Global Oil Field Chemicals Market Size, Share & Trends Analysis Report, Forecast Period, 2025-2030

Report ID: MS-2588 | Chemicals And Materials | Last updated: May, 2025 | Formats*:

The oilfield chemicals market includes the production, distribution, and application of specialised chemical products used all through the lifecycle of oil and gas wells. These chemicals are essential for the optimisation of drilling, cementing, stimulation, production, and enhanced oil recovery operations. They are meant to solve problems encountered during the extraction process, including corrosion, scaling, microbial growth, emulsion formation, and poor flow. Among potential consumers for oilfield chemicals are oil and gas exploration and production companies that want to improve efficiency, maximise production, maintain safety standards, and keep within setting regulations.

This market contains a wide range of chemical types, each performing a different task in the oilfield. Some of these chemicals are corrosion inhibitors and demulsifiers: the former helps protect the equipment from wearing down. The latter separates oil from water. Biocides control microbial activities, scale inhibitors keep mineral deposits away, and rheology modifiers adjust the flow behaviour of drilling fluids.

Oil Field Chemicals Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

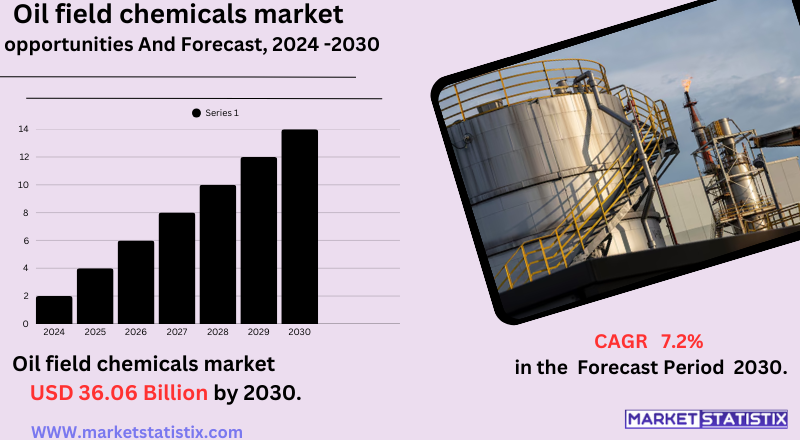

| Growth Rate | CAGR of 7.2% |

| Forecast Value (2030) | USD 36.06 Billion |

| By Product Type | Inhibitors, Rheology Modifiers, Surfactants, Foamers, Biocides, Friction Reducers, Demulsifiers, Other Products |

| Key Market Players |

|

| By Region |

|

Oil Field Chemicals Market Trends

The market for oilfield chemicals is today dominated by various dominant trends. To start with, there is a rising focus on the use of improved oil recovery (EOR) methods to maximise output from mature wells, fuelling demand for high-tech chemicals such as surfactants and polymers. Second, higher deep-water and ultra-deep-water drilling operations, mainly offshore, create the need for high-performance chemicals withstanding harsh conditions and pressures. This trend is particularly pertinent as India boosts its exploration of deeper waters to address rising energy needs.

Another major trend is increasing demand for environmentally friendly and sustainable oilfield chemicals as a result of stringent environmental regulations and greater emphasis on reducing the environmental footprint of oil and gas production. This includes creating and embracing biodegradable chemicals and chemicals with reduced toxicity. In addition, the market is seeing greater adoption of digital technologies for optimising chemical use, real-time monitoring of chemical conditions, and enhancing overall operational efficiency in the oilfields, including Indian oilfields.

Oil Field Chemicals Market Leading Players

The key players profiled in the report are Aquapharm Chemical Pvt. Ltd., Baker Hughes, The Lubrizol Corporation, Halliburton, Nouryon, Clariant, Solvay S.A., SMC Global, BASF SE, Thermax Chemical DivisioGrowth Accelerators

The market for oilfield chemicals is driven largely by the global energy demand, which calls for consistent and improved oil and gas exploration and production processes. As industries persist in the wake of increased world population and industrialisation, hydrocarbons' demand for use in multiple sectors is constantly on the rise, thus indirectly promoting chemicals' demand to optimise operations. In addition, new drilling and extraction technologies like hydraulic fracturing, horizontal drilling, and deep-water operations involve specialised chemical products to enhance efficiency, safety, and the ability to recover as much of a resource as possible from increasingly intricate reservoirs.

Another key driver is the increasing emphasis on improved oil recovery (EOR) methods as mature conventional oil reserves become depleted. EOR processes are highly dependent on the injection of targeted chemicals to enhance oil mobility and displacement, extending the life and productivity of existing wells. The rising investments in offshore and unconventional resources further drive the demand for specialised chemicals suited to these harsh environments, adding to market growth in India and globally.

Oil Field Chemicals Market Segmentation analysis

The Global Oil Field Chemicals is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Inhibitors, Rheology Modifiers, Surfactants, Foamers, Biocides, Friction Reducers, Demulsifiers, Other Products . The Application segment categorizes the market based on its usage such as Drilling, Cementing, Production, Workover & Completion. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for oilfield chemicals is highly competitive, with a combination of large, multinational chemical firms and niche regional players. Large multinational corporations such as Halliburton, Schlumberger, BASF, and Dow have a large global presence and provide a broad portfolio of chemical solutions and integrated services. Competition is based on product innovation, application knowledge, cost competitiveness, and the capacity to offer customized solutions for given well conditions and operational issues faced in areas such as India, which is witnessing growing exploration activity.

Competitive strategies include creating innovative chemical formulations that increase oil recovery, boost drilling efficiency, and mitigate environmental issues. Companies are also concentrating on establishing good relationships with oil and gas operators, offering technical services, and reconciling to the unique regulation and operational requirements of various geographies.

Challenges In Oil Field Chemicals Market

The market for oilfield chemicals is highly challenged by high operational costs and stringent environmental laws. Governmental agencies across the globe are putting stringent regulations on the discharge and usage of oilfield chemicals because of their possible impact on the environment, including soil contamination and water pollution. Adherence to these regulations frequently necessitates that companies spend on environmentally friendly substitutes and sophisticated waste treatment procedures, raising the cost of doing business and potentially prolonging project schedules. All of these combined impede market expansion, particularly as governments continue to promulgate new regulations reducing the availability of specific chemicals even more.

Furthermore, the prohibitive expense of oilfield chemicals and their disposal is yet another significant handicap. The process of disposal entails several costly steps, such as radiological and composition analysis, transportation, and adherence to non-norm waste regulations, which all add up to the cost burden for oil and gas operators. This cost factor, together with regulatory drivers, restricts the use of conventional oilfield chemicals and pushes manufacturers to prioritize the development of innovative, sustainable solutions – often at a greater cost. Consequently, the industry is constantly subjected to pressures to meet operational efficiency, regulatory requirements, and cost-effectiveness to compete in an ever-changing market.

Risks & Prospects in Oil Field Chemicals Market

Major market opportunities involve the expanding demand for chemicals enabling unconventional resource development, including shale oil and gas, and more emphasis on green and sustainable chemical solutions. Markets in Asia-Pacific, Latin America, and the Middle East represent strong growth opportunities as these economies accelerate exploration and production, with a focus on investments in deepwater and mature field recovery technology.

Regionally, North America leads the oilfield chemicals market with more than a third of world demand owing to its vast shale gas and oil production, sophisticated extraction technologies, and location of major industry players. The Middle East and Africa are anticipated to experience the highest growth, driven by massive investments in EOR and secondary recovery projects in Saudi Arabia and the UAE. In the meanwhile, Asia-Pacific is becoming an emerging market driven by growing energy requirements and greater exploration activities in China and India. These local conditions, along with continued innovation and a trend towards more environmentally friendly products, are driving the future direction of the oilfield chemicals market.

Key Target Audience

, Besides primary users, the market also addresses regulatory authorities, environmental consultants, and research institutions engaged in creating sustainable chemical solutions and regulatory compliance. Regional dynamics are significant, with North America, the Middle East, and Asia-Pacific as high-demand regions on account of continued drilling activities and investment in infrastructure. Understanding of the needs of each segment enables manufacturers to condition product formulations, marketing strategies, and after-sales services appropriately.,The prime target customers of the oilfield chemicals market are mostly oil and gas exploration and production (E&P) organizations, drilling companies, and oilfield service organizations. These are customers who utilise speciality chemicals—such as corrosion inhibitors, demulsifiers, surfactants, and scale inhibitors—to achieve efficient extraction, maintain equipment efficiency, and operate smoothly in both onshore and offshore drilling locations. Their procurement is influenced by factors like the performance of the product, cost competitiveness, environmental legislation, and technical support provided by suppliers. The oilfield chemicals sector has seen strong merger and acquisition (M&A) activity recently, fuelled by strategic growth and diversification drives. One key development is the acquisition of German chemical company Covestro by Abu Dhabi National Oil Company (ADNOC) for €14.7 billion ($16.6 billion), ADNOC's biggest transaction to date. The acquisition will help diversify ADNOC's portfolio from oil into high-performance polymers and speciality chemicals. Furthermore, ADNOC has set aside $1 billion in capital expenditure and M&A deals for 2025, with emphasis on the U.S. market. The world oilfield chemicals market is witnessing consistent growth due to increasing oil and gas exploration and production activities, especially in North America, which is the market leader. The market was around USD 24.75–30.40 billion in 2024 and is expected to reach USD 33.55–38.70 billion by 2032–2033. Critical drivers of growth comprise rising demand for improved oil recovery (IOR) methods, advancements in drilling technology, and higher investments in unconventional and deepwater extraction operations. Industry leaders are targeting innovation and portfolio expansion to address changing environment needs and the sophisticated demands of contemporary oilfield activities.

,

, Merger and acquisition

In North America, the oilfield chemicals industry has experienced consolidation by way of several strategic purchases. In April 2023, Dorf Ketal purchased Clariant's North American Land Oil business and created DK Energy Services LLC, which comprises more than 2,000 chemical formulations and Texas manufacturing facilities. Previously, in February 2023, Imperative Chemical Partners and RSI Chemicals joined together to form one of the biggest oil and gas production chemical companies specialising in the U.S. land market. These mergers indicate a pattern towards enriching service offerings and realising economies of scale within a competitive industry.Analyst Comment

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Oil Field Chemicals- Snapshot

- 2.2 Oil Field Chemicals- Segment Snapshot

- 2.3 Oil Field Chemicals- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Oil Field Chemicals Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Inhibitors

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Demulsifiers

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Rheology Modifiers

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Friction Reducers

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Biocides

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Surfactants

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 Foamers

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Other Products

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

5: Oil Field Chemicals Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Drilling

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Production

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Cementing

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Workover & Completion

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Oil Field Chemicals Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Nouryon

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 BASF SE

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 SMC Global

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Baker Hughes

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Halliburton

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 The Lubrizol Corporation

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Aquapharm Chemical Pvt. Ltd.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Clariant

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Solvay S.A.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Thermax Chemical Divisio

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Oil Field Chemicals in 2030?

+

-

Which type of Oil Field Chemicals is widely popular?

+

-

What is the growth rate of Oil Field Chemicals Market?

+

-

What are the latest trends influencing the Oil Field Chemicals Market?

+

-

Who are the key players in the Oil Field Chemicals Market?

+

-

How is the Oil Field Chemicals } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Oil Field Chemicals Market Study?

+

-

What geographic breakdown is available in Global Oil Field Chemicals Market Study?

+

-

Which region holds the second position by market share in the Oil Field Chemicals market?

+

-

How are the key players in the Oil Field Chemicals market targeting growth in the future?

+

-

,

The market for oilfield chemicals is driven largely by the global energy demand, which calls for consistent and improved oil and gas exploration and production processes. As industries persist in the wake of increased world population and industrialisation, hydrocarbons' demand for use in multiple sectors is constantly on the rise, thus indirectly promoting chemicals' demand to optimise operations. In addition, new drilling and extraction technologies like hydraulic fracturing, horizontal drilling, and deep-water operations involve specialised chemical products to enhance efficiency, safety, and the ability to recover as much of a resource as possible from increasingly intricate reservoirs.

, Another key driver is the increasing emphasis on improved oil recovery (EOR) methods as mature conventional oil reserves become depleted. EOR processes are highly dependent on the injection of targeted chemicals to enhance oil mobility and displacement, extending the life and productivity of existing wells. The rising investments in offshore and unconventional resources further drive the demand for specialised chemicals suited to these harsh environments, adding to market growth in India and globally.