Global Pem Electrolyzer Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-2578 | Consumer Goods | Last updated: May, 2025 | Formats*:

The Proton Exchange Membrane (PEM) electrolyser focuses on hydrogen-generating devices that employ a special form of electrolysis. PEM electrolysis employs a solid polymer electrolyte membrane a kind of polymer membrane commonly made with Nafion, for instance which conducts positively charged hydrogen ions (or protons) from the anode to the cathode. This has the added benefit of acting as a barrier, preventing the mixing of the hydrogen and oxygen gases evolved during the split of water. Because of its ability to produce high-purity hydrogen, compact configuration, and suitability for dynamic operation, this technology is widely accepted for integration with intermittent renewable energy sources.

Advantages presented by PEM electrolysers include high current densities leading to reduced operational costs and the capability to operate at high pressures, minimising the need for downstream compression of produced hydrogen. This array of applications is burgeoning, which includes green hydrogen production for industrial use (ammonia/methanol production and refining), fuelling hydrogen fuel cell vehicles (FCEVs), and power-to-gas energy storage applications, as well as stabilising the grid by converting hydrogen from excess renewable electricity.

Pem Electrolyzer Report Highlights

| Report Metrics | Details |

|---|---|

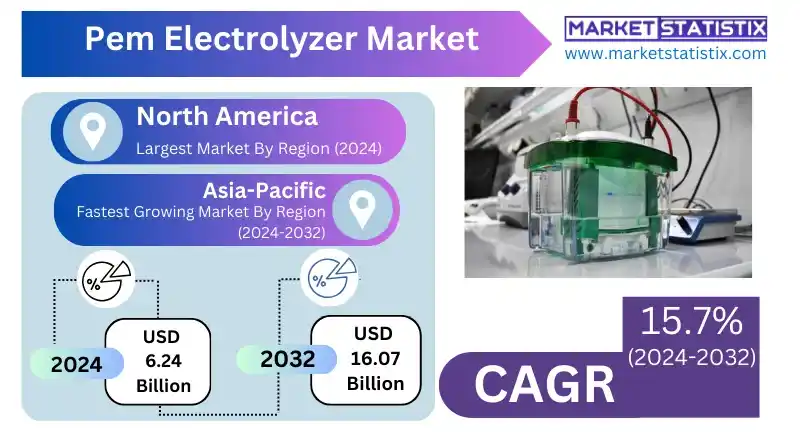

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 15.7% |

| Forecast Value (2032) | USD 16.07 Billion |

| By Product Type | Small Scale Type, Middle Scale Type, Large Scale Type |

| Key Market Players |

|

| By Region |

|

Pem Electrolyzer Market Trends

A prominent trend is the strong emphasis on improvements of PEM electrolyser systems in terms of efficiency and durability through advances in membrane technology, catalyst materials (where reducing the use of expensive precious metals such as platinum and iridium is a key consideration), and overall cell design. A growing trend involves the integration of PEM electrolysers with renewable energy sources such as solar and wind, aimed at producing green hydrogen and stabilising the grid.

Another significant trend is the increasing size of PEM electrolyser projects, from smaller distributed systems to large-scale industrial deployments to meet the rising demand from various sectors – transportation (fuel cell electric vehicles), industrial feedstock (ammonia, methanol), and power-to-gas energy storage.

Pem Electrolyzer Market Leading Players

The key players profiled in the report are Siemens Energy, H-Tec Systems, Ningbo Vet Energy Technology, Hydrogenics, Elogen, Ballard Power Systems, Nel ASA, Teledyne Energy Systems, Hitachi Zosen, Cummins Inc., Green Hydrogen Systems, Ohmium International, Next Hydrogen, Plug Power, Areva H2gen, Suzhou Jingli, Linde, Hystar, ITM Power, Elchemtech, Proton OnSite, McPhy Energy, Toshiba Energy Systems, Kobelco Eco-SolutionsGrowth Accelerators

The PEM electrolyser market is booming due to a cocktail of factors associated with the global decarbonisation drive and the growing awareness of hydrogen as a clean energy carrier. Firstly, the rising demand for green hydrogen is a primary driver. Coming from PEM electrolysis fed by renewable energy, green hydrogen is considered a key solution to the hard-to-electrify sectors such as heavy transport, shipping, aviation, and some industrial processes like steel and chemical production, as industries and governments around the world set ambitious targets to cut greenhouse gas emissions.

Secondly, supportive government policies and incentives are a key booster for the PEM electrolyser market. A host of countries and regions set up programmes to fund research and development, provide grants, and set targets around hydrogen production and deployment; these all seek to lower the cost of green hydrogen production, activate demand, and build various infrastructures to create a conducive environment for PEM electrolyser technology adoption.

Pem Electrolyzer Market Segmentation analysis

The Global Pem Electrolyzer is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Small Scale Type, Middle Scale Type, Large Scale Type . The Application segment categorizes the market based on its usage such as Electronics and Photovoltaics, Steel Plants, Industrial Gases, Energy Storage or Fueling for Fuel Cell Electric Vehicles (FCEVs), Power Plants, Power to Gas, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

With the increasing global demand for green hydrogen, the competitive landscape of the PEM electrolyiser market is becoming very dynamic and competitive. The market is composed of established industrial gas and energy companies, specialised electrolyser manufacturers, and innovative startups. Key competitive factors include electrolyser technology's efficiency and durability, reduction of capital and operational costs, scalability of production, and integration of electrolysers with renewable energy sources.

Strategic collaborations are underway among these important players, which involve massive investments in R&D for performance enhancement and for the reduction of reliance on costly materials, mainly platinum and iridium. They also are focused on ramping up manufacturing capabilities in anticipation of a growth spurt across multiple sectors, including transportation, industrial feedstock, and power-to-gas applications. This capacity to provide low-cost, dependable, and large-scale PEM electrolyser solutions will provide the edge that companies will need to be competitive in the evolving green hydrogen economy.

Challenges In Pem Electrolyzer Market

The PEM electrolyiser market presents itself as a tough environment, especially with high capital and operational costs. Materials that drive the biggest share of the cost include platinum group metal catalysts (especially iridium and platinum) and perfluorinated sulfonic-acid (PFSA) membranes, all of which contribute to the cell's performance and have limited availability on the market today. The manufacturing set-up is also very complex and poses an extra burden on scaling up construction, as an advanced automated mass-production line is required to manufacture such components, for example, catalyst-coated membranes.

Beyond costs, some major technical hurdles need to be bridged; these include durability and efficiency in vigorous acidic working conditions and a trade-off between membrane thickness (which aids conductivity) and life (to avoid gas crossover and degradation). A serious raw material bottleneck, especially concerning iridium, hinders the ability to fulfil future green hydrogen demand, in which present supply can barely cover a fraction of projected global capacity requirements by 2030.

Risks & Prospects in Pem Electrolyzer Market

PEM electrolysers can be integrated with renewable energy sources (solar, wind) to produce green hydrogen. The major opportunities are technical advancement in electrolysers to bring down costs and increase efficiency and their application expansion in different industrial sectors such as refining, automotive, and power generation.

Europe is in the lead due to aggressive climate goals and huge funding for hydrogen projects, along with strong regulatory support, with European Commission multi-billion hydrogen funding being an example in conjunction with Germany's H2Global Initiative. Asia-Pacific is an emerging region for high growth led by hydrogen infrastructure investments on a large scale in China, Japan, and South Korea amid the rising energy demand and manufacturing capacity. North America is another key market enhanced by technical targets and investment incentives along with a concentration on innovation. Therefore, all these regions set up the global PEG electrolyser market with specific localised opportunities directed by policy frameworks, industrial demand, and renewable energy integration.

Key Target Audience

The PEM electrolyser industry essentially targets all those industries and governments that are focused on decarbonisation and the green hydrogen transition. Other major stakeholders, like manufacturers of renewable energy, utility companies, and industrial sectors such as chemicals, refining, and ammonia production, are adopting PEM electrolysers for the production of green hydrogen for cleaner operations. For the transportation sector, especially the fuel cell electric vehicles (FCEV) segment, PEM technology was adapted to provide efficient hydrogen production for vehicle propulsion.

,

, The power generation sector has also adopted PEM electrolysers for the storage of excess renewable generation and to stabilise the grid and supply energy consistently. With increasing global demand expected to propel growth in H2 production, various technological advancements and applications across industries are supporting developments in this field and thereby creating opportunities in the PEM electrolyser market.

Merger and acquisition

Reflecting the industry's fast pace and strategic importance of green hydrogen technologies, the PEM electrolyiser market has seen considerable activity regarding mergers and acquisitions. In July 2024, with a strategic investment in Ohmium International, a prominent green hydrogen company, 3M of the U.S. was looking to enter into climate technologies. It intends to invest in Ohmium's manufacturing capability, which includes the construction of a new gigafactory in Bengaluru, India, thereby leveraging its global position.

In another significant development, the gigawatt-scale plant was inaugurated by Siemens Energy and Air Liquide in Berlin in November 2023 to produce very efficient PEM electrolyser modules. The facility uses advanced robotics and automation to manufacture electrolysers aimed at cheap production of low-carbon hydrogen while nurturing the innovation ecosystem across Europe.

Analyst Comment

The global market for PEM (Proton Exchange Membrane) electrolysers is buoyed by an increase in demand for green hydrogen as an energy carrier and investments in renewable energy infrastructure. The market size estimates for this market for 2024 differ widely, with estimates as low as $0.66 billion and as high as $7.56 billion, thus reflecting differences in segmentation and scope. Despite this discrepancy, all sources indicate strong growth trajectories, with projected compound annual growth rates and market values even reaching $15 billion by 2034. The high efficiency of the technology, fast dynamics, and easy integration with intermittent renewable energy make PEM electrolysers particularly attractive for industrial, transportation, and energy storage applications.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Pem Electrolyzer- Snapshot

- 2.2 Pem Electrolyzer- Segment Snapshot

- 2.3 Pem Electrolyzer- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Pem Electrolyzer Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Small Scale Type

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Middle Scale Type

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Large Scale Type

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Pem Electrolyzer Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Power Plants

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Steel Plants

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Electronics and Photovoltaics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Industrial Gases

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Energy Storage or Fueling for Fuel Cell Electric Vehicles (FCEVs)

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Power to Gas

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Others

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Pem Electrolyzer Market by Capacity

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 ≤ 500 kW

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 > 500 kW – 2 MW

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Above 2 MW

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Pem Electrolyzer Market by Technology

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Proton Exchange Membrane Technology

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Advanced PEM Designs

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Hybrid System Integrations

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Pem Electrolyzer Market by End-User Industry

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Energy and Utilities

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Transportation

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Chemicals

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Metallurgy

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

- 8.6 Food and Beverage

- 8.6.1 Key market trends, factors driving growth, and opportunities

- 8.6.2 Market size and forecast, by region

- 8.6.3 Market share analysis by country

9: Pem Electrolyzer Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 Cummins Inc.

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 Areva H2gen

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 McPhy Energy

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Hydrogenics

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 Ningbo Vet Energy Technology

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 Elchemtech

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Next Hydrogen

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Hitachi Zosen

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 Ohmium International

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 Nel ASA

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 Teledyne Energy Systems

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 Hystar

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 H-Tec Systems

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 Plug Power

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

- 11.15 Toshiba Energy Systems

- 11.15.1 Company Overview

- 11.15.2 Key Executives

- 11.15.3 Company snapshot

- 11.15.4 Active Business Divisions

- 11.15.5 Product portfolio

- 11.15.6 Business performance

- 11.15.7 Major Strategic Initiatives and Developments

- 11.16 Suzhou Jingli

- 11.16.1 Company Overview

- 11.16.2 Key Executives

- 11.16.3 Company snapshot

- 11.16.4 Active Business Divisions

- 11.16.5 Product portfolio

- 11.16.6 Business performance

- 11.16.7 Major Strategic Initiatives and Developments

- 11.17 Elogen

- 11.17.1 Company Overview

- 11.17.2 Key Executives

- 11.17.3 Company snapshot

- 11.17.4 Active Business Divisions

- 11.17.5 Product portfolio

- 11.17.6 Business performance

- 11.17.7 Major Strategic Initiatives and Developments

- 11.18 Proton OnSite

- 11.18.1 Company Overview

- 11.18.2 Key Executives

- 11.18.3 Company snapshot

- 11.18.4 Active Business Divisions

- 11.18.5 Product portfolio

- 11.18.6 Business performance

- 11.18.7 Major Strategic Initiatives and Developments

- 11.19 Siemens Energy

- 11.19.1 Company Overview

- 11.19.2 Key Executives

- 11.19.3 Company snapshot

- 11.19.4 Active Business Divisions

- 11.19.5 Product portfolio

- 11.19.6 Business performance

- 11.19.7 Major Strategic Initiatives and Developments

- 11.20 Green Hydrogen Systems

- 11.20.1 Company Overview

- 11.20.2 Key Executives

- 11.20.3 Company snapshot

- 11.20.4 Active Business Divisions

- 11.20.5 Product portfolio

- 11.20.6 Business performance

- 11.20.7 Major Strategic Initiatives and Developments

- 11.21 Linde

- 11.21.1 Company Overview

- 11.21.2 Key Executives

- 11.21.3 Company snapshot

- 11.21.4 Active Business Divisions

- 11.21.5 Product portfolio

- 11.21.6 Business performance

- 11.21.7 Major Strategic Initiatives and Developments

- 11.22 Ballard Power Systems

- 11.22.1 Company Overview

- 11.22.2 Key Executives

- 11.22.3 Company snapshot

- 11.22.4 Active Business Divisions

- 11.22.5 Product portfolio

- 11.22.6 Business performance

- 11.22.7 Major Strategic Initiatives and Developments

- 11.23 ITM Power

- 11.23.1 Company Overview

- 11.23.2 Key Executives

- 11.23.3 Company snapshot

- 11.23.4 Active Business Divisions

- 11.23.5 Product portfolio

- 11.23.6 Business performance

- 11.23.7 Major Strategic Initiatives and Developments

- 11.24 Kobelco Eco-Solutions

- 11.24.1 Company Overview

- 11.24.2 Key Executives

- 11.24.3 Company snapshot

- 11.24.4 Active Business Divisions

- 11.24.5 Product portfolio

- 11.24.6 Business performance

- 11.24.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Capacity |

|

By Technology |

|

By End-User Industry |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Pem Electrolyzer in 2032?

+

-

Which type of Pem Electrolyzer is widely popular?

+

-

What is the growth rate of Pem Electrolyzer Market?

+

-

What are the latest trends influencing the Pem Electrolyzer Market?

+

-

Who are the key players in the Pem Electrolyzer Market?

+

-

How is the Pem Electrolyzer } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Pem Electrolyzer Market Study?

+

-

What geographic breakdown is available in Global Pem Electrolyzer Market Study?

+

-

Which region holds the second position by market share in the Pem Electrolyzer market?

+

-

Which region holds the highest growth rate in the Pem Electrolyzer market?

+

-