Global Organic Dairy Products Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-792 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Organic Dairy Products Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

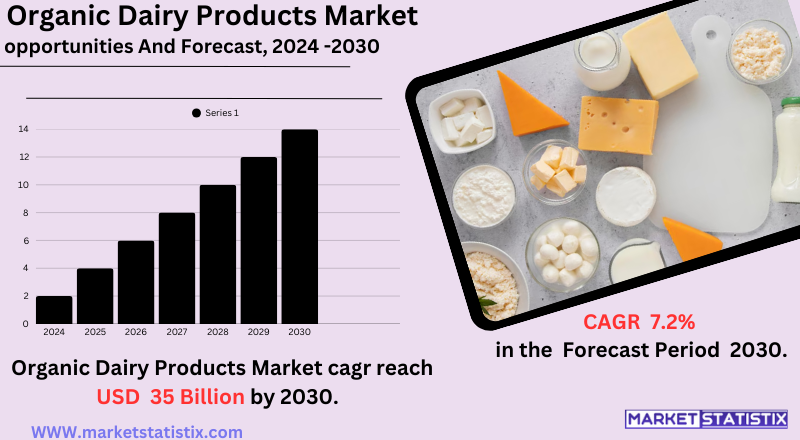

| Growth Rate | CAGR of 7.2% |

| Forecast Value (2030) | USD 35 Billion |

| By Product Type | Perforated Wire Ducts, Closed Wire Ducts, Open Wire Ducts, Slotted Wire Ducts |

| Key Market Players |

|

| By Region |

|

Organic Dairy Products Market Trends

The current Indian organic dairy products market is undergoing a major swing of quite a few important trends making a significant impact on its growth and evolution. The core engine behind it is gaining health consciousness among consumers in India and the rest of the world. About natural, nutritious, and free-of-synthetic-additive hormones and pesticides would also make organic dairy perform excellently. Besides, raising awareness about the environmental impact and animal welfare in conventional farming is motivating consumers towards organic alternatives. Most importantly, organic dairy has moved beyond milk. Consumers can now view a series of organic products such as yoghurt, cheese, butter, ghee, and even ice cream. This enables catering for diverse dietary needs and preferences, thus strengthening the market further.Organic Dairy Products Market Leading Players

The key players profiled in the report are Kraft Foods, Arla Foods UK Plc, AMUL, Meiji Dairies Corp., Sancor Cooperativas,, Megmilk Snow Brand, Dairy Farmers of America Inc (DFA), Danone, Fonterra Group Cooperative Limited, Royal FrieslandCampina N.V., Groupe Lactalis SA, Dean Foods Company, Organic Valley, Parmalat S.P.A, UnileverGrowth Accelerators

First and foremost, consumer health consciousness is the major factor driving sales. Consumers have become aware of the detrimental effects of conventional dairy farming, including the use of synthetic hormones, antibiotics, and pesticides. This has shifted their interest toward organic products that are considered healthier and more natural. The growing incidence of lifestyle-related diseases is another additional factor convincing the clientele to go for organic dairy, which is believed to have superior nutritional advantages such as increased omega-3 fatty acid and antioxidant content. Secondly, the awareness of environmental sustainability and ethical practices is another major driver in the industry. Conventional dairy farming has had serious environmental concerns when it comes to greenhouse gases and land use. Organic dairy farming is said to be better for the environment and animal welfare due to its emphasis on pasture-based systems, organic feed, and minimum use of synthetic inputs.Organic Dairy Products Market Segmentation analysis

The Global Organic Dairy Products is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Perforated Wire Ducts, Closed Wire Ducts, Open Wire Ducts, Slotted Wire Ducts . The Application segment categorizes the market based on its usage such as Commercial Applications, Industrial Applications, Residential Applications, Telecommunications. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The organic dairy products market consists of a competitive arena, populated by both major forces and smaller, niche brands. Danone (with brands such as Horizon Organic and Stonyfield), Arla Foods, Organic Valley, and Groupe Lactalis are some of the major companies holding a significant share in the market. Since these key players typically own a wide range of product offerings, strong brand recognition, and established distribution channels, they are able to cater to a large population of consumers. Some of the competitive strategies include product innovation (e.g., fortified organic dairy, novel flavours), the expansion of product lines, and television advertisement campaigns focused on sustainable development and ethical sourcing to attract eco-conscious customers. Mergers, acquisitions, and strategic alliances are also common strategies for these companies to build a strong market position and expand their geographical reach for the growing industry.Challenges In Organic Dairy Products Market

There are a few challenges that the organic dairy products market is facing in promoting growth and access. Highest on the priority list is high production cost, which further limits market penetration. Organic farming indeed involves extra labour-intensive practices and specialised organic feed that follow stringent certification standards, all of which make the end products very expensive for consumers. This price premium might deter low-income households from purchasing organic dairy products, especially in markets with lower consumer awareness and disposable incomes. The logistics and supply chain for organic dairy products also become complex, as they should be stored and transported accordingly to protect the integrity and certification. Another severe competitor to this market is the booming plant-based alternatives that attract buyers worldwide: vegans, lactose-intolerant consumers, and consumers mainly concerned with environmental issues. Further, the regulatory requirements and processes for certification may constitute a burden to the producers, and organic dairy products' short shelf life adds up to their logistical issues.Risks & Prospects in Organic Dairy Products Market

Major opportunities will arise from product innovations in plant-based and lactose-free alternatives, probiotic yoghurts, and value-added dairy products that reflect changing dietary preferences. Emerging markets in Asia, particularly urbanising areas, will also have huge growth since disposable incomes rise with greater awareness of organic food benefits. The largest markets for organic dairy products are those in the developed regions, with strong consumer bases that have established concerns for health, environmental sustainability and animal welfare. These regions benefit from strong regulatory support and their retail availability. The Asia-Pacific realm is the fastest growing, with rapid market development noted especially in India, as health awareness increases, benefitting from government support in organic agriculture and rising participation of the middle-class population.Key Target Audience

, The organic dairy products market largely targets health-conscious consumers who are now increasingly becoming aware of the benefits of organic farming and clean-label nutrition. Therefore, the group has associated families with young children, a sort of individuals suffering from dietary allergies, and mothers who are looking for dairy options with no hormones or antibiotics. Millennial and Gen Z individuals, who understand the value of nature and are more willing to pay for organic certification and transparency, are some of the major target groups driving demand., In addition, one of the other important customer market segments includes environmentally aware consumers. These consumers would normally hold such values as animal welfare and environmental sustainability in high esteem. They might also buy into "locally" or "organically" grown produce. Retailers, food service providers, and manufacturers who seek to expand their organic product lines via new products are also an important target group as they react to increasing consumer demand for organic alternatives in several dairy subcategories such as milk, cheese, yoghurt, and butter.Merger and acquisition

In the last few years, the M&A activities in organic dairy products have gone vastly up due to realignments in strategy and sustainability concerns. April 2024 saw the tipping point as Platinum Equity acquired Horizon Organic and Wallaby from Danone, marking Danone's short-term reworking of its portfolio toward core activities. The disposal fits into an industry-wide trend wherein the major players reassess their assets for a better fit with long-term sustainability targets and market requirements. Likewise, under a deal struck in September 2024, General Mills sold to Groupe Lactalis and Sodiaal its North American yoghurt operations encompassing Yoplait and Liberté brands for $2.1 billion in an effort to shift focus toward higher-margin brands due to the stiff competition. The European dairy firms also hit the M&A trail. In the first months of 2024, UK cooperative First Milk bought BV Dairy to diversify its product range and strengthen its commitment to sustainability and regenerative agriculture. Another Italian player, Granarolo, increased its presence with the acquisition of the milk production and marketing branch of Consorzio Produttori Latte Maremma in March 2024 in a strategic plan that has outlined over €300 million worth of investments up to 2027. The acquisitions reflect another global trend where dairy companies aim to invest in improving their market positions and keep pace with changing consumer preferences. >Analyst Comment

Strongly influenced by rising consumer interest in healthy, natural, and environmentally friendly food choices, the global organic dairy products market is largely growing. It is estimated that the market in 2025 will be around USD 34.34 billion to USD 46.18 billion; the market could have up to USD 79.97 billion by 2030 or USD 71.01 billion by 2034, according to the particular source. This growth has been driven by rising health consciousness, preferences for chemical-free products, and the assumption that organic dairy products meet a greater percentage of nutritional benefits, including better omega-3 fatty acids and antioxidants. At present Europe is the largest market, with more than 34% due to immense consumer' demands, government incentives, and an effective organic certification system.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Organic Dairy Products- Snapshot

- 2.2 Organic Dairy Products- Segment Snapshot

- 2.3 Organic Dairy Products- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Organic Dairy Products Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Open Wire Ducts

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Closed Wire Ducts

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Perforated Wire Ducts

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Slotted Wire Ducts

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Organic Dairy Products Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Residential Applications

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial Applications

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial Applications

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Telecommunications

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Organic Dairy Products Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 AMUL

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Arla Foods UK Plc

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Danone

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Dairy Farmers of America Inc (DFA)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Dean Foods Company

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Fonterra Group Cooperative Limited

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Groupe Lactalis SA

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Kraft Foods

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Meiji Dairies Corp.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Megmilk Snow Brand

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Organic Valley

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Parmalat S.P.A

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Royal FrieslandCampina N.V.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Sancor Cooperativas

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Unilever

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Organic Dairy Products in 2030?

+

-

Which type of Organic Dairy Products is widely popular?

+

-

What is the growth rate of Organic Dairy Products Market?

+

-

What are the latest trends influencing the Organic Dairy Products Market?

+

-

Who are the key players in the Organic Dairy Products Market?

+

-

How is the Organic Dairy Products } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Organic Dairy Products Market Study?

+

-

What geographic breakdown is available in Global Organic Dairy Products Market Study?

+

-

Which region holds the second position by market share in the Organic Dairy Products market?

+

-

How are the key players in the Organic Dairy Products market targeting growth in the future?

+

-