged protection, efficacy and low side effects of plant-rich compounds contribute significantly to this demand.

Another major driver is the continuous progress in scientific research and extraction technologies. Ongoing R&D efforts are validated by the medical benefits of various plant compounds, which is identifying new active ingredients and comprehensive applications in modern pharmaceuticals. In addition, superior extraction methods such as supercritical fluid extraction and enzyme-anticid extraction increase the purity, strength and yield of these extracts, making them more suitable for drug emotions and ensuring frequent quality. This is accelerating the growth of the market, combined with increasing investment in technological progress, assistant government initiatives and philanthropic innovations.

Risks & Prospects in Pharmaceutical Plant Extracts Market

The pharmaceutical plant extracts market is mainly inspired by the growing global demand for natural and plant-based healthcare products. Consumers are rapidly looking for options for synthetic drugs, increasing awareness about potential side effects and a priority for "clean-labelled" products. This trend is evident in increasing traditional systems such as herbal medicines and Ayurveda, especially in areas with a rich history of botanical medicine, such as India. Alleged protection, efficacy and low side effects of plant-rich compounds contribute significantly to this demand.

Another major driver is the continuous progress in scientific research and extraction technologies. Ongoing R&D efforts are validated by the medical benefits of various plant compounds, which is identifying new active ingredients and comprehensive applications in modern pharmaceuticals. In addition, superior extraction methods such as supercritical fluid extraction and enzyme-anticid extraction increase the purity, strength and yield of these extracts, making them more suitable for drug emotions and ensuring frequent quality. This is accelerating the growth of the market, combined with increasing investment in technological progress, assistant government initiatives and philanthropic innovations.

Key Target Audience

,,,

The pharmaceutical plant extracts market is mainly inspired by the growing global demand for natural and plant-based healthcare products. Consumers are rapidly looking for options for synthetic drugs, increasing awareness about potential side effects and a priority for "clean-labelled" products. This trend is evident in increasing traditional systems such as herbal medicines and Ayurveda, especially in areas with a rich history of botanical medicine, such as India. Alleged protection, efficacy and low side effects of plant-rich compounds contribute significantly to this demand.

,Another major driver is the continuous progress in scientific research and extraction technologies. Ongoing R&D efforts are validated by the medical benefits of various plant compounds, which is identifying new active ingredients and comprehensive applications in modern pharmaceuticals. In addition, superior extraction methods such as supercritical fluid extraction and enzyme-anticid extraction increase the purity, strength and yield of these extracts, making them more suitable for drug emotions and ensuring frequent quality. This is accelerating the growth of the market, combined with increasing investment in technological progress, assistant government initiatives and philanthropic innovations.

Merger and acquisition

The pharmaceutical plant extracts market is mainly inspired by the growing global demand for natural and plant-based healthcare products. Consumers are rapidly looking for options for synthetic drugs, increasing awareness about potential side effects and a priority for "clean-labelled" products. This trend is evident in increasing traditional systems such as herbal medicines and Ayurveda, especially in areas with a rich history of botanical medicine, such as India. Alleged protection, efficacy and low side effects of plant-rich compounds contribute significantly to this demand.

Another major driver is the continuous progress in scientific research and extraction technologies. Ongoing R&D efforts are validated by the medical benefits of various plant compounds, which is identifying new active ingredients and comprehensive applications in modern pharmaceuticals. In addition, superior extraction methods such as supercritical fluid extraction and enzyme-anticid extraction increase the purity, strength and yield of these extracts, making them more suitable for drug emotions and ensuring frequent quality. This is accelerating the growth of the market, combined with increasing investment in technological progress, assistant government initiatives and philanthropic innovations.

>Analyst Comment

The pharmaceutical plant extracts are experienced in the market, with a global market price of about 6.56 billion USD in 2025 and are estimated to reach 9.33 billion USD by 2033. This growth is primarily increased consumer preference and R&D innovation for herbal drugs, and there is an increasing demand for natural options for chronic disease. More than 63% of the market demand is attributed to preference for herbal treatment, as concerns about the side effects of synthetic drugs push consumers and healthcare providers to plant-based solutions. Additionally, integration of traditional medical knowledge with modern scientific research is expanding medical applications of plant extracts, giving further fuel to market expansion.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Pharmaceutical Plant Extracts- Snapshot

- 2.2 Pharmaceutical Plant Extracts- Segment Snapshot

- 2.3 Pharmaceutical Plant Extracts- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Pharmaceutical Plant Extracts Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Oleoresins

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Essential oils

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Flavonoids

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Alkaloids

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Carotenoids

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Other

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Pharmaceutical Plant Extracts Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food & beverages

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Cosmetics

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Pharmaceuticals

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Dietary Supplements

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Other

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Pharmaceutical Plant Extracts Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Givaudan

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Symrise AG

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Sensient Technologies

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Kangcare Bioindustry Co. Ltd.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Pt. Indesso Aroma

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Tokiwa Phytochemical Co. Ltd.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Native Extracts Pty. Ltd.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Synthite Industries Private Ltd.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Martin Bauer GmbH & Co. KG

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 International Flavours and Fragrances Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Pharmaceutical Plant Extracts in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Pharmaceutical Plant Extracts market?

+

-

How big is the Global Pharmaceutical Plant Extracts market?

+

-

How do regulatory policies impact the Pharmaceutical Plant Extracts Market?

+

-

What major players in Pharmaceutical Plant Extracts Market?

+

-

What applications are categorized in the Pharmaceutical Plant Extracts market study?

+

-

Which product types are examined in the Pharmaceutical Plant Extracts Market Study?

+

-

Which regions are expected to show the fastest growth in the Pharmaceutical Plant Extracts market?

+

-

Which application holds the second-highest market share in the Pharmaceutical Plant Extracts market?

+

-

What are the major growth drivers in the Pharmaceutical Plant Extracts market?

+

-

The pharmaceutical plant extracts market is mainly inspired by the growing global demand for natural and plant-based healthcare products. Consumers are rapidly looking for options for synthetic drugs, increasing awareness about potential side effects and a priority for "clean-labelled" products. This trend is evident in increasing traditional systems such as herbal medicines and Ayurveda, especially in areas with a rich history of botanical medicine, such as India. Alleged protection, efficacy and low side effects of plant-rich compounds contribute significantly to this demand.

Another major driver is the continuous progress in scientific research and extraction technologies. Ongoing R&D efforts are validated by the medical benefits of various plant compounds, which is identifying new active ingredients and comprehensive applications in modern pharmaceuticals. In addition, superior extraction methods such as supercritical fluid extraction and enzyme-anticid extraction increase the purity, strength and yield of these extracts, making them more suitable for drug emotions and ensuring frequent quality. This is accelerating the growth of the market, combined with increasing investment in technological progress, assistant government initiatives and philanthropic innovations.