Global Pet Snacks and Treats Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-838 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The pet snacks and treats market is concerned with the creation, distribution, and sale of speciality food items for pets, mainly dogs and cats, but also other companion animals such as birds, fish, and small mammals. Such products are not to be confused with regular pet food and are sold with various purposes apart from just nutrition. They are basically good for training, rewarding good behaviour, showing affection, or topping up some specific functional benefits that the animal might require. Some of the ingredients in this market include biscuits, dried meat, chew-stick treats, soft treats, dental treats, freeze-dried treats, and vitamin-and-mineral-enriched treats, for instance, those for dental health, joint health, and digestive support.

According to the growing trend of pet humanisation, the willingness to spend more for premium health-orientated products is fuelling the demand for pet snacks and treats. Increasing pet ownership around the world and rising disposable incomes provide additional fuel to this demand. Consumers are paying closer attention to the ingredients and nutritional value of pet treats, thus creating a mathematical surge in demand for natural and organic as well as functional products.

Pet Snacks and Treats Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

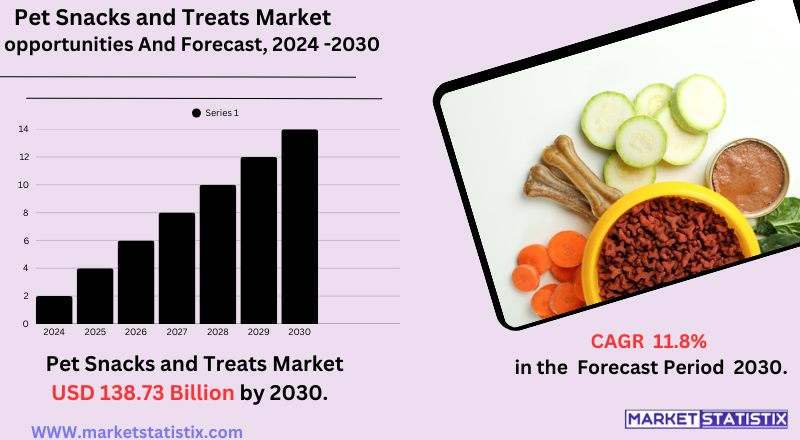

| Growth Rate | CAGR of 11.8% |

| Forecast Value (2030) | USD 138.73 Billion |

| By Product Type | Eatables, Chewables |

| Key Market Players |

|

| By Region |

|

Pet Snacks and Treats Market Trends

The premiumisation of animal treats is a key trend, as owners look for the best ingredients, innovative formulations, and special benefits for their animals. This has created demand for single-ingredient treats, gourmet flavours, and treats made with ingredients that are human-grade. This follows the trend of pet humanisation, whereby animals are families.

Another trend is pet health and wellness, which remains at the forefront. Pet parents are becoming more aware of the diet-health correlation and thus seek those treats with functional benefits, such as dental treats for dental health, joint treats with glucosamine and chondroitin, and others promoting digestive health containing probiotics and prebiotics. These wholesome and beneficial ingredients are setting the course for the innovation of products that consumers are now paying keen attention to within pet snacks and treats.

Pet Snacks and Treats Market Leading Players

The key players profiled in the report are The J.M. Smucker Company (United States), Addiction Foods (New Zealand), INC. (United States), Tiernahrung Deuerer GmbH (Germany), Affinity Petcare S.A (Spain), SCHELL & KAMPETER,, Wellness Pet Company (United States), Cargill (United States), Blue Buffalo Co., Ltd (United States), Unicharm Corporation (Japan), Spectrum Brands, Inc. (United States),Hill's Pet Nutrition, Inc. (United States)

Growth Accelerators

The pet snack and treat market is growing robustly due to a handful of major factors. The humanisation of pets is one such factor, whereby owners regard companion animals as full members of their families. This emotional bond translates into greater expenditure on premium-quality, truly healthy treats for the well-being and enjoyment of their pets – the same way humans choose natural and organic options. With this type of "pet parenting", there are treatment demands for premium snacks and treats with functional benefits such as dental care, joint support, and digestive health.

The other driver is mass global pet adoption, together with a rise in disposable incomes. The latest consumer trends globally see an increasing expenditure on pet snacks and treats with more households adopting pets and a rise in their disposable income. This trend is very much seen in emerging economies as their middle class considers pet ownership and spends more on pet pampering. With the presence of convenience brought about by e-commerce and online retail, the growth of this market is further accelerated by providing easy access to pet snacks and treats in myriad options catering to consumers' diverse preferences and needs.

Pet Snacks and Treats Market Segmentation analysis

The Global Pet Snacks and Treats is segmented by Type, and Region. By Type, the market is divided into Distributed Eatables, Chewables . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The pet food treats market is mixing major multinational companies and a number of smaller niche players when it comes to rivalling against each other. Major global players like Mars, Nestlé Purina, and General Mills (through Blue Buffalo) have a majority market share because of their vast distribution channels, great brand recognition, and large portfolios. The huge players also pour huge amounts into R&D to innovate their products to meet changing consumer trends in natural, organic, and functional treats.

The market that sits in the middle of the competition arena is little, with many companies that focus their attention on one type of product, ingredient, or channel of distribution. This includes those involved in single-ingredient treats, novel proteins, and direct sales over the Internet. Competition is becoming fierce in areas of product innovation, health/ingredient differentiation, and strategic partnerships or acquisitions. The rise of e-commerce has only intensified the competition by levelling the playing field and giving brands, both big and small, the ability to reach a broader consumer base, thus making it highly dynamic and consumer-driven.

Challenges In Pet Snacks and Treats Market

As the pet snacks and treats market continues its rapid phase of growth, it finds some considerable obstacles. Among the key challenges is the growing awareness of pet obesity and related health issues among pet owners. It has thus been increasingly emphasised by consumers that their pets should be kept well, whereas their knowledge of nutritionally balanced treats is dwindling, in contrast to standard calorie-rich treats. This trend compels manufacturers to innovate and reformulate products to meet health-conscious preferences—the market potential for indulgent treats is thus limited, requiring constant investment in R&D.

Another notable obstacle is the low awareness and limited adoption of speciality pet snacks and treats in developing regions. While pet ownership increases in these markets, the knowledge about the benefits premium or functional treats carry remains minuscule; also, the economic barriers restrict access to high-quality products. Also, the industry deals with the rising prices of raw materials, strict regulatory requirements, and evaporation of low-quality alternatives that ultimately tarnish consumer trust. To navigate these challenges, companies should focus on consumer education, product differentiation, and sustainability while tapping into digital channels and personalised offers to seize emerging opportunities across established and developing markets.

Risks & Prospects in Pet Snacks and Treats Market

Core market opportunities include functional treat offerings for targeted health issues (dental, weight, and joint support), alongside organic, plant-based, and hypoallergenic products with an emphasis on sustainable packaging and new ingredients. Innovation remains supported by premiumisation, with pet owners looking for higher-quality, natural, and health-orientated snacks, while digital upheaval in distribution, particularly in e-commerce and direct-to-consumer sales, throws open lucrative paths of expansion.

Regionally, North America possesses the largest revenue share, spurred by pet health and clean-label diets, along with a strong culture of pet ownership. Close on its heels lies Europe, where moderate demand for organic and natural treats coupled with rigorous standards for quality graces countries like France, Germany, and the UK. In full throttle stands Asia-Pacific, especially fast-growing, while China, Japan, and India serve as major players – ironing out premium and functional treats by urbanisation, income growth, and the notion of pets as family creates demand. Emerging Latin America and Africa proffer strong growth potential, supported by rising pet adoption and shifting consumer attitudes toward pet care. This regional distinction calls out for localised product strategies and inventive offerings in the quest for global market share.

Key Target Audience

The major emphasis of the snack and treat market for pets is on pet owners who consider their pets as family members. This core group are pretty old since the markets for pet treat products are usually split up into many demographic categories, but sentimentally, they are much alike in their concern for the well-being of their animals. In the wake of recent developments, pet owners are beginning to turn into conscious consumers who want to know what goes into their pet treat items and what nutritional/wellness benefits these treats offer: natural, organic, or with dental, joint, or allergy benefits.

,, ,Among this wide customer base, there exist some marked segments. Millennials and Gen Zs make up a significant and fast-growing portion of the pet-owner population: higher online purchase propensity; seeking premium and sustainable products; social media is the key medium of product discovery and recommendation. Established, somewhat traditional pet owners providing their animals with respected treats include Gen X and baby boomers; both groups are slowly attempting to embrace trends with respect to quality treat products.

,

Merger and acquisition

There have been several mergers-and-acquisitions operations in pet snacks and treats markets in recent years. On November 13, 2024, General Mills announced its $1.45 billion acquisition of Whitebridge Pet Brands Division for the North American premium cat feeding and pet treating business. It serves to position General Mills more alright in the high-growth wet cat food segment, including brands like Tiki Pets and Cloud Star. This, in fact, is just one acquisition within a broader selection of acquisitions put forth by General Mills to expand its pet food portfolio, including Blue Buffalo and Edgard & Cooper.

In another major acquisition completed earlier that year (January 2024), VAFO Group – the premium European pet food manufacturer – moved ahead in the pet food race by acquiring Finland's Dagsmark Pet Food. This secures a position for VAFO as the thundering number one player in the Nordic pet food market. The acquisition facilitates VAFO's expansion into other Nordic markets while enhancing product portfolios, particularly wet pet food. Consequently, these strategic moves have been a response to the growing consumer demand for natural and health-concerned pet products and the increasing trend of premiumisation in pet nutrition.

>

Analyst Comment

The global pet snacks and treats industry is currently evolving rapidly: increasing pet ownership, pet humanisation, and, above all, developing knowledge about pet health and wellness. The market is valued at about USD 50.84 billion in 2025 and is forecasted to climb up anywhere between USD 85.99 billion and USD 138.73 billion by 2034. The North American market is observed as the leader due to the high rate of pet ownership and the trend of humanising pets, thereby creating an excellent demand for premium, natural, and health-based products. The market's spectrum includes organic treats, traditional ones, functional snacks, and speciality variants catering to the various dietary needs of different pet types.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Pet Snacks and Treats- Snapshot

- 2.2 Pet Snacks and Treats- Segment Snapshot

- 2.3 Pet Snacks and Treats- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Pet Snacks and Treats Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Eatables

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Chewables

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Pet Snacks and Treats Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 SCHELL & KAMPETER

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 INC. (United States)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 The J.M. Smucker Company (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Addiction Foods (New Zealand)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Tiernahrung Deuerer GmbH (Germany)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Wellness Pet Company (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Spectrum Brands

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Inc. (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Cargill (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Affinity Petcare S.A (Spain)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Unicharm Corporation (Japan)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Blue Buffalo Co.

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Ltd (United States)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14

Hill's Pet Nutrition

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Inc. (United States)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Pet Snacks and Treats in 2030?

+

-

Which type of Pet Snacks and Treats is widely popular?

+

-

What is the growth rate of Pet Snacks and Treats Market?

+

-

What are the latest trends influencing the Pet Snacks and Treats Market?

+

-

Who are the key players in the Pet Snacks and Treats Market?

+

-

Hill's Pet Nutrition, Inc. (United States)

are among the key players in the Pet Snacks and Treats marketHow is the Pet Snacks and Treats } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Pet Snacks and Treats Market Study?

+

-

What geographic breakdown is available in Global Pet Snacks and Treats Market Study?

+

-

Which region holds the second position by market share in the Pet Snacks and Treats market?

+

-

How are the key players in the Pet Snacks and Treats market targeting growth in the future?

+

-

The pet snack and treat market is growing robustly due to a handful of major factors. The humanisation of pets is one such factor, whereby owners regard companion animals as full members of their families. This emotional bond translates into greater expenditure on premium-quality, truly healthy treats for the well-being and enjoyment of their pets – the same way humans choose natural and organic options. With this type of "pet parenting", there are treatment demands for premium snacks and treats with functional benefits such as dental care, joint support, and digestive health.

,

,