Global Off-Highway Electric Vehicle (EV) Market Size, Share & Trends Analysis Report, Forecast Period, 2025-2030

Report ID: MS-2554 | Automation and Process Control | Last updated: Apr, 2025 | Formats*:

Off-Highway Electric Vehicle (EV) Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

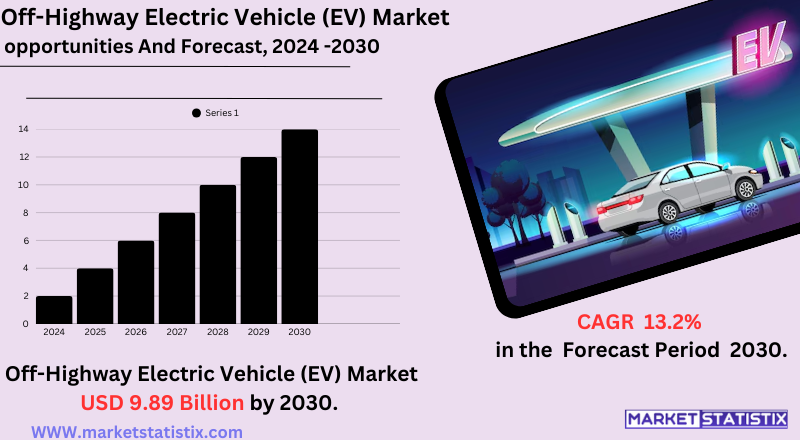

| Growth Rate | CAGR of 13.2% |

| Forecast Value (2030) | USD 9.89 Billion |

| By Product Type | Li-ion, Lead-acid |

| Key Market Players |

|

| By Region |

|

Off-Highway Electric Vehicle (EV) Market Trends

The major market trends include the prompt development of battery technology, the increasingly flexible and modular vehicle designs to be applied in a wider range of applications, and increasing joint efforts and partnerships between technology providers and equipment manufacturers. In addition, smart and interconnected technologies enabling better fleet management and operational efficiency are increasingly coming onboard. Towards this end, there's developing a highly robust charging infrastructure at job sites and attempting to seek new solutions – for example, battery swapping – that would serve to eliminate downtime. The demand for quieter operations in urban and environmentally sensitive areas would be further increased by the advent of electric off-highway vehicles.Off-Highway Electric Vehicle (EV) Market Leading Players

The key players profiled in the report are Deere & Company, Hitachi Construction Machinery Co., Ltd., Komatsu Ltd., J C Bamford Excavators Ltd., Caterpillar Inc., Volvo Construction Equipment AB, CNH Industrial N.V., Doosan Corporation, Sandvik AB, Epiroc ABGrowth Accelerators

Tightly regulated environmental norms for reducing emissions in industries related to construction, agriculture, and mining are among the most significant influences on the off-highway electric vehicles (EVs). Governments are tightening standards and giving incentives throughout the world to encourage the adoption of zero-emission vehicles. Another significant factor is the long-term total cost of ownership (TCO) benefits associated with electric vehicles. While the initial purchase prices for off-highway EVs might be higher, long-term savings, particularly in fuel costs, can be significant, as electric power is mostly cheaper than diesel. In addition, electric vehicles normally require less maintenance due to fewer moving parts, leading to more availability and lower servicing costs.Off-Highway Electric Vehicle (EV) Market Segmentation analysis

The Global Off-Highway Electric Vehicle (EV) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Li-ion, Lead-acid . The Application segment categorizes the market based on its usage such as Agriculture, Construction, Mining. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Currently, the competitive environment of off-highway electric vehicles (EVs) has a combination of established heavy machinery manufacturers and emerging electric vehicle (EV) technology companies. As long-standing global players focused on ICE vehicles, like Caterpillar, Volvo, Komatsu, and John Deere, have now begun investing substantially and introducing electric and hybrid models into their product range. These companies are utilising their wide distribution channels and established customer relationships. In parallel, more and more specialised electric vehicle manufacturers and technology companies have entered the market, often with concentrated focuses on certain vehicle types or specified niche applications within construction, agriculture, mining, and material handling. The influx of newcomers thus enhances innovation in battery technology, electric powertrains, and charging solutions.Challenges In Off-Highway Electric Vehicle (EV) Market

The market for electric off-highway vehicles has sky-high challenges which may hold back their wide applicability despite the estimates of robust growth ahead. High initial purchase cost remains an effective barrier to entry vis-à-vis diesel equipment, keeping industries (particularly those in developing countries) from justifying an investment. In addition, short operational range, long recharge times, and the absence of charging facilities in remote or rural areas limit the accentuation of new electric off-highway vehicles in areas such as construction, mining, and agriculture characterised by around-the-clock, intensive operations. Volatile raw material prices, particularly of key battery components and metals, tend to swell production costs and consequently reduce affordability, which is additionally affected by economic uncertainties, inflationary pressures, and regional inequalities in infrastructure development. All these bastions of hurdles give way to the uneven adoption of such markets globally. Besides this, the complications are added with the need for continuous innovations, such as improving battery efficiency, fast charging, and autonomy in vehicles, along with the absence of globally agreed regulatory standards.Risks & Prospects in Off-Highway Electric Vehicle (EV) Market

Continuing the growth with changes in battery technology, expansion of charging facilities, and the future integration of autonomous, connected technologies gives key marks in the market. Incentives offered by governments along with their efforts toward sustainable development accelerated the electrification trends, whereas industry alliances and innovative concepts have made vehicle designs modular and multipurpose to tap a larger potential market. Currently, geographically, North America holds the maximum market share of off-highway EVs with a strong regulatory framework alongside advanced infrastructure and early intake by some of the industry's large players. Asia-Pacific is the fastest region identified as growing as a result of rapid industrialisation, urbanisation, and heavy investments in electrification, especially in China and the Indian continent. Europe has also made very large strides with aggressive decarbonisation policies as well as incentives on electric machinery.Key Target Audience

Key stakeholders in this market include OEMs like Caterpillar, Komatsu, and Deere & Company, which invest in electric vehicle development for off-highway applications. Also, battery technology companies like Xerotech provide scalable battery solutions for a vast array of off-highway applications. Government agencies and regulatory authorities constitute the other major players, as their policies and incentives for curbing greenhouse gas emissions support the rapid adoption of electric vehicles in such sectors. Further market segmentation is available by propulsion type. Battery electric vehicles (BEVs) dominate currently due to their zero-emission nature, while hybrid electric vehicles (HEVs) are gaining acceptance as an interim strategy for industries moving toward full electrification.Merger and acquisition

The off-highway electric vehicle (EV) market is experiencing rising merger and acquisition (M&A) activity as both incumbent firms and start-ups seek to maintain market share and gain technological supremacy. The latest trends in M&A show a strong strategic push by leading Original Equipment Manufacturers (OEMs) and component suppliers to further their electrification potential and augment their product lines in this fast-changing sector. For example, the sale in early 2024 of Proterra's battery business to Volvo points to the significance of securing battery technology and supply chains. Komatsu's acquisition of American Battery Solutions in 2023 was also pursued to enhance Komatsu's internal battery development and production ability for its electric mining and construction equipment. These strategic moves are propelled partly by increasing demand for more sustainable solutions, the advent of rigorous emission legislation, and the perennial cost advantages of electric vehicles in off-highway applications, such as construction, agriculture, and mining. Through one-off M&A activities, companies access critical technologies and expand market coverage to fast-track their electrification journeys. >Analyst Comment

The global Off Highway Electric Vehicle (EV) market would grow much faster than previous estimates, reaching $8.64 billion in 2024 to some $10.92 billion in 2025. The market, projected at about $25.27 billion eventually, would be powered by strict environmental regulations; rising fuel prices that will catalyse growth in areas like construction, mining, and agriculture, along with sustainability and emission reduction from these segments. The further adoption of off-highway EV technology is dependent on improved battery technologies, government subsidies, and infrastructure for rapid charging, all shifts from conventional internal combustion engine-powered alternatives.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Off-Highway Electric Vehicle (EV)- Snapshot

- 2.2 Off-Highway Electric Vehicle (EV)- Segment Snapshot

- 2.3 Off-Highway Electric Vehicle (EV)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Off-Highway Electric Vehicle (EV) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Li-ion

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Lead-acid

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Off-Highway Electric Vehicle (EV) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Construction

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Agriculture

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Mining

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Off-Highway Electric Vehicle (EV) Market by Propulsion Outlook

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Battery Electric Vehicle (BEV)Hybrid Electric Vehicle (HEV)

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

7: Off-Highway Electric Vehicle (EV) Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Caterpillar Inc.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 CNH Industrial N.V.

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Hitachi Construction Machinery Co.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Ltd.

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 J C Bamford Excavators Ltd.

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Komatsu Ltd.

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Volvo Construction Equipment AB

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Deere & Company

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Doosan Corporation

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Sandvik AB

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Epiroc AB

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Propulsion Outlook |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Off-Highway Electric Vehicle (EV) in 2030?

+

-

Which type of Off-Highway Electric Vehicle (EV) is widely popular?

+

-

What is the growth rate of Off-Highway Electric Vehicle (EV) Market?

+

-

What are the latest trends influencing the Off-Highway Electric Vehicle (EV) Market?

+

-

Who are the key players in the Off-Highway Electric Vehicle (EV) Market?

+

-

How is the Off-Highway Electric Vehicle (EV) } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Off-Highway Electric Vehicle (EV) Market Study?

+

-

What geographic breakdown is available in Global Off-Highway Electric Vehicle (EV) Market Study?

+

-

Which region holds the second position by market share in the Off-Highway Electric Vehicle (EV) market?

+

-

How are the key players in the Off-Highway Electric Vehicle (EV) market targeting growth in the future?

+

-